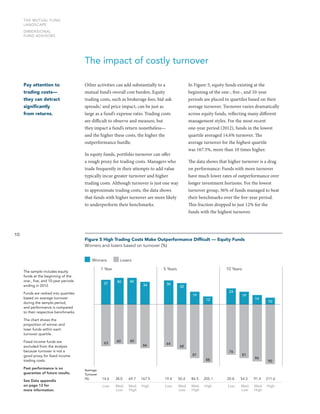

1) The mutual fund landscape comprises thousands of funds competing to identify mispriced securities, making it difficult for most funds to consistently outperform their benchmarks over time.

2) Few funds survive for long periods, with about half of equity funds disappearing within 10 years, largely due to poor performance. Similarly, only about one in six funds delivers benchmark-beating returns over 10 years.

3) Past outperformance is not predictive of future success, as most "winning" funds fail to continue outperforming in subsequent periods. High costs also predict future underperformance, with funds in the lowest cost quartiles more likely to outperform over 5 and 10 year periods.