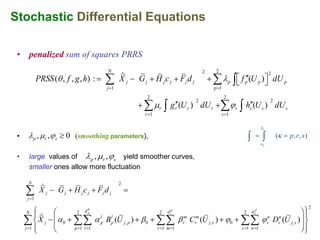

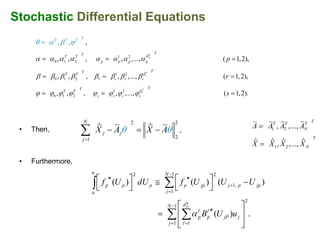

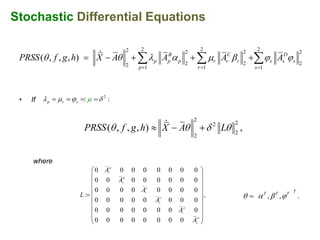

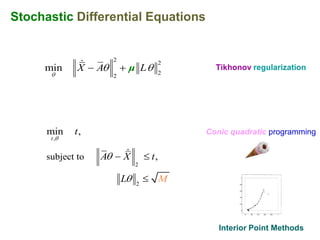

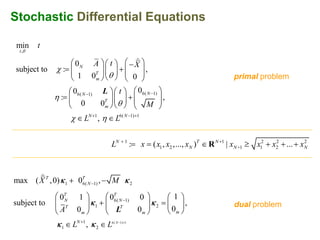

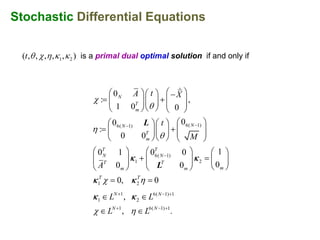

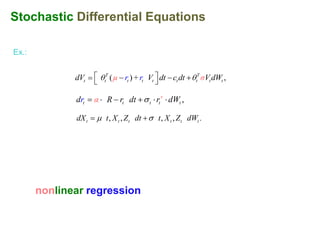

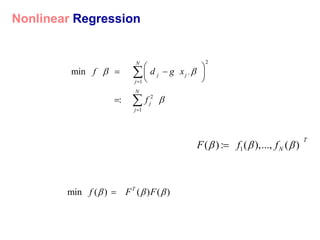

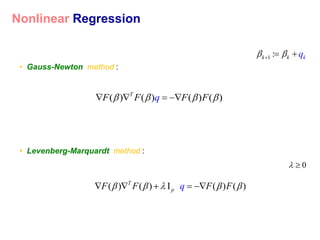

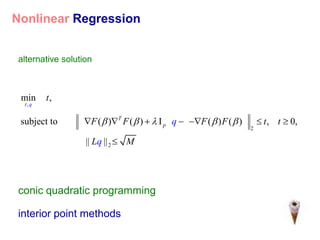

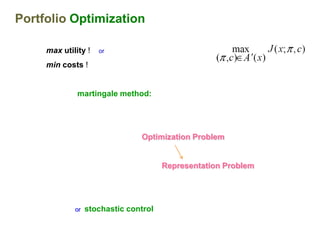

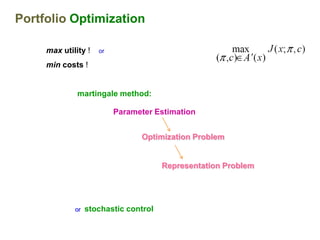

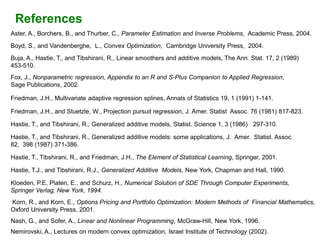

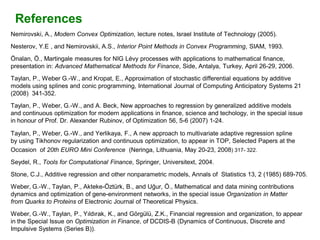

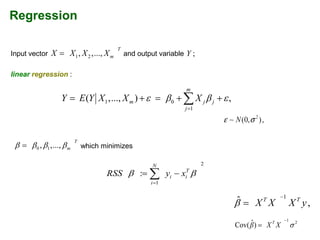

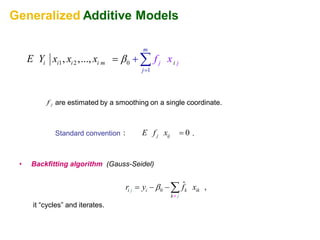

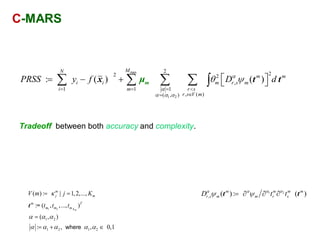

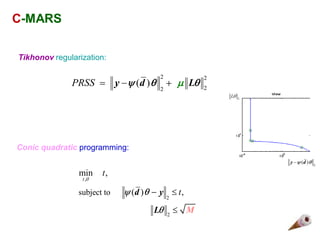

The document discusses advancements in parameter estimation within stochastic differential equations and various statistical models. It covers topics such as nonlinear regression, conic quadratic programming, and portfolio optimization. The work highlights the balance between accuracy and stability in estimation methods, drawing from various mathematical principles and techniques.

![Stochastic Differential Equations

dX t a( X t , t )dt b( X t , t )dWt

drift and diffusion term

Wt N (0, t ) (t [0, T ])

Wiener process](https://image.slidesharecdn.com/09-kiev2010-finance-sde-willi-100819074818-phpapp02/85/Parameter-Estimation-in-Stochastic-Differential-Equations-by-Continuous-Optimization-4-320.jpg)

![Stochastic Differential Equations

dX t a( X t , t )dt b( X t , t )dWt

drift and diffusion term

Ex.: price, wealth, interest rate, volatility

processes

Wt N (0, t ) (t [0, T ])

Wiener process](https://image.slidesharecdn.com/09-kiev2010-finance-sde-willi-100819074818-phpapp02/85/Parameter-Estimation-in-Stochastic-Differential-Equations-by-Continuous-Optimization-5-320.jpg)

![MARS

y y

c-(x, )=[ (x )] c+(x, )=[ (x )] c-(x, )=[ (x )] c+(x,egressionx ith)]

r )=[ ( w

x x](https://image.slidesharecdn.com/09-kiev2010-finance-sde-willi-100819074818-phpapp02/85/Parameter-Estimation-in-Stochastic-Differential-Equations-by-Continuous-Optimization-11-320.jpg)

![Stochastic Differential Equations Revisited

dX t a( X t , t )dt b( X t , t )dWt

drift and diffusion term

Ex.: price, wealth, interest rate, volatility,

processes

Wt N (0, t ) (t [0, T ])

Wiener process](https://image.slidesharecdn.com/09-kiev2010-finance-sde-willi-100819074818-phpapp02/85/Parameter-Estimation-in-Stochastic-Differential-Equations-by-Continuous-Optimization-14-320.jpg)

![Stochastic Differential Equations Revisited

dX t a( X t , t )dt b( X t , t )dWt

drift and diffusion term

Ex.: bioinformatics, biotechnology

(fermentation, population dynamics)

Universiti Teknologi Malaysia

Wt N (0, t ) (t [0, T ])

Wiener process](https://image.slidesharecdn.com/09-kiev2010-finance-sde-willi-100819074818-phpapp02/85/Parameter-Estimation-in-Stochastic-Differential-Equations-by-Continuous-Optimization-15-320.jpg)

![Stochastic Differential Equations Revisited

dX t a( X t , t )dt b( X t , t )dWt

drift and diffusion term

Ex.: price, wealth, interest rate, volatility,

processes

Wt N (0, t ) (t [0, T ])

Wiener process](https://image.slidesharecdn.com/09-kiev2010-finance-sde-willi-100819074818-phpapp02/85/Parameter-Estimation-in-Stochastic-Differential-Equations-by-Continuous-Optimization-16-320.jpg)