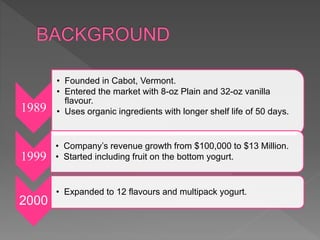

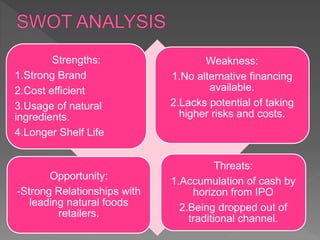

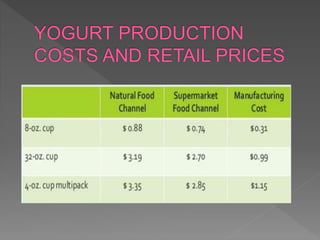

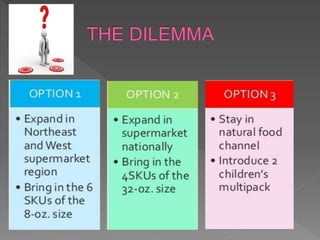

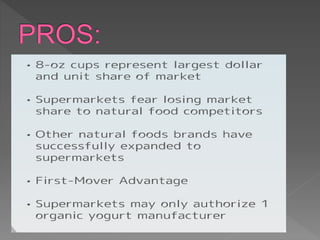

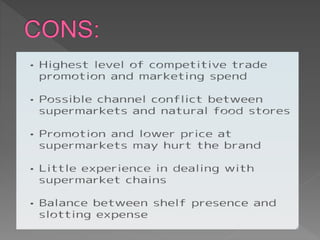

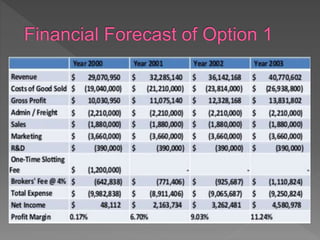

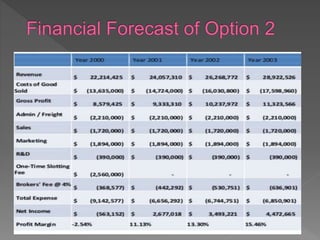

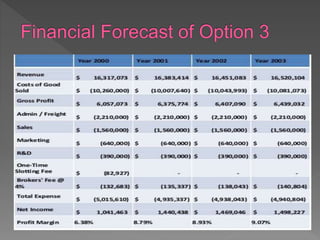

This document summarizes the history and growth of an organic yogurt company from 1989 to 2001. It was founded in Vermont in 1989 with plain and vanilla yogurts. By 1999, revenue had grown to $13 million and they expanded flavors. Market analysis showed the organic market was predicted to grow significantly. The company needed to choose an option to grow revenue to $20 million by 2001. Their strengths included their brand and use of natural ingredients. They chose to expand their highest demand 8oz yogurt line nationally to exceed their $20 million goal and generate 200% revenue growth.