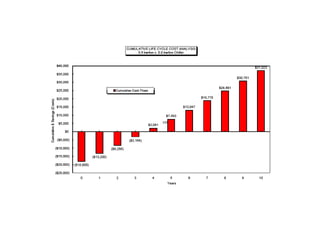

A life cycle cost analysis compares the total costs of equipment and systems over their entire useful lives, including initial installation costs as well as operational and maintenance costs. It can help justify investments in more efficient technologies that have a higher upfront cost but lower lifetime expenses. This example analyzes two different chillers over 10 years using metrics like net present value, payback period, and internal rate of return to determine which option provides the best long-term value. It finds that a more efficient chiller with an initial premium of $18,000 has a positive net present value of $23,984 and payback period of 3.8 years, making it the most cost-effective choice.

![ANNUAL ENERGY COST DISCOUNT

YEAR PRESENT VALUE

DIFFERENCE FACTOR

1 $4,800 0.9524 $4,572

2 $4,944 0.9070 $4,484

3 $5,092 0.8638 $4,399

4 $5,245 0.8227 $4,315

5 $5,402 0.7835 $4,233

6 $5,565 0.7462 $4,152

7 $5,731 0.7107 $4,073

8 $5,903 0.6768 $3,995

9 $6,080 0.6446 $3,919

10 $6,263 0.6139 $3,845

$41,988

NPV = $41988 - $18,000 = $23,984

SIR = $41988 / $18000 = 2.33

Adjusted Internal Rate of Return (AIRR) = [(1+d)x(SIR)^(1/n)]-1 = [(1+.05)x(2.33)^(1/10)]-1 = 0.14 OR 14%](https://image.slidesharecdn.com/performingalifecyclecostanalysis-13303099390722-phpapp01-120226203327-phpapp01/85/Performing-A-Life-Cycle-Cost-Analysis-15-320.jpg)