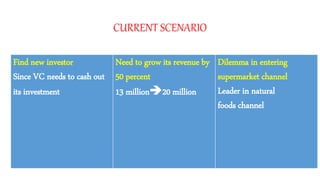

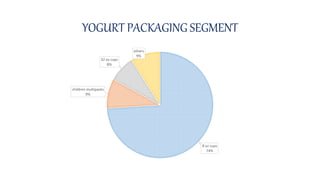

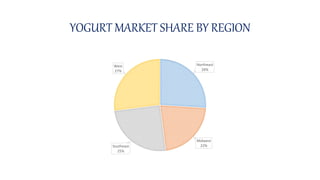

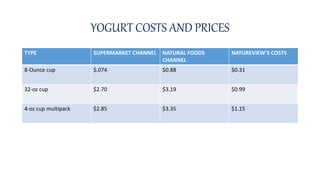

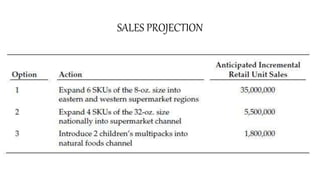

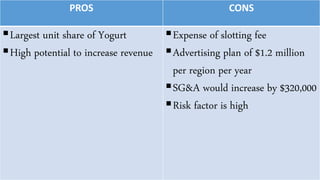

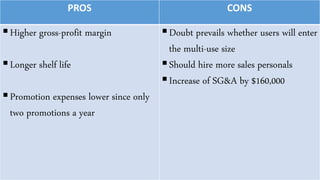

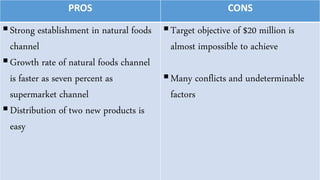

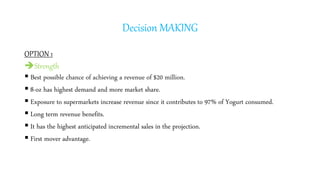

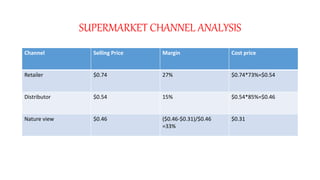

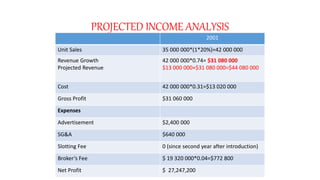

Natureview Yogurt is considering three options to grow its revenue from $13 million to $20 million. Option 1 is to expand its 8-oz product line in northeast and western supermarkets, which has the highest potential for increasing sales but also carries the most risk. Option 2 is to launch a 32-oz size nationally, which has a higher profit margin but may not attract consumers. Option 3 is to introduce children's multipacks in natural food stores, which avoids risks in new channels but may not achieve the revenue goal. The analysis indicates Option 1 offers the best chance of hitting $20 million in revenue and greatest long-term benefits, despite requiring higher expenses.