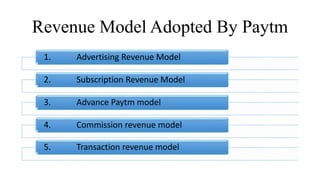

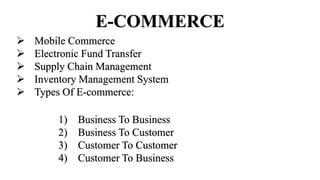

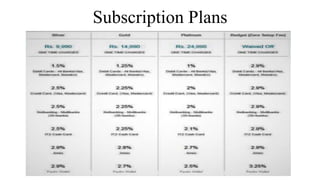

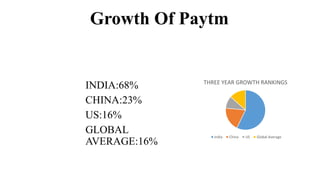

Paytm started in 2010 as a mobile recharge service and expanded into a digital payments platform. It has grown significantly since demonetization in India through its various payment, banking and e-commerce services. Paytm generates revenue through advertising, subscriptions, commissions and transaction fees from its payment services. It faces competition from other digital payment companies but continues to grow through expanding its service offerings and gaining brand awareness across India.