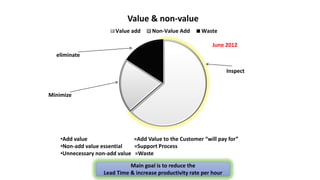

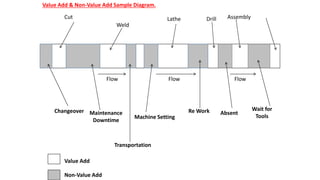

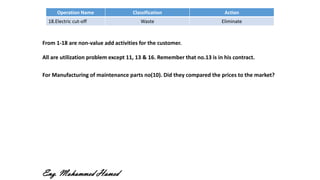

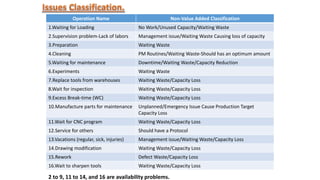

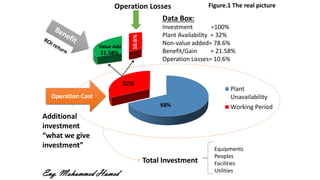

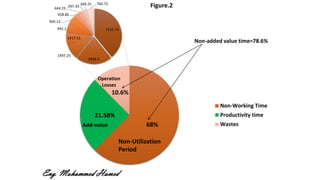

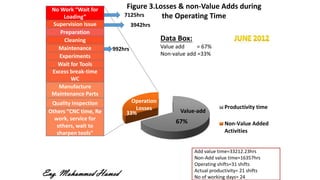

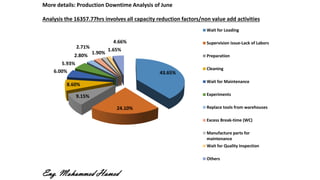

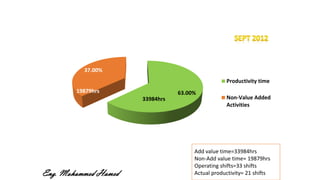

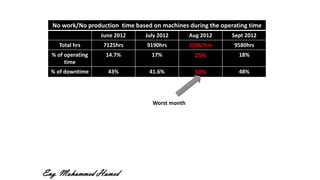

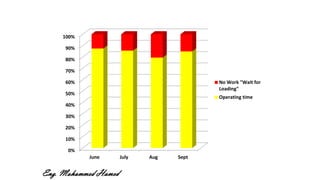

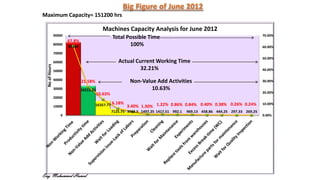

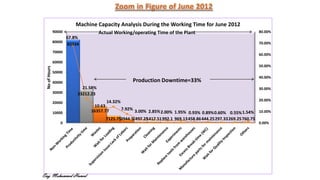

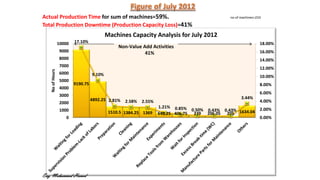

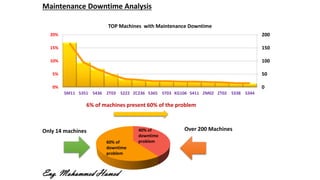

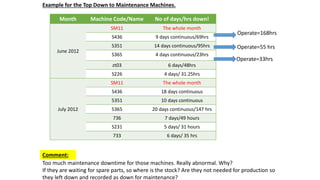

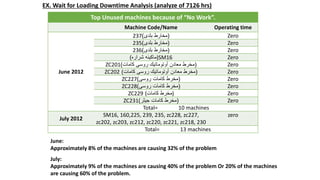

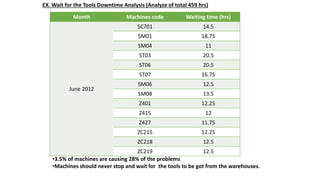

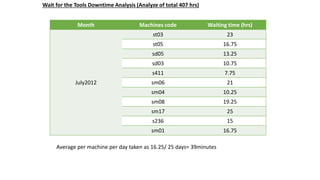

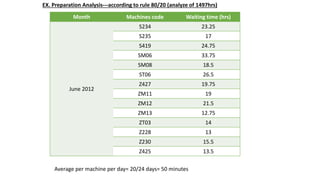

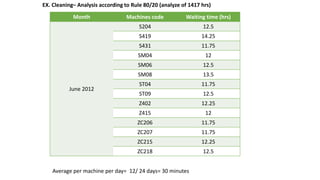

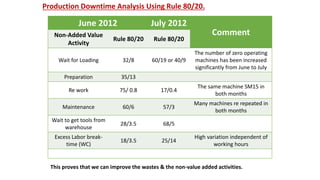

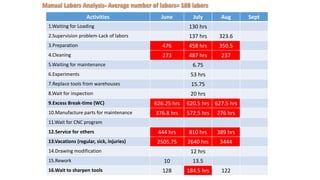

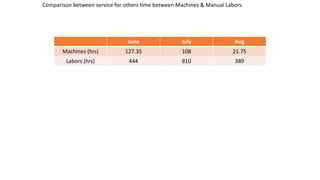

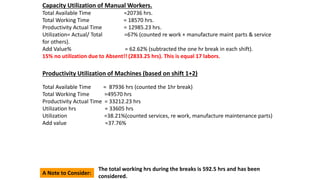

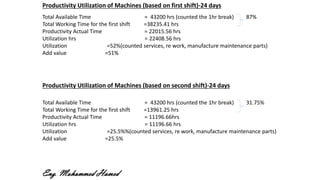

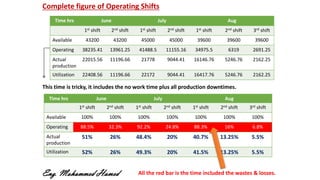

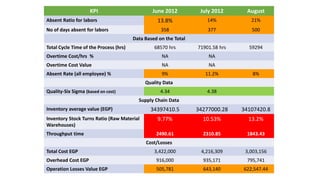

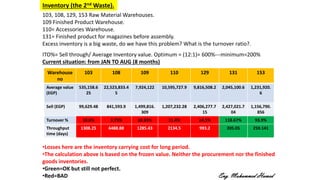

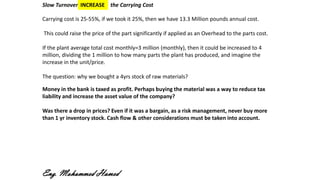

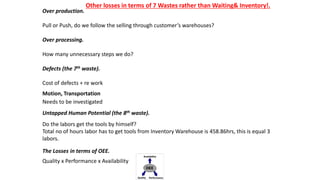

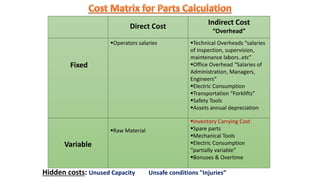

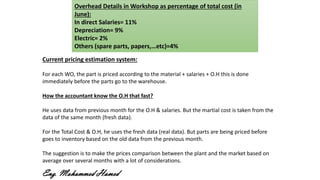

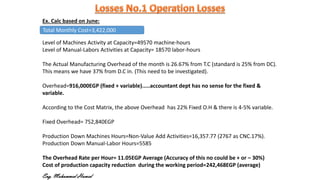

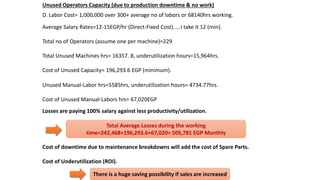

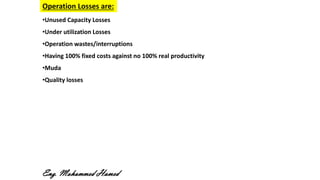

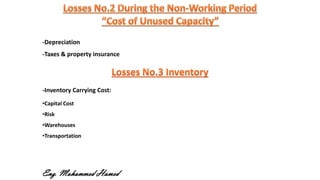

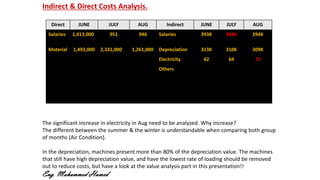

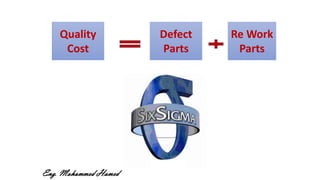

The document provides a SWOT analysis and operational review of a workshop producing spare parts. It identifies key weaknesses as a lack of lean implementation and high operation losses. Opportunities include reducing overheads and hidden losses to lower prices and increase sales. Non-value added activities account for 78.6% of time, including waiting, changeovers, and quality inspection. Implementation of standard work and reducing downtime could significantly increase productivity and profits.