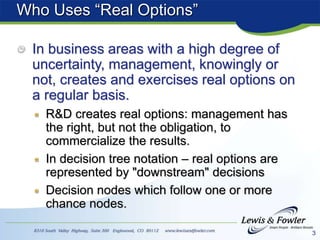

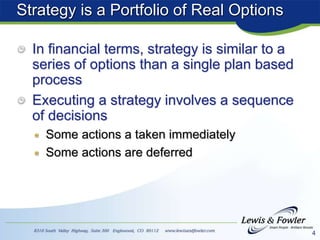

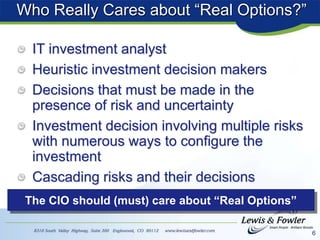

This document discusses the concept of 'real options' as a decision-making tool in uncertain environments, particularly in project portfolio management. It highlights how real options allow businesses to maintain the right but not the obligation to act on investments, utilizing methods from financial theory for quantification. Additionally, it addresses the importance of real options for investment analysts and provides examples related to IT asset acquisition and development projects.

![7

An Acquisition Example

IT has the option to spend money, K to acquire an IT

asset

At any point in time, t, during an interval [0,T], K is known with

certainty

Future changes in K, are uncertain

After the asset is acquired, cash flow, C, is received representing

differential benefits from the acquisition of the IT asset

Since the cost and the benefits are uncertain it might be

better to wait before investing in the IT asset

The costs may decrease over time (as is the case in many IT

investments)

The benefits may decrease over time as well in the absence of

the IT investment

Both the cost and the value are uncertain

What is a CIO to do?](https://image.slidesharecdn.com/notesonrealoptions-200211051919/85/Notes-on-real-options-7-320.jpg)