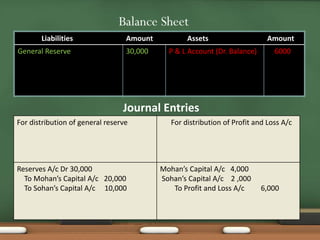

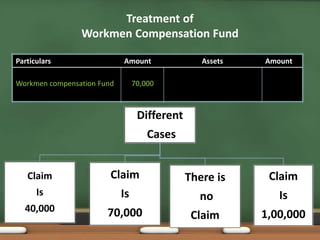

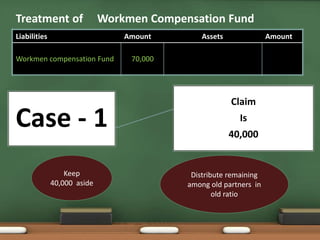

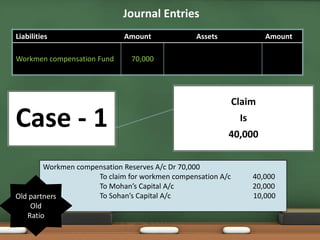

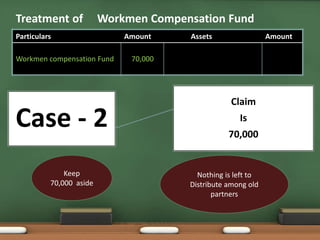

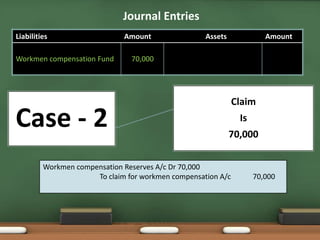

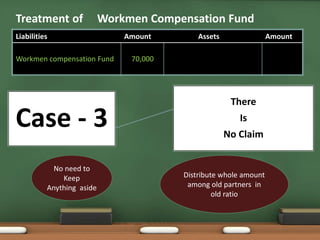

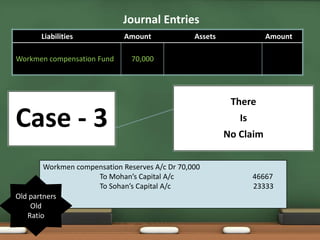

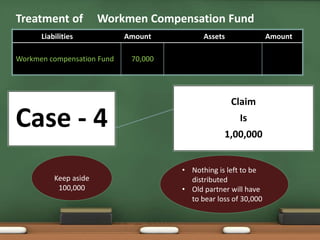

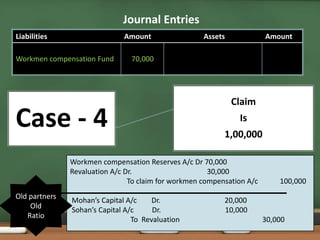

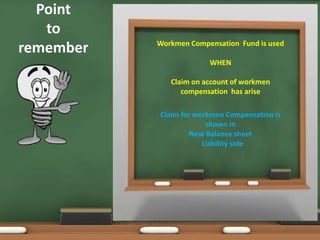

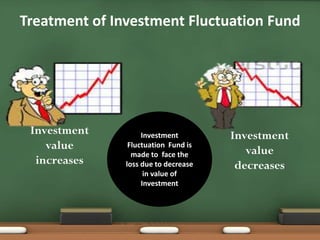

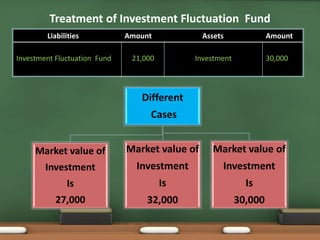

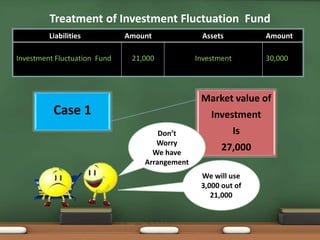

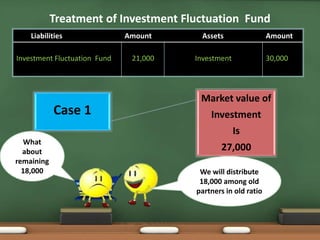

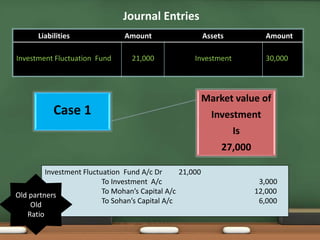

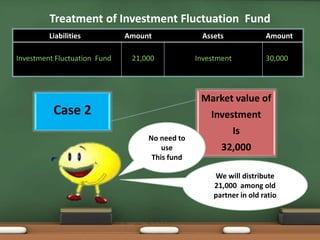

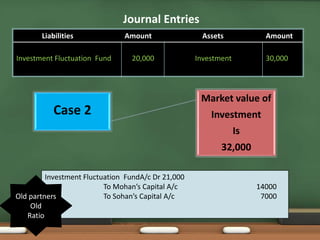

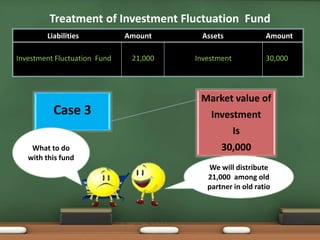

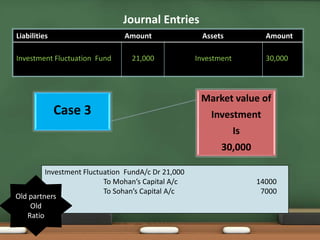

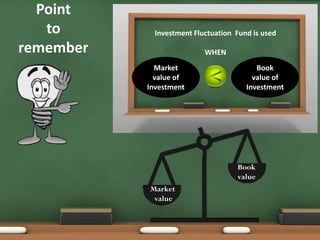

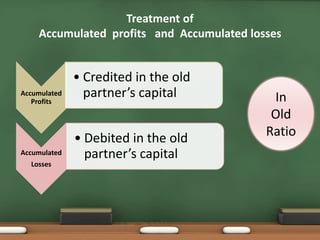

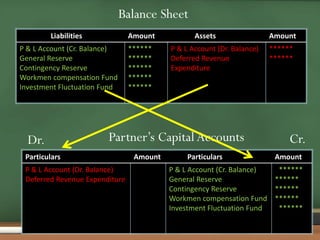

This document discusses the treatment of accumulated profits/losses, workmen compensation fund, and investment fluctuation fund when admitting a new partner to a partnership firm. It provides examples of journal entries for distributing reserves and funds to old partners' capital accounts in their old profit sharing ratios when the balance sheet shows accumulated profits, no claim on funds, or shortfalls covered by the funds. If claims exceed a fund's balance, the old partners must share the loss.

![Journal Entries

For distribution of undistributed profit and

reserve.

For distribution of loss

Reserves A/c Dr

Profit & Loss A/c(Profit) Dr.

To Old Partner’s Capital A/c[individually]

Old Partner’s Capital A/c Dr. [individually]

To Profit and Loss A/c [Loss]

In

Old

Ratio](https://image.slidesharecdn.com/classxiiaccountancy-140929132334-phpapp02/85/Class-xii-accountancy-Partnership-6-320.jpg)