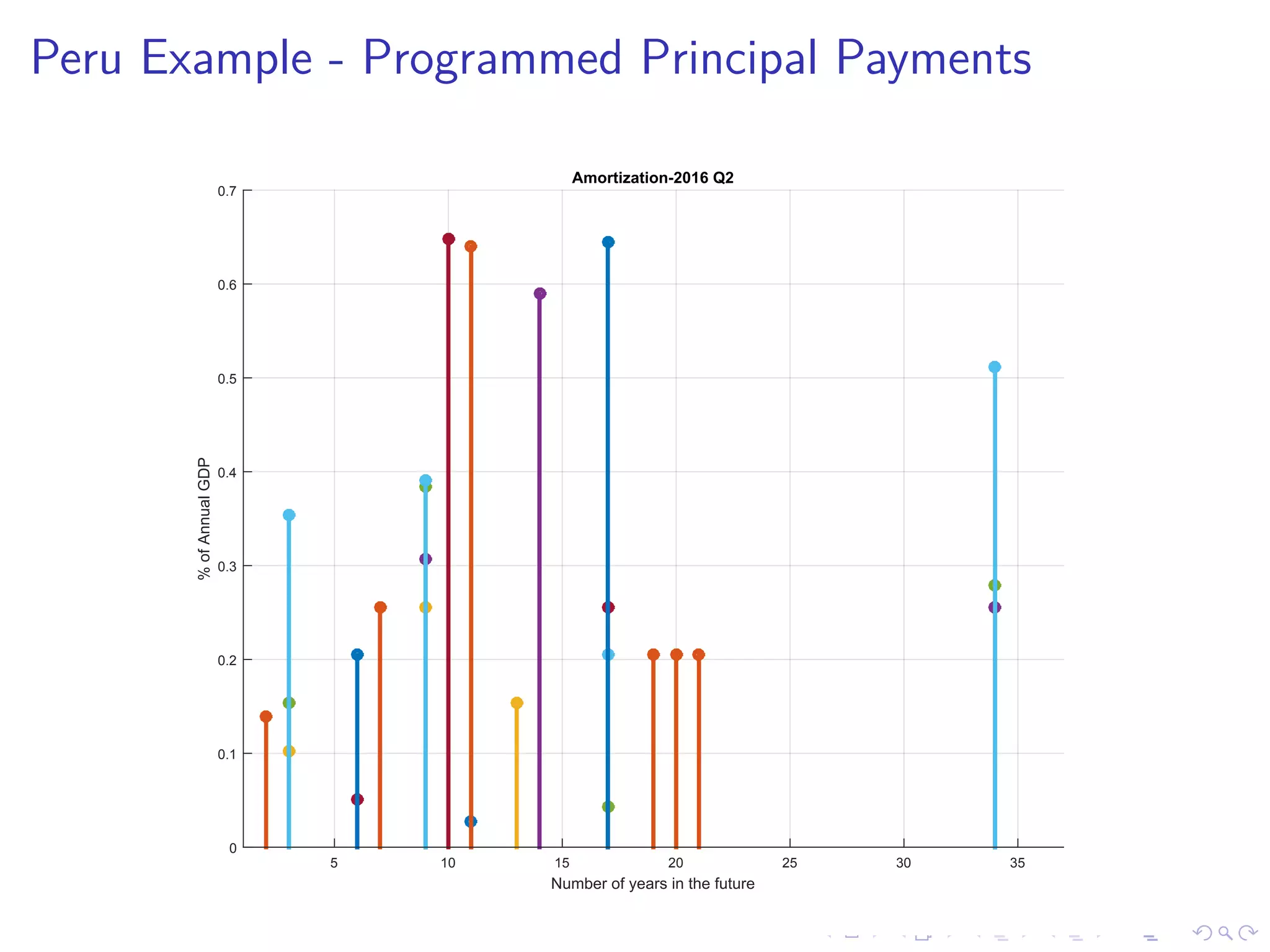

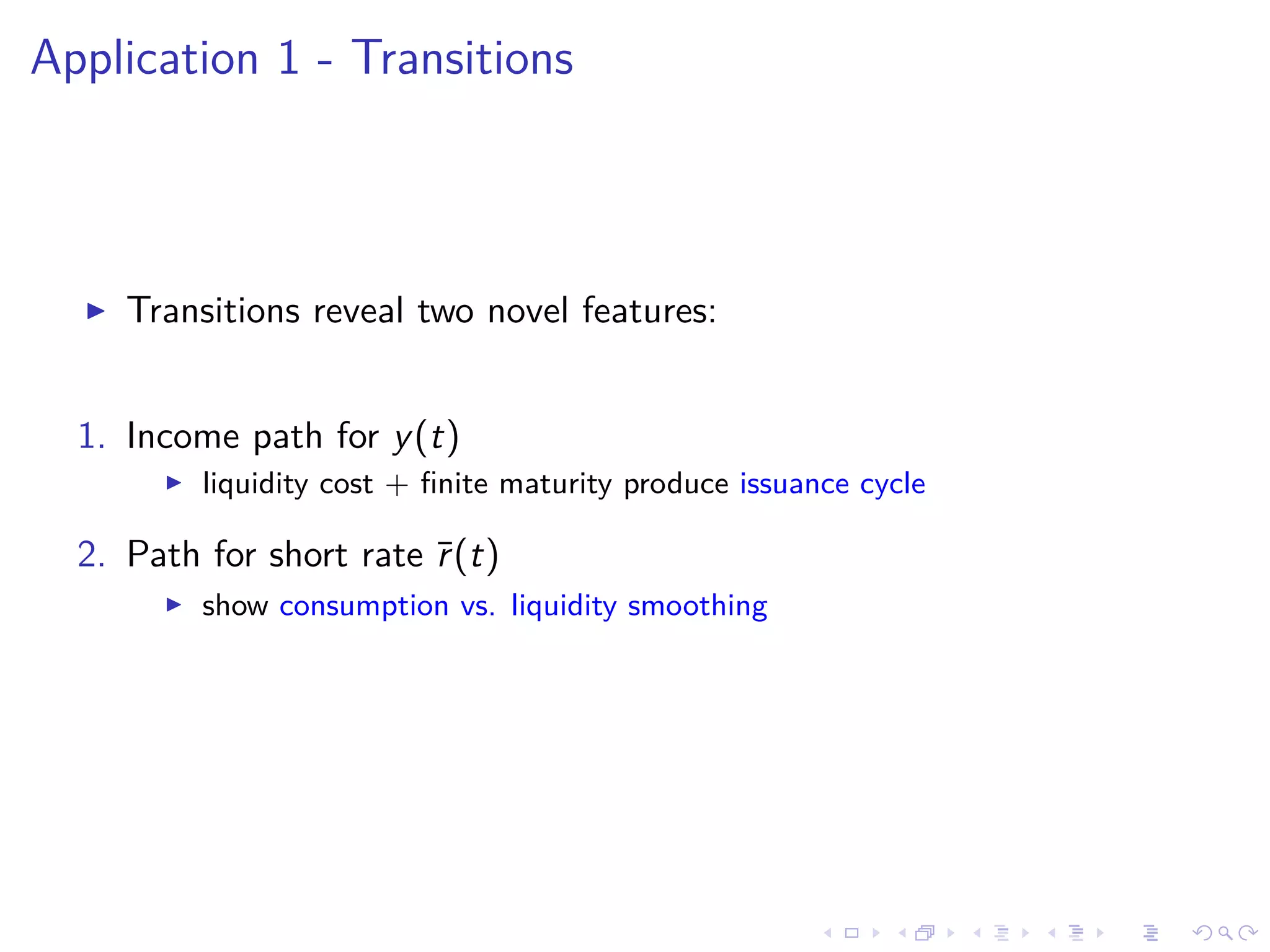

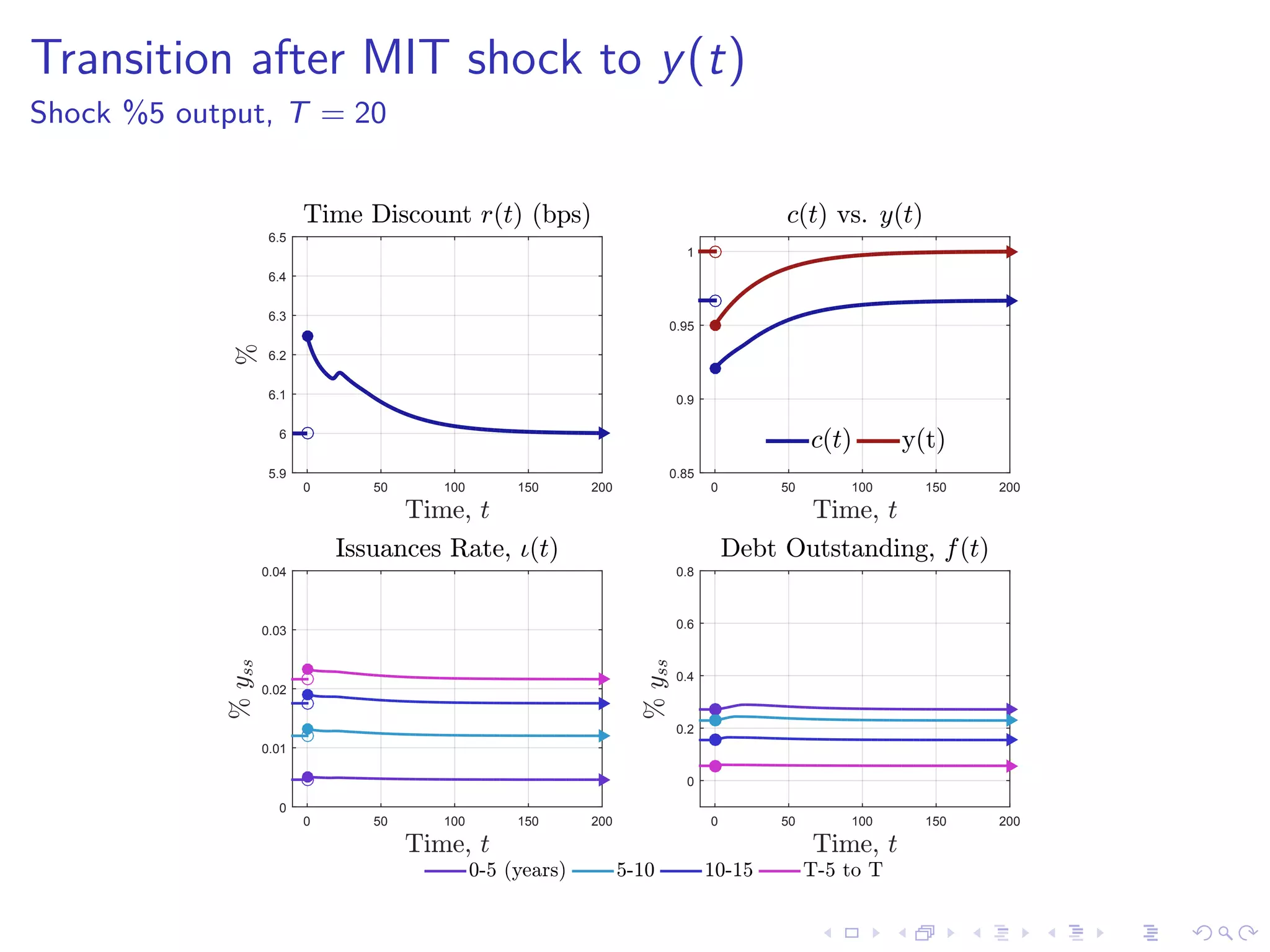

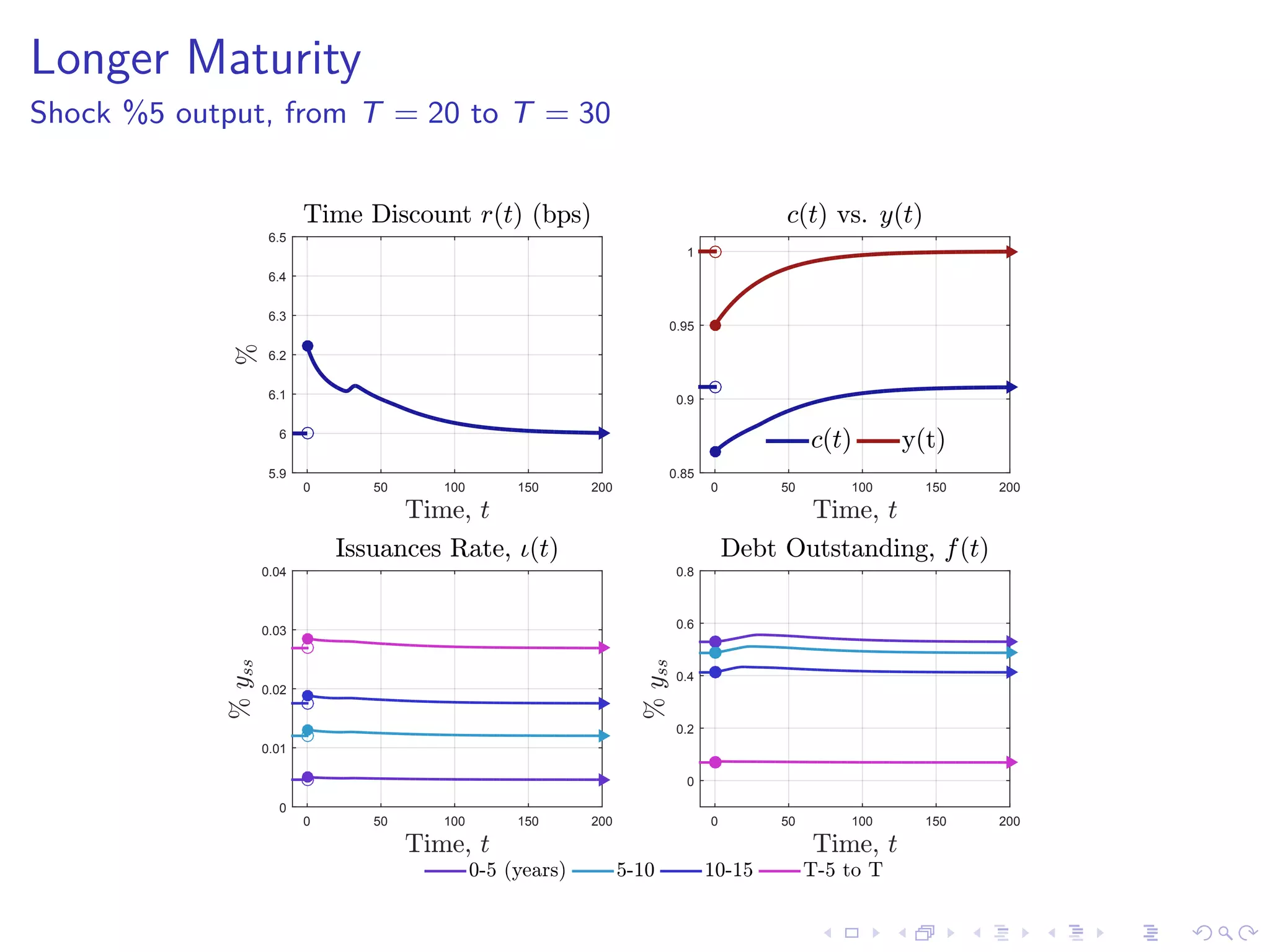

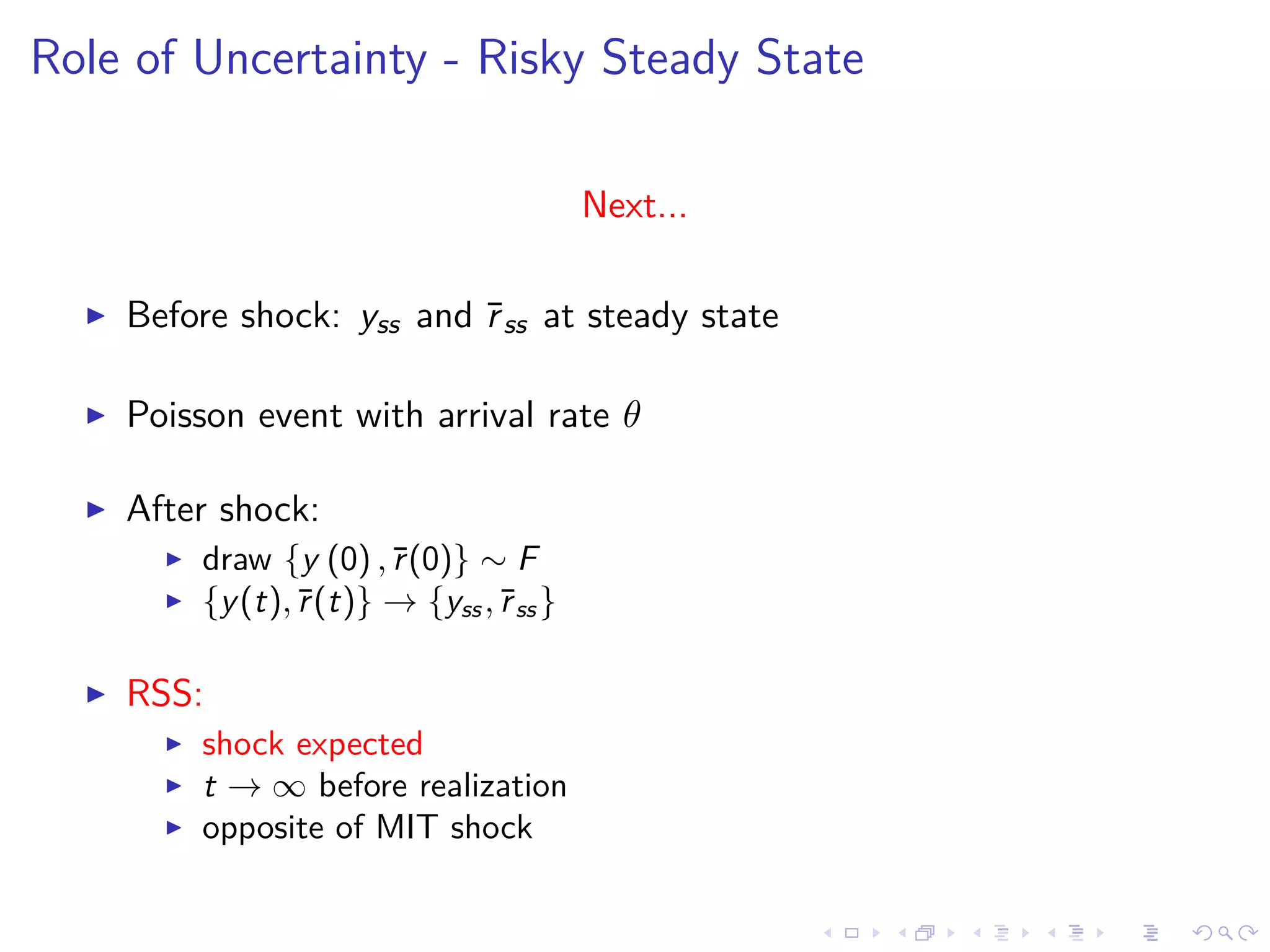

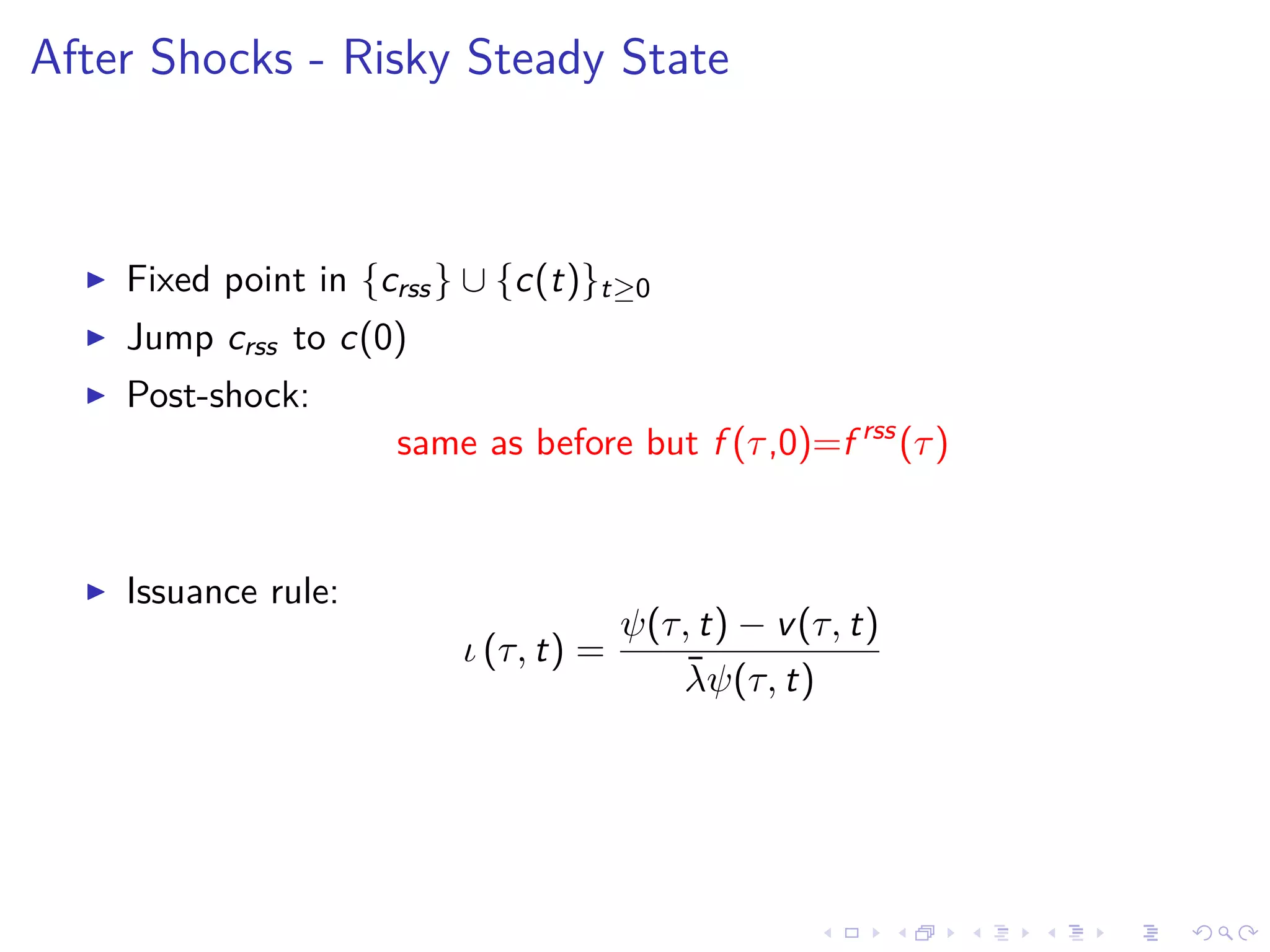

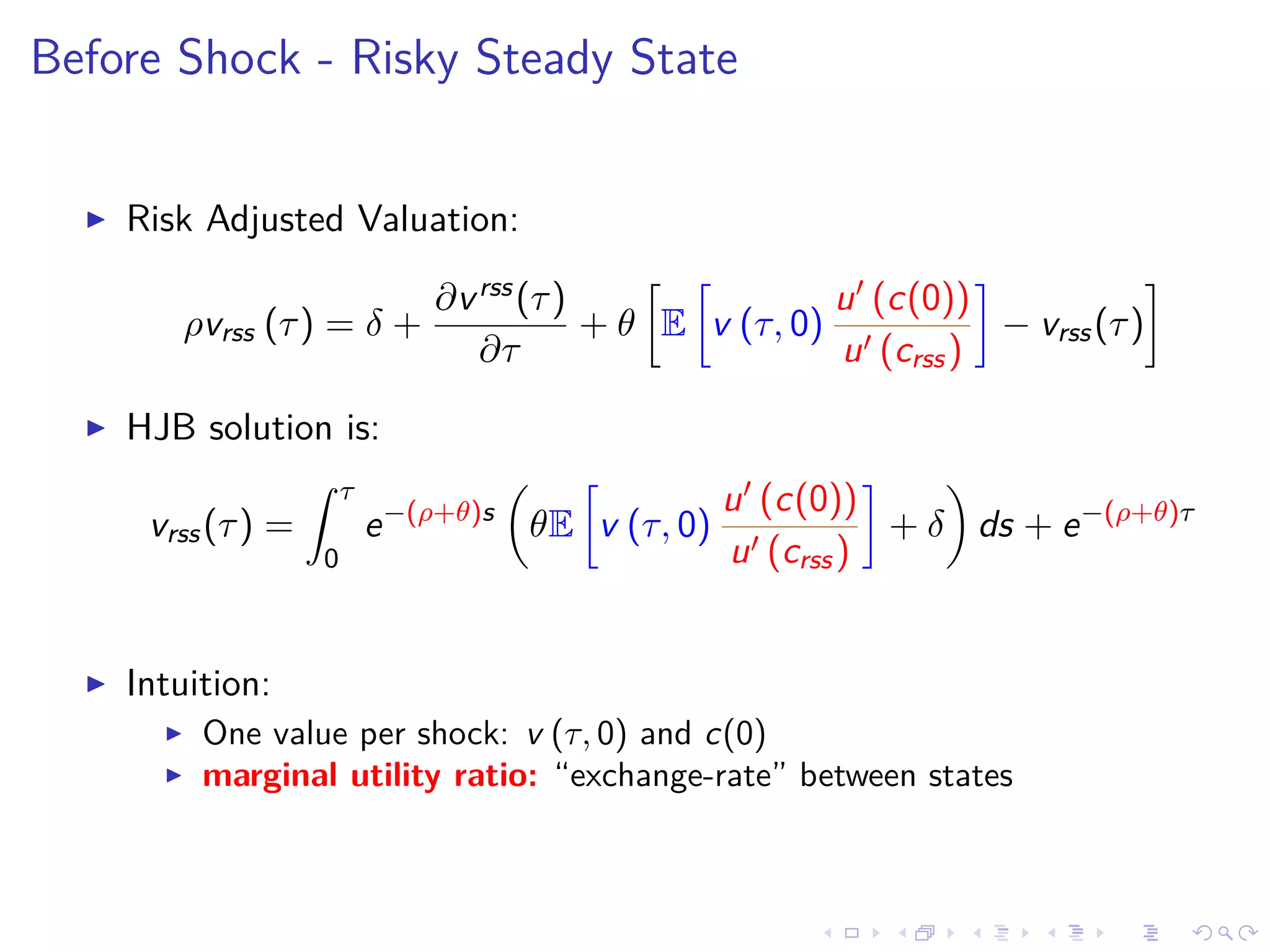

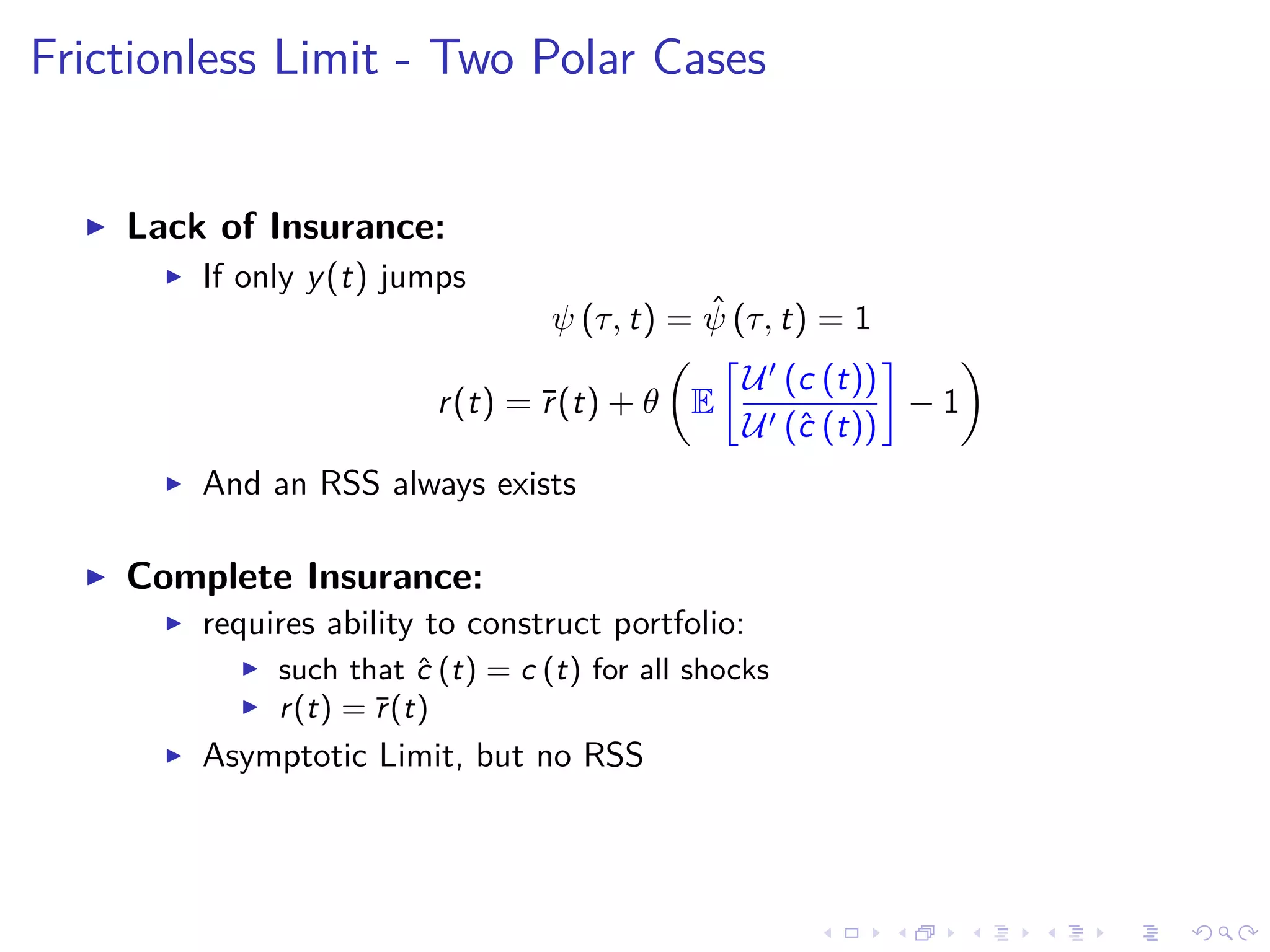

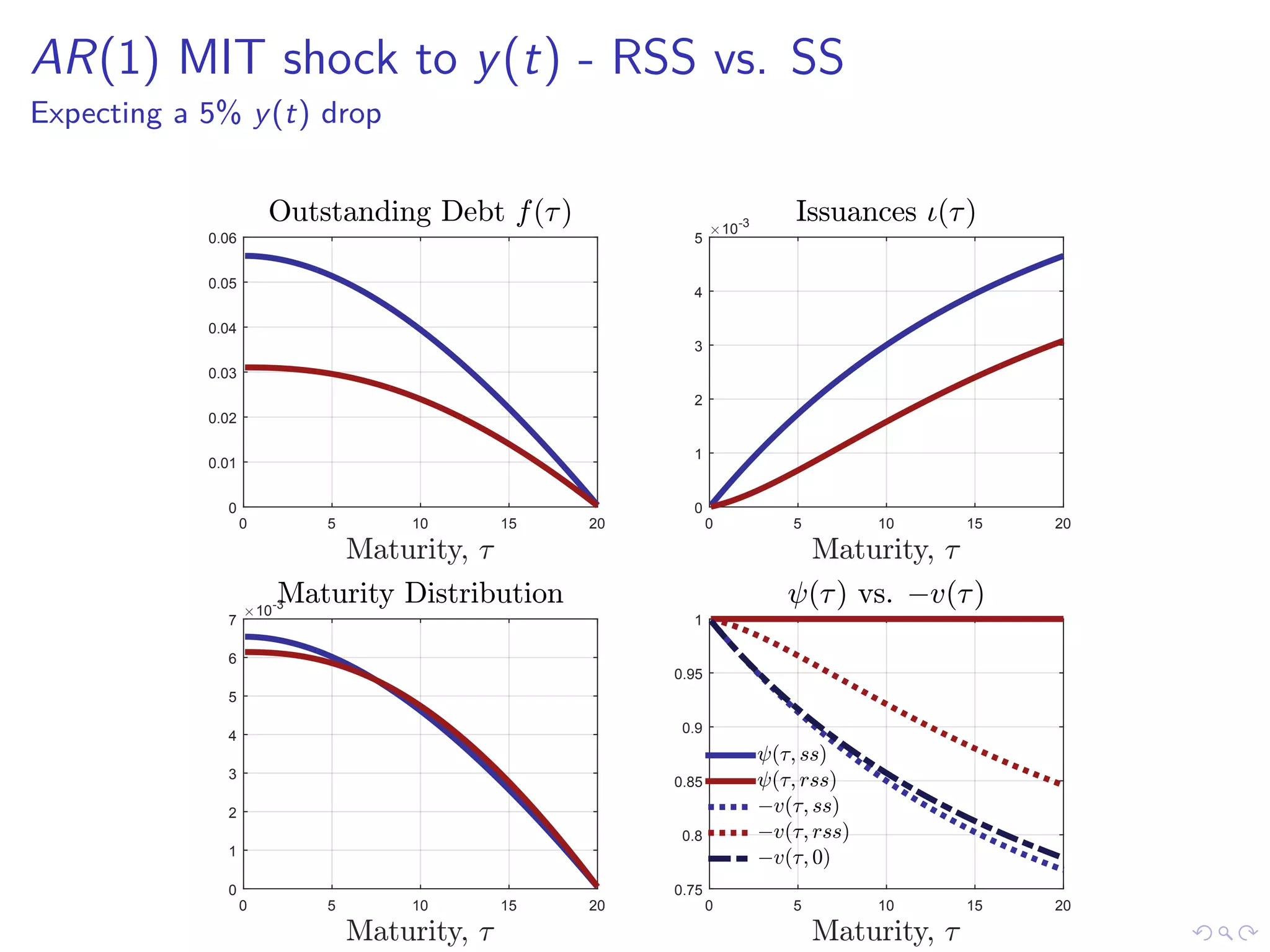

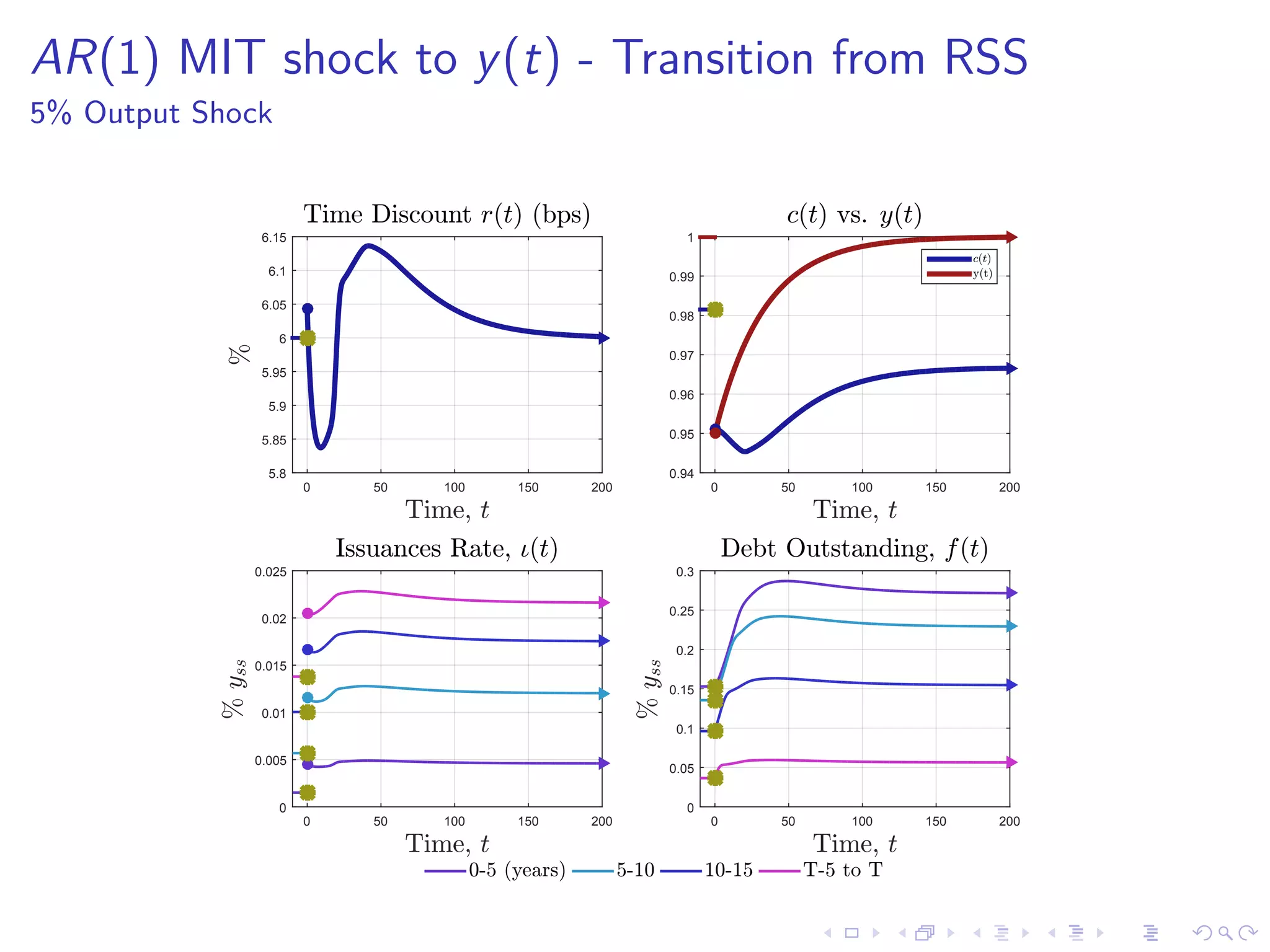

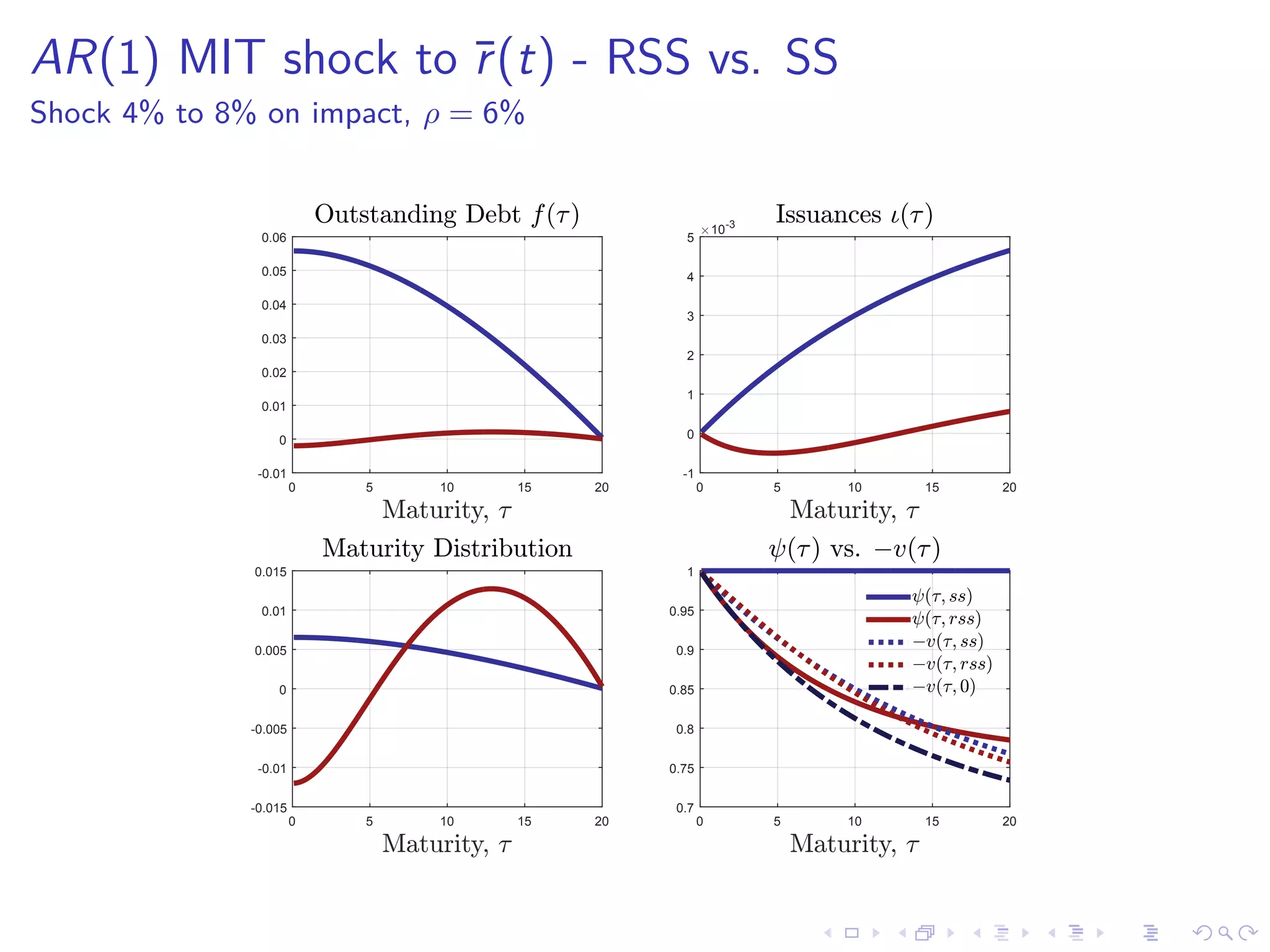

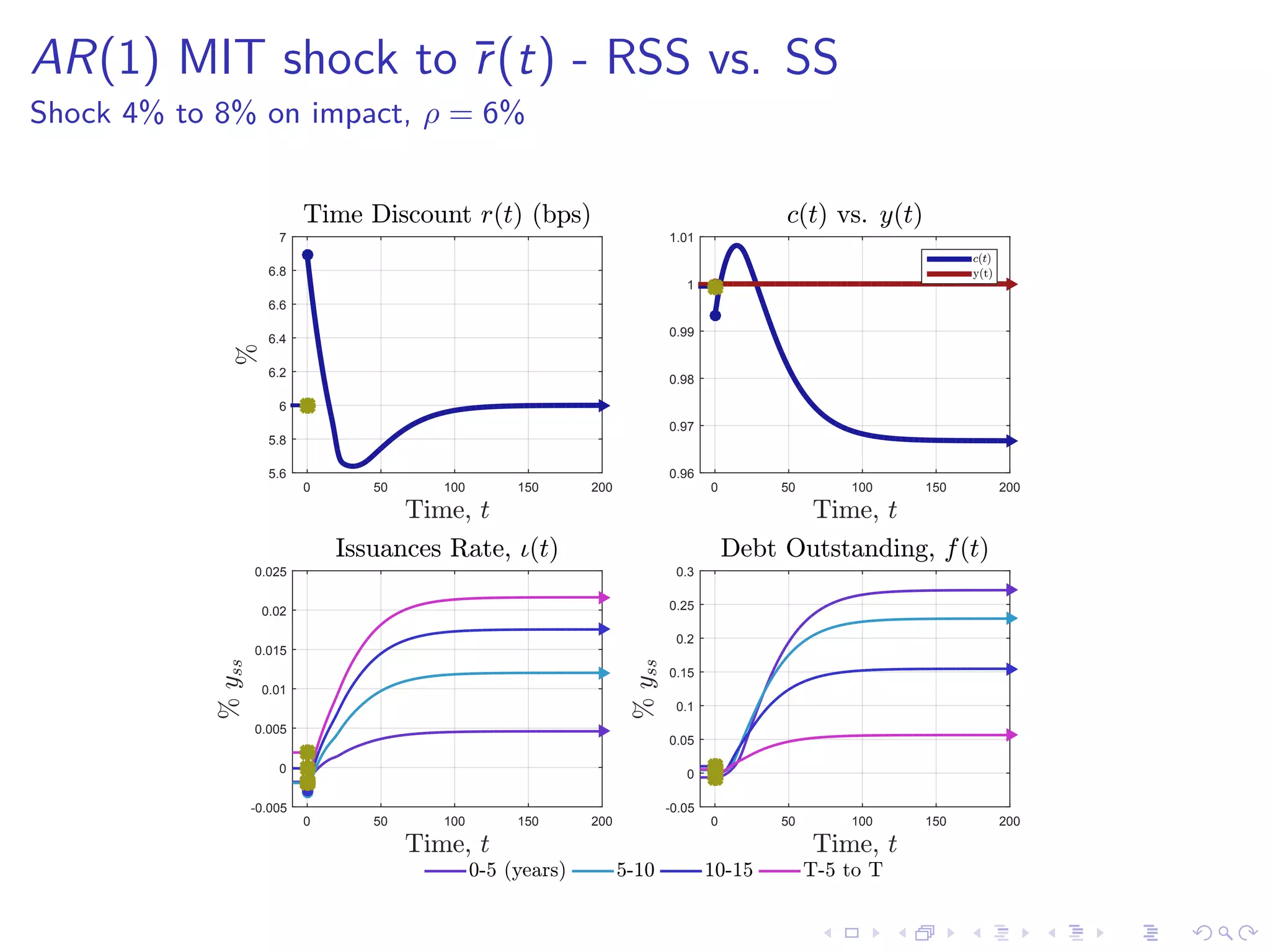

This document discusses optimal debt maturity management. It presents a model where a sovereign can issue a continuum of bonds with arbitrary cash flows to examine debt dynamics. The model highlights the role of liquidity costs in shaping issuance and maturity choices. It shows that income and interest rate shocks can lead to cycles in issuance as the sovereign balances liquidity smoothing versus consumption smoothing. Longer maturity horizons and interest rate shocks emphasize consumption smoothing over liquidity smoothing in transitions following shocks.

![Environment: shocks, preference and state

Random paths: income y(t), short rate ¯r(t)

later: default

Preferences:

V0 = E[

∞

0

e−ρt

u(c(t))dt] and u(x) ≡

c1−σ − 1

1 − σ

State: debt f (τ, t), expiration τ ∈ [0, T]](https://image.slidesharecdn.com/slides-180613205204/75/Optimal-debt-maturity-management-9-2048.jpg)

![Environment: bond price

Bond Price ψ(τ, t):

short rate ¯r(t) path and no-arbitrage:

ψ(τ, t) = E[e

−

τ

0

¯r(t+s)ds

+ δ

τ

0

e

−

s

0

¯r(t+z)dz

ds]

In HJB form:

¯r(t)ψ(τ, t) = δ +

∂ψ

∂t

−

∂ψ

∂τ

; ψ(0, t) = 1](https://image.slidesharecdn.com/slides-180613205204/75/Optimal-debt-maturity-management-11-2048.jpg)

![General Problem

Perfect Foresight

V [f (·, 0)] = max

{ι(τ,t)}t∈[0,∞),τ∈[0,T]

Et

∞

t

e−ρ(s−t)

u(c(s))ds s.t.

c (t) = y (t) − f (0, t) +

T

0

[q (τ, t, ι) ι (τ, t) − δf (τ, t)] dτ

∂f

∂t

= ι (τ, t) +

∂f

∂τ

; f (τ, 0) = f0(τ)

Dual: Dual](https://image.slidesharecdn.com/slides-180613205204/75/Optimal-debt-maturity-management-13-2048.jpg)

![Solving it

Step 1. Lagrangian

L (ι, f ) =

∞

0

e−ρt

u (c(t)) dt

+

∞

0

T

0

e−ρt

j (τ, t) −

∂f

∂t

+ ι (τ, t) +

∂f

∂τ

dτdt,

c(t) = y (t) − f (0, t) +

T

0

[q (t, τ, ι) ι (τ, t) − δf (τ, t)] dτ.

Step 2. First-Order Condition and Envelope

Marginal Value

u (c) q (τ, t, ι) +

∂q

∂ι

ι (τ, t) =

Marginal Cost

−j (τ, t)

ρj (τ, t) = −δu (c (t)) +

∂j

∂t

−

∂j

∂τ

, if τ ∈ (0, T]

and j (0, t) = −u (c (t)) .](https://image.slidesharecdn.com/slides-180613205204/75/Optimal-debt-maturity-management-16-2048.jpg)

![Solving it

Step 1. Lagrangian

L (ι, f ) =

∞

0

e−ρt

u (c(t)) dt

+

∞

0

T

0

e−ρt

j (τ, t) −

∂f

∂t

+ ι (τ, t) +

∂f

∂τ

dτdt,

c(t) = y (t) − f (0, t) +

T

0

[q (t, τ, ι) ι (τ, t) − δf (τ, t)] dτ.

Step 2. First-Order Condition and Envelope

Marginal Value

u (c) ψ (τ, t) − ¯λψ (τ, t) ι =

Marginal Cost

−j (τ, t)

ρj (τ, t) = −δu (c (t)) +

∂j

∂t

−

∂j

∂τ

, if τ ∈ (0, T]

and j (0, t) = −u (c (t)) .](https://image.slidesharecdn.com/slides-180613205204/75/Optimal-debt-maturity-management-17-2048.jpg)

![Optimal Path

Proposition:

1) v(τ, t) ≡ − j(τ,t)

u (c(t)) solves "individual trader” price-PDE:

r(t)

ρ+σ

.

c(t)/c(t)

v (τ, t) = δ +

∂v

∂t

−

∂v

∂τ

, if τ ∈ (0, T]

v (0, t) = 1

2) issuances ι(τ, t):

ψ (τ, t) − ¯λψ (τ, t) ι

marginal income

= v (τ, t)

discounted payouts

3) PDE given f0, c(t) given by BC](https://image.slidesharecdn.com/slides-180613205204/75/Optimal-debt-maturity-management-18-2048.jpg)

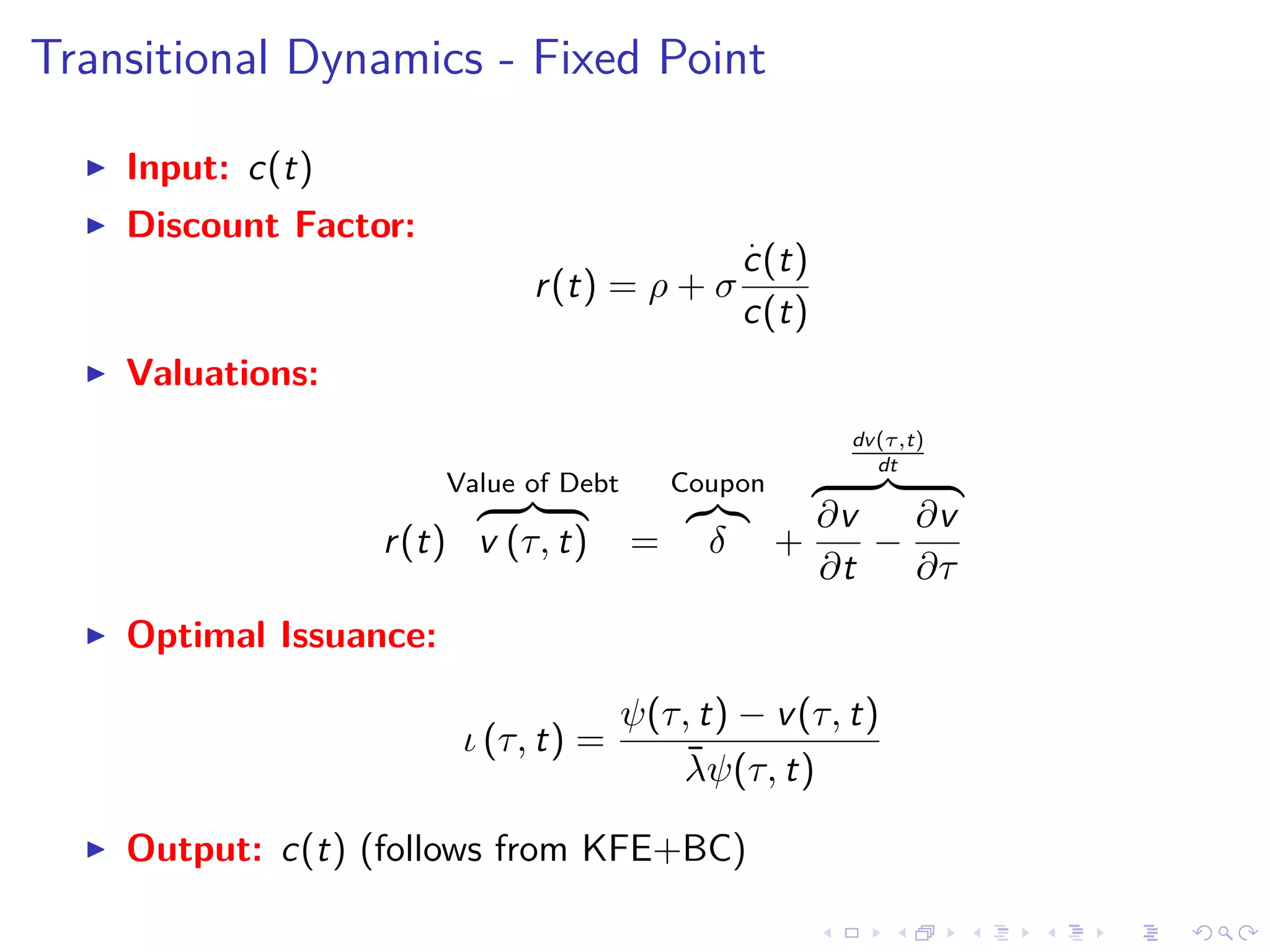

![Optimal Path

Proposition:

1) v(τ, t) ≡ − j(τ,t)

u (c(t)) solves ‘"ndividual trader” price-PDE:

r(t)

ρ+σ

.

c(t)/c(t)

v (τ, t) = δ +

∂v

∂t

−

∂v

∂τ

, if τ ∈ (0, T]

v (0, t) = 1

2) issuances ι(τ, t):

ι =

ψ (τ, t) − v (τ, t)

¯λψ (τ, t)

3) PDE given f0, c(t) given by BC](https://image.slidesharecdn.com/slides-180613205204/75/Optimal-debt-maturity-management-19-2048.jpg)

![Frictionless Limit - Pre-shock Transition

ˆψ (τ, t) = ˆv (τ, t)

Price Equation:

¯r (t) ˆψ (τ, t) = δ +

∂ ˆψ

∂t

−

∂ ˆψ

∂τ

+ θ E [ψ (τ, t)] − ˆψ (τ, t)

HJB and ˆψ (τ, t) = ˆv (τ, t)

r(t) ˆψ (τ, t) = δ +

∂ ˆψ

∂t

−

∂ ˆψ

∂τ

+ θ E

U (c (t))

U (ˆc (t))

ψ (τ, t) − ˆψ (τ, t)

both equations must be consistent](https://image.slidesharecdn.com/slides-180613205204/75/Optimal-debt-maturity-management-39-2048.jpg)

![Dual

Given {c(t)}t≥0, then planner’s discount:

r(t) = ρ + σ

˙c(t)

c(t)

Dual Problem

D [f (·, 0)] = min

{ι(τ,t)}t=τ∈[0,∞),τ∈[0,T]

∞

0

e−

t

0

r(s)ds

ytdt s.t.

∂f

∂t

= ι (τ, t) +

∂f

∂τ

, f (T, t) = 0; f (τ, 0) = f0(τ)

y (t) = c (t) + f (0, t) −

T

0

[q (τ, t, ι) ι (τ, t) − δf (τ, t)] dτ

back](https://image.slidesharecdn.com/slides-180613205204/75/Optimal-debt-maturity-management-49-2048.jpg)

![Dual (button)

Given {c(t)}t≥0, then planner’s discount:

r(t) = ρ − σ

˙c(t)

c(t)

Dual:

D [f (·, 0)] = min

{ι(τ,t)}t=τ∈[0,∞),τ∈[0,T]

∞

0

e−

t

0

r(s)ds

(f (0, t)−

T

0

(ψ(τ, t) − λ

∂f

∂t

= ι (τ, t) +

∂f

∂τ

, f (τ, 0) = f0(τ)

back](https://image.slidesharecdn.com/slides-180613205204/75/Optimal-debt-maturity-management-50-2048.jpg)

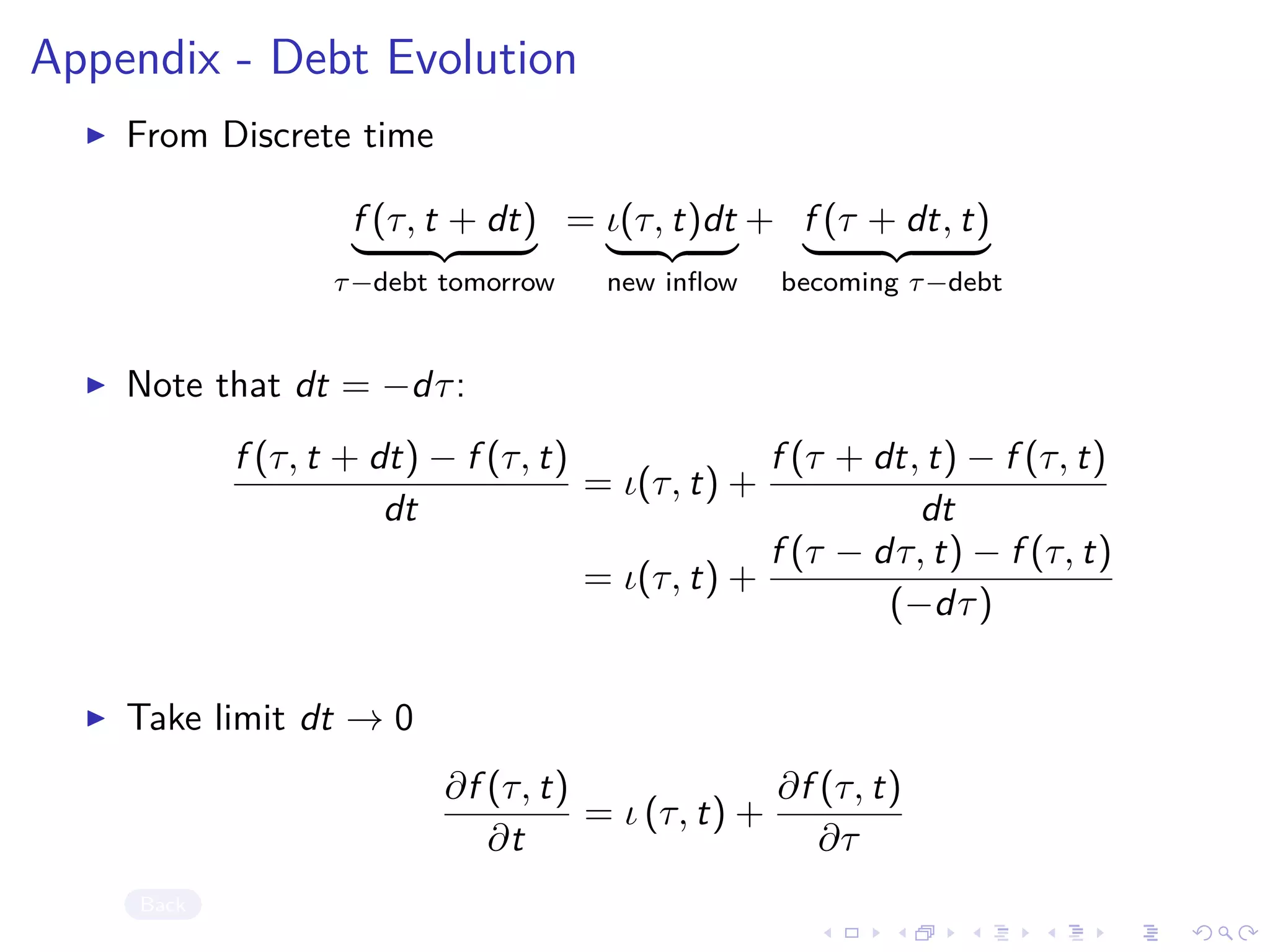

![Transitional Dynamics - Fixed Point Algorithm in r(t)

1. Build:

r(t) = ρ − σ

˙c(t)

c(t)

2. Plug r(t) into value PDE:

r(t)v (τ, t) = −δ +

∂v

∂t

−

∂v

∂τ

3. Build issuances:

ι (τ, t) =

ψ(τ, t) + v(τ, t)

¯λ

4. Obtain f (t, τ):

f (τ, t) =

min{T,τ+t}

τ

ι(t + τ − s, s)ds + I[T > t + τ] · f (τ + t, 0)

5. c(t) given by

cout

(t) = y (t) − f (0, t) +

T

0

[q (τ, t, ι) ι (τ, t) − δf (τ, t)] dτ](https://image.slidesharecdn.com/slides-180613205204/75/Optimal-debt-maturity-management-62-2048.jpg)