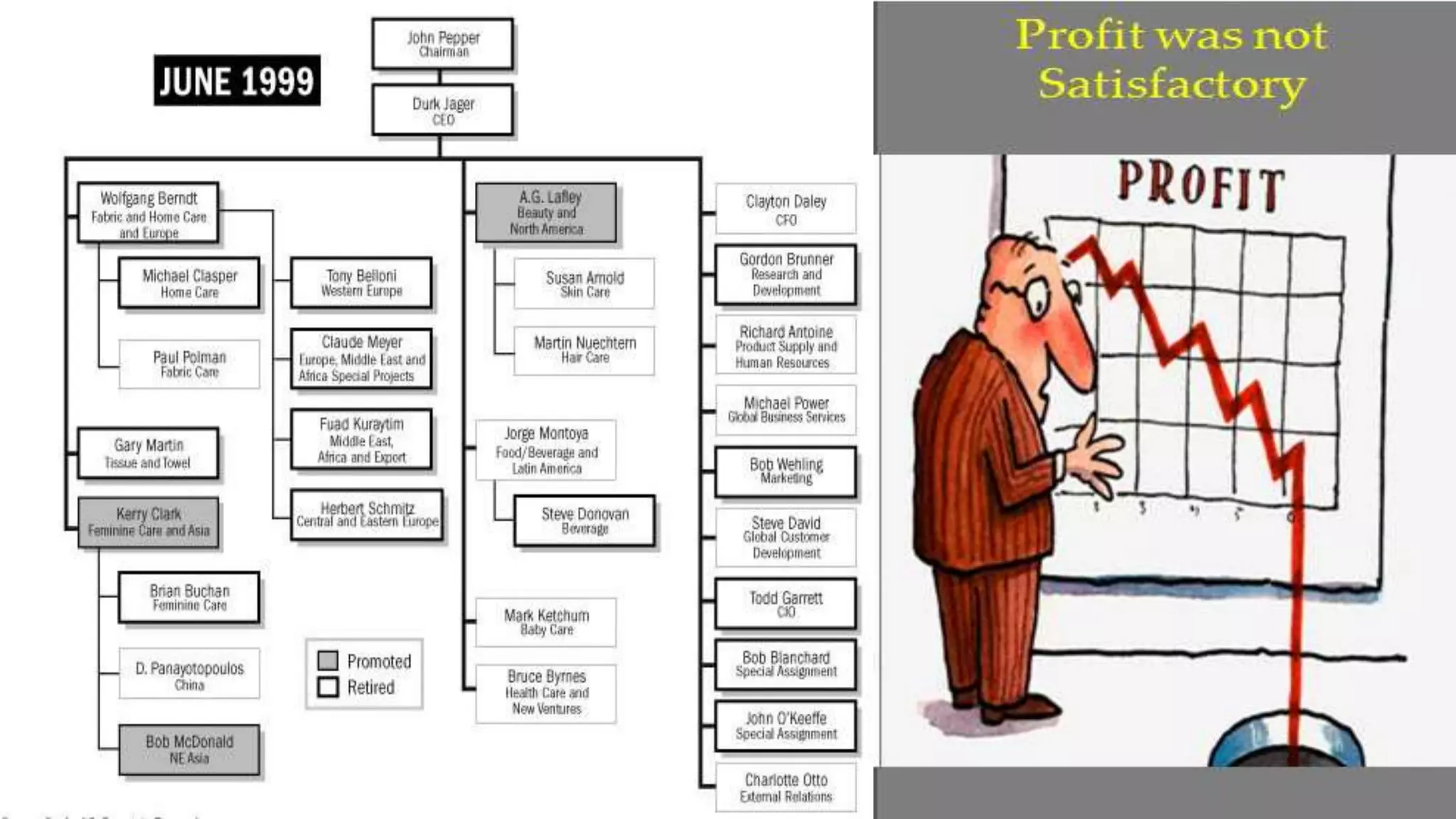

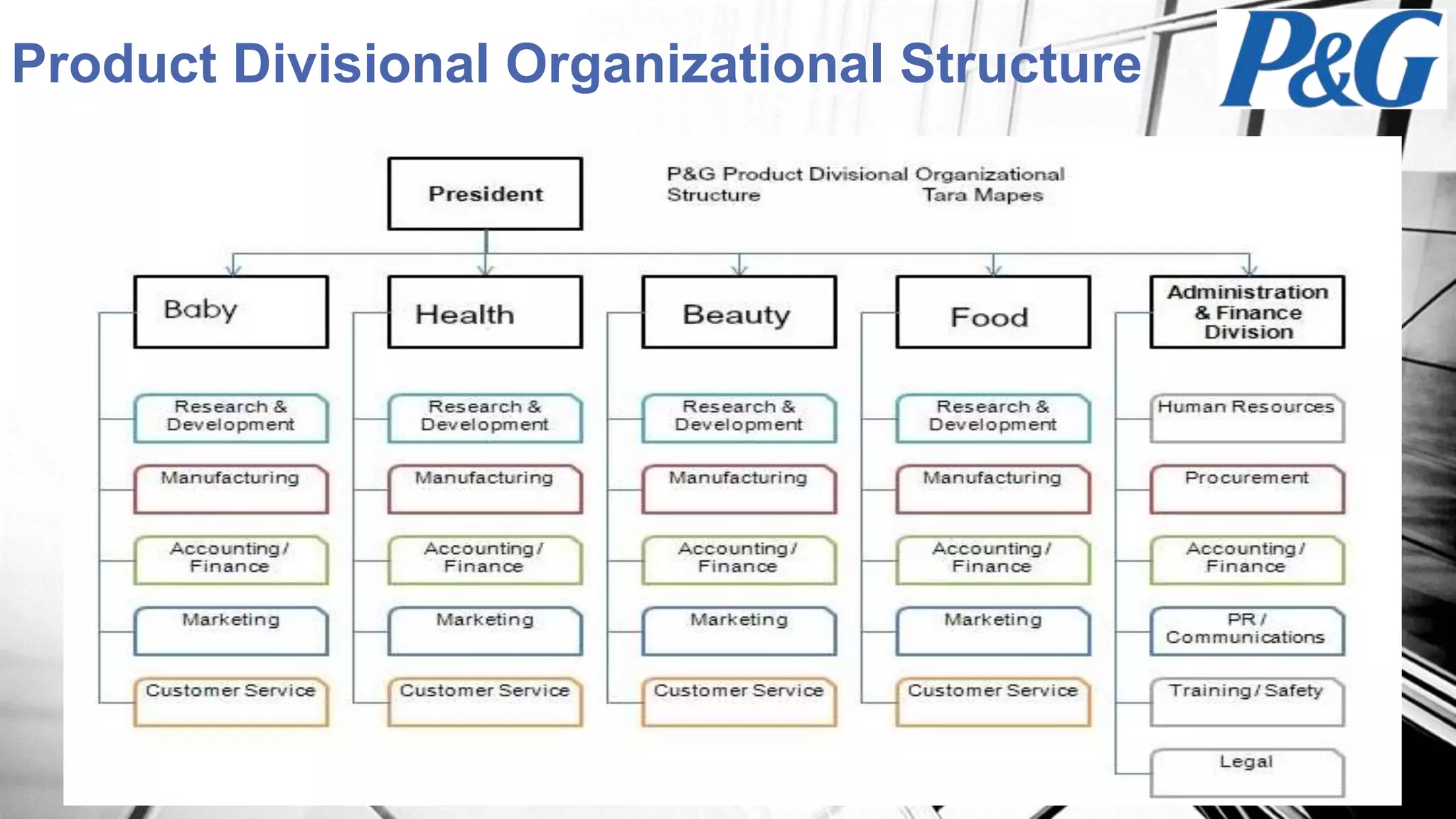

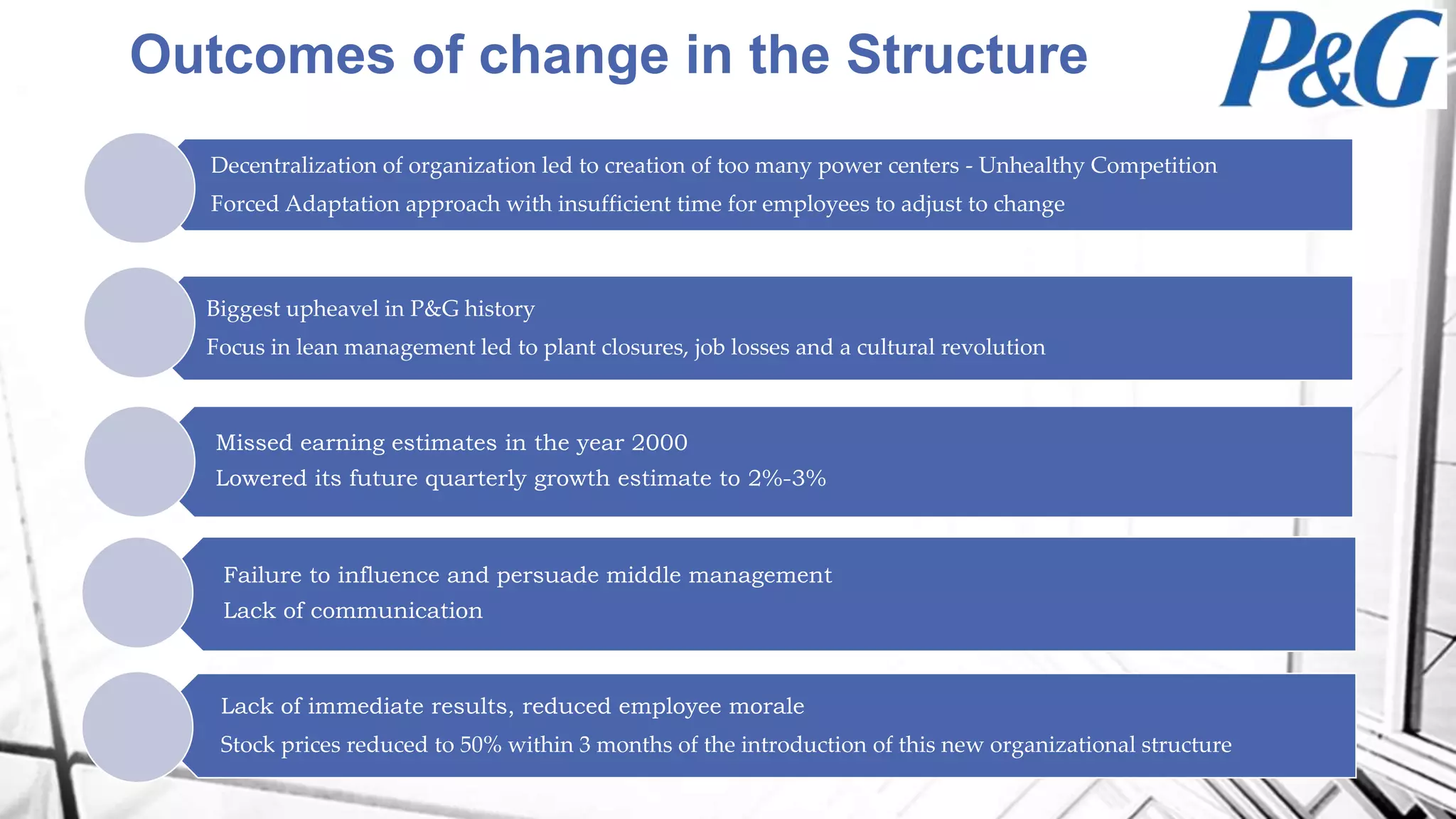

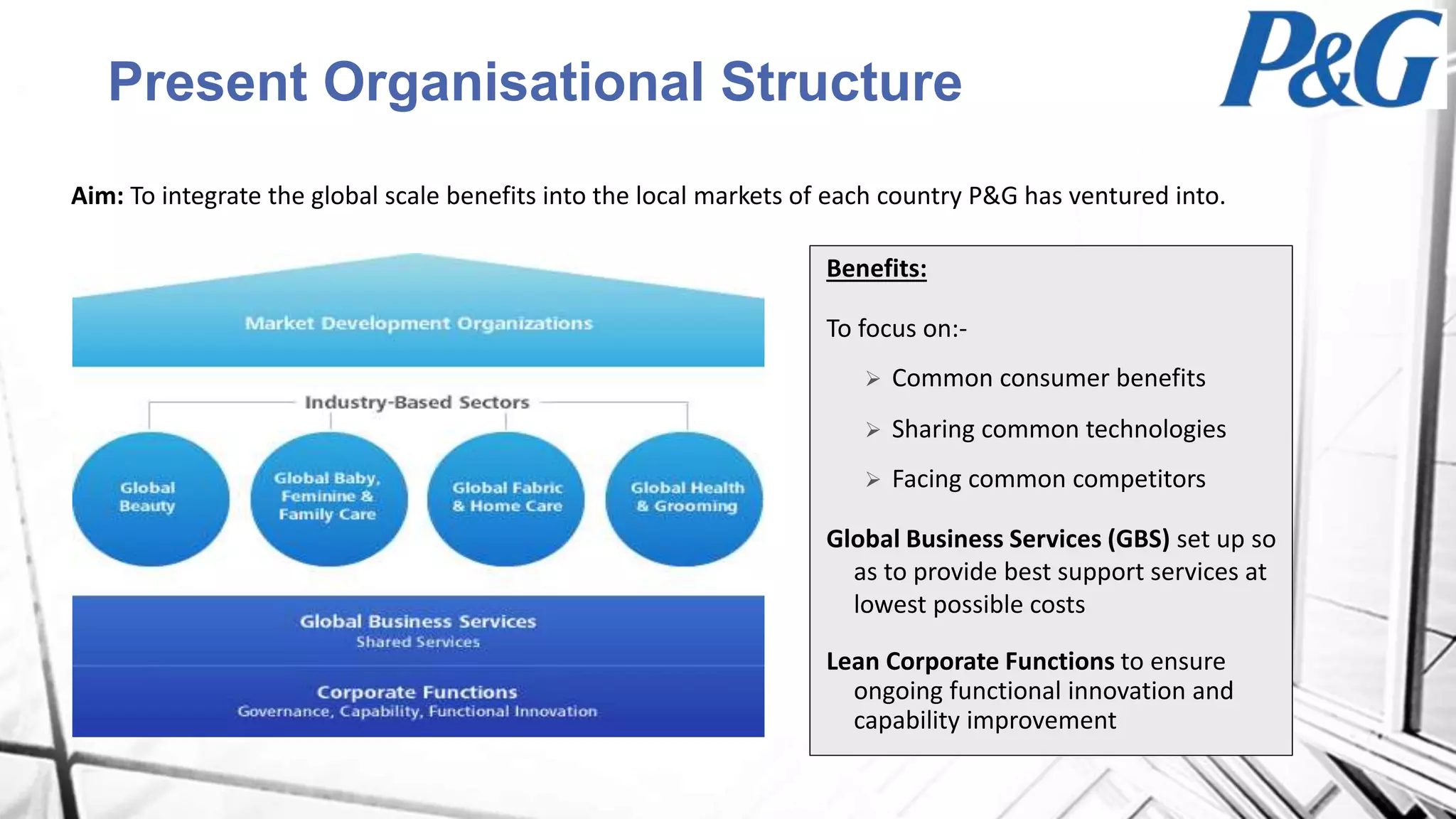

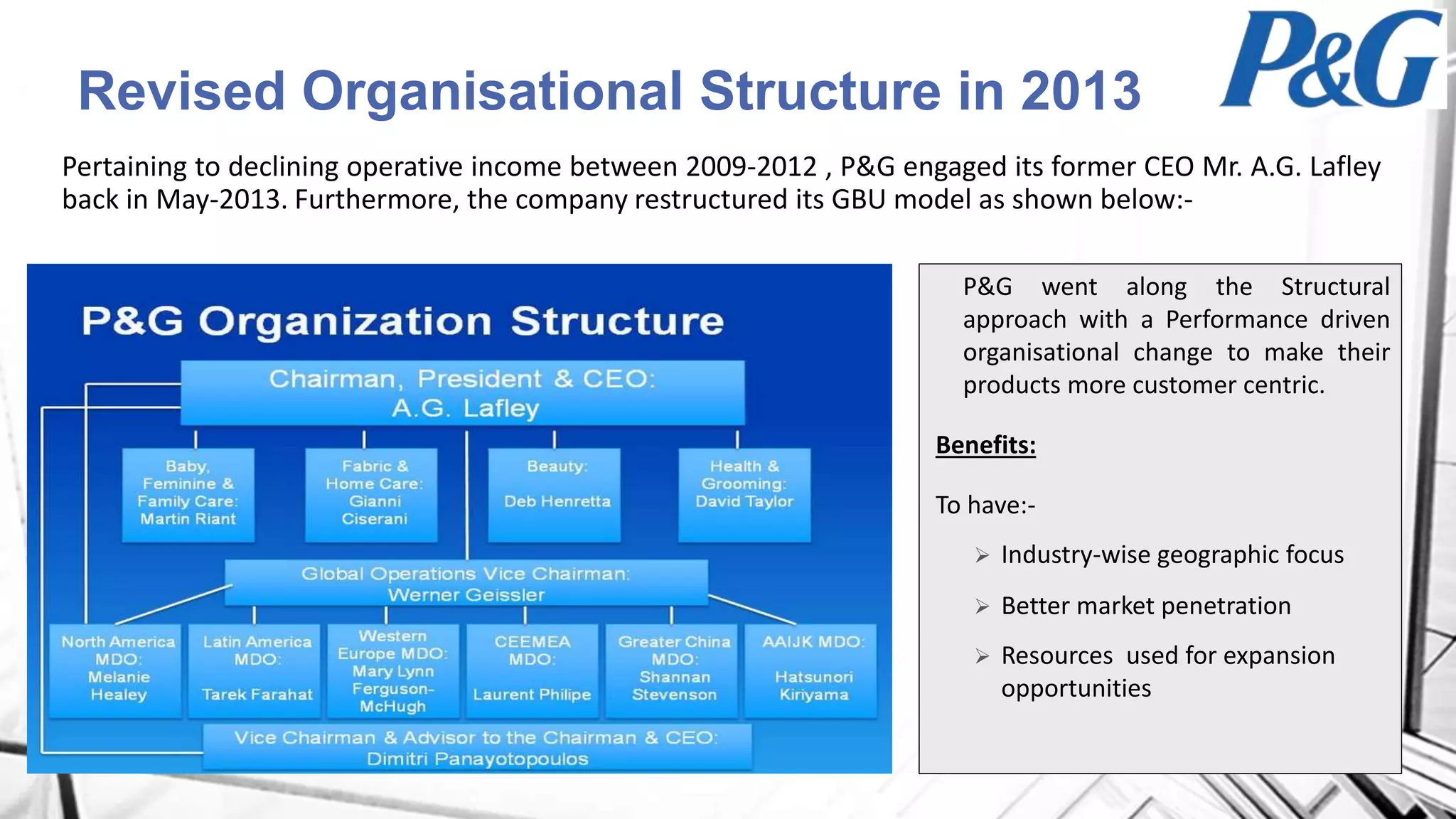

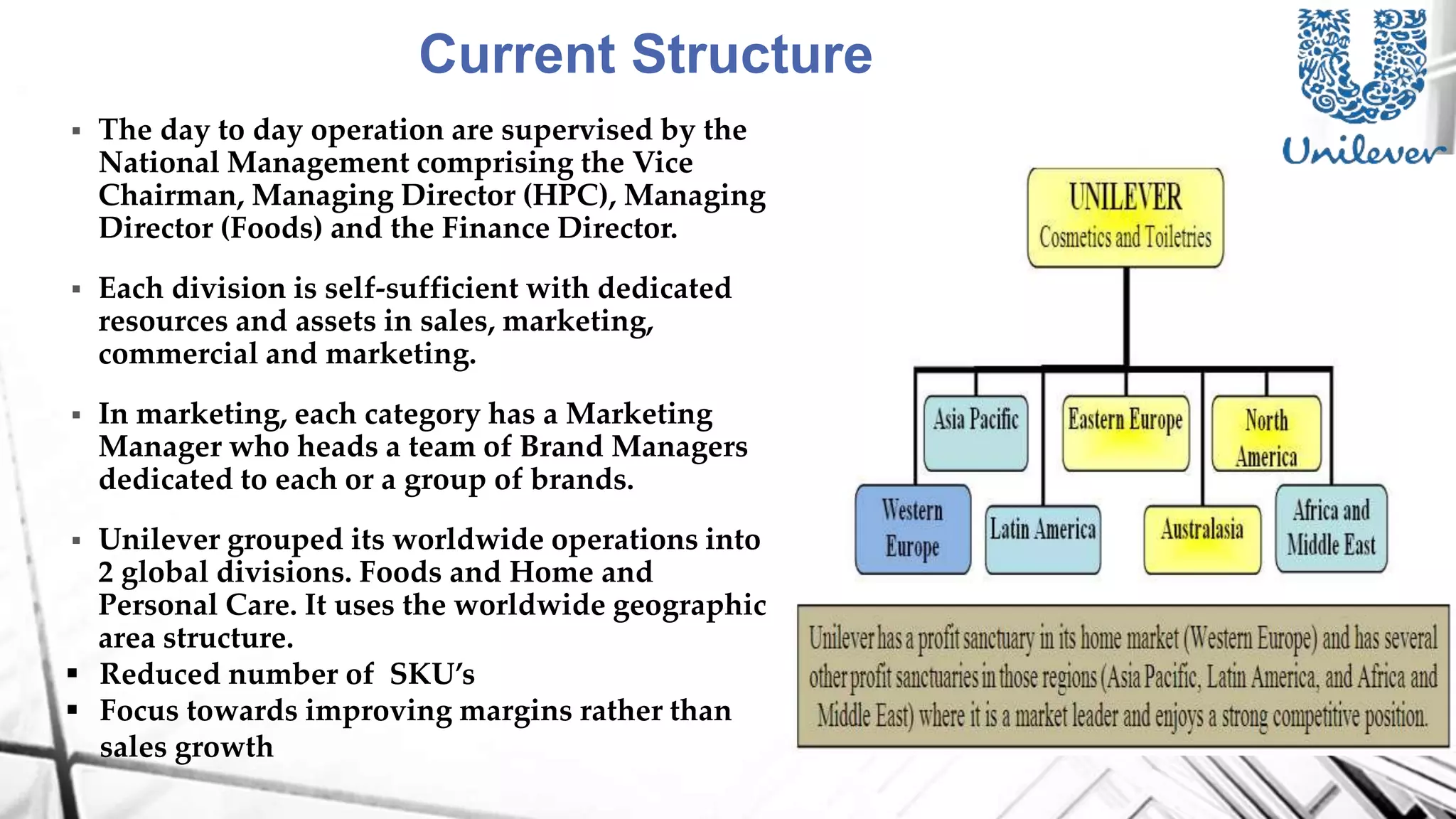

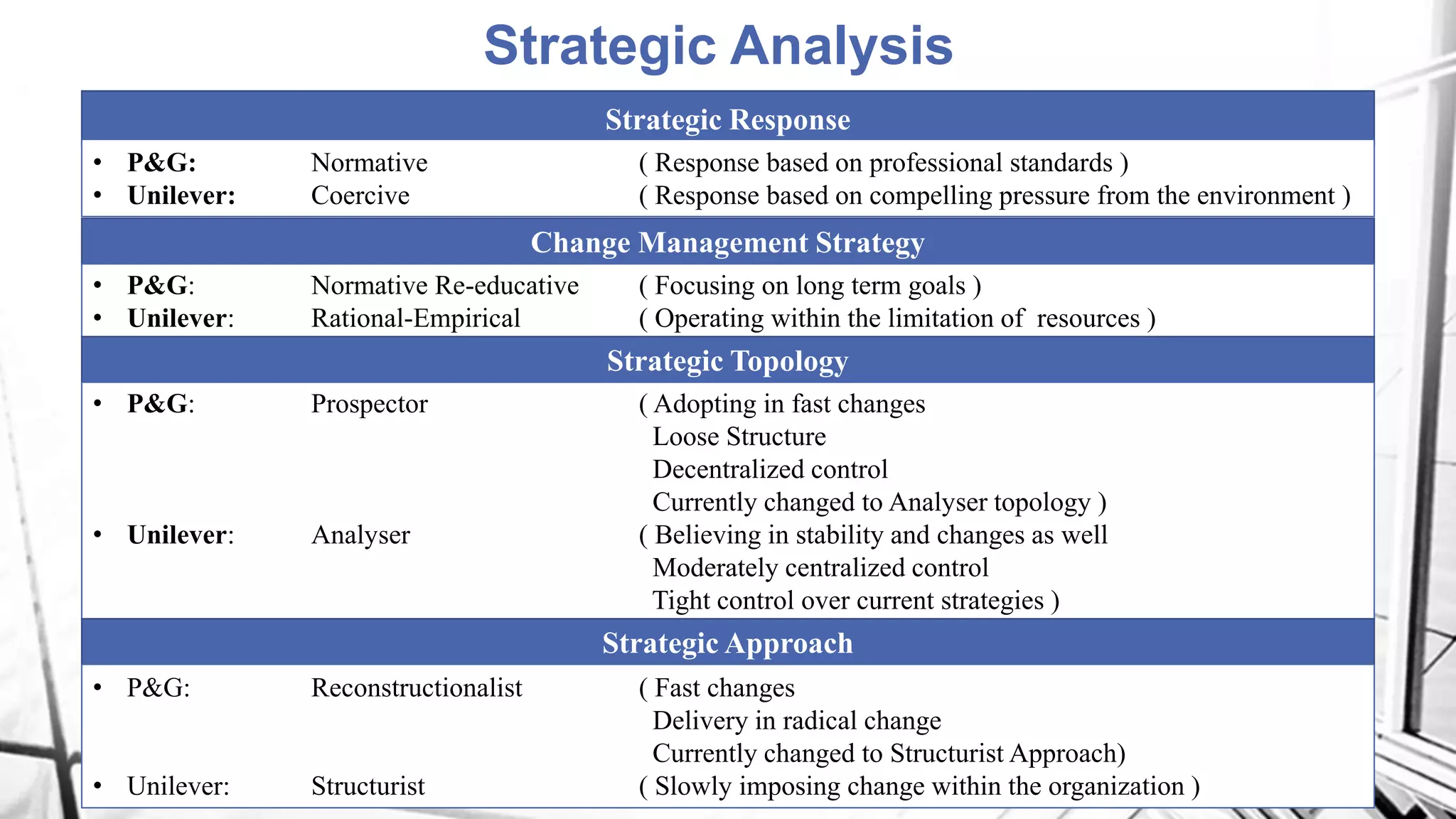

Group 8 analyzed the organizational structures of P&G and Unilever over time. P&G transitioned from a matrix structure to global business units to a hybrid structure. This caused issues like lack of results, reduced morale, and stock price declines. Unilever decentralized but then centralized in response to EU integration. Both companies now aim to integrate global scale benefits locally while focusing on customers. Group 8 evaluated their change approaches and provides recommendations like improving communication, culture, resources, and focusing on value, emerging markets, and maintaining standards.