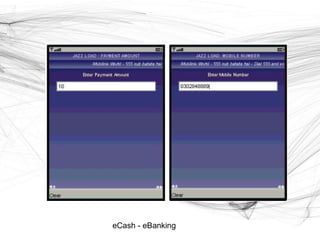

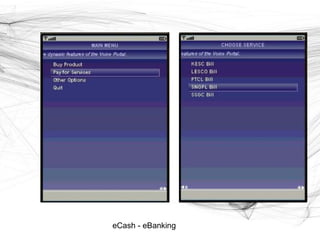

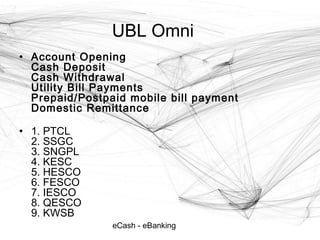

The document discusses various forms of electronic payments including credit cards, debit cards, electronic funds transfer, electronic checks, and cash cards. It provides details on popular e-payment platforms in Pakistan like Mobilink Genie, UBL Omni, and Easy Paisa. The main advantages of electronic cash are that it can be more efficient and lead to lower prices due to reduced transaction costs. However, disadvantages include lack of tax trail and increased risk of money laundering and forgery.