GST on works contract

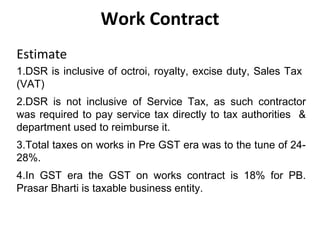

- 1. Work Contract Estimate 1.DSR is inclusive of octroi, royalty, excise duty, Sales Tax (VAT) 2.DSR is not inclusive of Service Tax, as such contractor was required to pay service tax directly to tax authorities & department used to reimburse it. 3.Total taxes on works in Pre GST era was to the tune of 24- 28%. 4.In GST era the GST on works contract is 18% for PB. Prasar Bharti is taxable business entity.

- 2. Work Contract Estimated Tax in Pre GST Era on Building Work 1. 2.Excluding Electrical items the tax can be assumed as 24% in Building work 3.The taxes in Building work excluding services can be assumed to be = 18% Excise (on cement, steel & other items) - 12.5% VAT - 7.5% CST - 1% Service Tax - 6% Total - 27%

- 3. Works Contract Estimate in GST - Era 1.The taxes in DSR may be assumed to be 18% 2.Present GST on Building work in PB is 18%. 3.Therefore any estimate based on DSR in GST era can be presumed to be inclusive of GST @ 18% (inclusive of all taxes). 4.The estimate in the end will show taxes separately. 5.Say Estimated cost = 100 based on DSR 6.Taxes are as per rule 35 of CGST rules. 1. Cost excluding taxes = 100 = 84.8 118 2. CGST = 7.6 3. SGST = 7.6 Total = 100.00

- 4. Work Contract Justification in the GST Era 1.The contractor uses material & labour as input and he is charged taxes on input tby supplier of materials/ labour. He will get ITC on taxes paid to suppliers. 2.The contractor supplies works contract service, which is out put supply of contractor. He is liable to pay tax to government on out put of works contract. 3.Net tax liability of contract = (out put tax liability on value of works contract– ITC on materials & services.) 4.Prepare the justification on MR. 5.Add Justified Amount on MR and Net tax liability of contractor. 6.Justification is (Justified Amount on MR + out put tax on justified amount – ITC on materials & services.)

- 5. Work Contract NIT Conditions 1.The GST has been implemented by the Government of India with effect from 1st July 2017. The rates quoted by the tenders, shall be firm and inclusive of all taxes including GST. 2.Tenderer shall examine the various provisions of CGST Act, 2017 IGST Act, 2017/ UGST Act – 2017/ SGST Act 2017 of the respective state and up to date amendments issued from time to time and other applicable taxes before bidding/ tendering. The tenderer shall also confirm to the rules made under these Acts. 3.The tenderer shall ensure that benefit of Input tax credit (ITC) likely to be availed by them is duly considered by them while quoting rates.

- 6. Work Contract, NIT 4. The contractor shall submit the invoice of the work executed as per rule 46 of the CGST rules. The taxes will be calculated as per rule 35 of CGST Rules 2017. 5. As contractor’s rates are inclusive of all taxes, no reimbursement of any tax shall be made to the contractor. The clause 37 of GCC of NIT/contract stands modified accordingly. 6. TDS on income tax, labour cess and other statutory deductions shall be made at source as per prevalent laws. TDS on GST as & when becomes applicable will also be deducted as per relevant GST Act/ rules/ notification.

- 7. Work Contract INVOICE 1.The contractor shall submit the invoice of the work done as per rule 46 of the CGST rules. 2.The contractor shall mention his invoice number, GSTIN number and also the GSTIN number of the department. 3.The invoice shall indicate CGST, SGST/ UTGST or IGST as per rules. The taxes will be calculated as per rule 35 of CGST rules 2017. 4.Say Gross Amount of work done as per contract rates = Rs. 100 5.Amount excluding taxes = 6.GGST = x9 7.CGST = x9 8.Payable amount including GST And Taxes= 100. Further deductions shall be made as per statutory provisions/contract. 100 118 100 118 100 118

- 8. Work Contract 1. The contractor shall file the invoice details in GSTR-1 on GSTN portal and shall pay the GST to the Government at the time of filling the monthly return. 2. DDO will indicate the invoice details of the contractor in GSTR-2 of the PB. The GSTR-2 will be sent to SNO of AIR/ DD within the stipulated date as circulated by PB.

- 9. Work Contract Deposit Work 1. The CCW will submit estimate to client department inclusive of departmental charges & GST & other taxes. 2. The GST will however be worked out & indicated in the estimate. 3. GST will be applicable on full amount ie [Estimated cost without GST + Departmental charges]. 4. The CCW will make payment to contractor as per the invoice of contractor. 5. CCW will submit invoice to client department adding departmental charges and indicating the GST. 6. The CCW will mention AIR GSTIN and GSTIN of the client organization (if registered)

- 10. Work Contract Deposit Work 7. The input and output invoice details shall be sent to SNO of AIR in GSTR-2/GSTR-1 timely so that PB /client department may get benefit of ITC wherever permissible. 8. The GST on output supply charged from client department will be paid to the Government by PB after availing ITC. The PB will get ITC only when contractor files his invoice details on GSTN portal.

- 11. THE END THANKS