Embed presentation

Downloaded 19 times

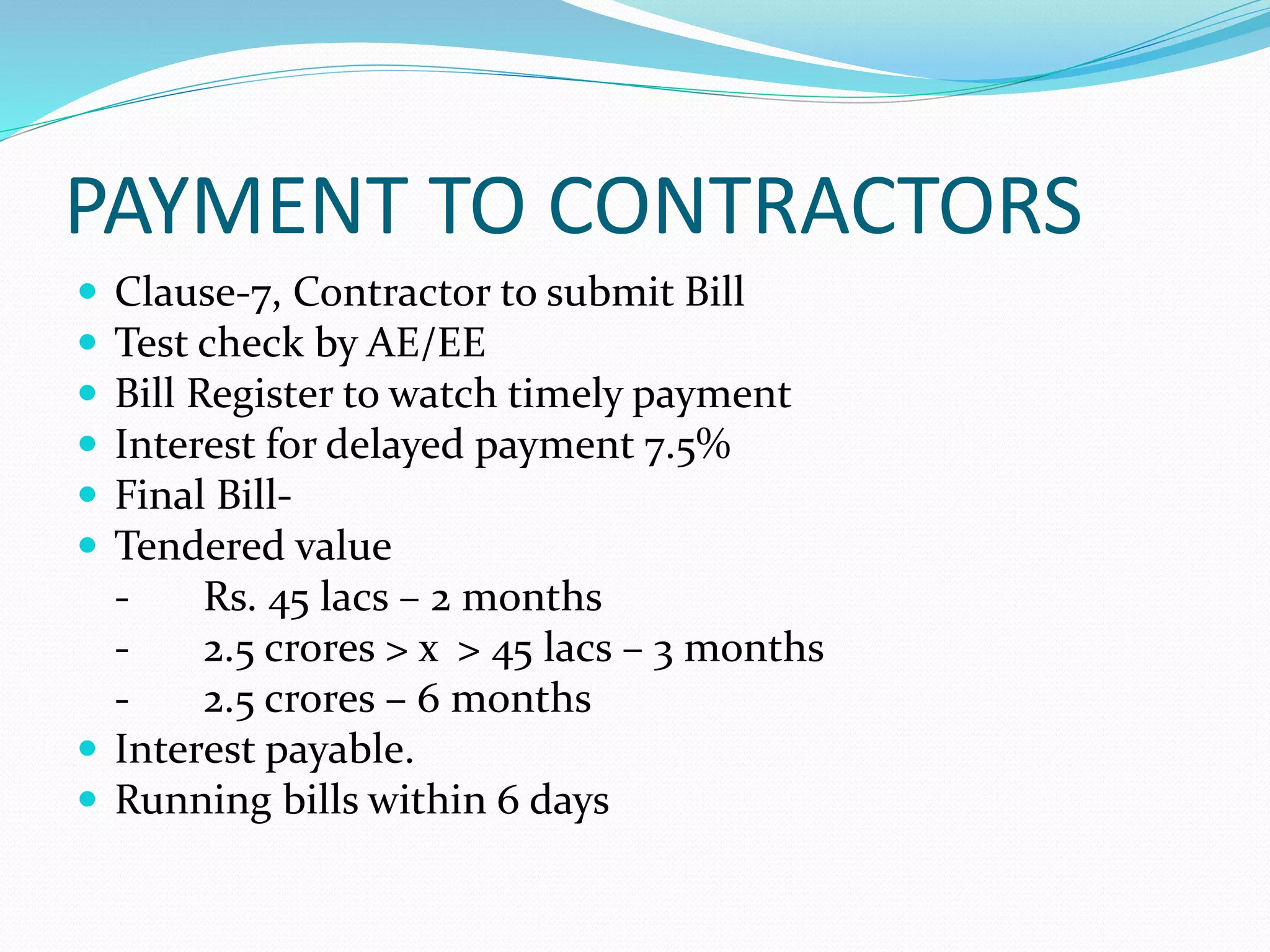

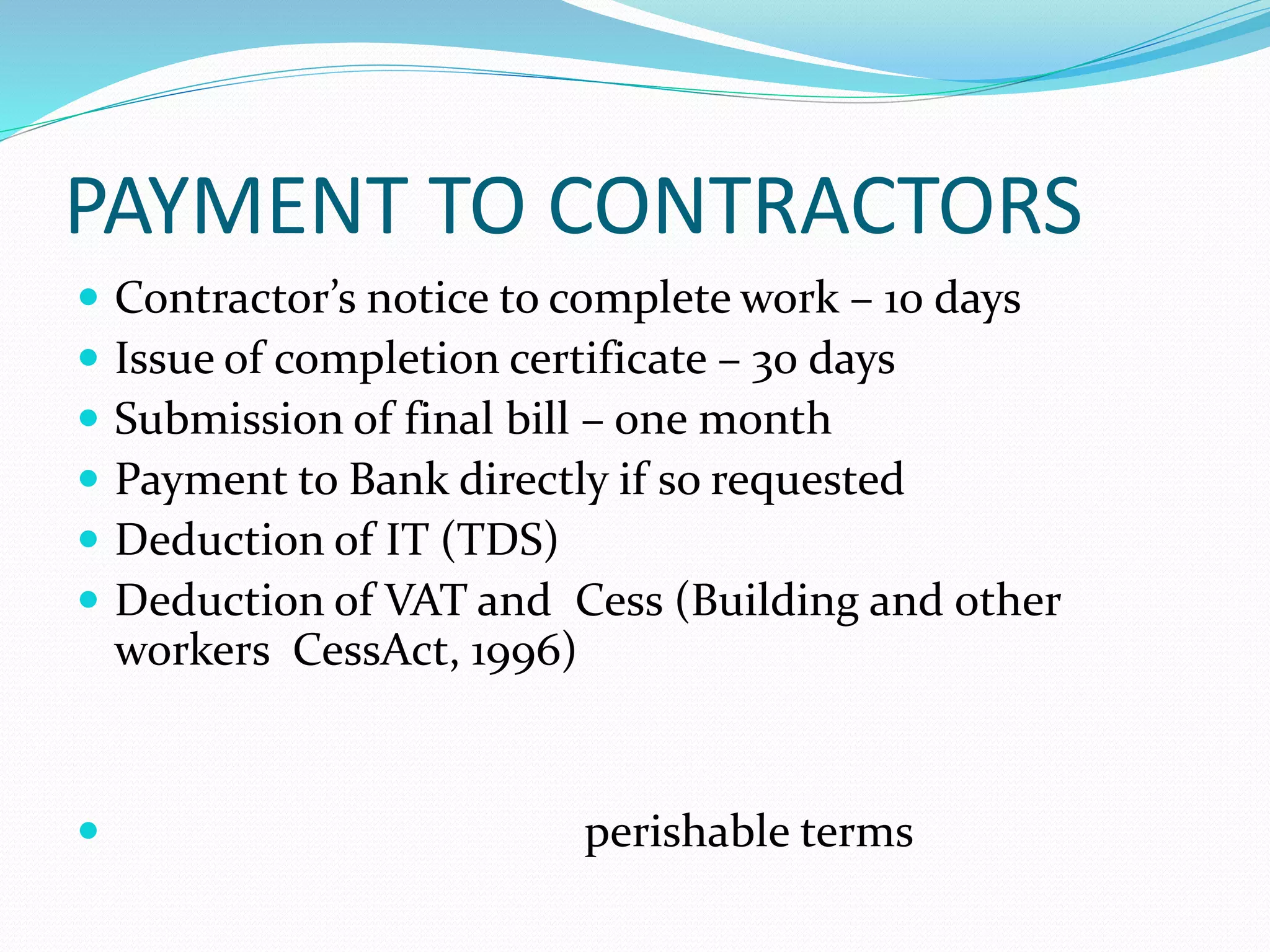

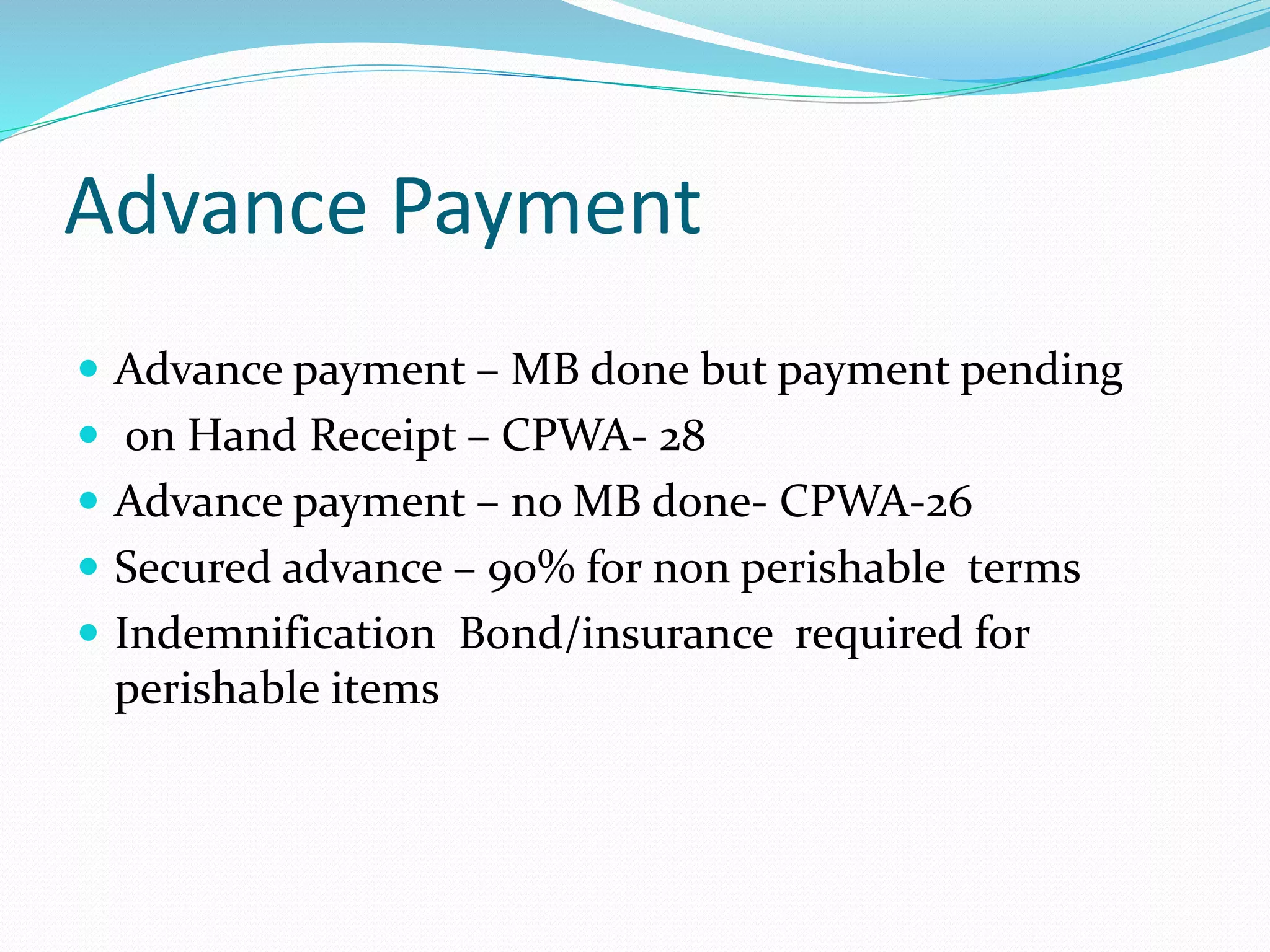

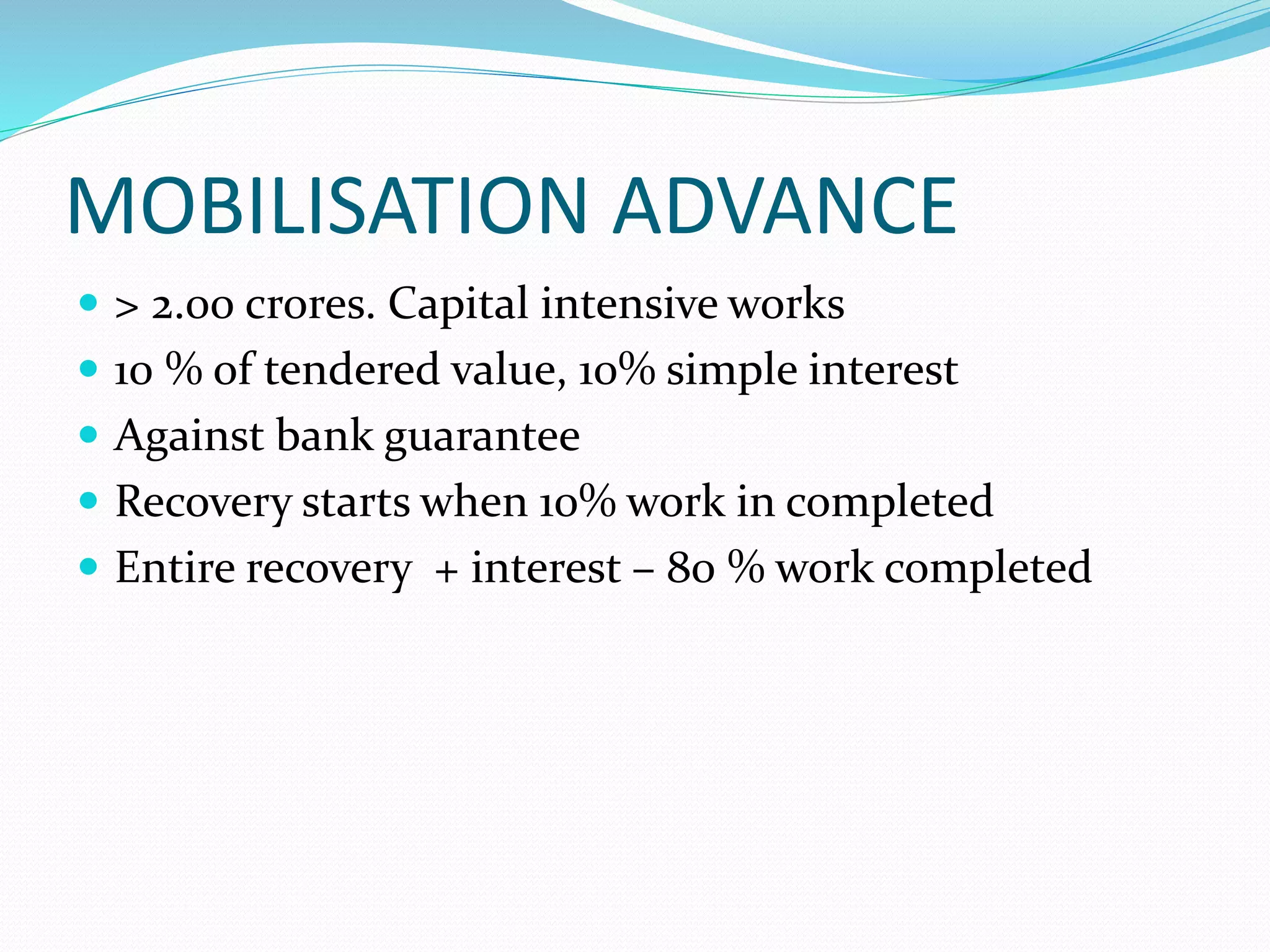

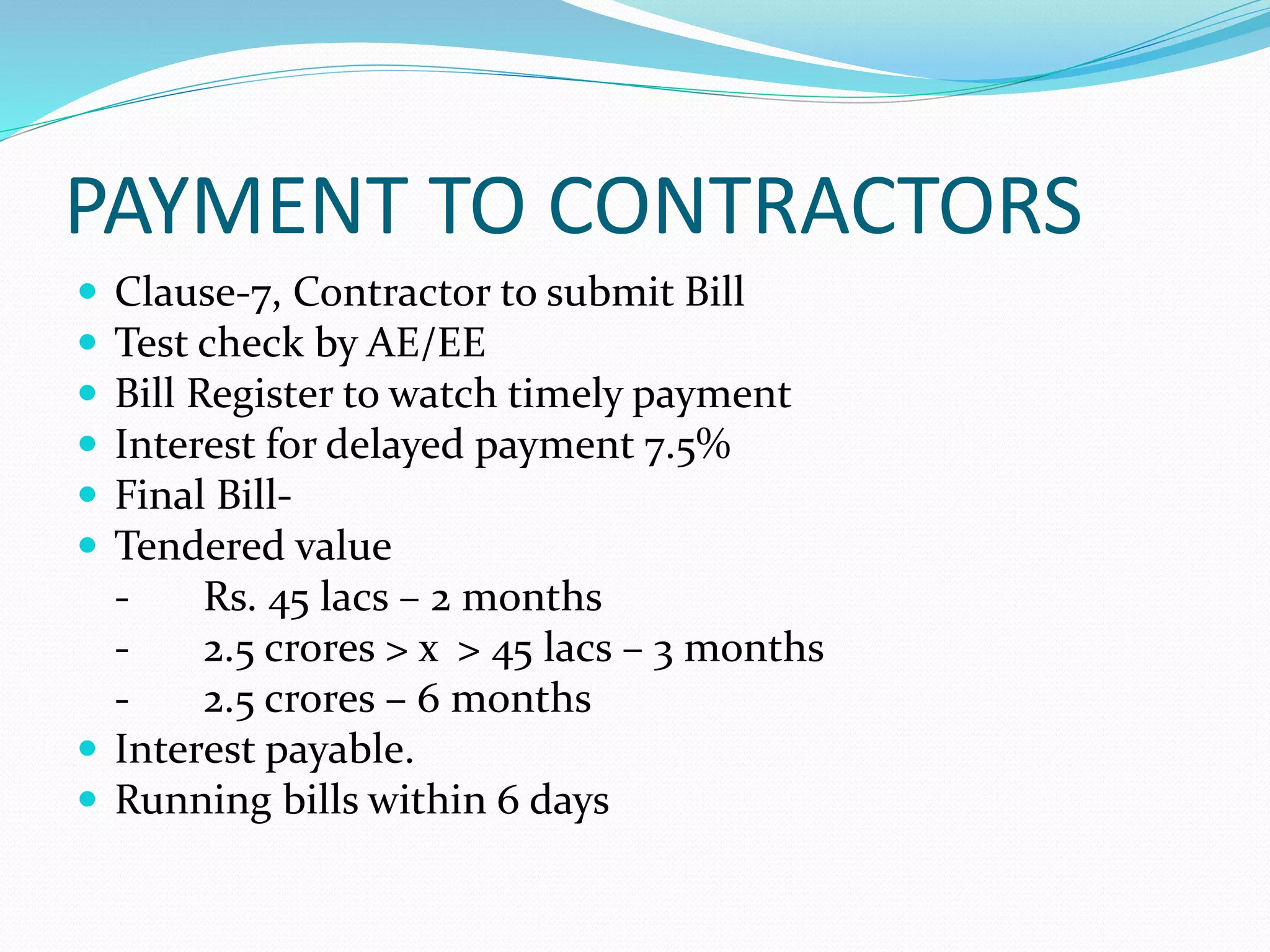

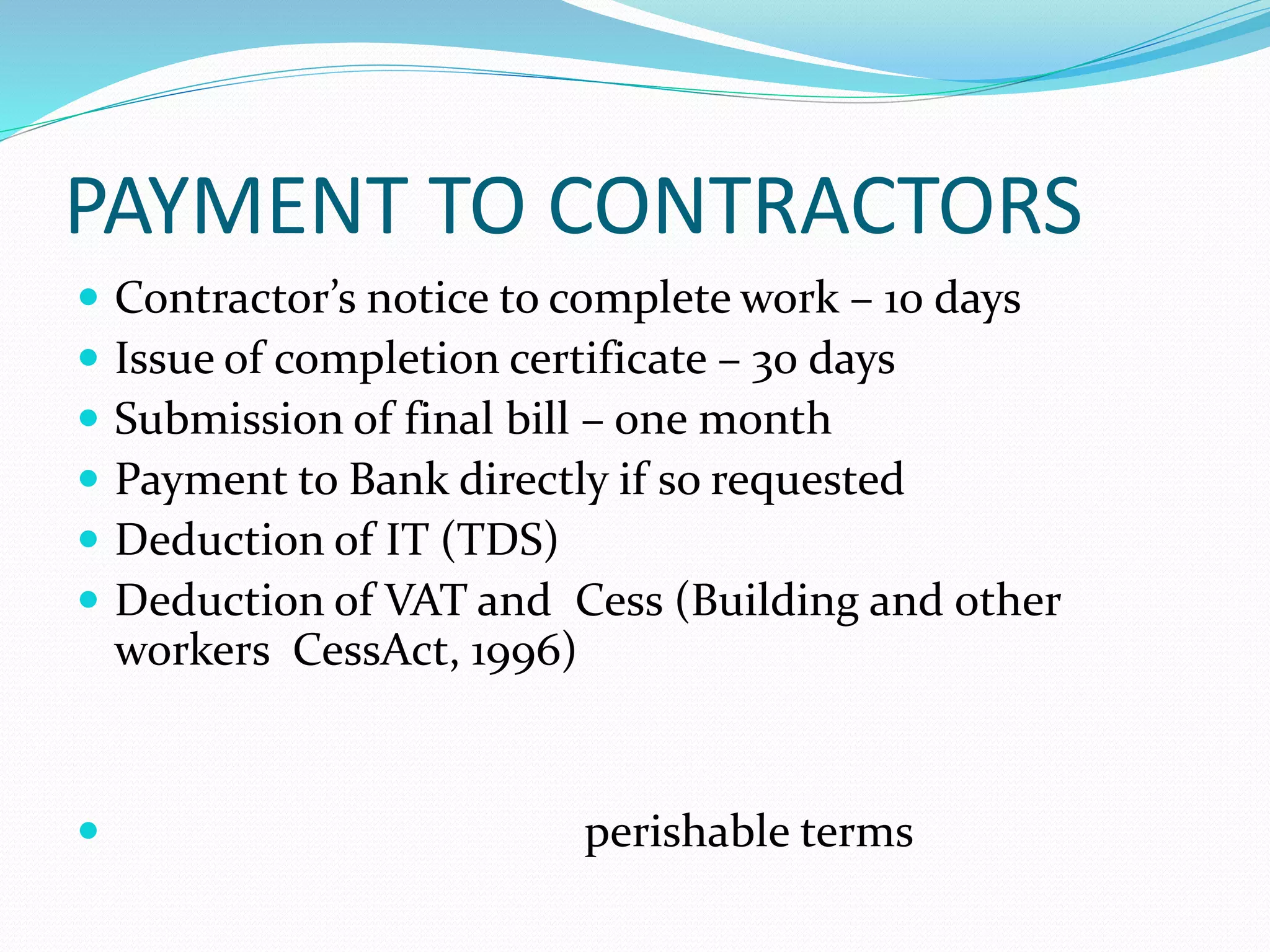

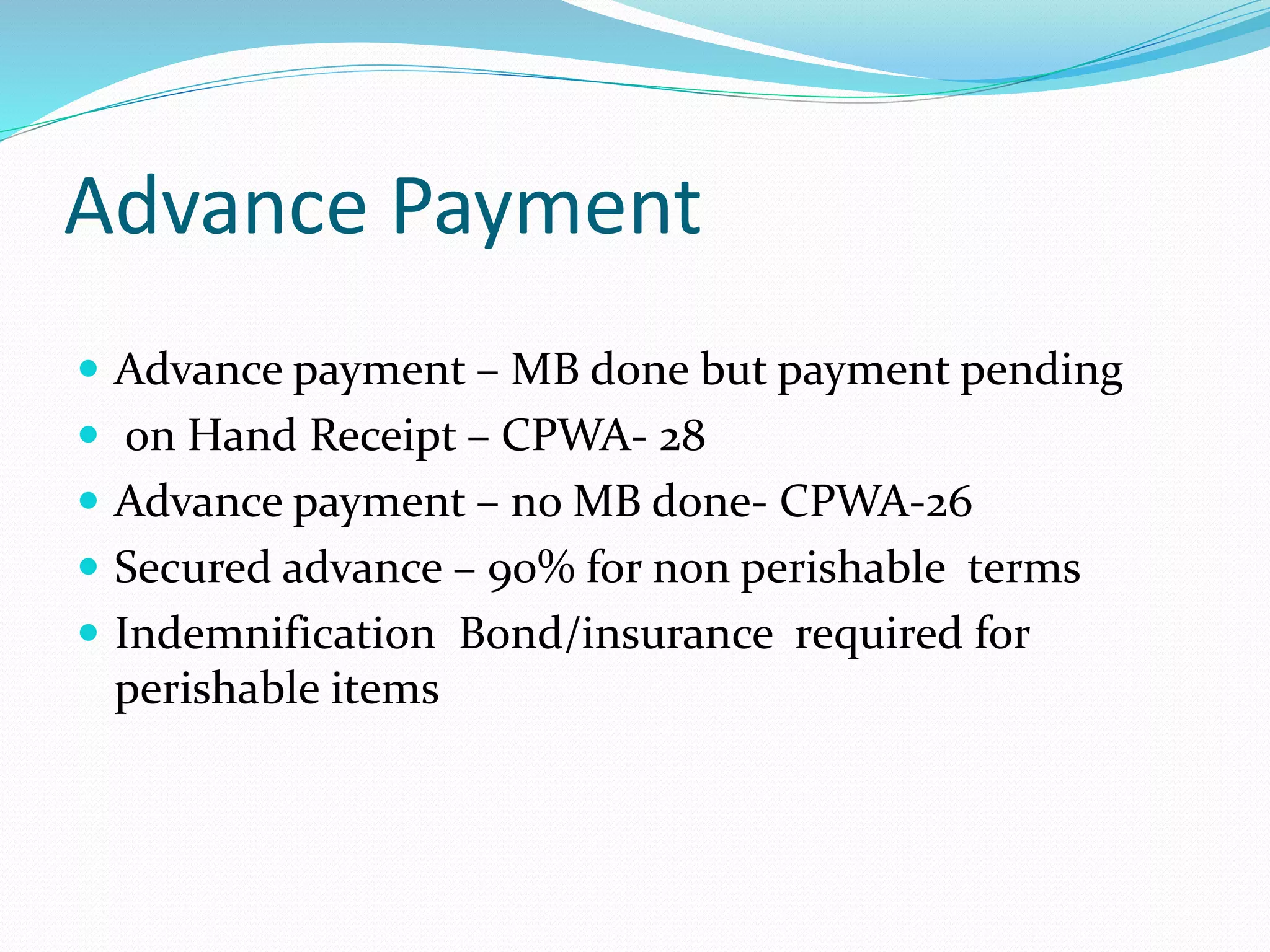

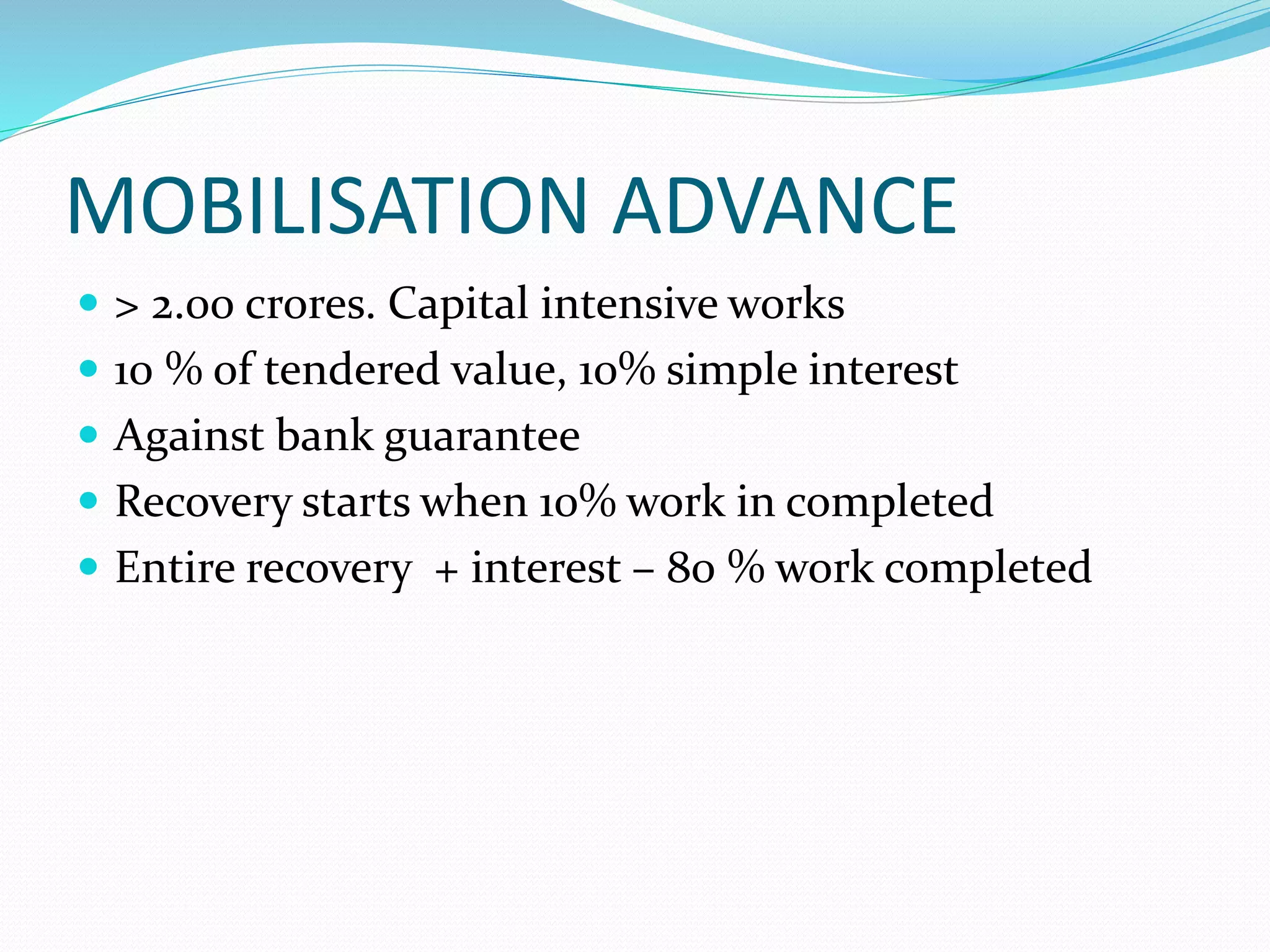

The document outlines policies for payments to contractors, including: 1) Contractors must submit bills that are then checked by engineers before payment. Final bills are based on tender value and interest is owed for delayed payments. 2) Contractors must notify completion within 10 days and receive completion certificates within 30 days. Final bills must be submitted within 1 month of completion. 3) Payments can be made directly to banks if requested. Deductions will be made for taxes, VAT, and cess. Advance payments require security and permits while mobilization advances over 2 crores require bank guarantees.