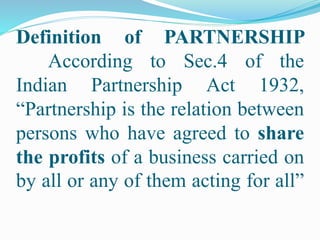

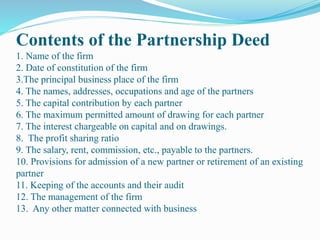

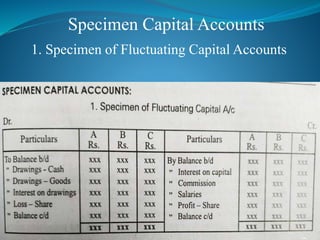

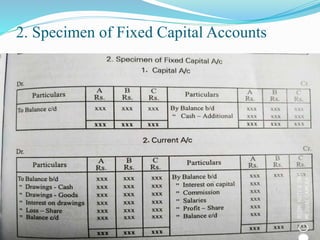

The document outlines the definition and characteristics of partnership under the Indian Partnership Act 1932, highlighting the essential elements such as profit sharing, agreement, management, and unlimited liability. It emphasizes that partnerships are formed through voluntary agreements often documented as partnership deeds, which include details like firm name, partners' information, capital contributions, and profit-sharing ratios. Additionally, it distinguishes between fixed and fluctuating capital accounts used in partnership accounting.