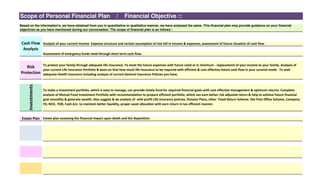

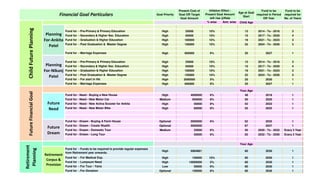

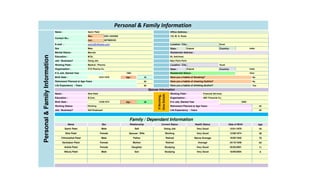

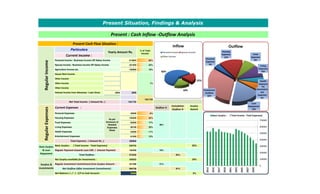

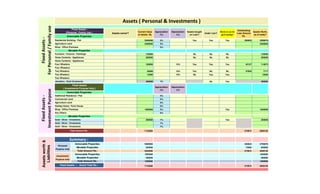

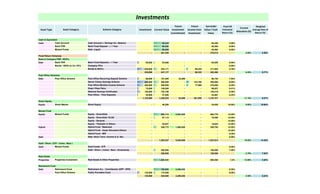

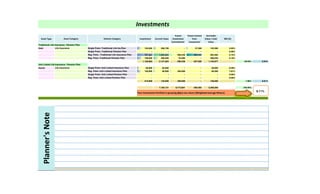

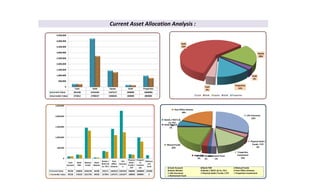

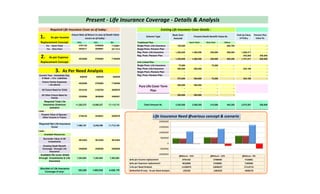

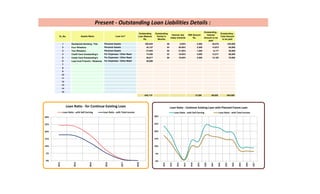

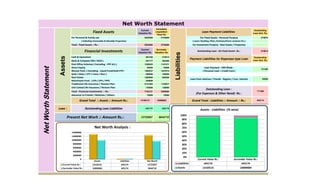

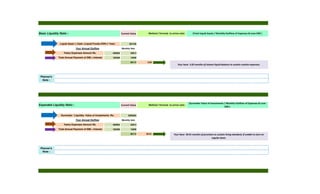

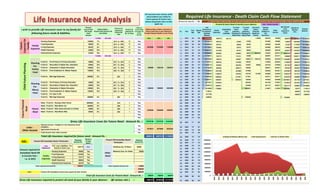

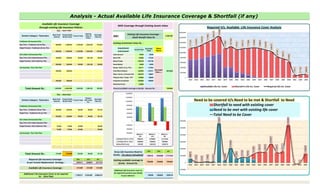

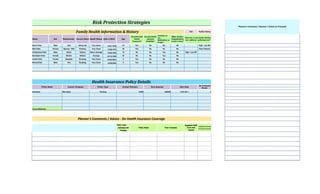

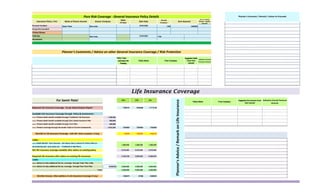

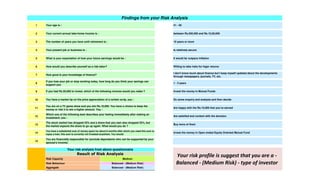

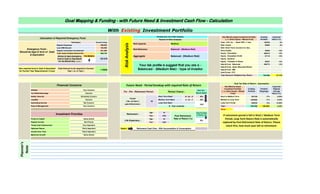

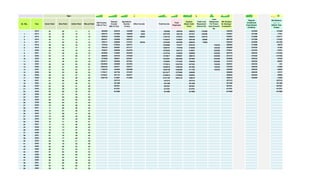

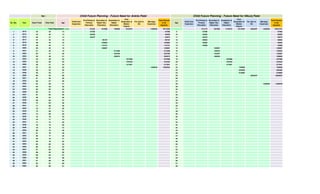

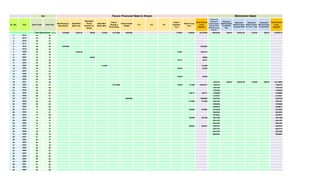

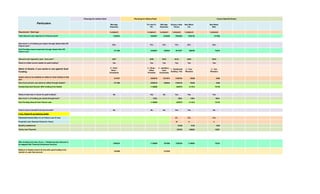

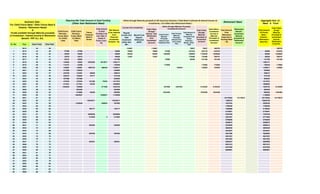

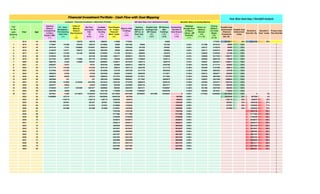

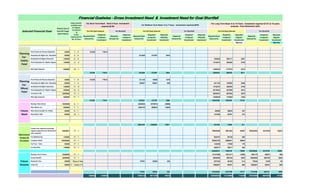

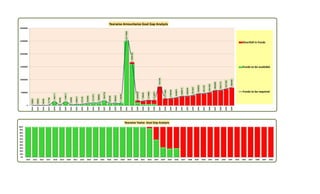

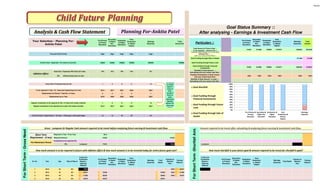

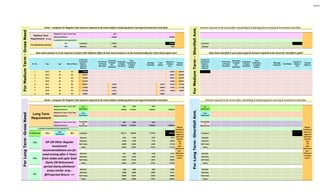

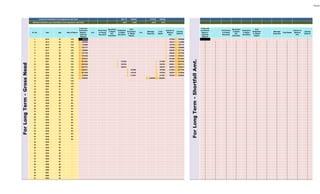

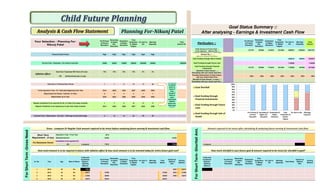

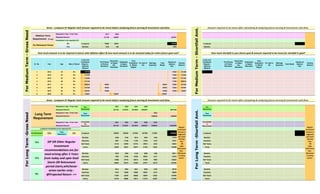

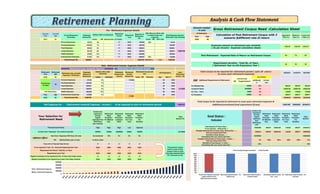

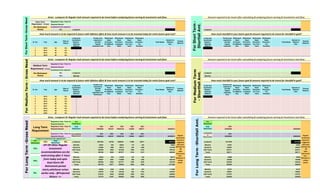

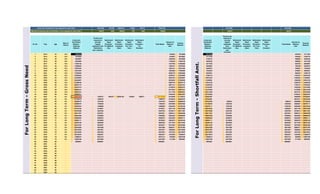

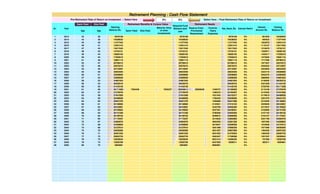

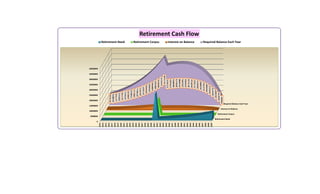

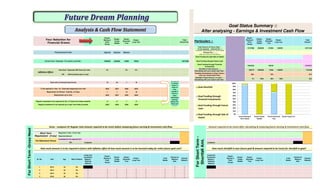

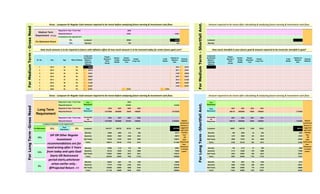

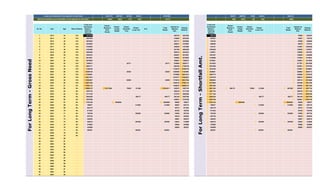

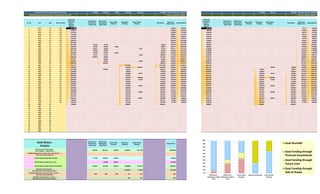

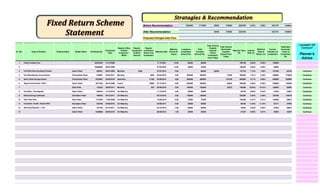

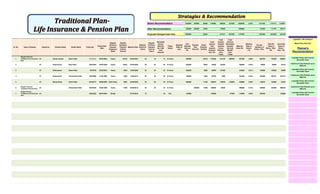

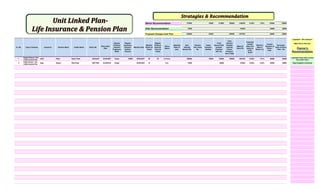

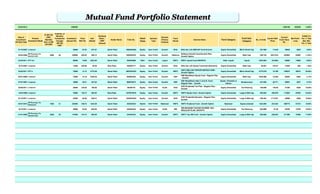

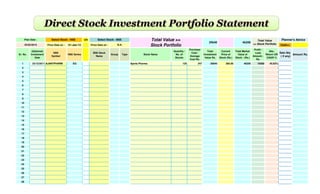

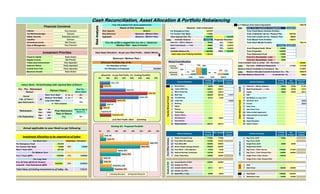

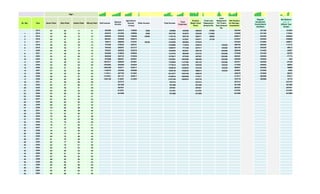

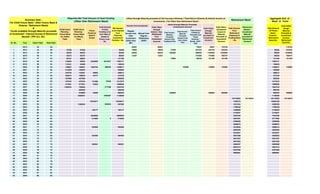

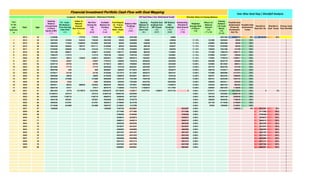

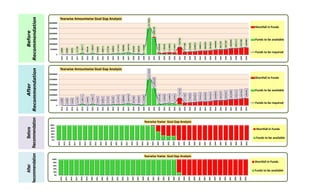

The document is a comprehensive personal financial planning report for Samir Patel and his family, prepared by Satish Mistry of XL Finplan. It includes an analysis of their personal finances, investment strategies, risk protection assessments, and detailed goal prioritization to guide their financial objectives effectively. Key elements covered are cash flow analysis, insurance evaluation, and recommended investment portfolios to meet future financial needs.