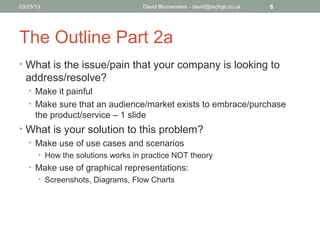

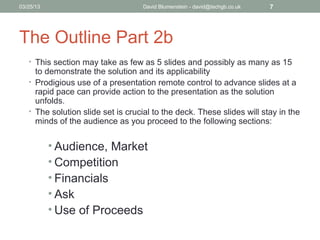

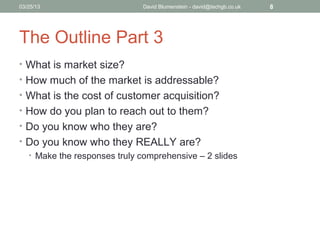

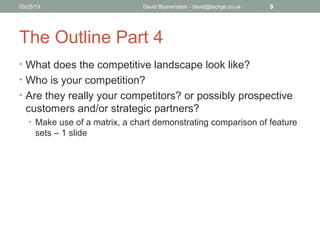

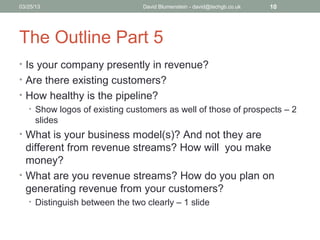

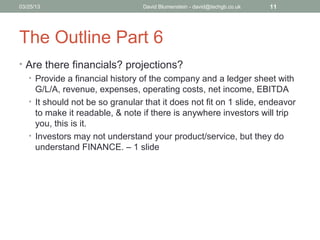

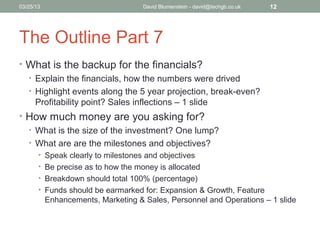

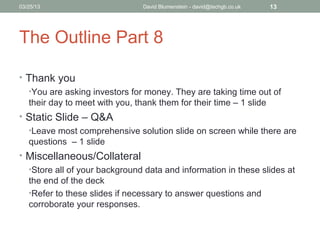

The document outlines a comprehensive guide for creating an investor presentation slide deck, emphasizing the importance of clarity, focus on objectives, and showcasing the value proposition of a company. It details the essential components of the deck, including company overview, market analysis, competition, financial projections, and how to effectively communicate the funding request. Additionally, it highlights the need for the presentation to reflect the company's vision and preparedness, while also engaging the audience and answering their questions.