The document discusses fiscal administration and the budget process in the Philippines. It covers:

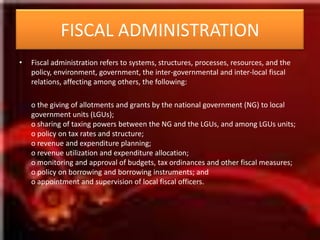

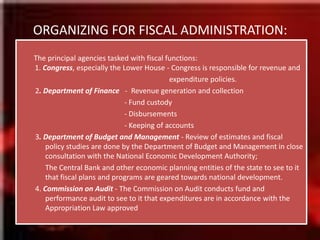

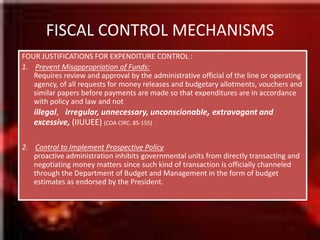

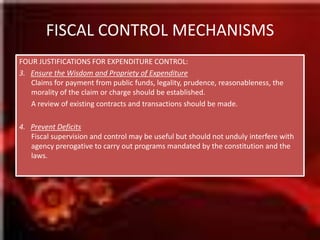

1) Key aspects of fiscal administration including intergovernmental relations and the roles of agencies like Congress, the Department of Finance, and Commission on Audit.

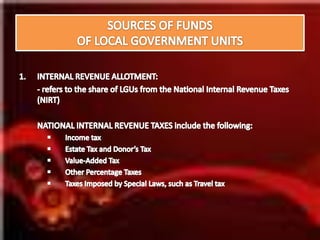

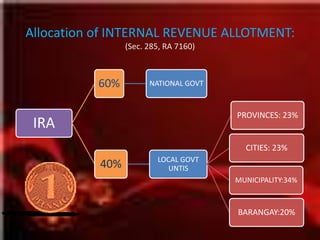

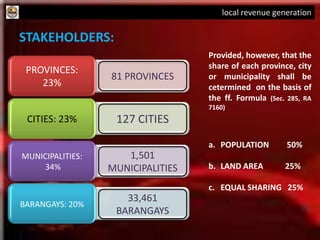

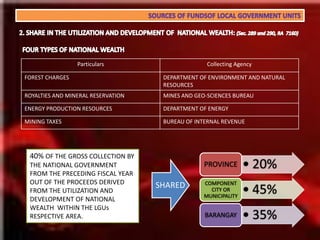

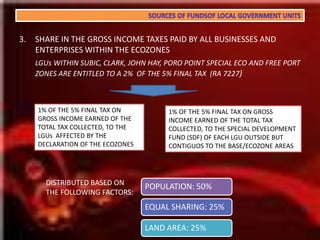

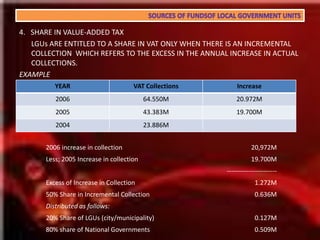

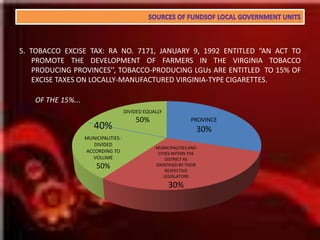

2) Sources of funds for local governments including internal revenue allotments, shares of national wealth and taxes, and the formulas for allocating these funds.

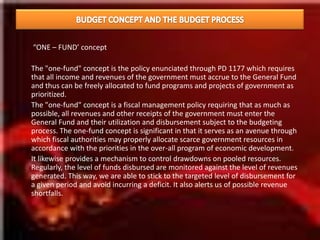

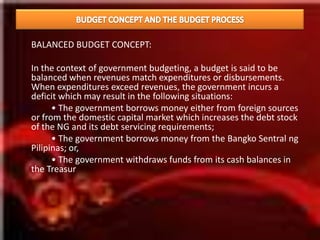

3) Core budget concepts used including the one-fund concept, balanced budgeting, and total resource budgeting. It also discusses the government's surplus budgeting policy.