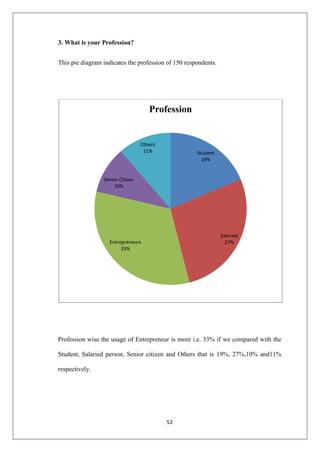

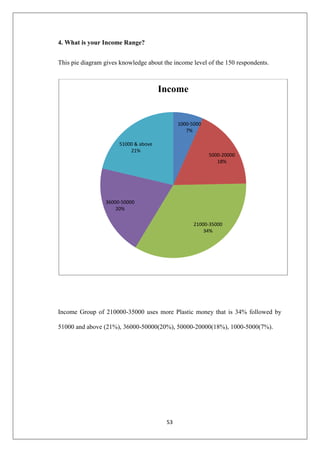

This document is a project report submitted by Nikhil D'Souza in partial fulfillment of the requirements for a Master of Management Studies degree from the University of Mumbai. The project examines factors influencing consumer behavior towards the use of plastic money (credit/debit cards) in Mumbai. The report includes declarations, certificates, acknowledgements, an executive summary, and chapters on the introduction and research methodology, literature review, data analysis, findings, and conclusions and recommendations. The study aims to understand consumer attitudes and behaviors related to using plastic money for payments in Mumbai.