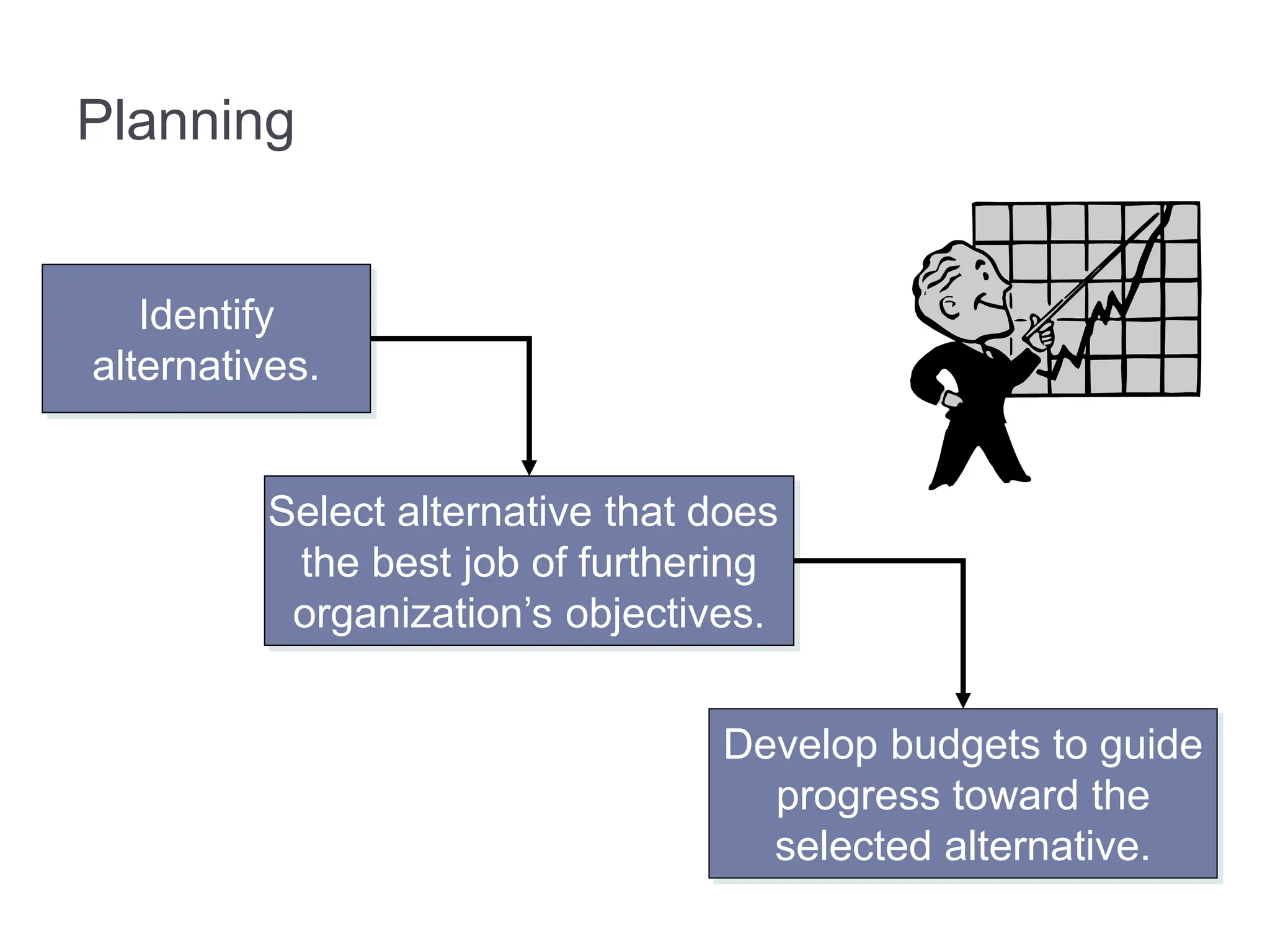

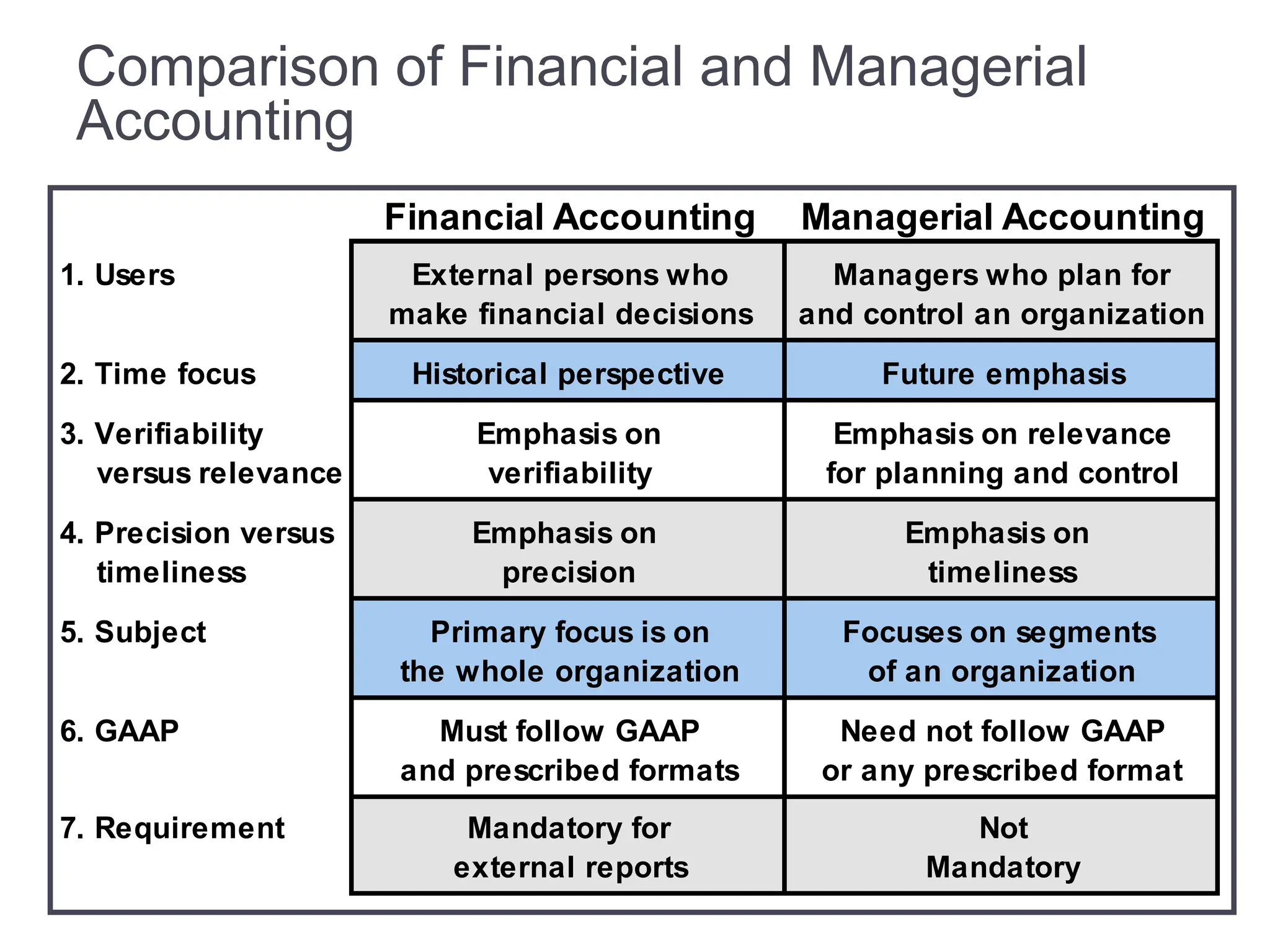

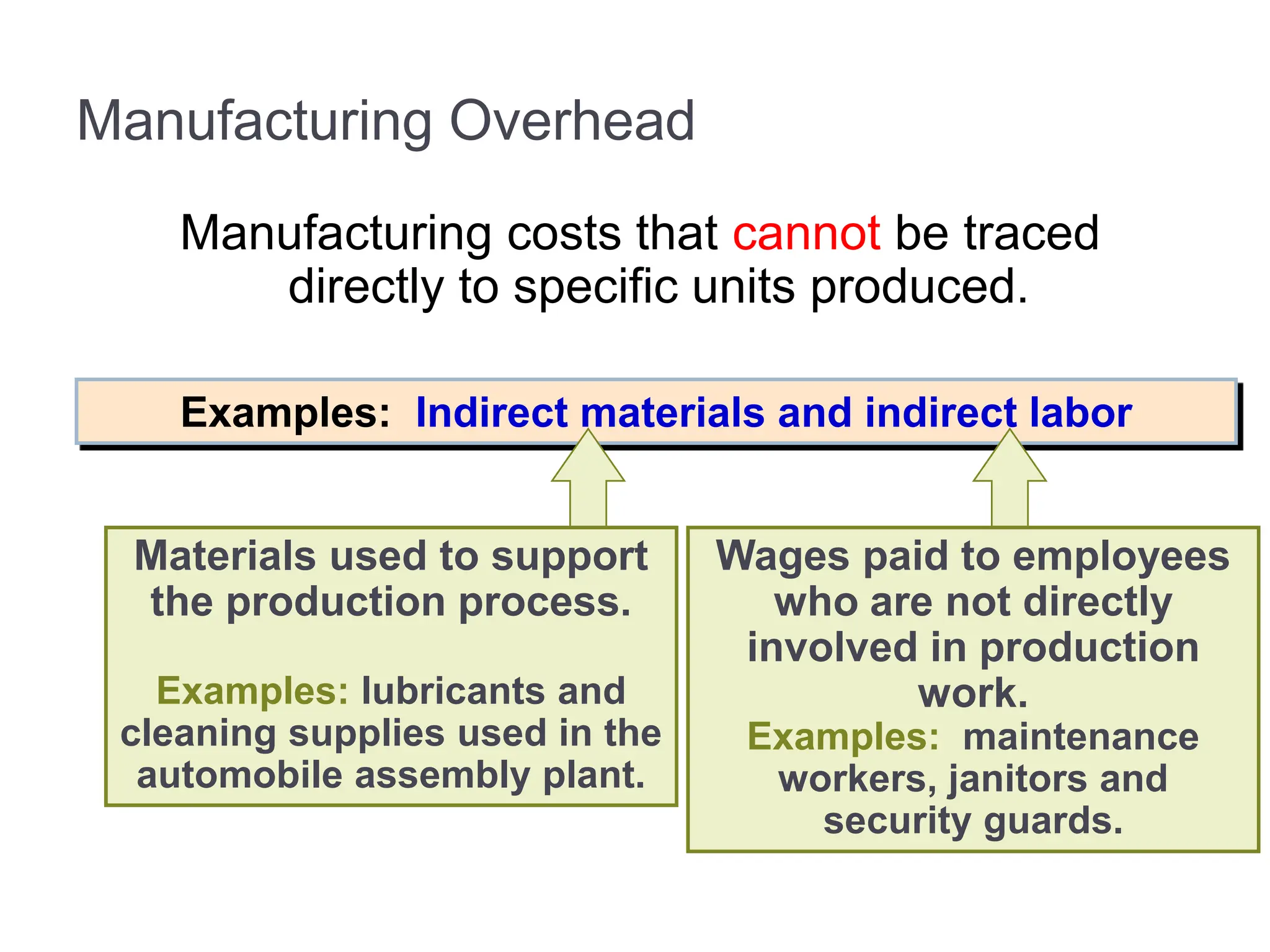

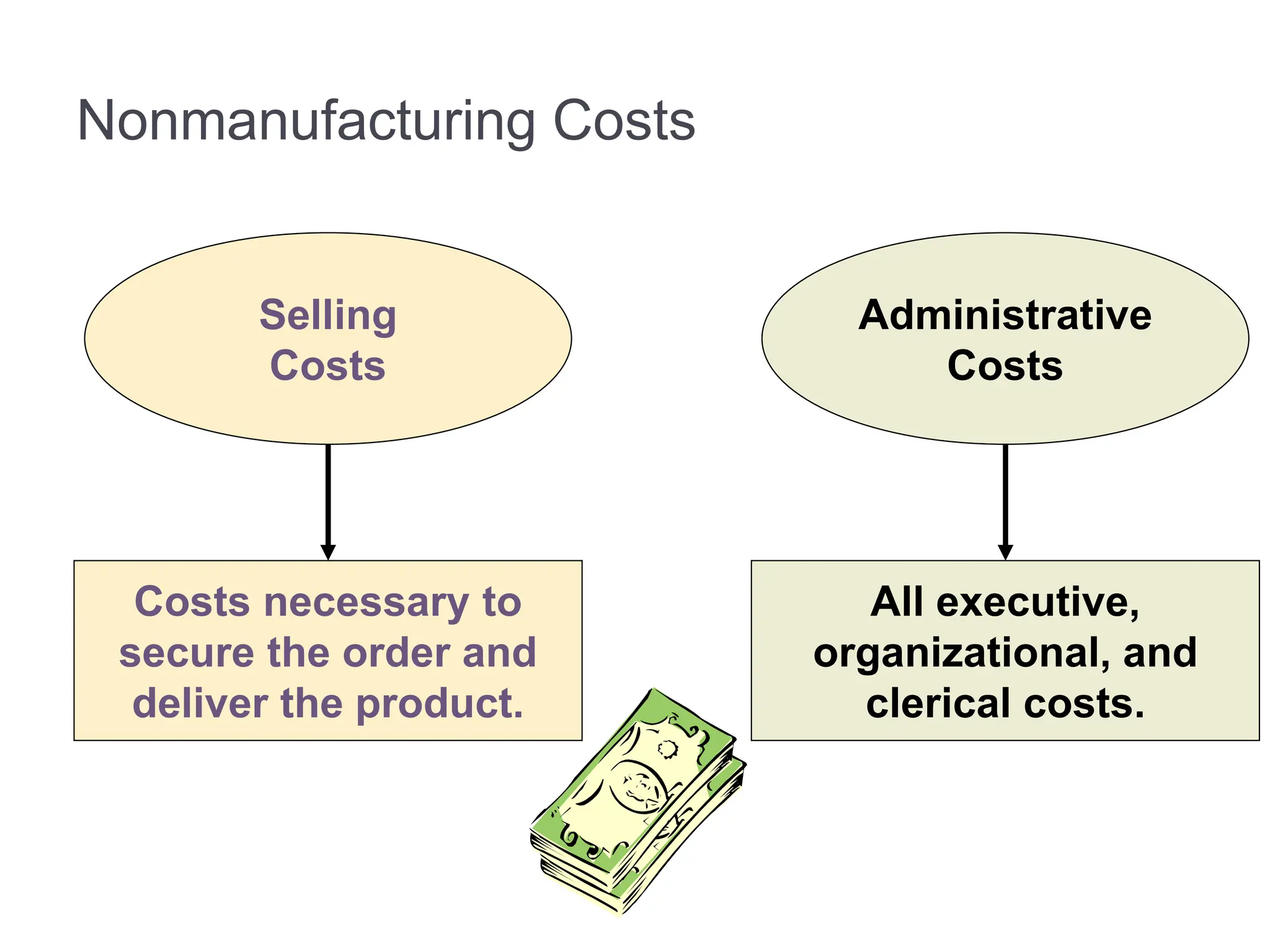

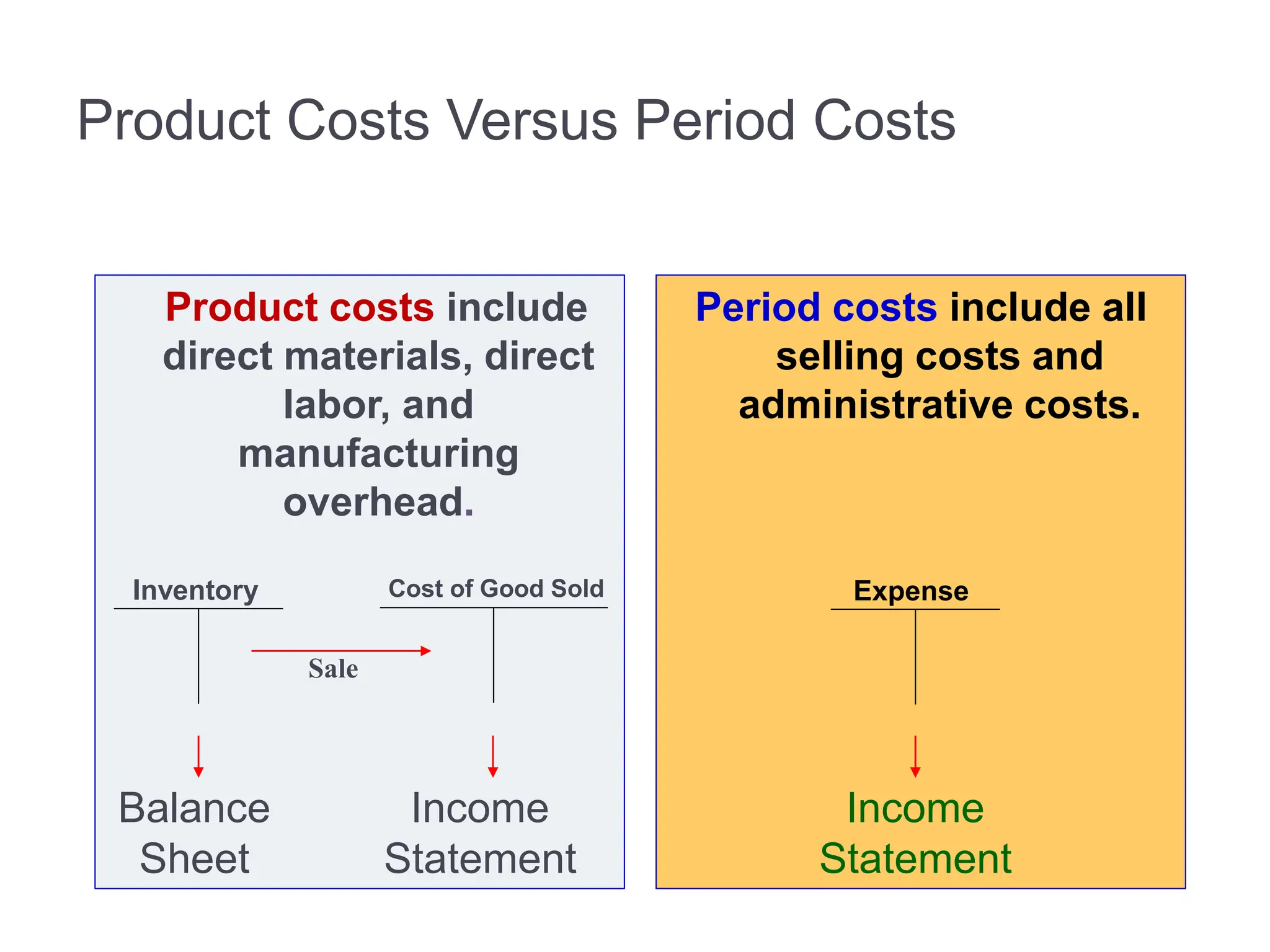

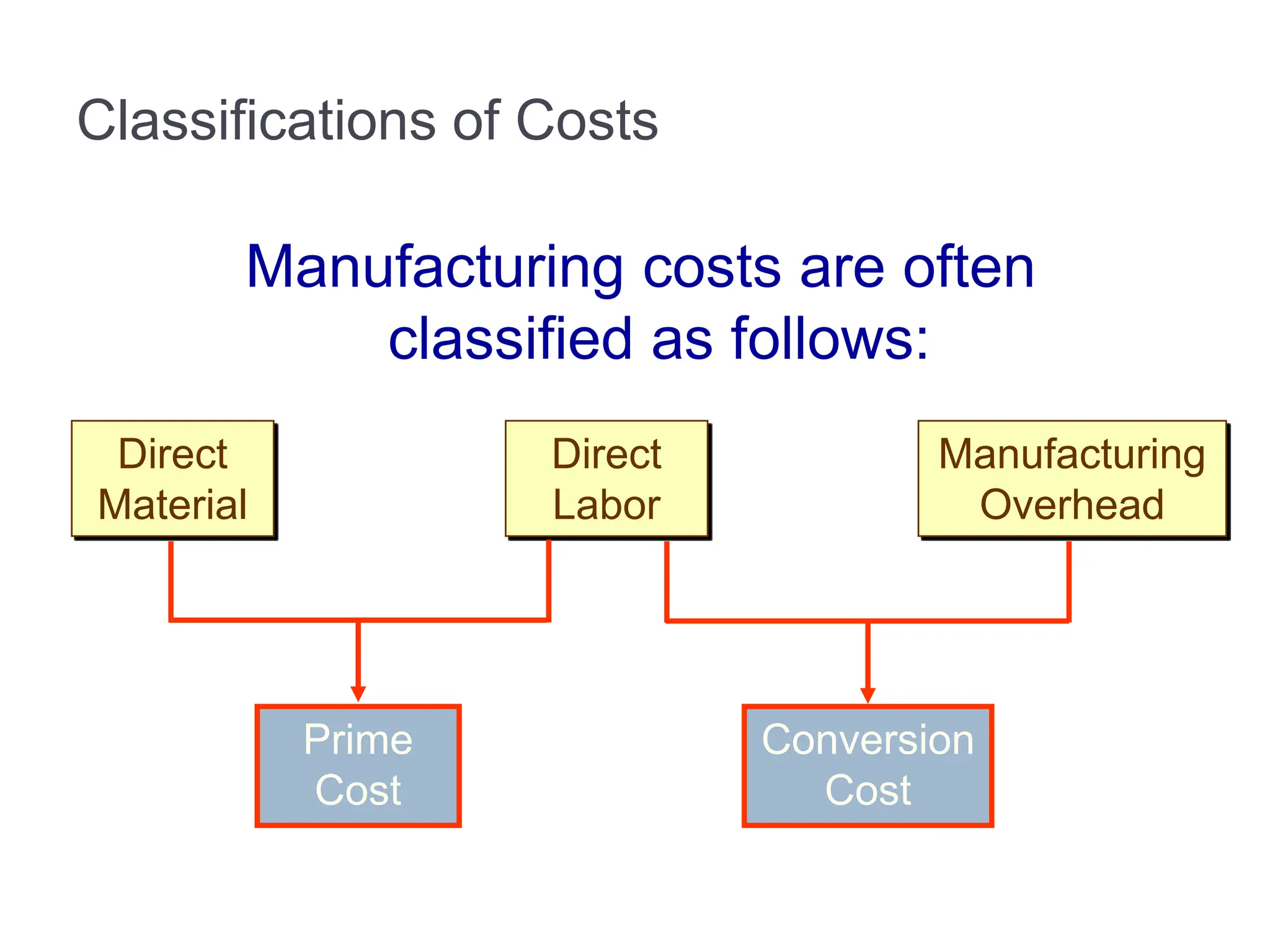

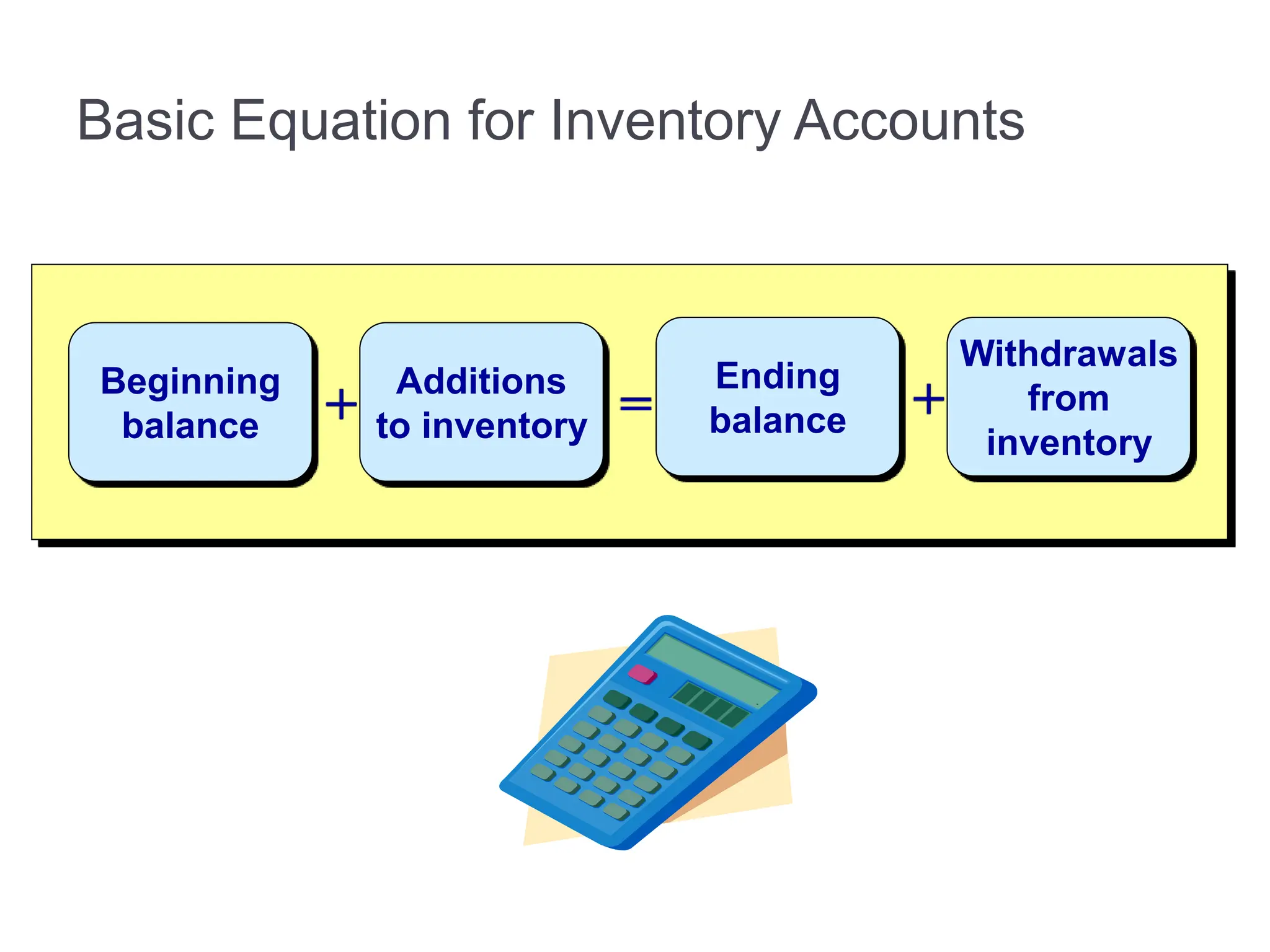

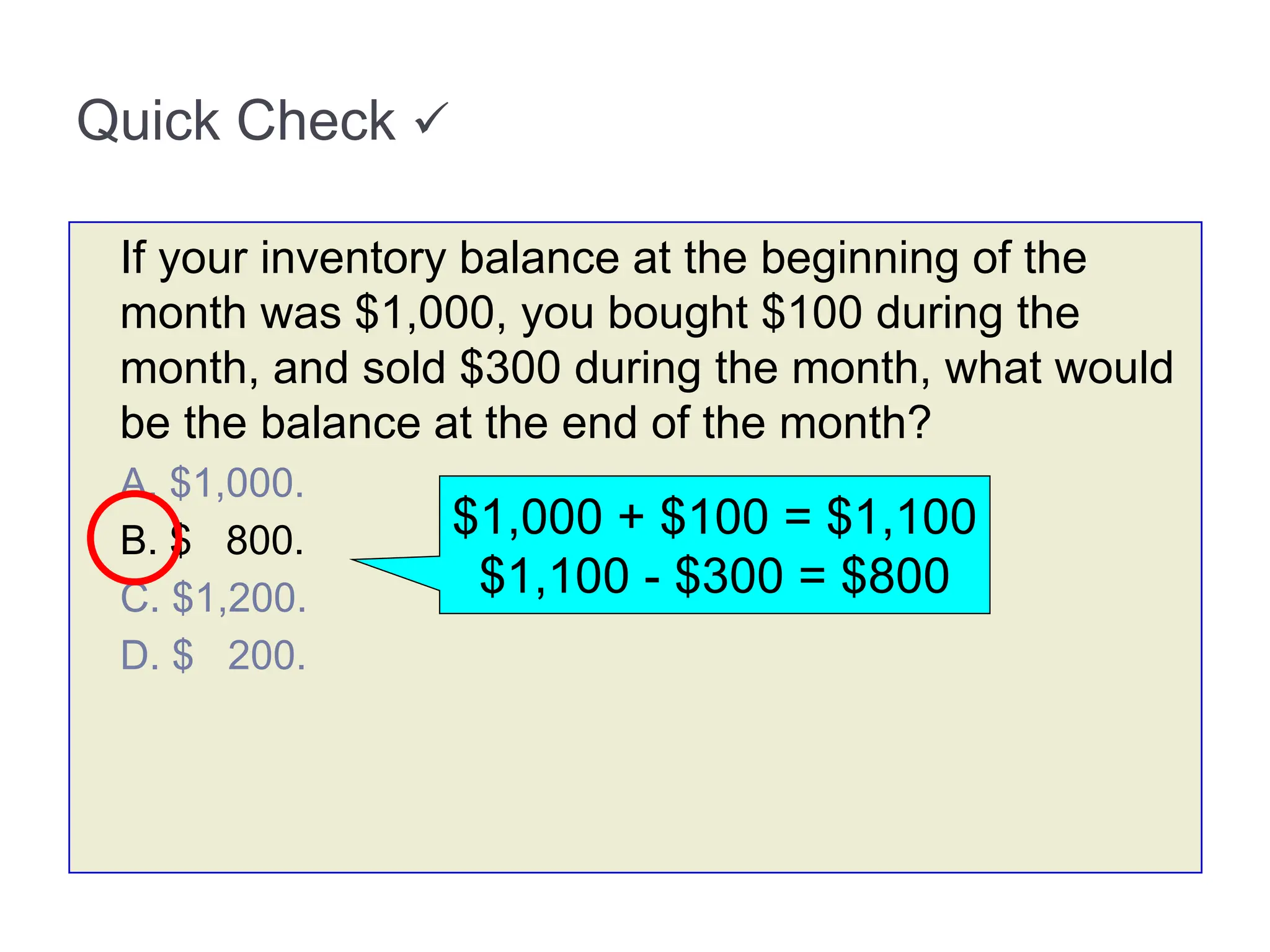

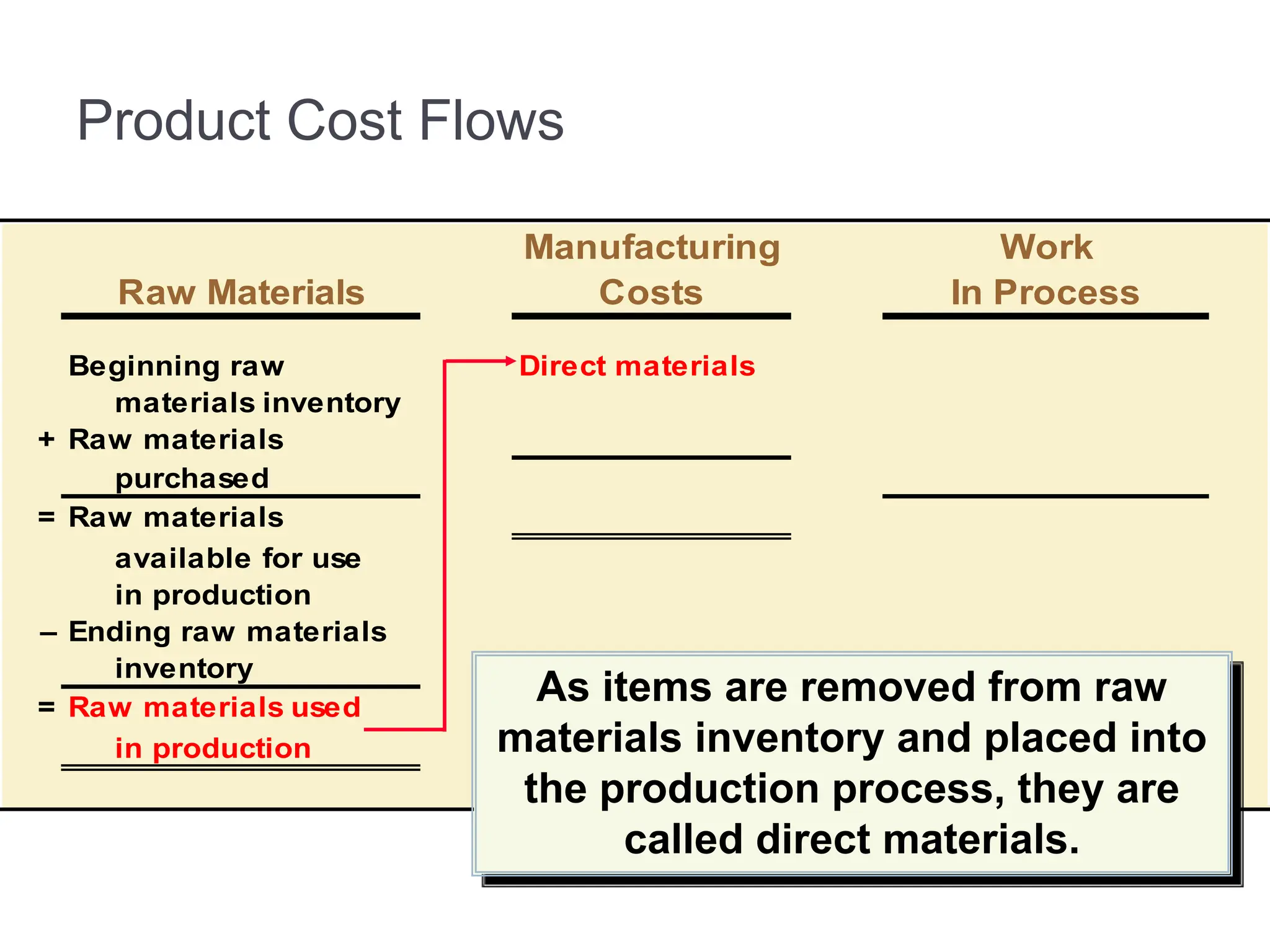

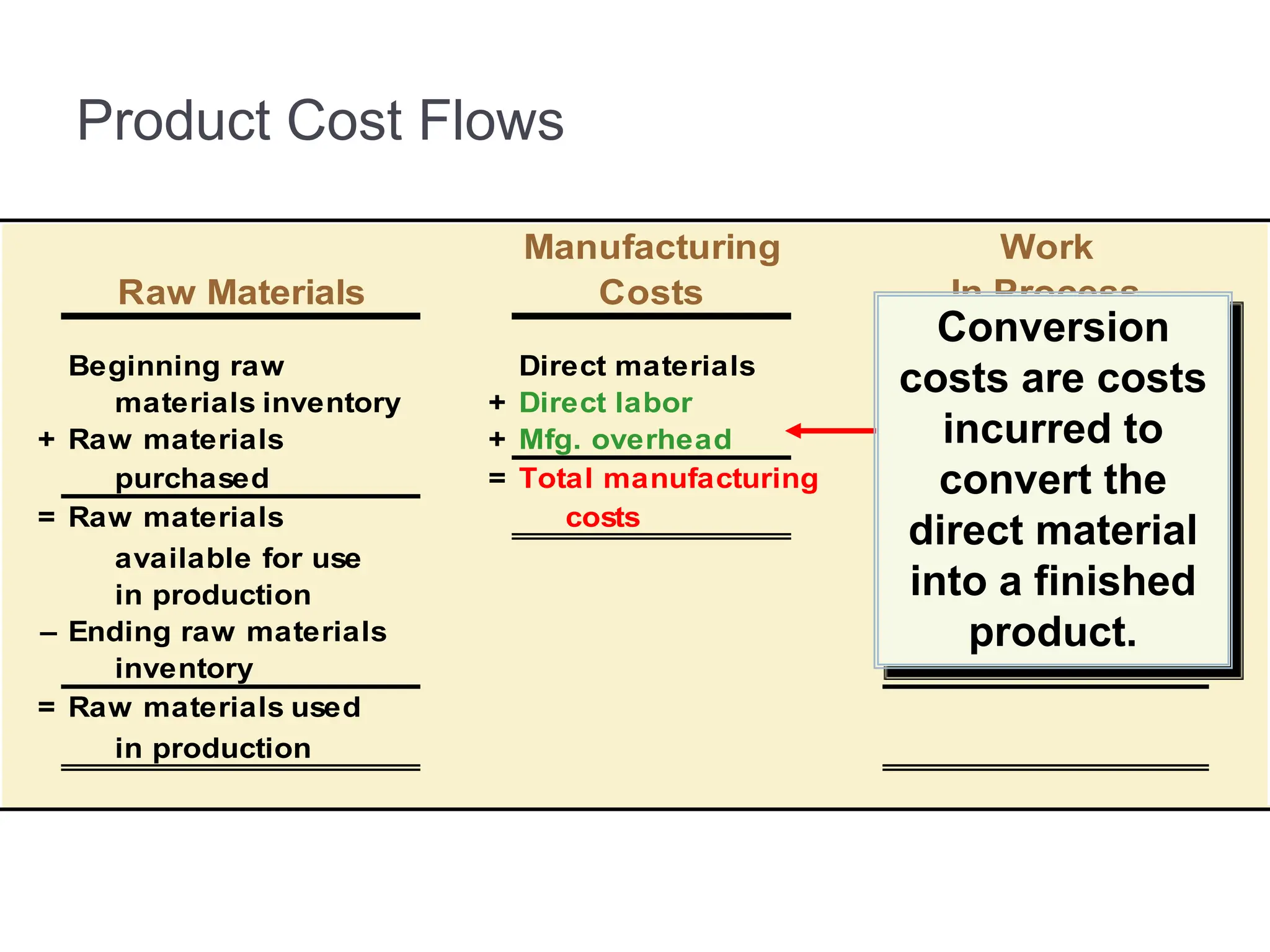

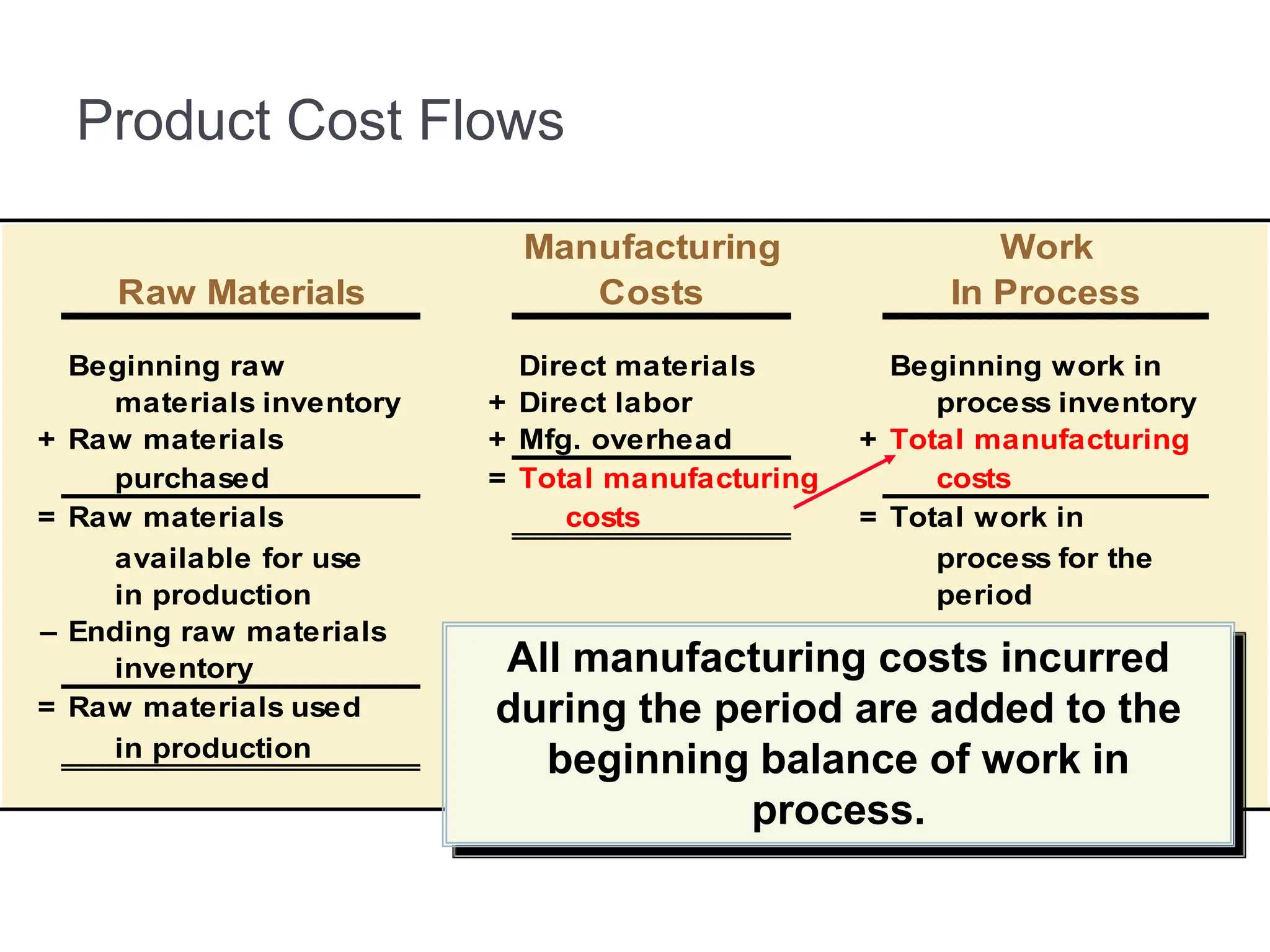

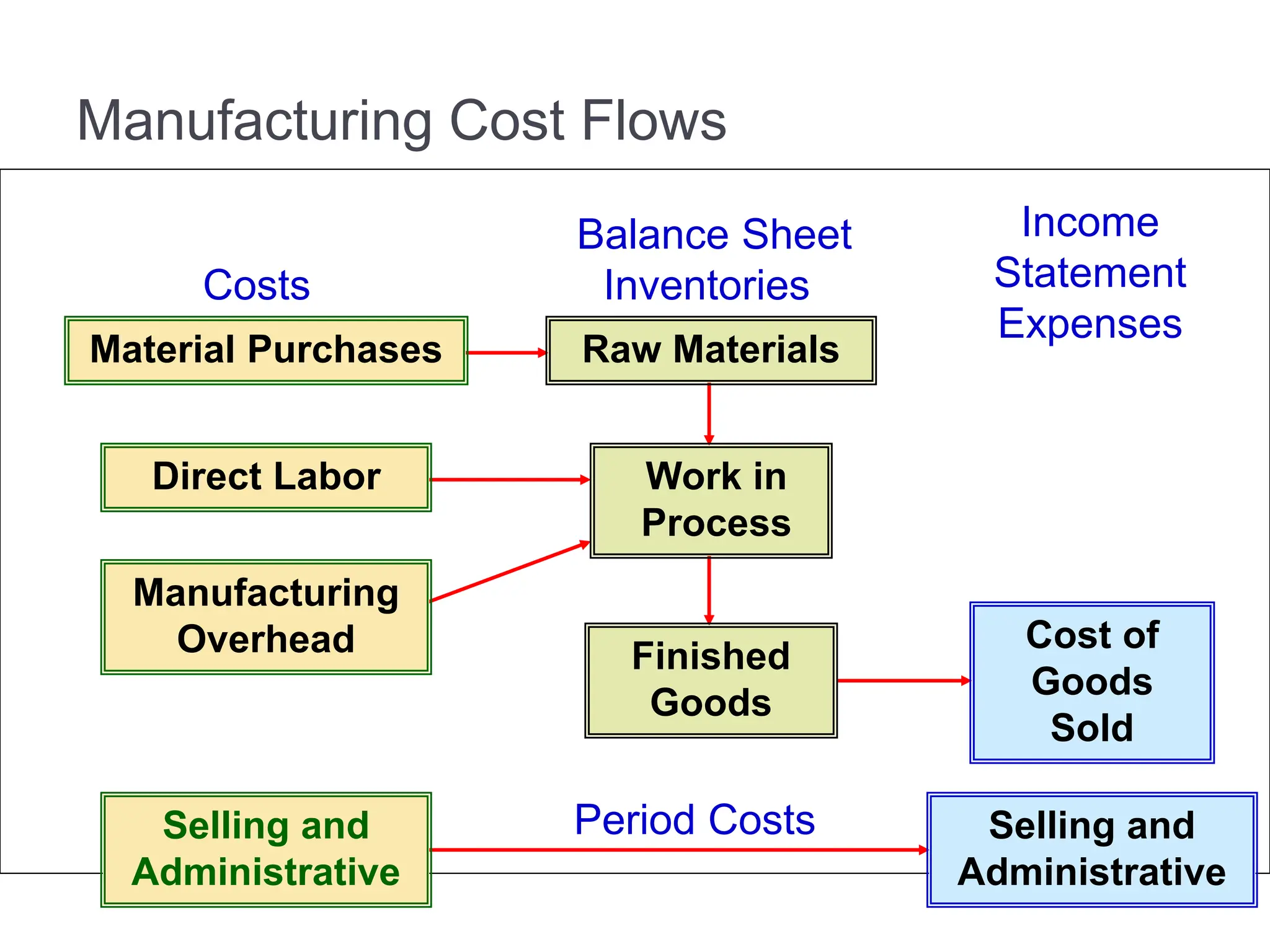

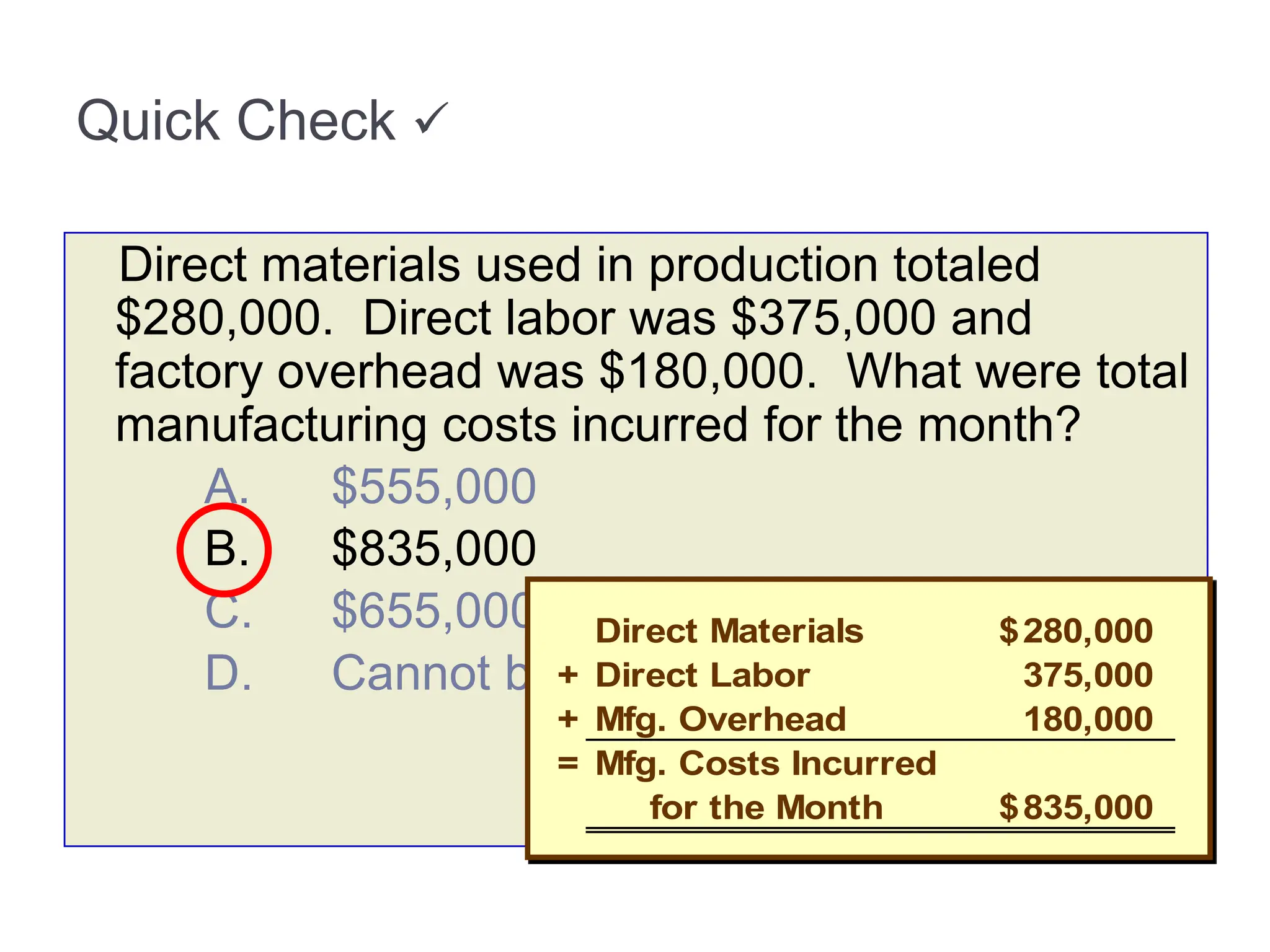

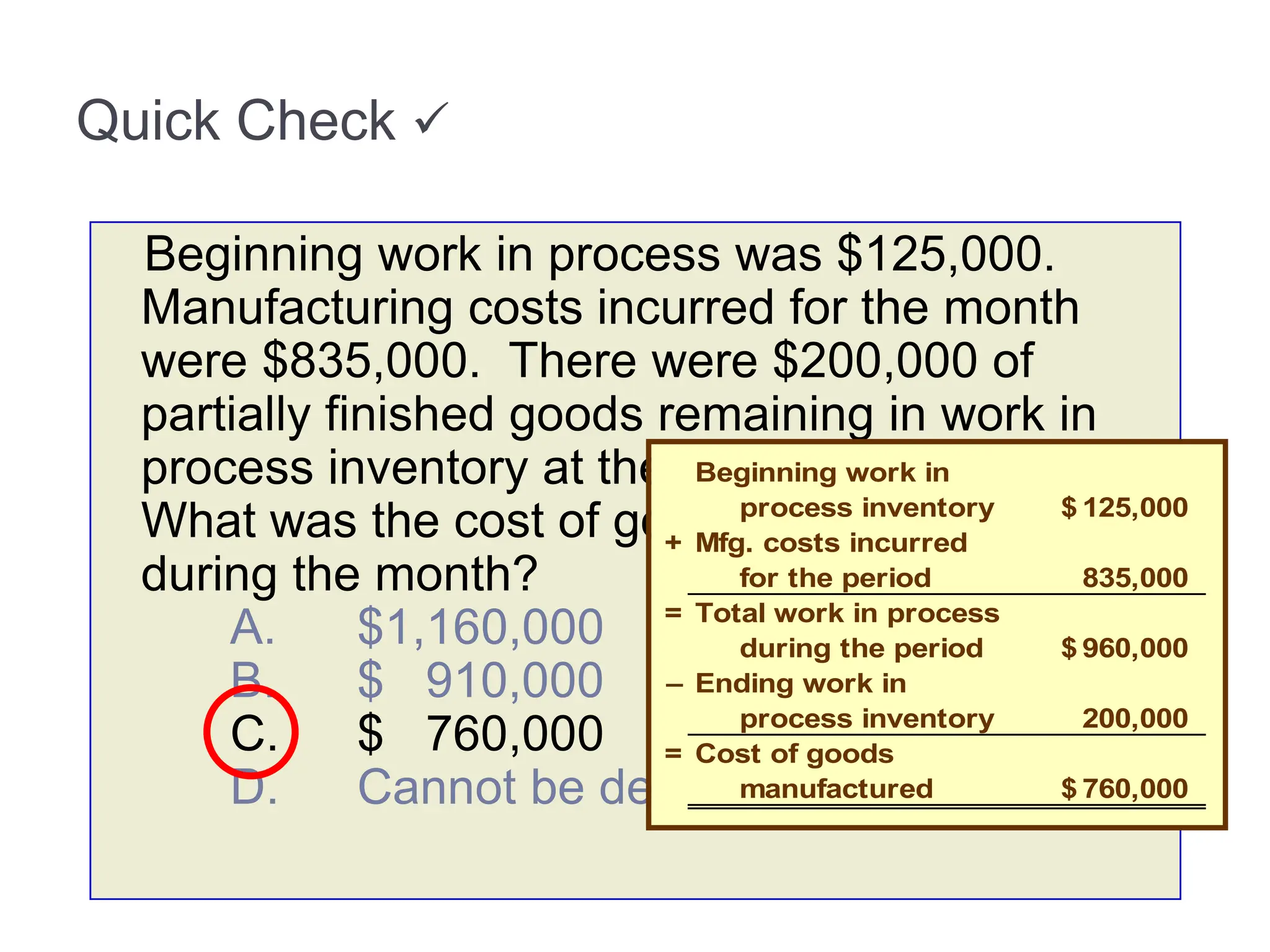

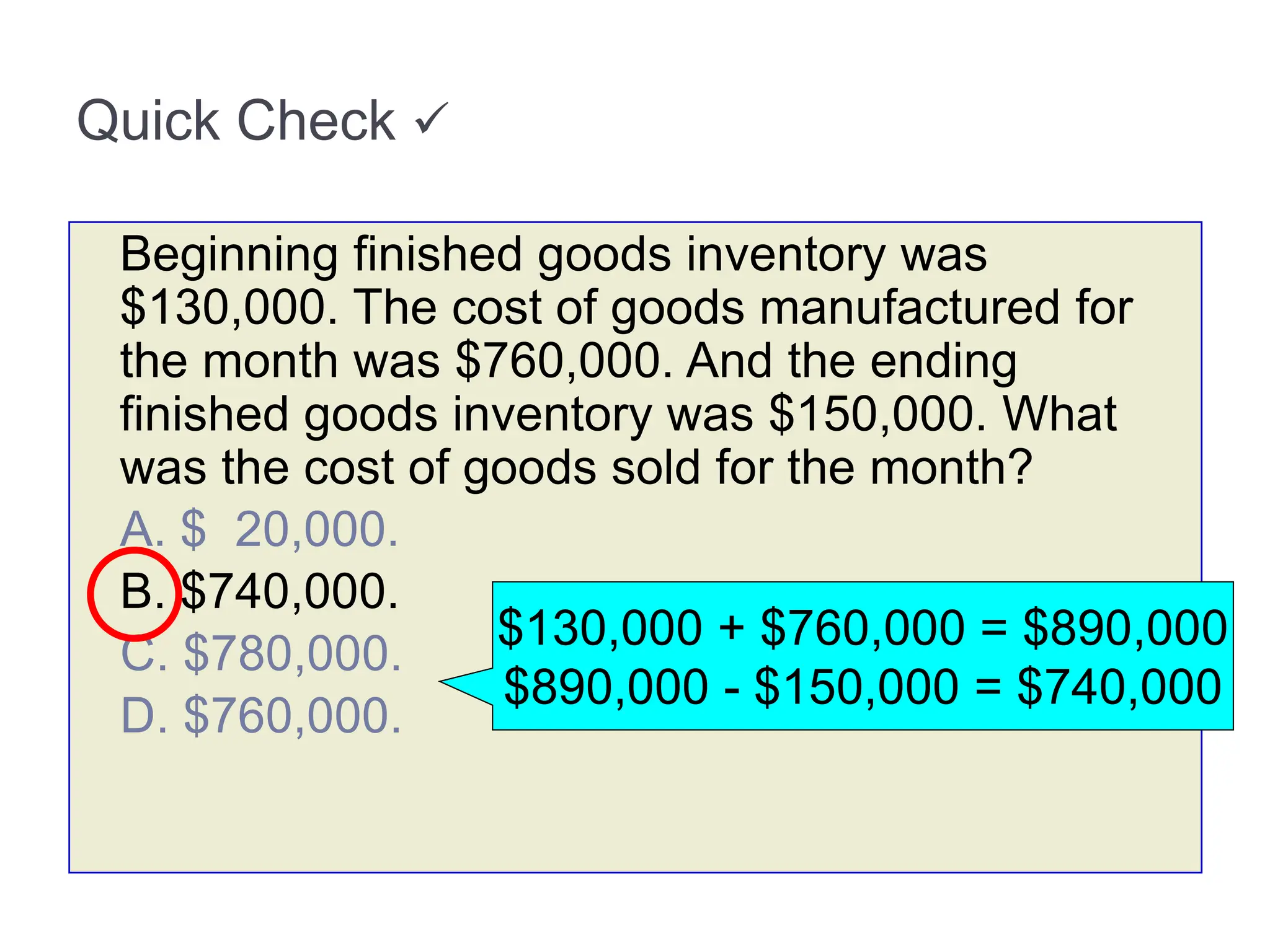

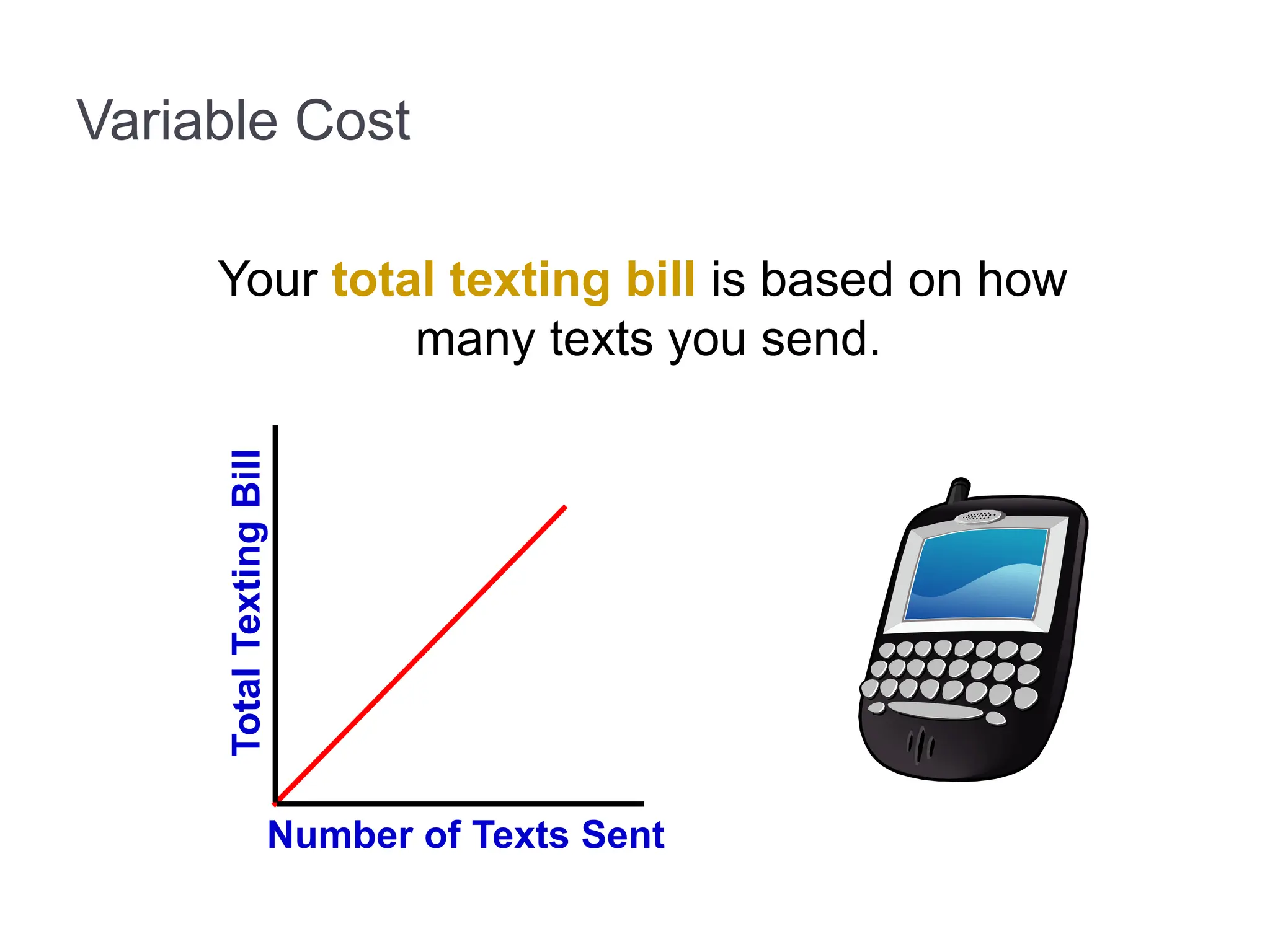

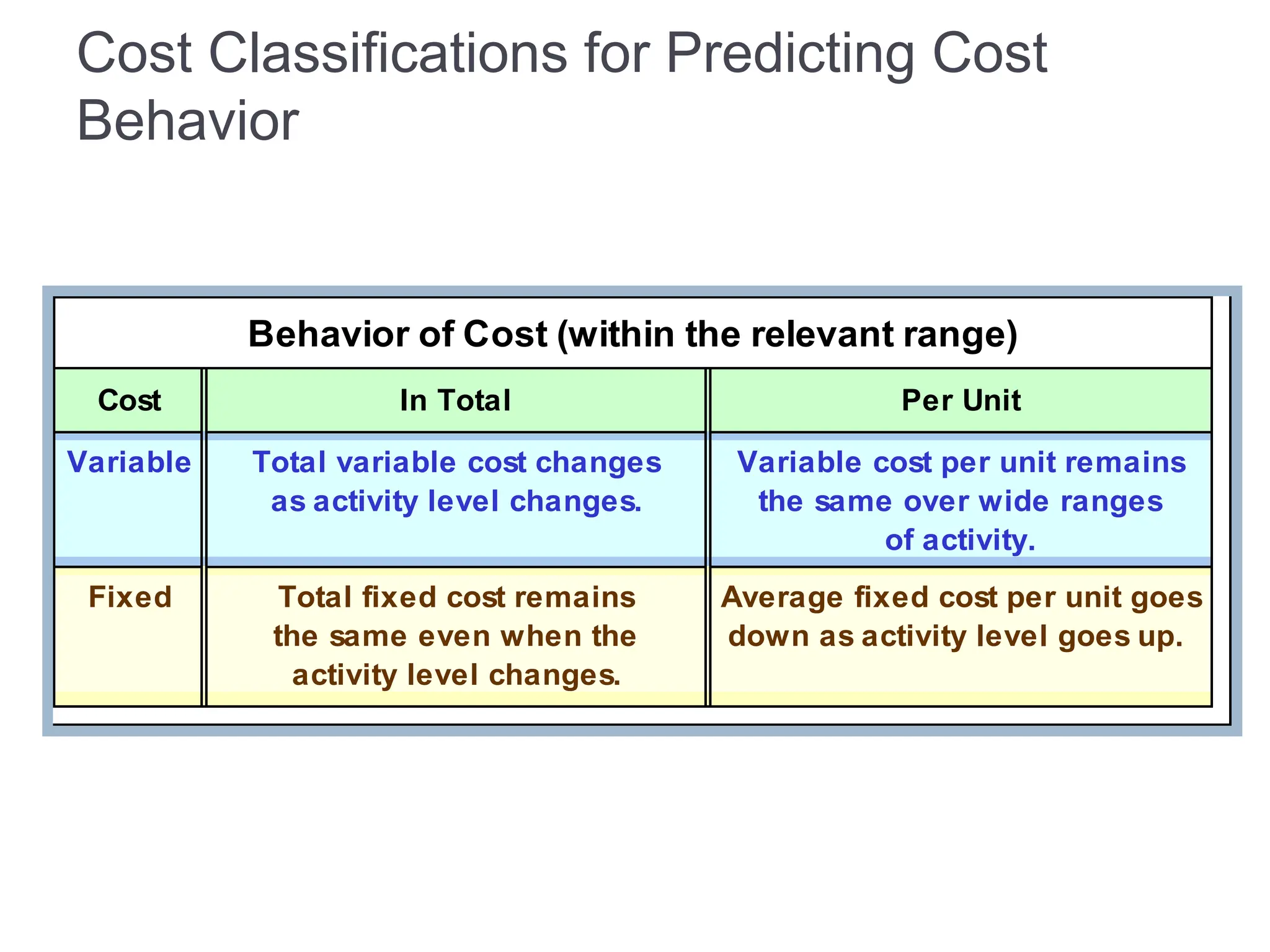

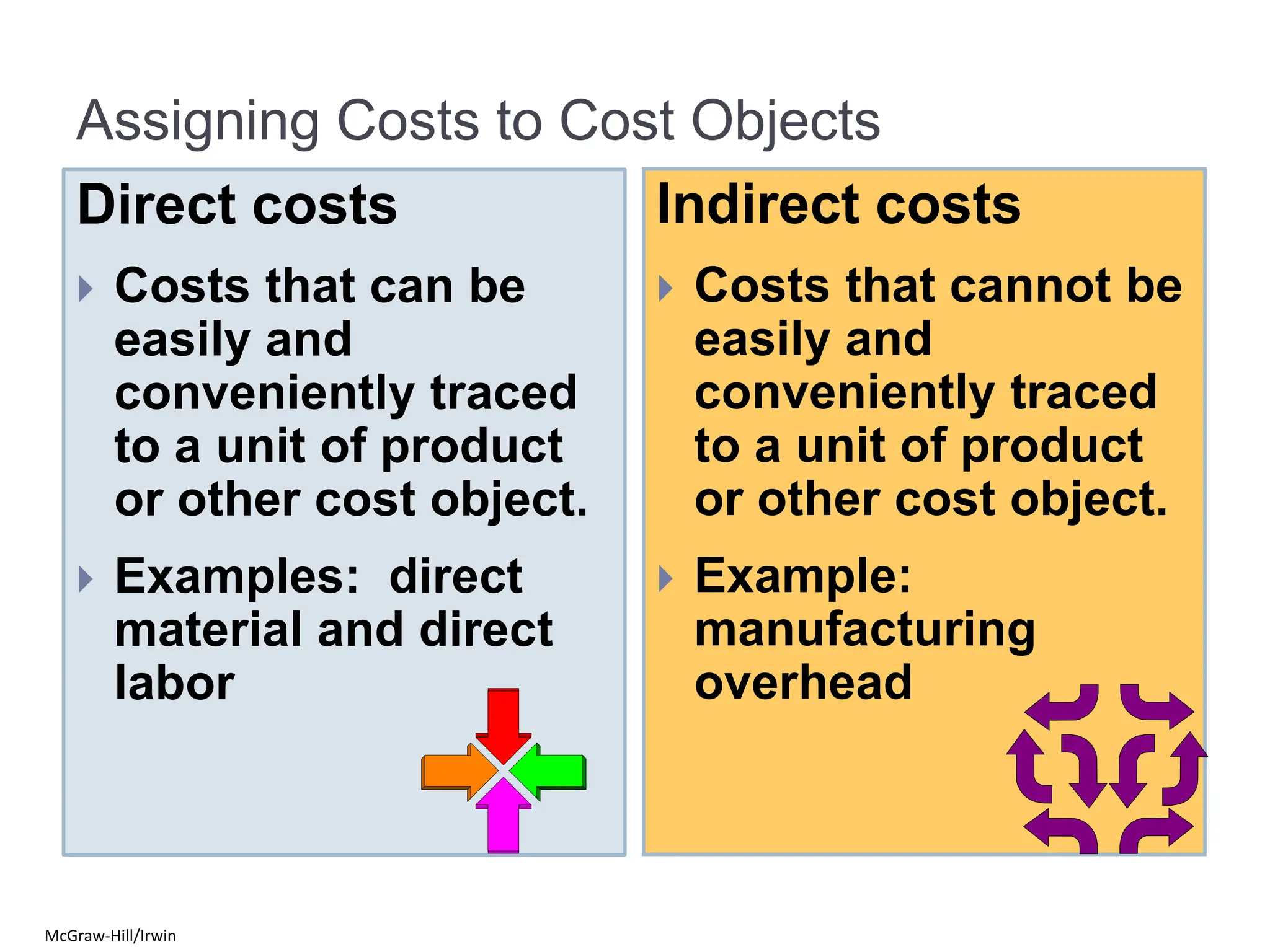

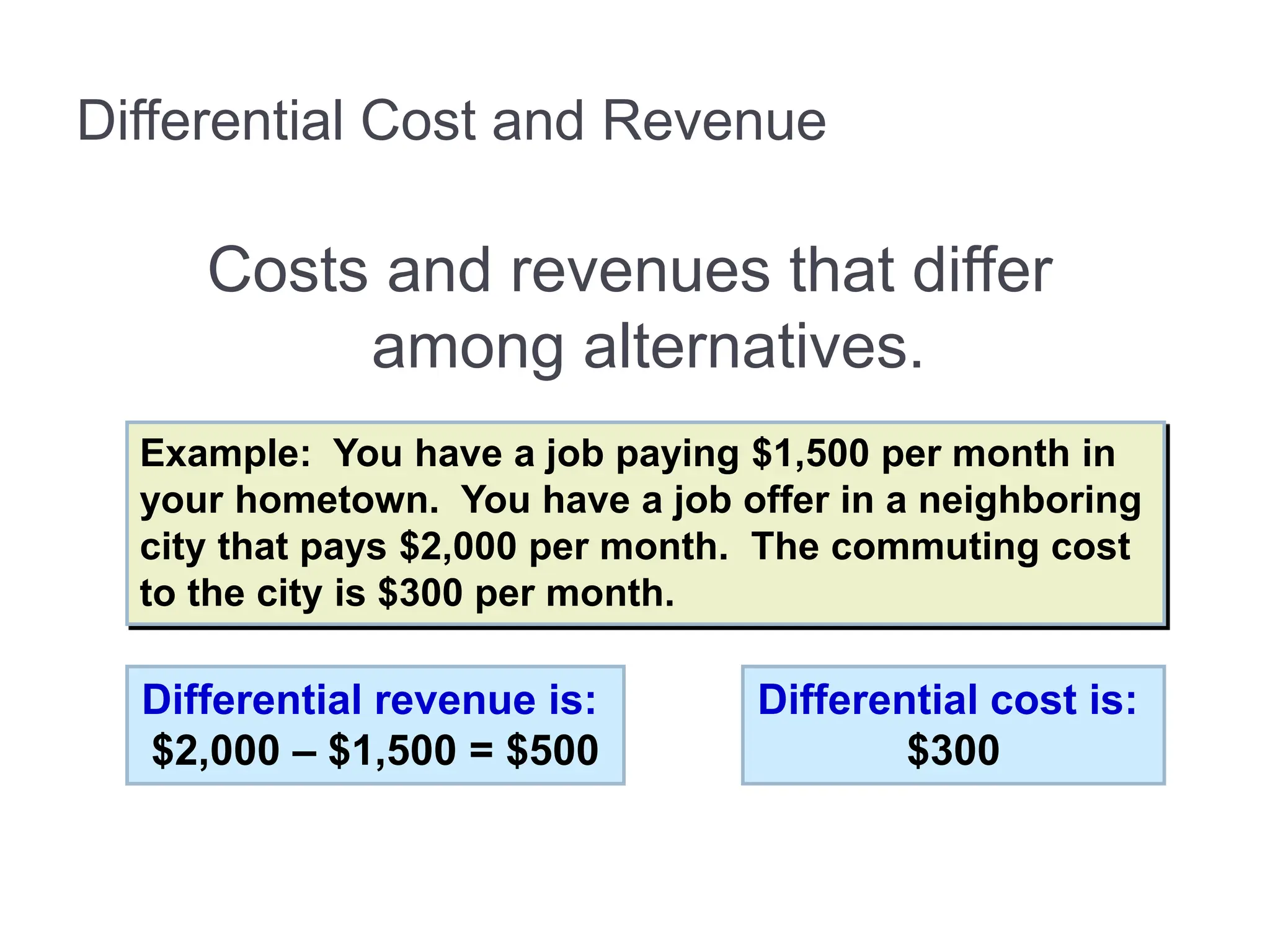

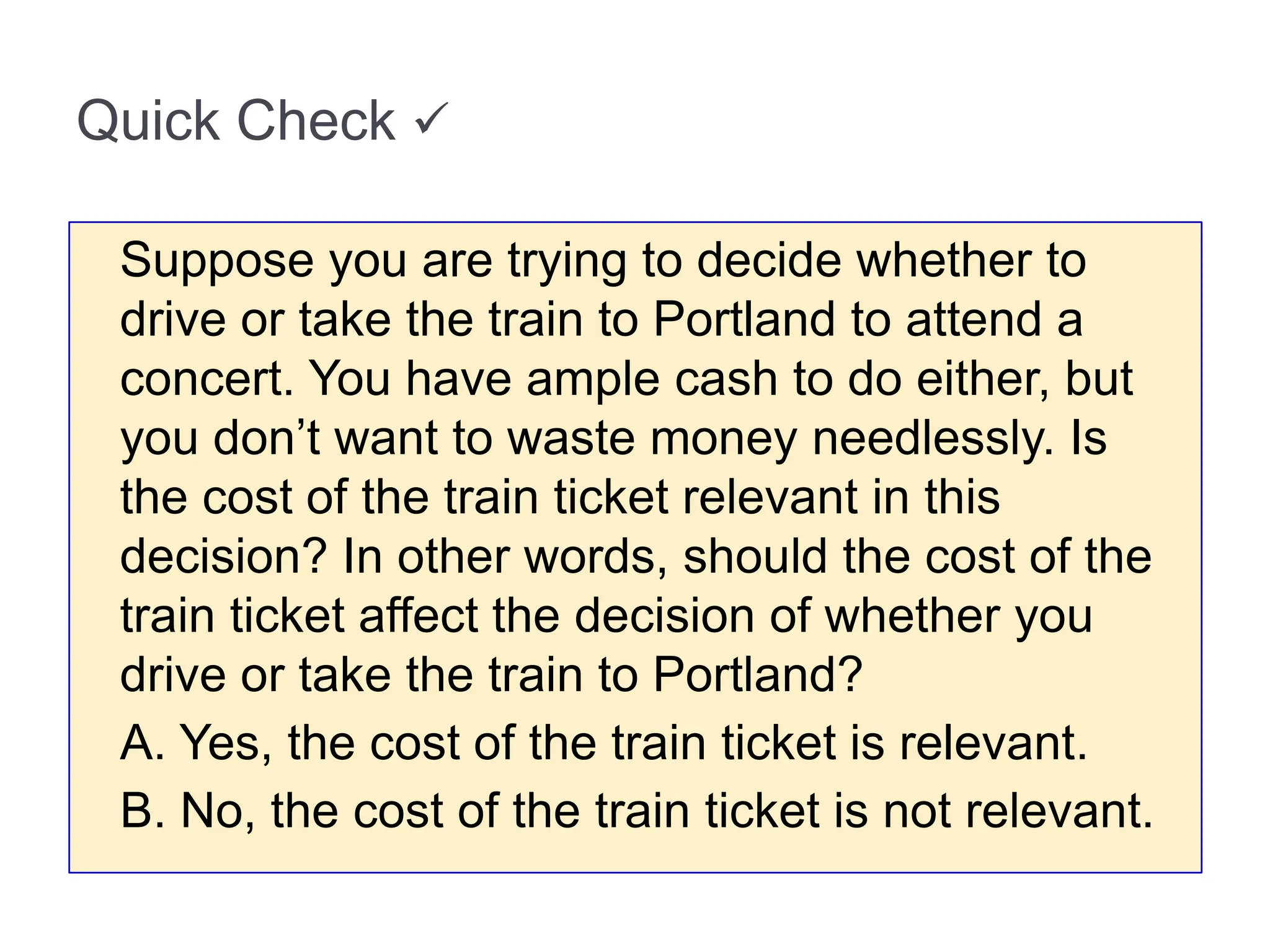

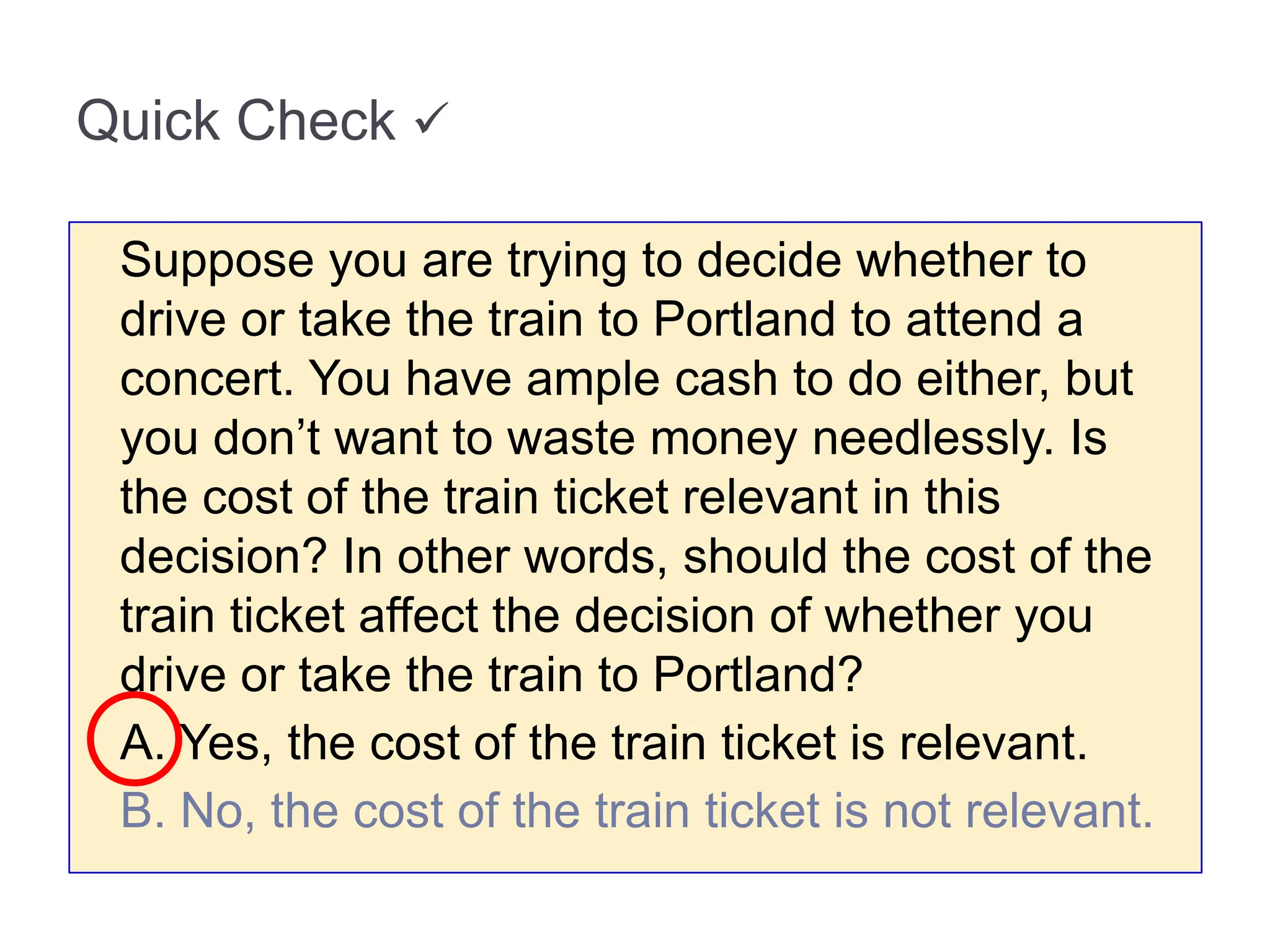

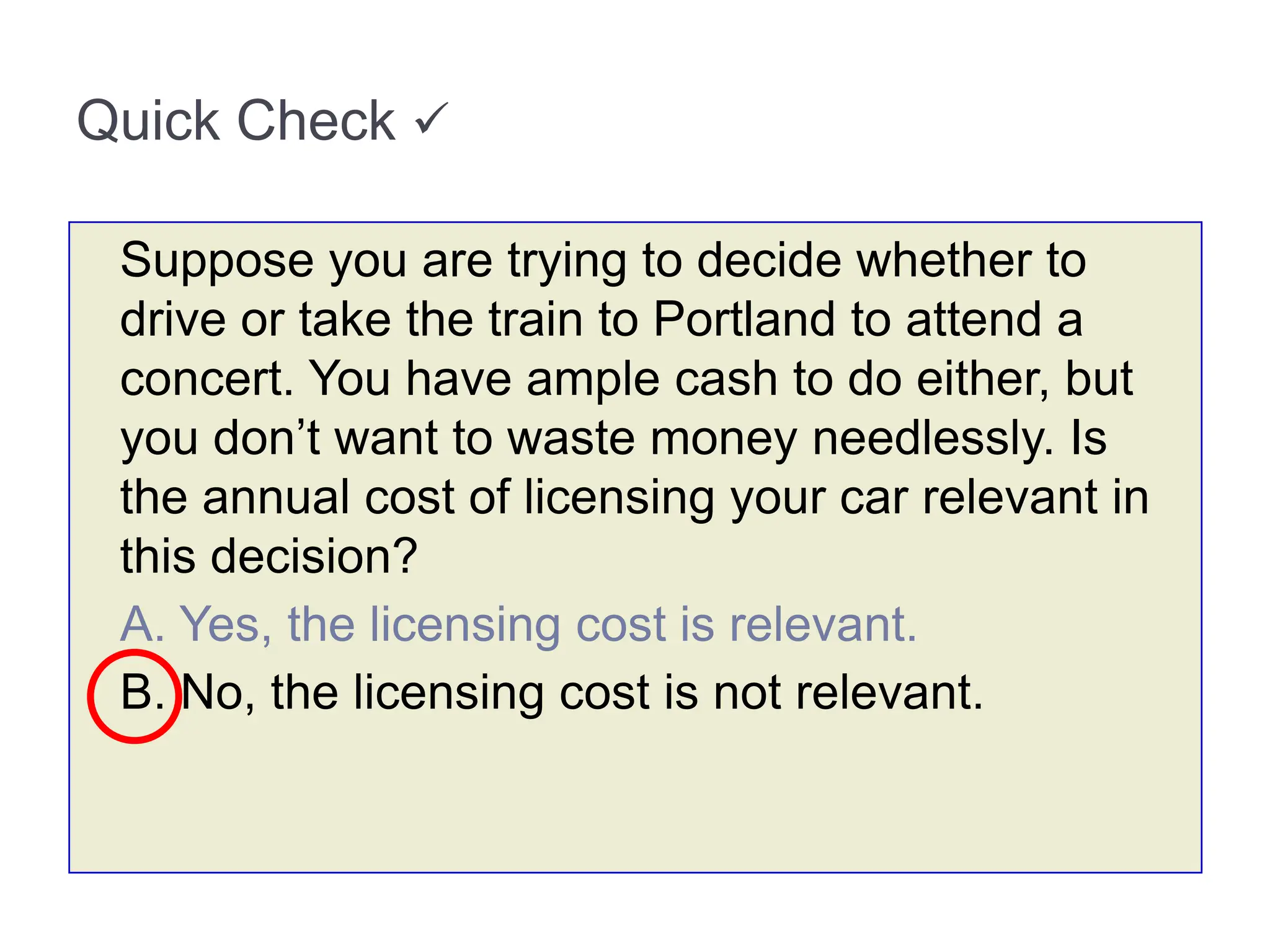

The document discusses key concepts in managerial accounting including the functions of management, planning and control, cost classifications, and inventory accounting. It defines direct materials, direct labor, and manufacturing overhead as the three basic manufacturing cost categories. It also distinguishes between product costs and period costs, with examples of each. Finally, it covers the differences between variable and fixed costs, direct and indirect costs, and defines differential costs, opportunity costs, and sunk costs.