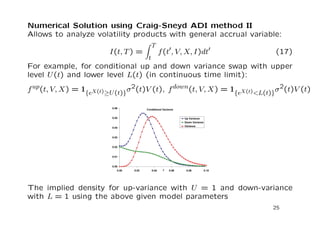

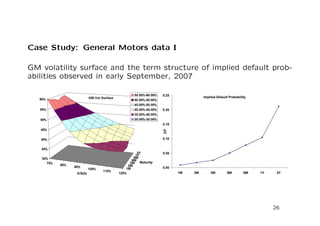

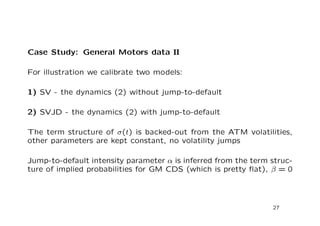

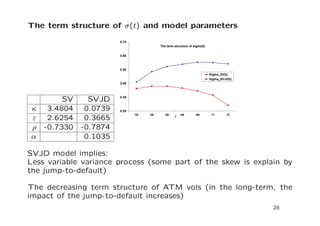

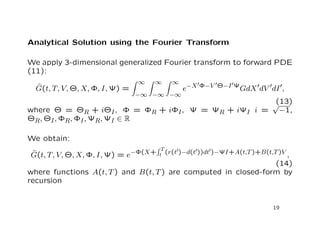

The document discusses a stochastic volatility model that incorporates jumps in volatility and the possibility of default. It describes the dynamics of the model and how it can be used to price volatility and credit derivatives. Analytical and numerical methods are presented for solving the pricing problem. As an example application, the model is fit to data on General Motors to analyze the implications.

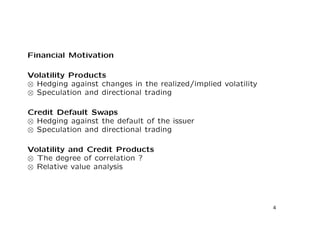

![Volatility Products II

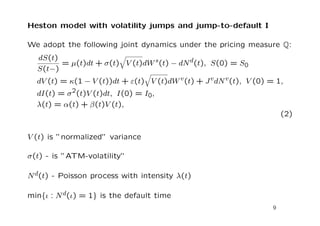

Forward-start call:

U(TF ; T) = max

S(T)

S(TF )

K; 0

!

where TF - forward start time, T - maturity

Forward-start variance swap:

U(TF ; T) = IN(TF ; T) K2

fair

Option on the future implied volatility (VIX-type option):

U(T; T) = max

q

E[IN(T; T +T)] K; 0

The values of these products are sensitive to the evolution of the

volatility surface

6](https://image.slidesharecdn.com/quant2007presentation-140830013556-phpapp01/85/Volatility-derivatives-and-default-risk-6-320.jpg)

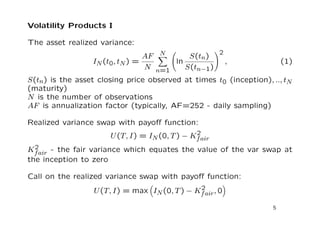

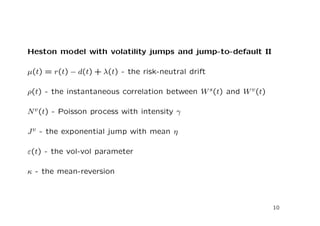

![Model Interpretation: Asset Realized Variance

The expected variance:

V (T) := EQ[V (T)jV (0) = 1] = 1+

1 eT

(3)

Assuming for moment no default risk, the asset realized variance in

the continuous-time limit becomes:

I(T) = lim

N!1

X

tn2N

ln

S(tn)

S(tn1)

!2

=

Z T

0

2(t0)V (t0)dt0 (4)

The expected realized variance:

I(T) := EQ[I(T)jV (0) = 1] =

Z T

0

2(t0)V (t0)dt0 (5)

Given the values of mean-reversion parameters and jump parameters

and

, we can extract the term structure of 2(t) from the fair

variance curve observed from the market data

11](https://image.slidesharecdn.com/quant2007presentation-140830013556-phpapp01/85/Volatility-derivatives-and-default-risk-12-320.jpg)

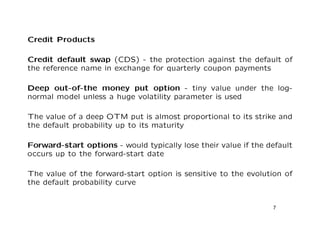

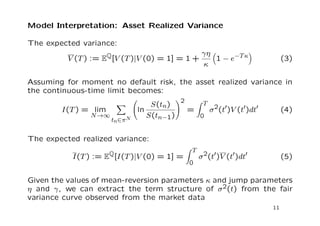

![Model Interpretation: Jump-to-Default

The probability of survival up to time T:

Q(t; T) = EQ[ Tj t] = EQ[e

R T

t (t0)dt0

] (6)

The probability of defaulting up to time T is connected to the inte-

grated expected variance:

Qc(t; T) = EQ[ Tj t] = 1Q(t; T)

Z T

t

((t0)+](https://image.slidesharecdn.com/quant2007presentation-140830013556-phpapp01/85/Volatility-derivatives-and-default-risk-13-320.jpg)

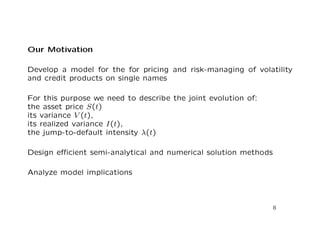

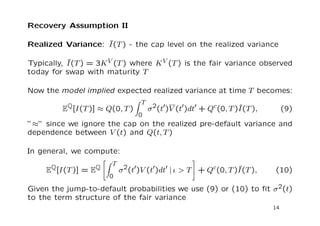

![Recovery Assumption II

Realized Variance: ^I(T) - the cap level on the realized variance

Typically, ^I(T) = 3KV (T) where KV (T) is the fair variance observed

today for swap with maturity T

Now the model implied expected realized variance at time T becomes:

EQ[I(T)] Q(0; T)

Z T

0

2(t0)V (t0)dt0 +Qc(0; T)^I(T); (9)

since we ignore the cap on the realized pre-default variance and

dependence between V (t) and Q(t; T)

In general, we compute:

EQ[I(T)] = EQ

Z T

0

2(t0)V (t0)dt0 j T

#

+Qc(0; T)^I(T); (10)

Given the jump-to-default probabilities we use (9) or (10) to](https://image.slidesharecdn.com/quant2007presentation-140830013556-phpapp01/85/Volatility-derivatives-and-default-risk-20-320.jpg)