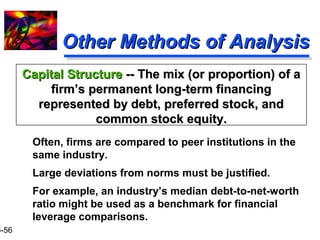

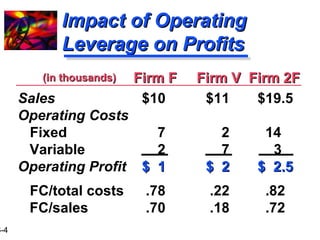

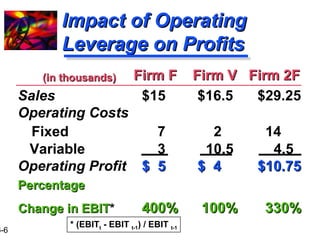

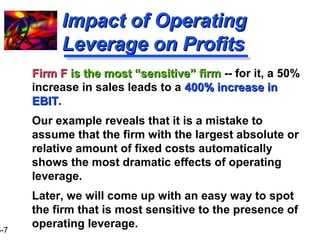

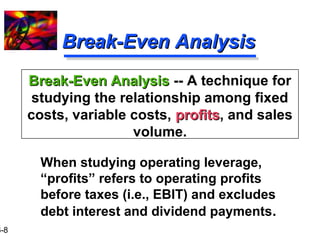

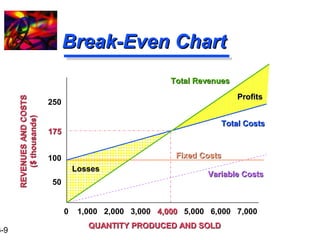

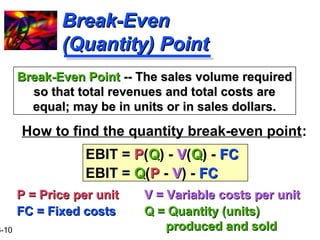

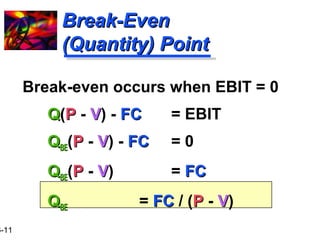

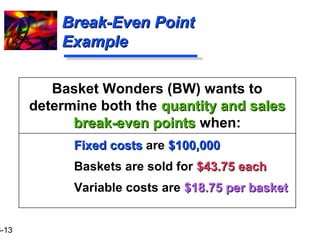

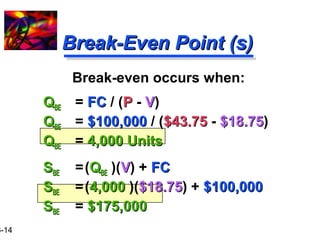

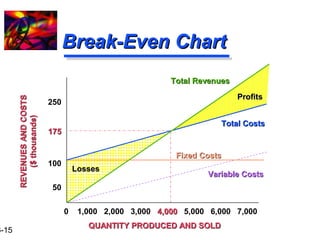

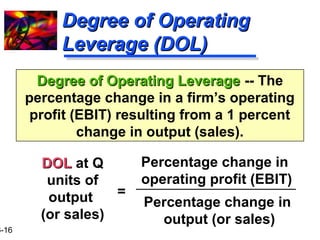

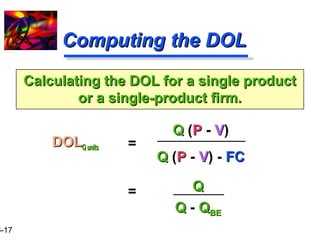

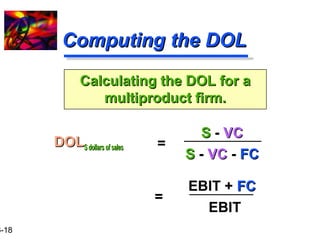

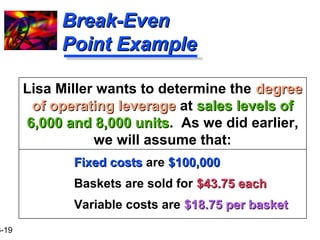

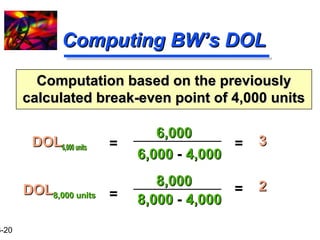

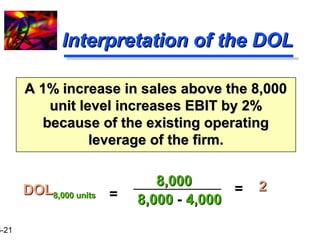

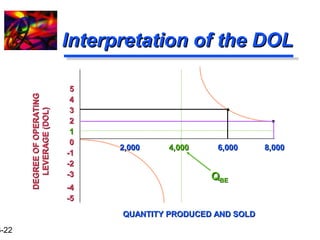

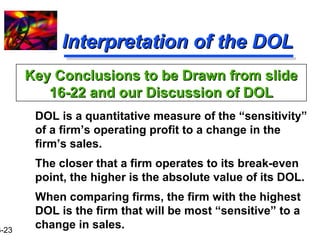

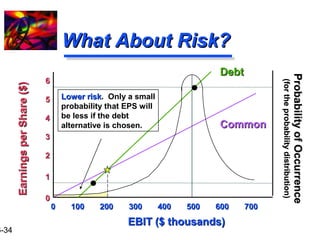

This document discusses operating leverage and financial leverage. It defines operating leverage as the use of fixed operating costs by a firm and financial leverage as the use of fixed financing costs. It then provides examples to illustrate how operating leverage can impact a firm's profits and how to calculate measures of operating leverage like the break-even point and degree of operating leverage (DOL). The DOL measures the percentage change in operating profit from a 1% change in sales. Firms closer to the break-even point have a higher DOL and are more sensitive to sales changes. Financial leverage is used to increase returns for common shareholders but also increases business risk.

![16-5

IImmppaacctt ooff OOppeerraattiinngg

LLeevveerraaggee oonn PPrrooffiittss

Now, subject each firm to a 5500%%

iinnccrreeaassee iinn ssaalleess for next year.

Which firm do you think will be more

““sseennssiittiivvee”” to the change in sales (i.e.,

show the largest percentage change in

operating profit, EBIT)?

[ ] FFiirrmm FF; [ ] FFiirrmm VV; [ ] FFiirrmm 22FF.](https://image.slidesharecdn.com/leverage-140910233646-phpapp01/85/Operating-and-Financial-Leverage-5-320.jpg)

![16-12

BBrreeaakk--EEvveenn ((SSaalleess)) PPooiinntt

How to find the sales break-even point:

SSBBEE = FFCC + (VVCCBBEE)

SSBBEE = FFCC + (QQBBEE )(VV)

or

SSBBEE

** = FFCC / [1 - (VVCC / S) ]

* Refer to text for derivation of the formula](https://image.slidesharecdn.com/leverage-140910233646-phpapp01/85/Operating-and-Financial-Leverage-12-320.jpg)

![16-37

CCoommppuuttiinngg tthhee DDFFLL

DDFFLL EBIT of $X

CCaallccuullaattiinngg tthhee DDFFLL

= EBIT

EEBBIITT - II - [ PPDD / (1 - tt) ]

EEBBIITT == EEaarrnniinnggss bbeeffoorree iinntteerreesstt aanndd ttaaxxeess

II == IInntteerreesstt

PPDD == PPrreeffeerrrreedd ddiivviiddeennddss

tt == CCoorrppoorraattee ttaaxx rraattee](https://image.slidesharecdn.com/leverage-140910233646-phpapp01/85/Operating-and-Financial-Leverage-37-320.jpg)

![16-38

WWhhaatt iiss tthhee DDFFLL ffoorr EEaacchh

ooff tthhee FFiinnaanncciinngg CChhooiicceess??

CCaallccuullaattiinngg tthhee DDFFLL ffoorr NNEEWW eeqquuiittyy* aalltteerrnnaattiivvee

DDFFLL $$550000,,000000

= $500,000

$$550000,,000000 - 00 - [00 / (1 - 00)]

= 11..0000

* The calculation is based on the expected EBIT](https://image.slidesharecdn.com/leverage-140910233646-phpapp01/85/Operating-and-Financial-Leverage-38-320.jpg)

![16-39

WWhhaatt iiss tthhee DDFFLL ffoorr EEaacchh

ooff tthhee FFiinnaanncciinngg CChhooiicceess??

CCaallccuullaattiinngg tthhee DDFFLL ffoorr NNEEWW ddeebbtt * aalltteerrnnaattiivvee

DDFFLL $$550000,,000000

= $500,000

{{ $$550000,,000000 - 110000,,000000

- [00 / (1 - 00)] }

= $$550000,,000000 / $400,000

= 11..2255

* The calculation is based on the expected EBIT](https://image.slidesharecdn.com/leverage-140910233646-phpapp01/85/Operating-and-Financial-Leverage-39-320.jpg)

![CCaallccuullaattiinngg tthhee DDFFLL ffoorr NNEEWW pprreeffeerrrreedd * aalltteerrnnaattiivvee

16-40

WWhhaatt iiss tthhee DDFFLL ffoorr EEaacchh

ooff tthhee FFiinnaanncciinngg CChhooiicceess??

DDFFLL $$550000,,000000

= $500,000

{{ $$550000,,000000 - 00

- [9900,,000000 / (1 - ..3300)] }

= $$550000,,000000 / $400,000

= 11..3355

* The calculation is based on the expected EBIT](https://image.slidesharecdn.com/leverage-140910233646-phpapp01/85/Operating-and-Financial-Leverage-40-320.jpg)

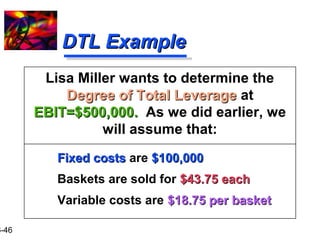

![16-45

CCoommppuuttiinngg tthhee DDTTLL

DDTTLL QQ uunniittss ((oorr SS ddoollllaarrss)) = ( DDOOLL QQ uunniittss ((oorr SS ddoollllaarrss)) )

DDTTLL S dollars

of sales

x ( DDFFLL EEBBIITT ooff XX ddoollllaarrss )

= EBIT + FC

EEBBIITT - II - [ PPDD / (1 - tt) ]

DDTTLL Q units

QQ (PP -- VV)

QQ (PP -- VV) - FC - II - [ PPDD / (1 - tt) ]

=](https://image.slidesharecdn.com/leverage-140910233646-phpapp01/85/Operating-and-Financial-Leverage-45-320.jpg)

![16-47

CCoommppuuttiinngg tthhee DDTTLL

ffoorr AAllll--EEqquuiittyy FFiinnaanncciinngg

DDTTLLSS ddoollllaarrss = (DDOOLL SS ddoollllaarrss) x (DDFFLLEEBBIITT ooff $$SS )

DDTTLLSS ddoollllaarrss = (11..22 ) x ( 11..00* ) = 11..2200

DDTTLL S dollars

of sales

=

$$550000,,000000 + $100,000

$$550000,,000000 - 00 - [ 00 / (1 - ..33) ]

= 11..2200

*Note: No financial leverage.](https://image.slidesharecdn.com/leverage-140910233646-phpapp01/85/Operating-and-Financial-Leverage-47-320.jpg)

![16-48

CCoommppuuttiinngg tthhee DDTTLL

ffoorr DDeebbtt FFiinnaanncciinngg

DDTTLLSS ddoollllaarrss = (DDOOLL SS ddoollllaarrss) x (DDFFLLEEBBIITT ooff $$SS )

DDTTLLSS ddoollllaarrss = (11..22 ) x ( 11..2255* ) = 11..5500

DDTTLL S dollars

of sales

=

$$550000,,000000 + $100,000

{ $$550000,,000000 - $$110000,,000000

- [ 00 / (1 - ..33) ] }

= 11..5500

*Note: Calculated on Slide 39.](https://image.slidesharecdn.com/leverage-140910233646-phpapp01/85/Operating-and-Financial-Leverage-48-320.jpg)

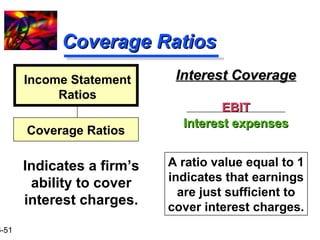

![16-52

CCoovveerraaggee RRaattiiooss

DDeebbtt--sseerrvviiccee CCoovveerraaggee

EEBBIITT

{ IInntteerreesstt eexxppeennsseess +

[PPrriinncciippaall ppaayymmeennttss // ((11--tt)) ] }

Income Statement

Ratios

Coverage Ratios

Indicates a firm’s

ability to cover

interest expenses and

principal payments.

Allows us to examine the

ability of the firm to meet

all of its debt payments.

Failure to make principal

payments is also default.](https://image.slidesharecdn.com/leverage-140910233646-phpapp01/85/Operating-and-Financial-Leverage-52-320.jpg)