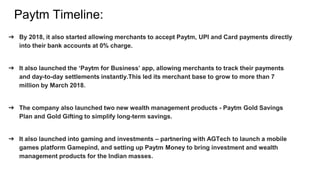

Paytm is India's largest digital payments platform that offers comprehensive payment services for customers and merchants through its wallet, app, and payment bank. Founded in 2010, Paytm pioneered QR-based mobile payments in India and has over 7 million merchants accepting payments through its platform. Paytm aims to bring banking and financial services to 500 million unserved and underserved Indians through its payment bank. The company generates revenue through affiliation marketing fees from advertisements on its app.