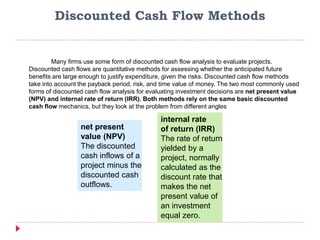

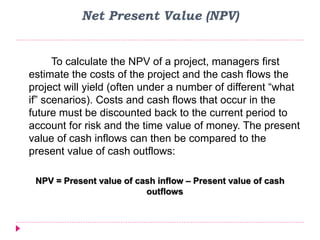

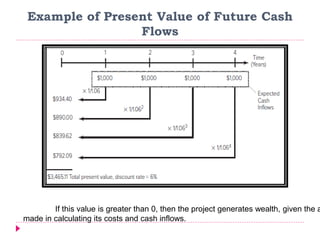

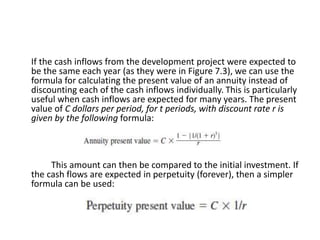

This document discusses quantitative methods for evaluating projects, specifically net present value (NPV) analysis. It explains that NPV analysis involves estimating the future cash flows and costs of a project in current dollars by discounting future amounts using a discount rate. A project has a positive NPV if the present value of the expected future cash inflows is greater than the present value of the cash outflows. The document provides an example calculation of NPV and discusses how NPV analysis can be used to evaluate whether a project should be accepted.