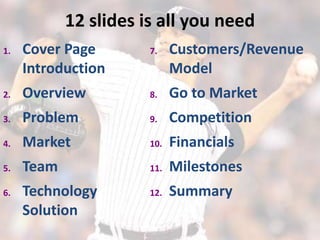

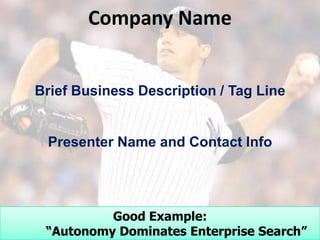

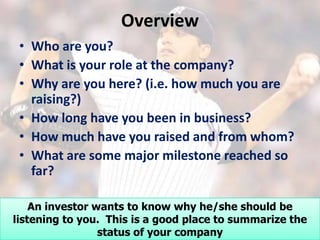

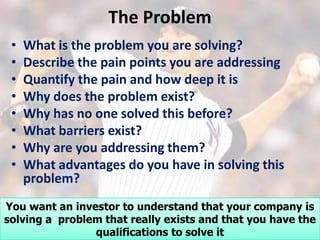

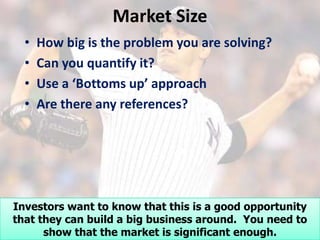

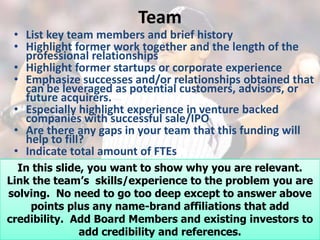

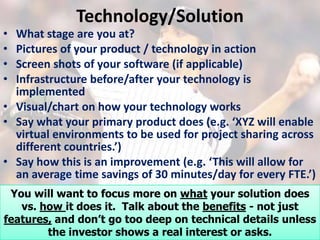

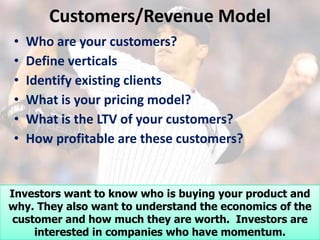

The document outlines the essentials for preparing a persuasive business plan and pitch for investors, emphasizing the importance of storytelling in conveying a business's potential. It covers key aspects such as identifying the problem, market size, team qualifications, technology, customer revenue models, go-to-market strategies, and competition. The document also provides a structure for a successful presentation, highlighting the need for preparation and clarity in delivering the pitch.