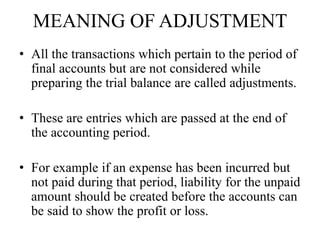

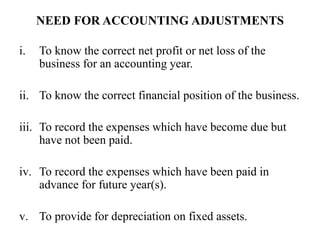

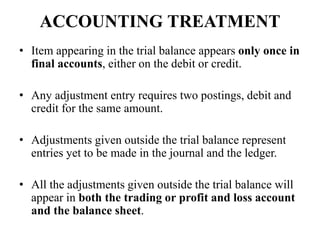

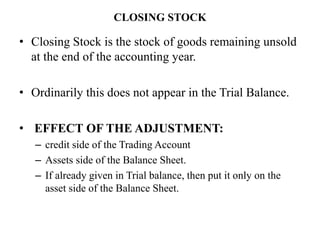

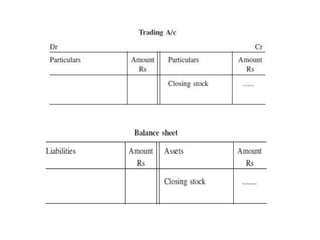

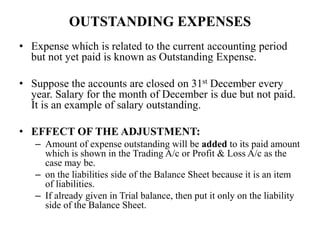

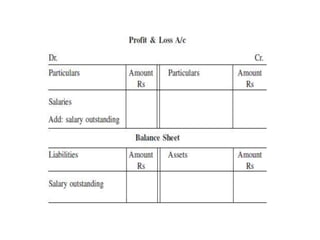

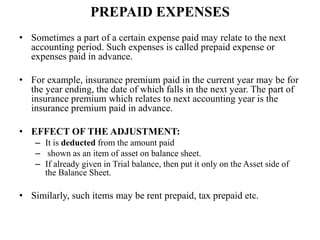

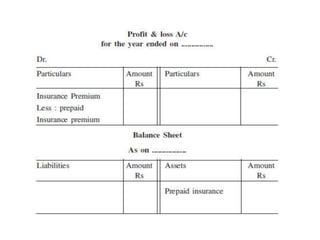

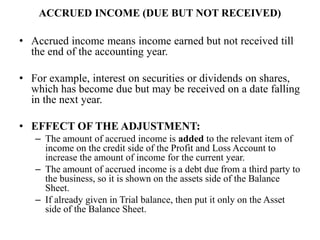

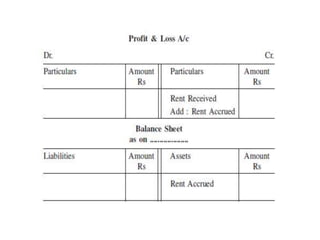

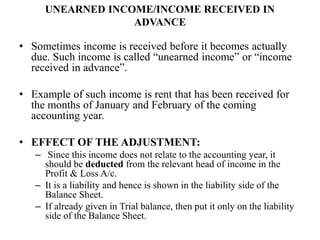

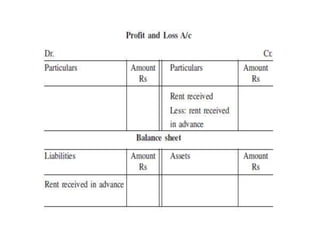

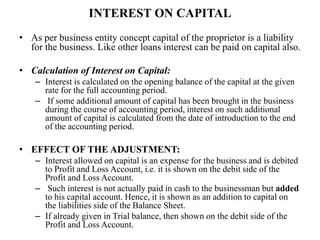

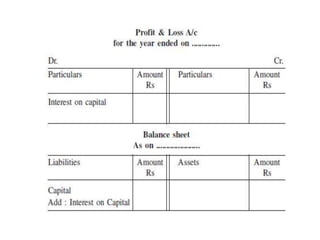

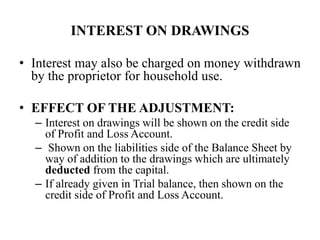

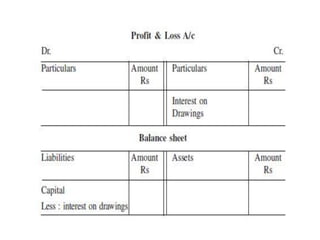

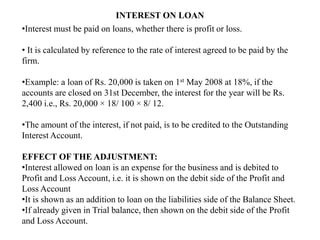

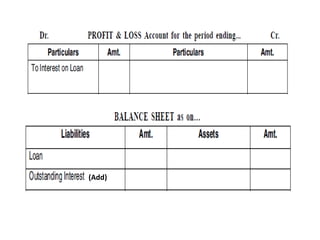

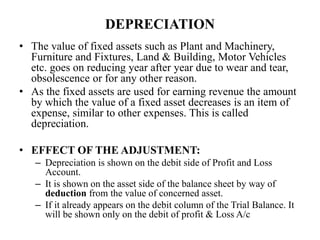

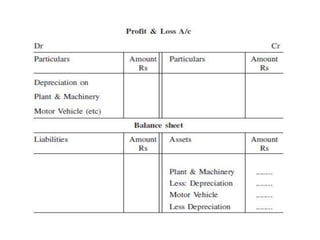

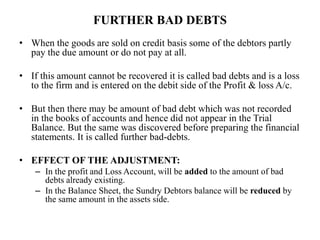

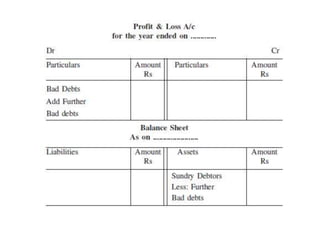

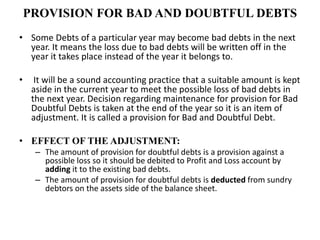

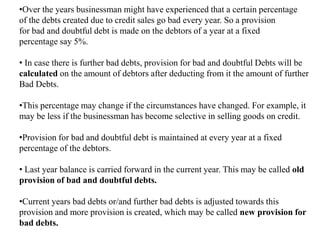

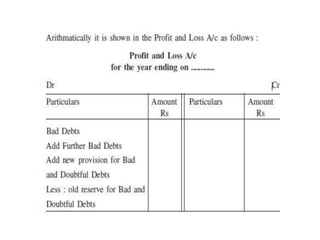

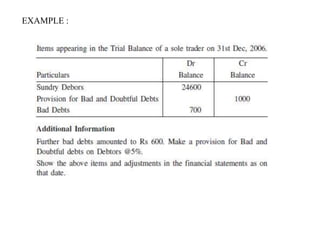

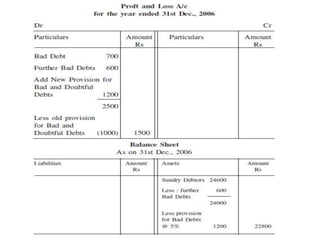

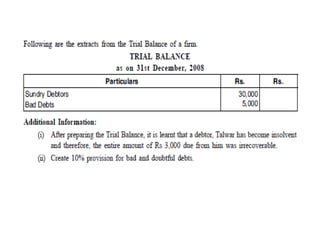

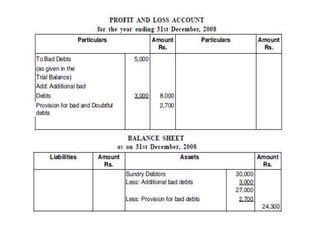

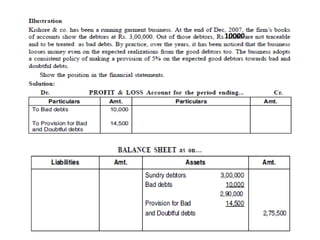

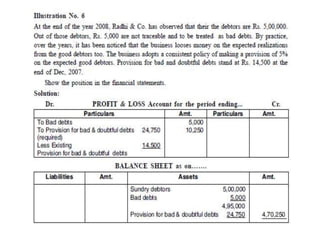

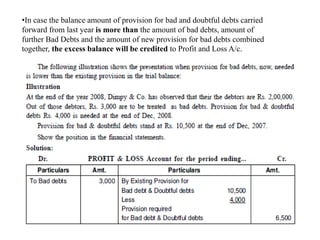

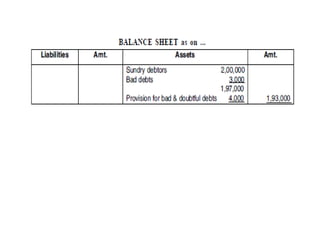

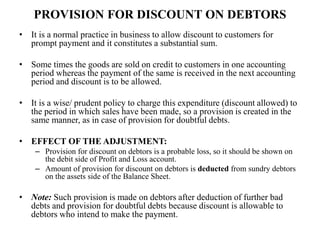

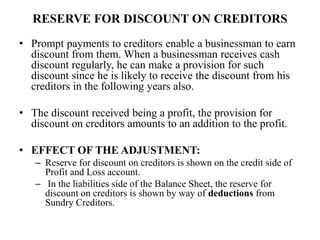

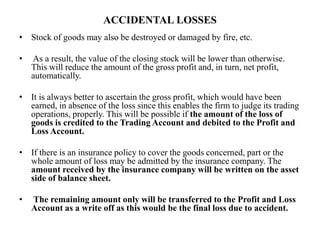

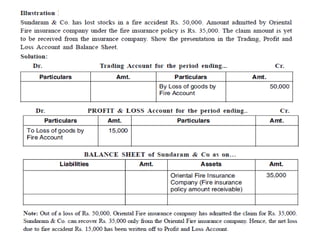

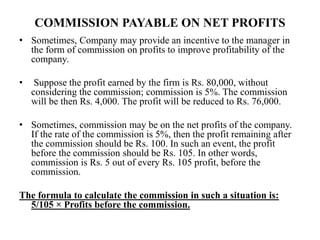

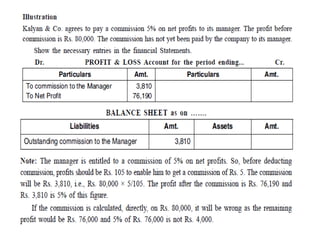

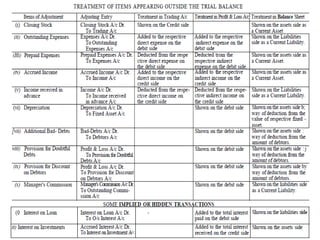

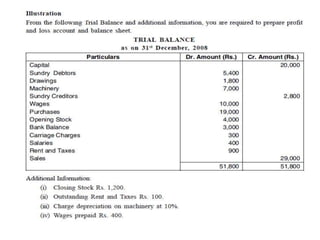

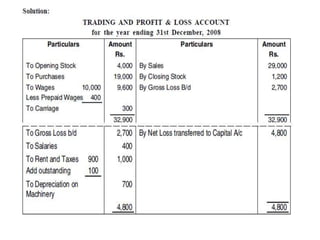

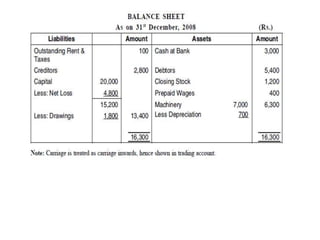

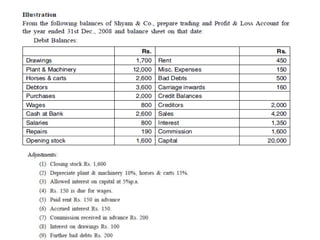

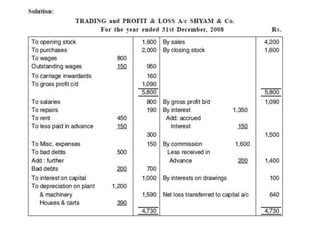

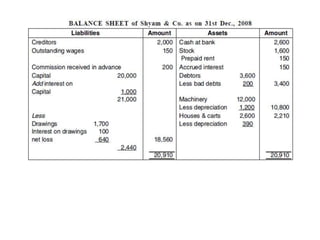

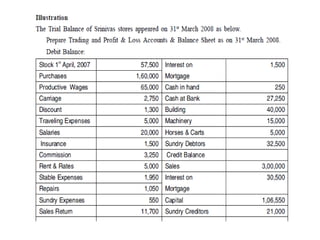

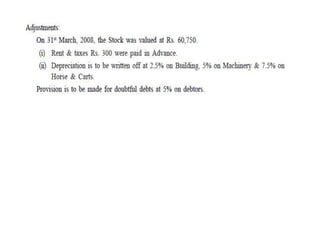

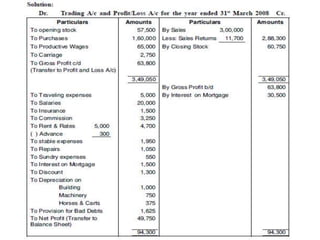

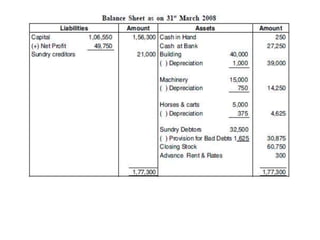

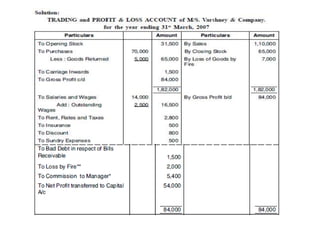

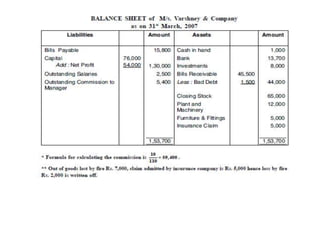

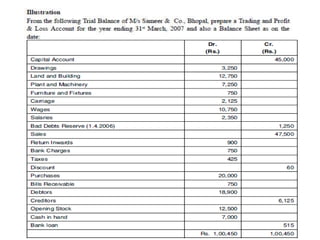

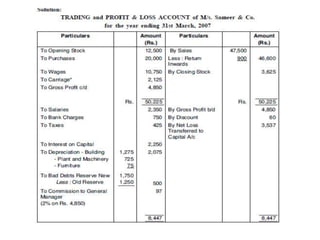

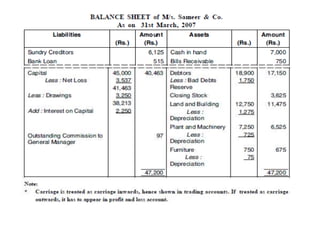

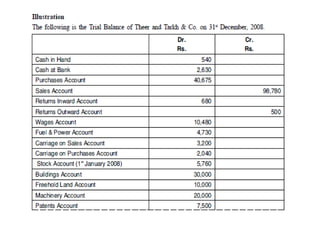

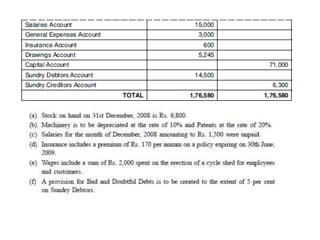

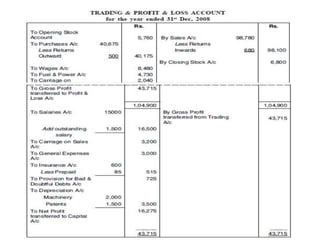

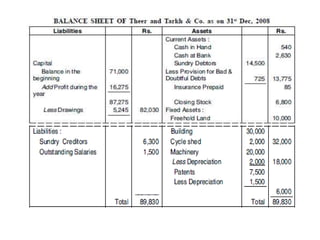

The document discusses various accounting adjustments that may be required before finalizing financial statements at the end of an accounting period. Some key adjustments mentioned include closing stock, outstanding expenses, prepaid expenses, accrued income, unearned income, depreciation, bad debts, and provisions. The effects of each adjustment on the trading account, profit and loss account, and balance sheet are explained. Common adjustments like interest on capital, drawings, and loans are also covered. The purpose of adjustments is to determine the true profit/loss for the period and accurate financial position of the business.