- Prior to 2011, service tax was collected on a cash basis and was due by the 5th/6th of the month after the service was provided, regardless of whether payment was received. This led to delays or non-payment of taxes.

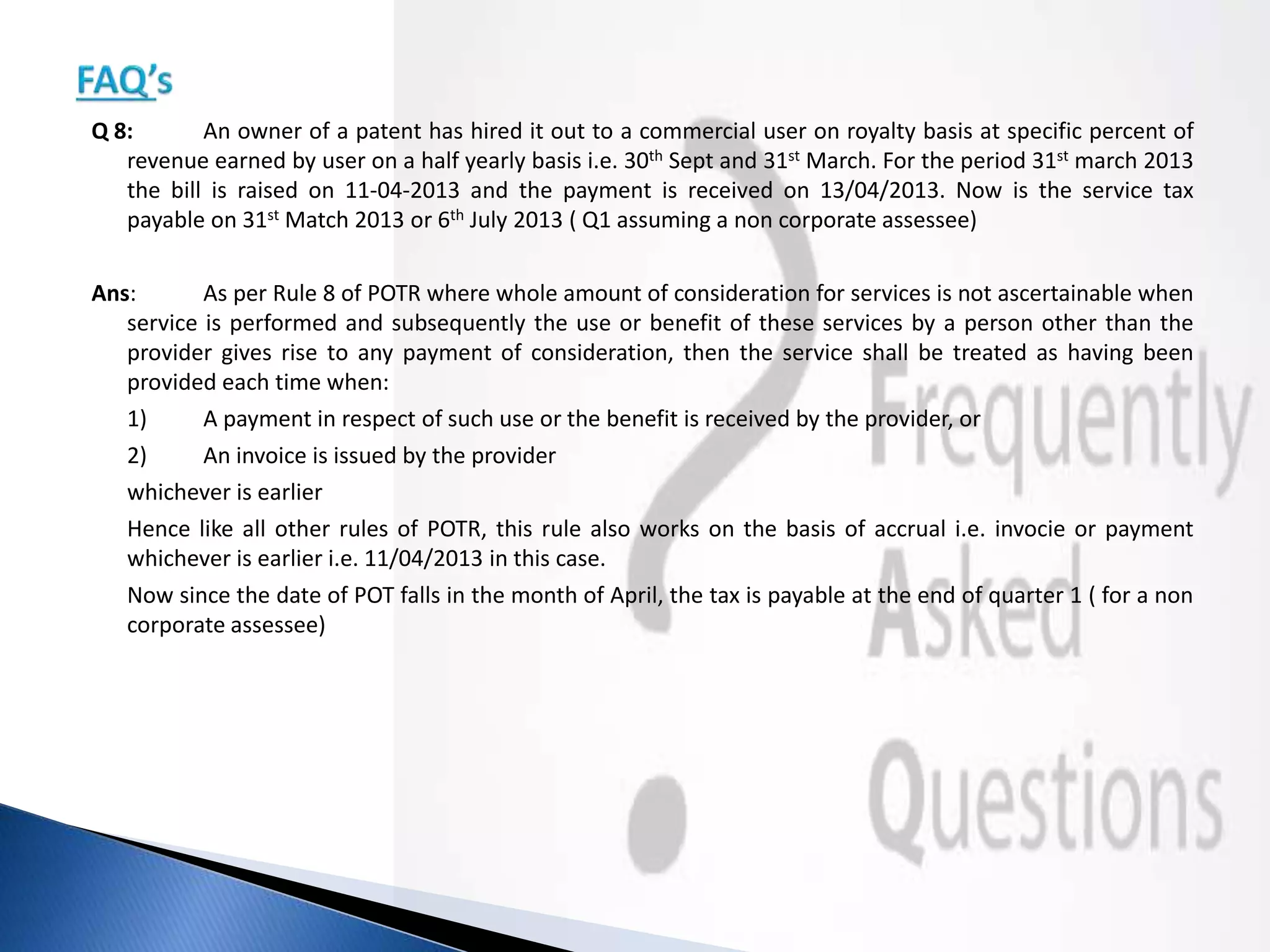

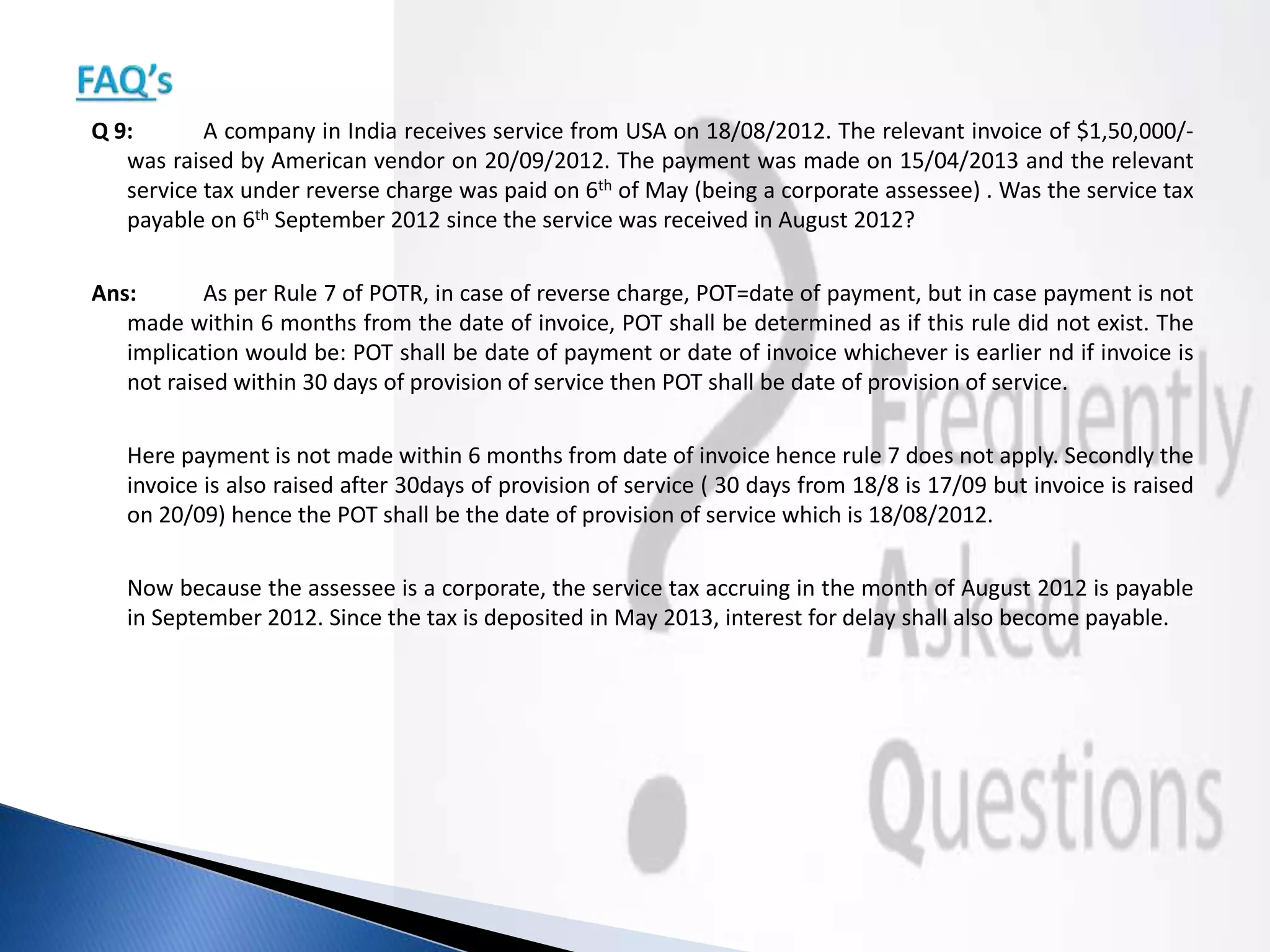

- In 2011, Point of Taxation Rules (POTR) were introduced to shift the tax collection basis from cash to accrual. Now, the service tax due date depends on the service completion date or invoice date, not payment receipt.

- POTR define the point in time when the service is deemed provided and tax becomes due. This aims to better align the service tax regime with the proposed GST regime.