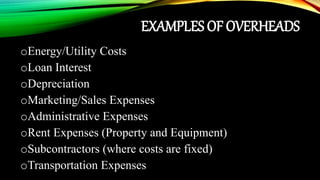

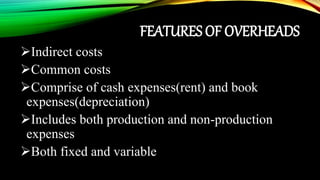

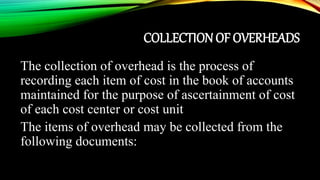

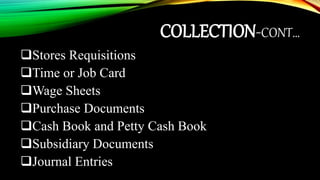

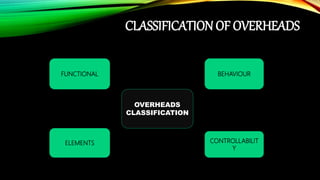

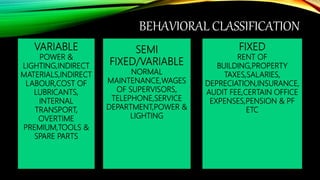

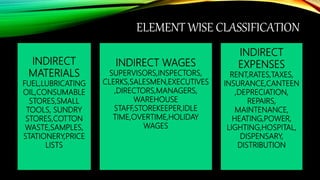

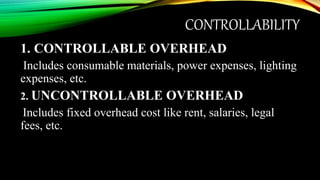

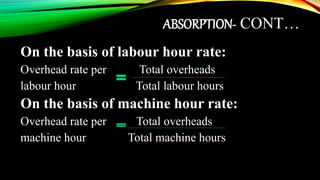

This document defines overheads as indirect costs of operating a business, such as rent, utilities, marketing, and administration. It provides examples of overhead items and discusses how overheads are classified based on their function, behavioral characteristics, elements, and controllability. The document also covers the processes of collecting, allocating, apportioning, and absorbing overheads to determine the accurate cost of products or services.