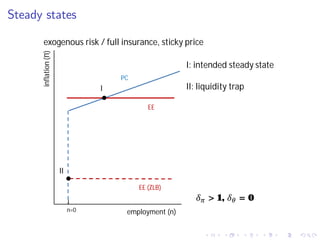

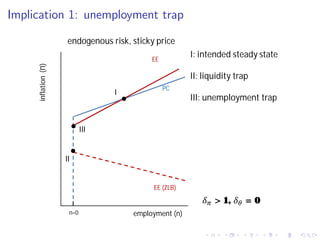

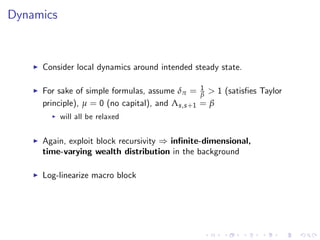

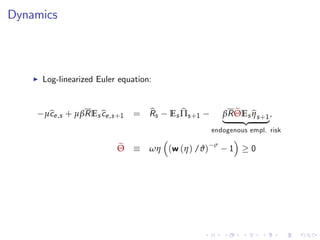

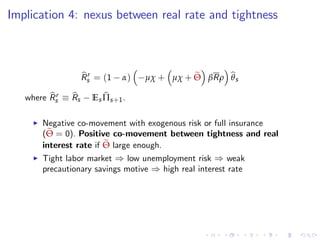

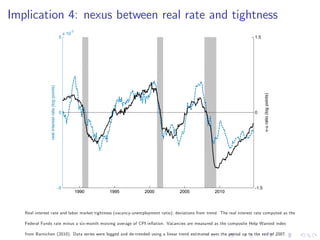

This document summarizes an analytical framework for studying macroeconomic fluctuations combining heterogeneous agent models (HANK) with search and matching frictions in the labor market (SAM). It shows that the interaction between endogenous income risk from SAM unemployment and precautionary savings from HANK can amplify business cycles. Specifically, it finds that this interaction can lead to an unemployment trap, cause a breakdown of the Taylor principle, amplify shock responses, and create a positive nexus between labor market tightness and the real interest rate due to time-varying unemployment risk. The framework is calibrated to match U.S. macro data and its implications are derived both analytically and quantitatively.

![Preferences

I continuum of single-member households, indexed by i 2 [0, 1]

I utility:

Vi,t = Et

∞

∑

s=t

βs t

c1 σ

i,s 1

1 σ

ζni,s

!

,

I consumption:

ci,s =

Z

j

cj

i,s

1 1/γ

dj

1/(1 1/γ)

I employment status:

ni,s =

0 if not employed at date s

1 if employed at date s

I receive wi,s when employed, produce ϑ at home if not employed](https://image.slidesharecdn.com/sterkeui-171130084549/85/Macroeconomic-fluctuations-with-HANK-SAM-7-320.jpg)

![Budget constraint

ci,s + bi,s + xi,s = ni,s wi,s + (1 ni,s ) ϑ +

Rs 1

Πs

bi,s 1 +

(1 τi ) Rx,s

Πs

xi,s 1

Heterogeneous returns to equity due to individual-speci…c equity holding fee

τi 2 [0, 1]

I Benhabib, Bisin and Zhu (2011), Gabaix, Lasry, Lions and Moll (2016),

Fagereng, Guiso, Malacrino and Pistaferri (2016).

I special case: limited participation (τi 2 f0, 1g), Christiano, Eichenbaum

and Evans (1997)](https://image.slidesharecdn.com/sterkeui-171130084549/85/Macroeconomic-fluctuations-with-HANK-SAM-12-320.jpg)

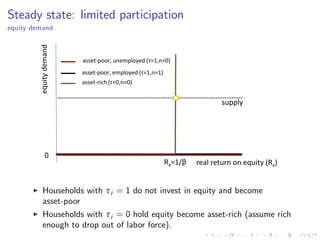

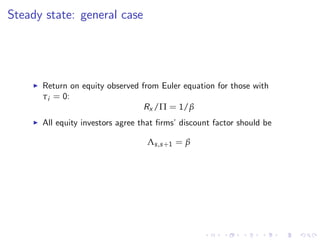

![Steady state: general case

I Equity fee τi follows some distribution with support [0, 1].

I There is a threshold τ such that households with τi > τ do not

invest in equity and end up holding zero wealth in equilibrium

I ) ci,s = ni,s ws + (1 ni,s ) ϑ

I Let I = fi : τi > τ, ni,s = 1g be the set of households who never

invest in equity and are currently employed.

I Can show that, in equilibrium, these households are on their Euler

equation, i.e.

1 = β

R

Π

Es

ci,s

ci,s+1

σ

, i 2 I

β

R

Π

Es

ci,s

ci,s+1

σ

, i /2 I](https://image.slidesharecdn.com/sterkeui-171130084549/85/Macroeconomic-fluctuations-with-HANK-SAM-15-320.jpg)

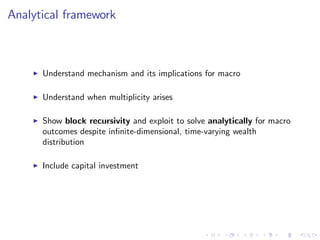

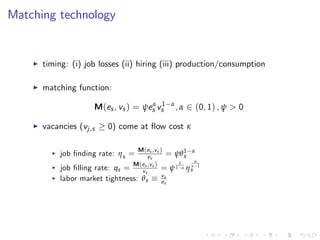

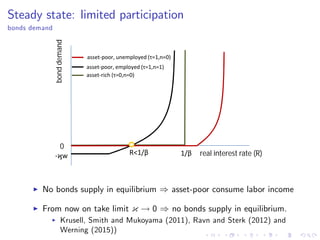

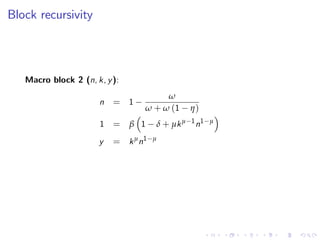

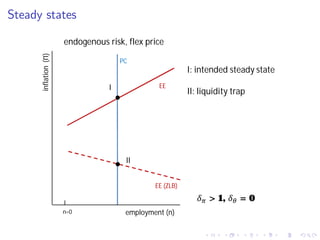

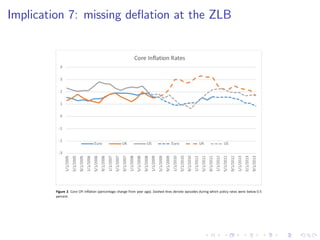

![Role of …rms’discounting

Output response to TFP shock

0 10 20 30 40

0

1

2

3

4

5

A. WITHOUT CAPITAL

%

0 10 20 30 40

0

1

2

3

4

5

B. WITH CAPITAL

%

firms discount with subjective discount rate (1/)

firms discount with real interest rate (Es

[Rs

/s+1

])

TFP](https://image.slidesharecdn.com/sterkeui-171130084549/85/Macroeconomic-fluctuations-with-HANK-SAM-48-320.jpg)