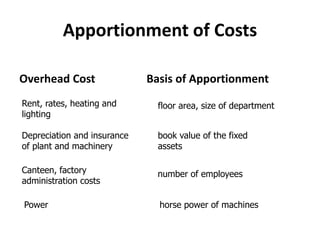

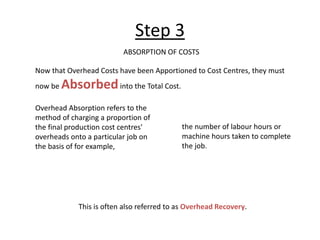

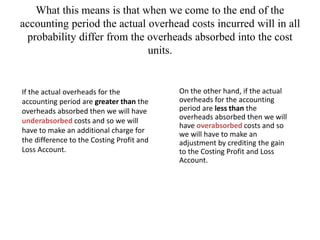

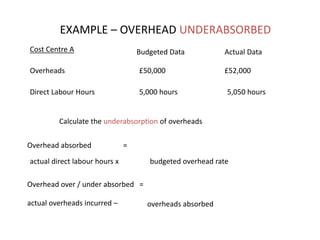

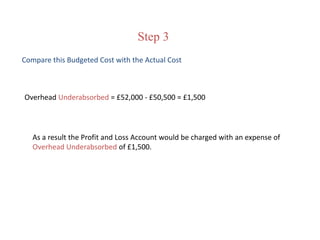

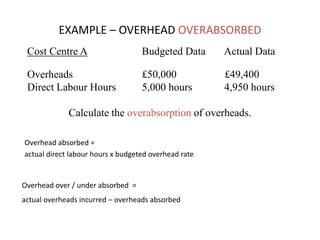

This document discusses cost accounting concepts including direct and indirect costs, cost centers, and overhead absorption. It defines three elements of cost - materials, labor, and other expenses. Other expenses can be direct or indirect. Indirect expenses are known as overheads. Costs are traced to cost centers and then allocated or apportioned. Overheads are absorbed into total costs using predetermined overhead rates based on factors like direct labor hours. Budgeted overhead rates may differ from actual rates, resulting in over- or under-absorption of overheads. Examples demonstrate calculating overhead under- and over-absorption.