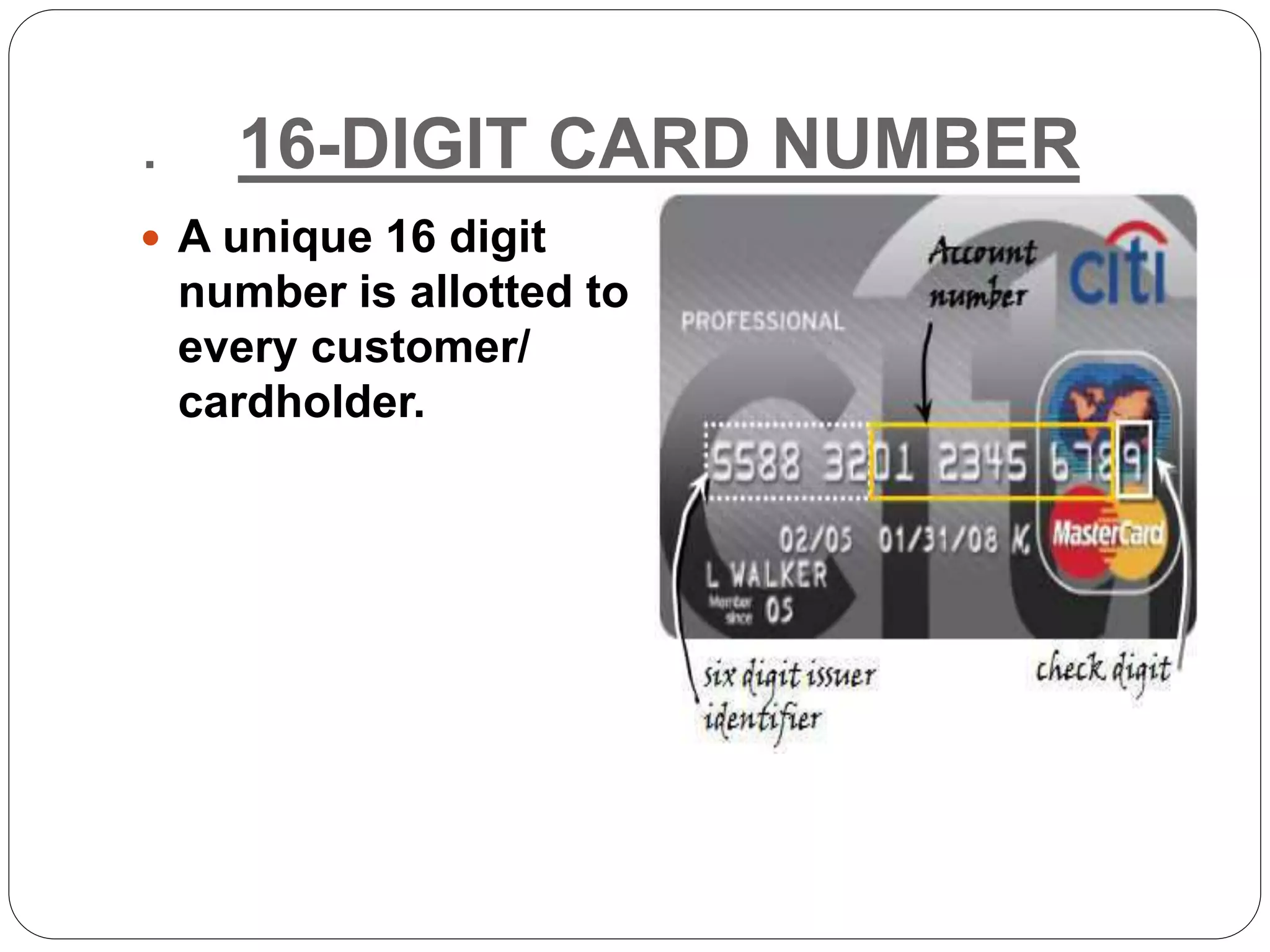

Plastic money refers to bank cards like debit and credit cards that allow cardholders to make purchases up to a predetermined credit limit. The first plastic money was introduced in 1951 by Franklin National Bank in New York. There are various types of cards including debit, credit, charge, smart, and co-branded cards. Key features include not needing to carry cash, obtaining cash from ATMs, and paying bills automatically. To be eligible for a card, one must earn over 60,000 rupees annually and have a bank savings account. Major banks in Pakistan that issue credit and debit cards include Standard Chartered, SBP, Allied Bank, and Habib Bank. Cards display the customer's name, 16-digit number