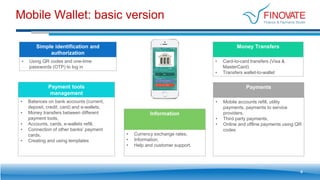

The document outlines a proposal for a bank mobile wallet solution, emphasizing its benefits for both banks and customers, such as cost reduction, customer data collection, and increased engagement with tech-savvy clients. It details the functionalities of the wallet, including account management, money transfers, and payment services, while proposing a turnkey solution with an initial cost of $30,000. Additionally, it suggests potential future enhancements and highlights the expertise of the development team in fintech solutions.