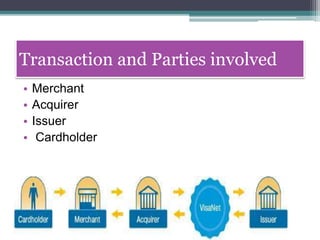

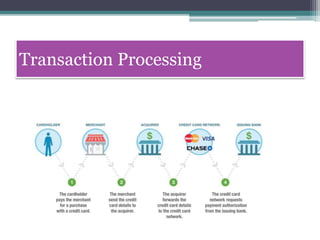

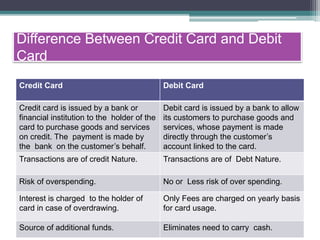

This presentation provides an overview of credit and debit cards. It defines debit cards as allowing direct withdrawal of funds from a customer's bank account for purchases. Credit cards allow cardholders to borrow money for purchases and pay it back later, potentially with interest. The document describes different types of credit and debit cards such as standard, premium, limited purpose, and specialty cards. It also outlines the parties involved in a transaction and how transaction processing works. Finally, it summarizes the key differences between credit and debit cards, such as credit cards being for purchases on credit versus debit cards withdrawing directly from a linked bank account.