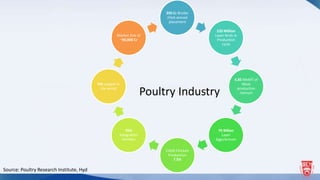

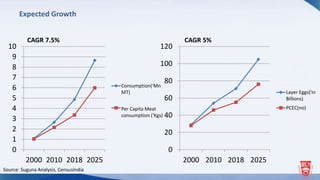

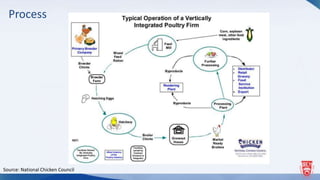

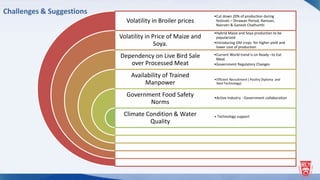

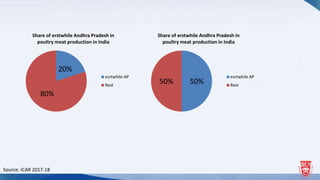

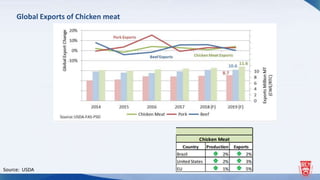

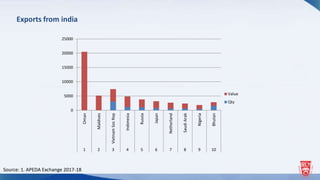

The document discusses India's poultry industry, which places 350 million broiler chicks annually and has 220 million layer birds in production. It produces 4.85 million metric tons of meat annually and 70 billion eggs. The industry has an annual growth rate of 7.5% and is the 5th largest globally with a market size of around 90,000 crores. It discusses production figures and processes for broilers and layers. It also outlines some challenges facing the industry like price volatility and availability of trained labor, and suggestions to address them.