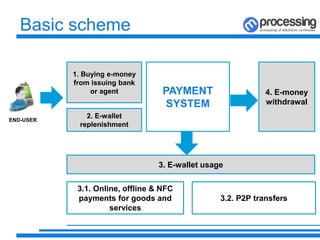

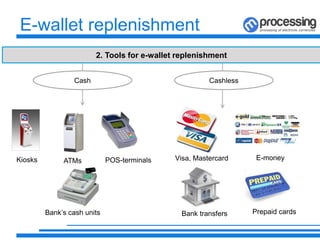

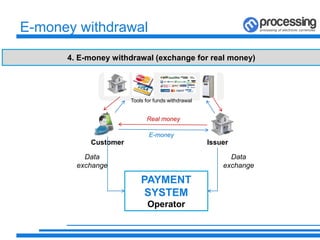

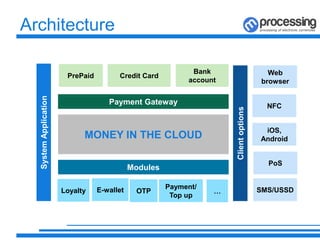

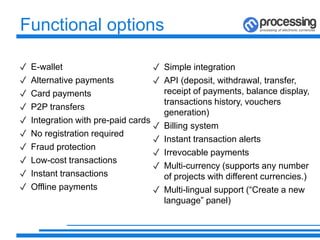

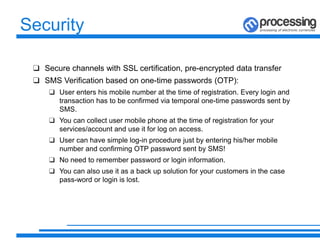

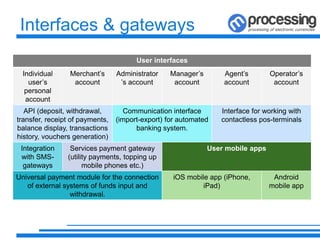

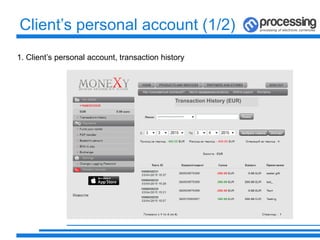

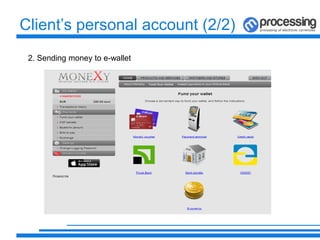

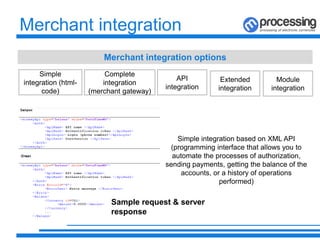

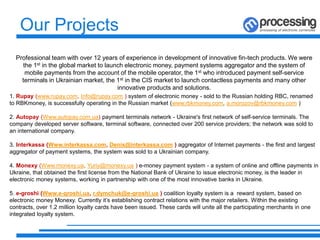

The document describes a payment system that enables customers to pay for goods and services using an e-wallet. The system allows users to replenish their e-wallet through cash or cashless methods and make payments online, offline, or through NFC. Merchants can integrate the payment system through APIs or simple integration options. The system has robust security features like OTP verification and is supported by a professional team with over 12 years of experience in fintech products.