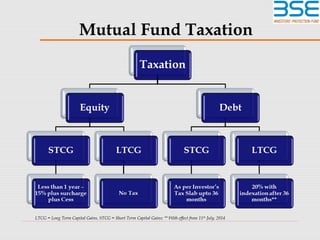

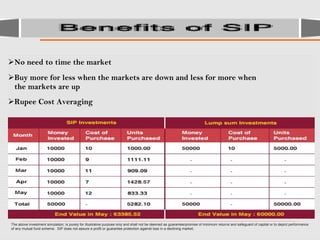

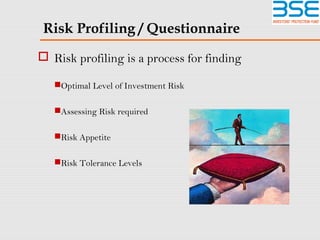

The document provides information about capital markets in India. It discusses the Bombay Stock Exchange (BSE) as the oldest stock exchange in Asia, established in 1875. It lists various market offerings at BSE like cash market, derivatives, debt market segment, and ETFs/mutual funds. It also describes how the capital market operates with T+2 settlement system and details demat and e-trading facilities. It notes the role of regulator SEBI and various asset class offerings like equity, debt, gold. The document emphasizes the importance of investing to beat inflation and highlights equity investing can provide higher long-term returns than fixed deposits.