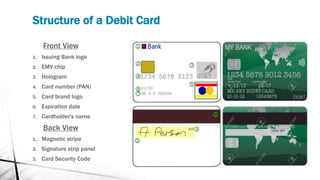

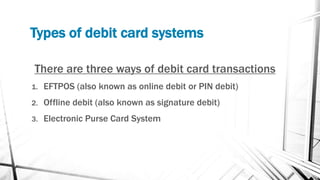

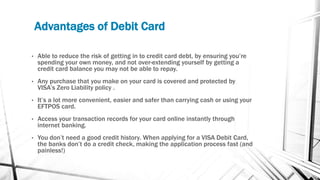

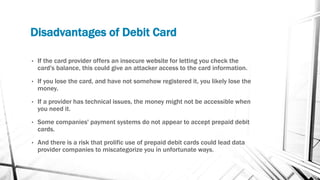

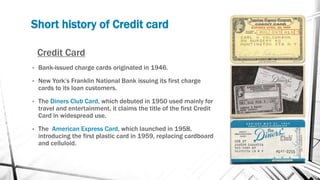

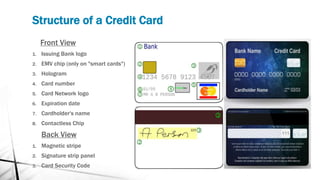

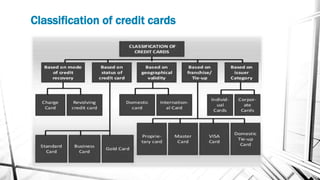

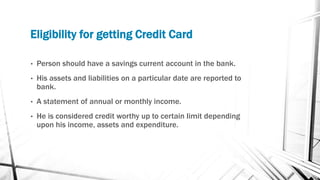

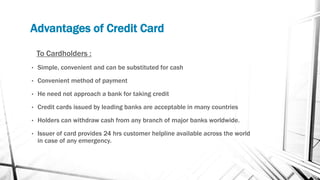

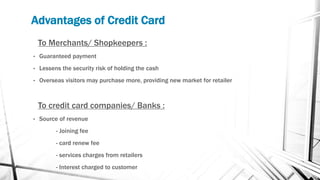

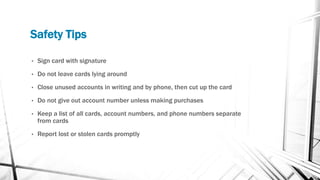

The document is a presentation on debit and credit cards, covering their definitions, histories, structures, types, advantages, and disadvantages. It explains how debit cards work, including transaction systems and their benefits, as well as the operational mechanics of credit cards and safety tips for users. The information is presented by a group of students from a Bangladesh university as part of their coursework in computer science and engineering.