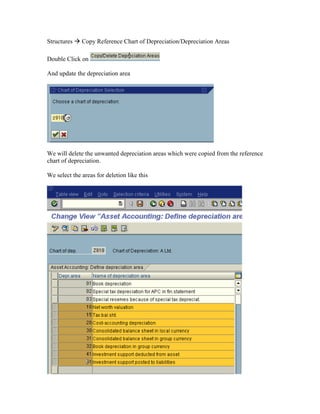

This document provides an overview of configuring asset accounting in SAP. It discusses organizational structures, integration with the general ledger, valuation, depreciation, configuring the depreciation key, special valuation, master data, information systems, asset data transfer, and preparation for production startup. The summary discusses copying a reference chart of depreciation from Germany to create a new chart, specifying descriptions, deleting unnecessary depreciation areas, assigning input tax indicators, and assigning the chart of depreciation to a company code.