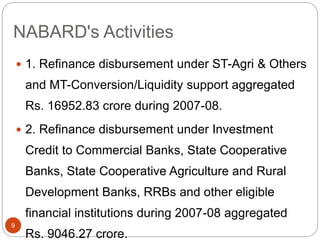

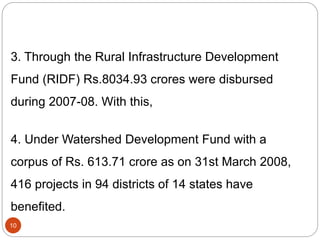

NABARD was established in 1982 to provide credit and promote rural development. It aims to provide refinancing support and institutional development to rural lending institutions. NABARD also acts as a regulator for cooperative banks and RRBs. Its key activities include refinancing loans for agriculture and rural development, implementing the Rural Infrastructure Development Fund, and promoting programs like watershed development and Kisan Credit Cards. NABARD's functions involve preparing annual rural credit plans, monitoring rural credit flow, providing guidelines to rural lenders, and coordinating rural financing activities across institutions.