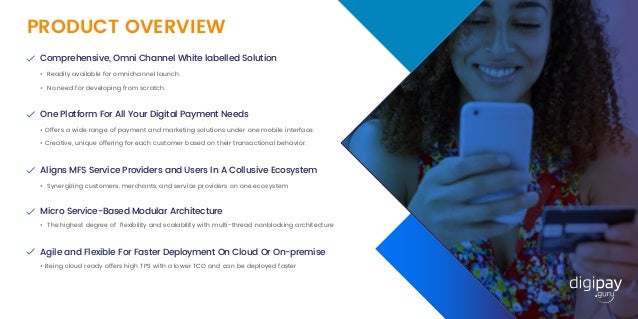

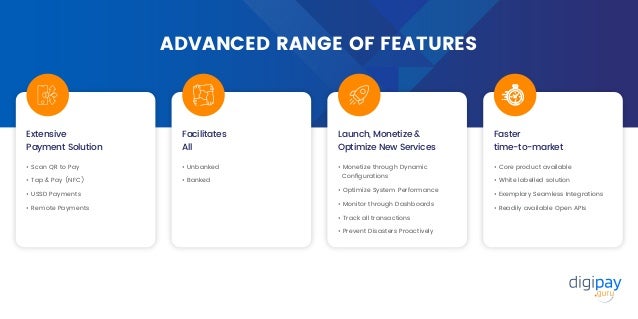

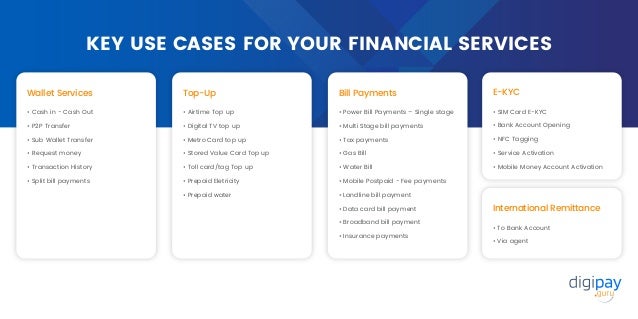

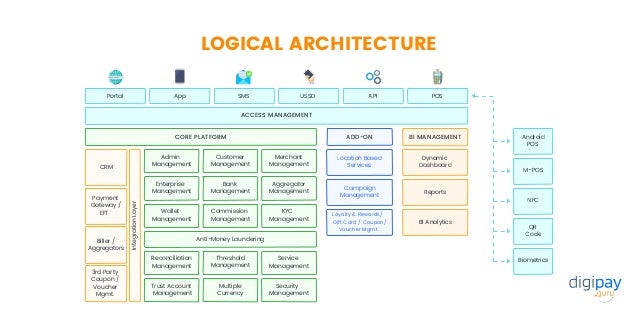

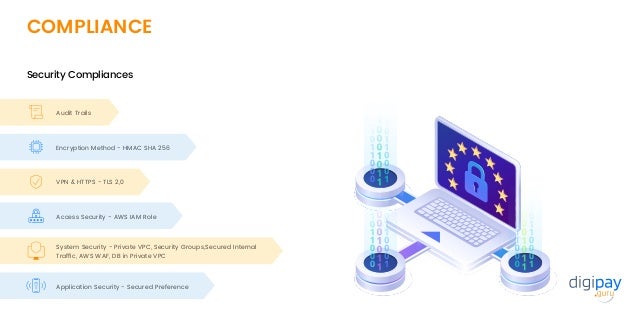

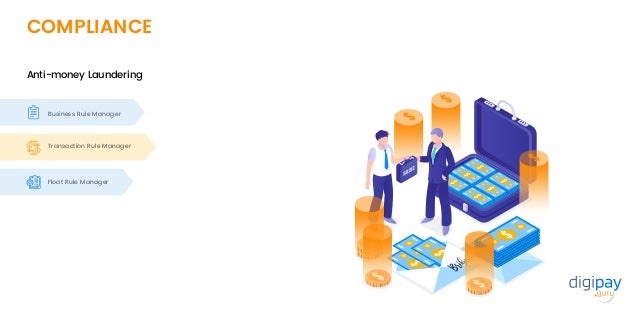

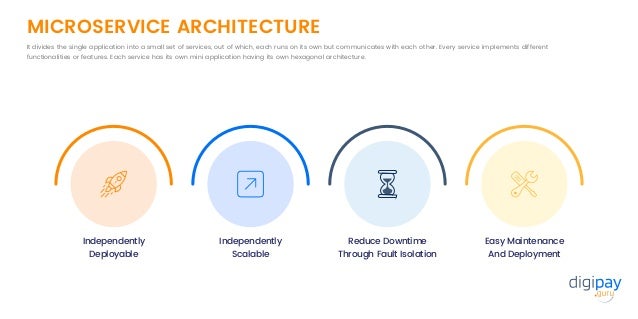

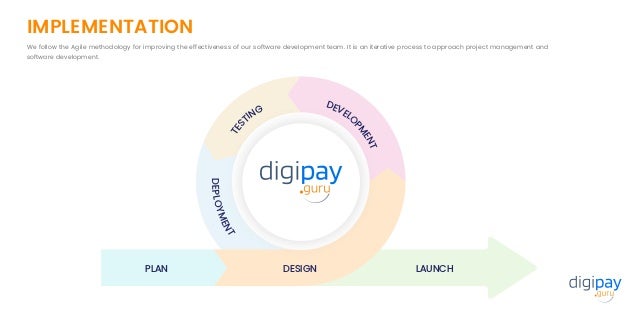

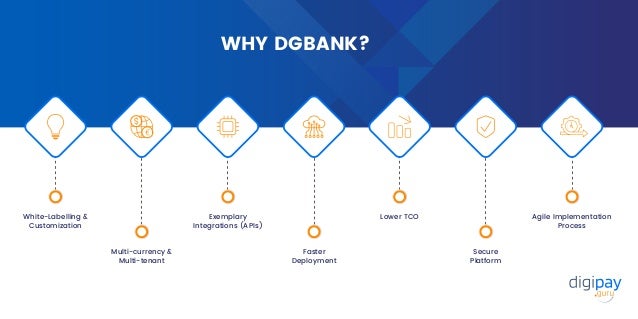

Digipay is a mobile money solution launched in 2019 by Peerbits, offering a range of financial services including mobile wallets, bill payments, and international remittance, serving non-banking financial institutions, banks, and telcos. With over 1.2 billion registered mobile money accounts and advanced features like white-labeling and customizable integrations, it aims to enhance the digital payment ecosystem while ensuring high security and scalability. The company emphasizes an agile implementation process tailored to client needs, providing efficient and innovative fintech solutions.