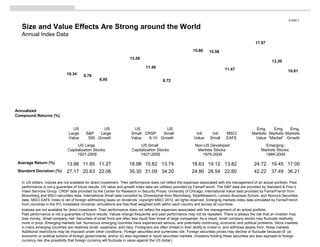

Size and value effects for stocks thru 2009

•Download as PPT, PDF•

1 like•489 views

Dimensional Fund Advisors' powerful slides on the small cap and value effect detail how small stocks and value stocks enhance portfolio returns and explain portfolio performance.

Report

Share

Report

Share

Recommended

Why Pillar Capital (Investment approach)

Pillar Capital provides investment management services focused on dimensions of returns, diversification, and investor discipline. Dimensions of returns refers to systematic differences in expected returns based on factors like company size, relative price, and profitability. Historical data shows that investing based on these dimensions has rewarded long-term investors. Portfolios can be structured to target dimensions shown to produce premiums, like favoring small cap, value, and high-profitability companies.

The Power of Economic Science 2012

This document discusses innovations in finance from the 1950s to today. It begins by outlining conventional wisdom from the 1930s that focused on picking individual winners and holding concentrated portfolios. It then summarizes several seminal works and developments that helped shift the field: James Tobin's separation theorem emphasized diversification; William Sharpe developed the single-factor capital asset pricing model relating risk and return; Eugene Fama developed the efficient market hypothesis asserting that markets accurately reflect information. This led to the development of index funds by John Bogle, providing low-cost, passive investment options. Overall, the document outlines major theoretical and practical innovations that professionalized the field of finance and emphasized diversification, risk-adjusted returns, and passive investing.

Structured Investing In An Unstructured World

Structured Investing is based on 80+ years of financial market data, Nobel Prize-winning economic research, and in-depth studies of investor psychology and behavior.

The Power of Economic Science

The document discusses the performance of various model investment portfolios from 1973-2010. It provides the annualized compound returns and annualized standard deviations for 5 model portfolios over this period. The model portfolios had varying allocations to US and international stocks, bonds, and emerging markets. Model portfolio 5, which had the most diversified allocation, achieved the highest annualized return of 11.65% and relatively low standard deviation of 11.26% compared to the other portfolios.

Structured Investing

The document discusses structured investing based on decades of financial market data and economic research. It describes a structured investing approach that seeks to capture market returns by investing in large numbers of stocks across asset classes while minimizing costs. It emphasizes investing in stocks, small companies, and value stocks based on academic research identifying these risks as worth taking over the long term. The approach also advocates diversifying globally and across multiple asset classes.

Indices(Aangepas)

An index reflects movements in the underlying market and expresses price changes over time. Indices are used by institutional investors to analyze strategies and measure performance. The most important type is the market-value weighted index, where components are weighted by their total market capitalization. This includes major indices like the S&P 500. Investors can purchase index funds to obtain returns matching the performance of indices like the ALSI at low cost.

Pursuing a Better Investment Experience with Capital Associates

This document outlines 10 key principles for improving the odds of investment success:

1) Embrace market pricing and the information incorporated into prices.

2) Don't try to outguess the market through stock picking or market timing as most funds do not outperform their benchmarks.

3) Resist chasing past performance as it does not predict future returns.

4) Let markets work for you through long-term investing as this has rewarded investors over time.

Abacus Weath Partners Investment slideshow

The document discusses strategies for creating an investment portfolio based on Nobel Prize-winning academic research. It recommends structuring portfolios to take advantage of factors like company size, relative price, and profitability that have been shown to increase returns. Specifically, it suggests investing more in small and value stocks, as both have higher returns than large or growth stocks over the long run. The document also provides examples of model portfolios that diversify across global stock and bond index funds targeting these factors.

Recommended

Why Pillar Capital (Investment approach)

Pillar Capital provides investment management services focused on dimensions of returns, diversification, and investor discipline. Dimensions of returns refers to systematic differences in expected returns based on factors like company size, relative price, and profitability. Historical data shows that investing based on these dimensions has rewarded long-term investors. Portfolios can be structured to target dimensions shown to produce premiums, like favoring small cap, value, and high-profitability companies.

The Power of Economic Science 2012

This document discusses innovations in finance from the 1950s to today. It begins by outlining conventional wisdom from the 1930s that focused on picking individual winners and holding concentrated portfolios. It then summarizes several seminal works and developments that helped shift the field: James Tobin's separation theorem emphasized diversification; William Sharpe developed the single-factor capital asset pricing model relating risk and return; Eugene Fama developed the efficient market hypothesis asserting that markets accurately reflect information. This led to the development of index funds by John Bogle, providing low-cost, passive investment options. Overall, the document outlines major theoretical and practical innovations that professionalized the field of finance and emphasized diversification, risk-adjusted returns, and passive investing.

Structured Investing In An Unstructured World

Structured Investing is based on 80+ years of financial market data, Nobel Prize-winning economic research, and in-depth studies of investor psychology and behavior.

The Power of Economic Science

The document discusses the performance of various model investment portfolios from 1973-2010. It provides the annualized compound returns and annualized standard deviations for 5 model portfolios over this period. The model portfolios had varying allocations to US and international stocks, bonds, and emerging markets. Model portfolio 5, which had the most diversified allocation, achieved the highest annualized return of 11.65% and relatively low standard deviation of 11.26% compared to the other portfolios.

Structured Investing

The document discusses structured investing based on decades of financial market data and economic research. It describes a structured investing approach that seeks to capture market returns by investing in large numbers of stocks across asset classes while minimizing costs. It emphasizes investing in stocks, small companies, and value stocks based on academic research identifying these risks as worth taking over the long term. The approach also advocates diversifying globally and across multiple asset classes.

Indices(Aangepas)

An index reflects movements in the underlying market and expresses price changes over time. Indices are used by institutional investors to analyze strategies and measure performance. The most important type is the market-value weighted index, where components are weighted by their total market capitalization. This includes major indices like the S&P 500. Investors can purchase index funds to obtain returns matching the performance of indices like the ALSI at low cost.

Pursuing a Better Investment Experience with Capital Associates

This document outlines 10 key principles for improving the odds of investment success:

1) Embrace market pricing and the information incorporated into prices.

2) Don't try to outguess the market through stock picking or market timing as most funds do not outperform their benchmarks.

3) Resist chasing past performance as it does not predict future returns.

4) Let markets work for you through long-term investing as this has rewarded investors over time.

Abacus Weath Partners Investment slideshow

The document discusses strategies for creating an investment portfolio based on Nobel Prize-winning academic research. It recommends structuring portfolios to take advantage of factors like company size, relative price, and profitability that have been shown to increase returns. Specifically, it suggests investing more in small and value stocks, as both have higher returns than large or growth stocks over the long run. The document also provides examples of model portfolios that diversify across global stock and bond index funds targeting these factors.

Parametric perspectives-winter-2010 (1)

Parametric provides strategies for exploiting increased market volatility, including rebalancing portfolios and using options strategies. Rebalancing reduces concentration risks and volatility over time by selling assets that have increased in value and buying those that have decreased, capturing returns from volatility. Options strategies can also provide downside protection for portfolios while retaining upside potential. Parametric implemented an options overlay for a client in 2008 that protected against a 5-20% market decline while retaining upside to 30%, balancing protection and participation in gains.

Pursuing_a_Better_Investment_Experience_Slides

This document provides guidance on pursuing a better investment experience. It recommends embracing market pricing, not trying to outguess the market, resisting chasing past performance, letting markets work for you long-term, considering drivers of returns like company size and profitability, practicing smart diversification globally, avoiding market timing, managing emotions, focusing on long-term advice over entertainment, and controlling what you can like having a tailored plan.

Getting Through a Volatile Market

This presentation shows steps one can take today to get through today\'s volatile market and put oneself in the best possible position going forward

Stock Market And The Economy

The document discusses the stock market boom of the late 1990s and its impact on the US economy. It finds that the stock market boom between 1995 and 2000 added significantly to economic growth during that period, with estimates that GDP growth was 1.5% higher each year due to the wealth effects of rising stock prices. However, it also led to issues like a lower personal saving rate, a higher trade deficit, and made the economy more vulnerable when the bubble burst in 2001-2002. The document concludes that without the stock boom, the 1990s expansion would not have looked as strong and the 2001 recession may not have occurred.

Putnam Absolute Return Funds

This document provides an overview and summary of Putnam Absolute Return Funds. It discusses how increased stock market volatility and low bond yields argue for alternative investment strategies. The Putnam Absolute Return Funds aim to generate positive returns regardless of market conditions with less volatility than traditional markets. Each fund seeks a different return target above inflation over a 3-year period using flexible portfolio management across global fixed income, stocks, and alternative assets.

Pursuing a Better Investment Experience

This document provides guidance on pursuing a better investment experience. It recommends embracing market pricing, not trying to outguess the market, resisting chasing past performance, letting markets work for you long-term, considering drivers of returns like value and profitability, practicing smart diversification globally, avoiding market timing, managing emotions, ignoring entertainment over advice, and focusing on controllable factors like a personalized financial plan.

Dfa basic slides 2013

The document discusses three dimensions of expected stock returns:

1) Company size - Small company stocks tend to have higher expected returns than large company stocks over time.

2) Company price - Lower-priced "value" stocks tend to have higher expected returns than higher-priced "growth" stocks over time.

3) Equity market - Stocks tend to have higher expected returns than fixed income investments like bonds over time.

Market indices

An index is constructed to measure movements in financial markets like stocks and bonds. The SENSEX is India's oldest stock market index, first compiled in 1986 based on 30 large, established companies. It uses a free-float methodology, where the index level reflects the free-float market value of component stocks relative to a base period. Stocks are selected based on criteria like market capitalization, liquidity, and representation of key industries.

Dfa all slides 2013

The document discusses diversification across different asset classes and geographic regions. It presents 5 model portfolios with varying allocations to US and international stocks and bonds. The most diversified portfolio (Portfolio 5) allocates 30% to international stocks, 7.5% to several US stock size and style factors, and 40% to bonds. Tables show the annual returns and volatility of returns for each model portfolio from 1998-2012. The most diversified portfolio had the highest annualized return of 7.02% and second highest standard deviation of returns of 13.68%.

Factors That Influence Stock Price

Understand what and how impacts the market and influences the stock price of several companies. To know more or invest in stocks visit: www.karvyonline.com or call us on 18004198283.

How to Build an Investment Portfolio

This document provides guidance on building an effective investment portfolio through diversification and managing risk. It recommends creating an asset allocation policy based on your risk tolerance that diversifies across asset classes like stocks and bonds. Specific funds should then be selected within each asset class and regularly monitored to ensure the portfolio still matches your goals and risk profile as markets change over time. The focus should be on long-term growth while minimizing downside risk through this diversified, balanced approach.

Putnam Absolute Return Funds Q&A Q2 2013

- Global bond markets were disrupted in the quarter as bond yields rose sharply due to expectations that the Federal Reserve would scale back its bond-buying program sooner than anticipated.

- Within fixed income, mortgage prepayment strategies detracted from performance but rebounded later in the quarter, while term-structure positioning and commercial mortgage-backed securities contributed to results.

- In stocks, selection strategies and some currency positions in non-directional strategies hurt returns in the 500 and 700 funds.

The Science of Investing

Swindells Financial Planning presents "The Science of Investing", demonstrating athe structured, disciplined and evidence based investment philosophy

L Pch6

The document discusses different methods for calculating rates of return on investments. It provides details on simple rates of return, adjusted rates of return, and holding period returns. Historical data on rates of return for various asset classes like stocks, bonds, and bills from 1926-1999 is presented, showing average annual returns and standard deviations. The risk-return relationship and concept of risk premiums are also covered.

Permal TAF sales piece 0510 (2016_01_25 03_57_23 UTC)

This document discusses the Legg Mason Permal Tactical Allocation Fund, a fund-of-funds that invests across global markets and asset classes. It has four dimensions of flexibility: geography, asset class, investment vehicles, and asset allocation. This allows it to adjust its allocation across equities, fixed income, alternatives and cash as market conditions change. Recently it has shifted more to stocks and alternatives from bonds. The fund aims to generate equity-like returns with lower volatility by diversifying across multiple asset classes. It is managed by Permal, a global pioneer in multi-manager funds with over 35 years of experience.

Ntu 2010 Presentation (Tnfm)

This document discusses three investors who achieved billion-dollar fortunes through successful investing strategies:

- Warren Buffett achieved annual returns of 28% by investing in "great businesses with wide moats" and holding them for the long term.

- George Soros made $1.8 billion in 1992 by shorting the British pound and investing in German marks, epitomizing a willingness to take huge risks.

- John Paulson made $20 billion for his firm during the financial crisis by correctly betting against the US housing market and financial stocks.

Market Volitility

This document provides an overview and analysis of the economic situation and stock market in 2008 during the financial crisis. It discusses the major events that occurred, including bank failures and government interventions. It also looks at where the economy and markets currently stand, and offers recommendations to long-term investors to remain invested and not overreact to short-term volatility.

Randomness of returns_historical_asset_class_ranking_2014 skittles

The Need for Diversification (“Skittles Chart”) Asset Class Index Performance

The “Skittles Chart” is a great way to show investors the randomness of investment returns from one year to the next, reinforcing the potential benefits of Asset Class Investing as an alternative to active management.

Stock market and the economy ppt slides

The document discusses the relationship between the stock market and economic activity. It begins by introducing the topic and explaining how firms raise funds through debt and equity financing. It then defines what a stock market is, how stocks are traded, and how stock prices are determined by supply and demand. Several factors that can influence stock prices are explained, including economic conditions, firm-specific factors, and market factors. The relationship between the stock market and broader economy is explored, specifically how changes in the stock market can impact aggregate demand and economic growth through wealth and investment effects, and how economic conditions can in turn impact stock prices and investor sentiment. The role of the Federal Reserve in responding to stock market fluctuations is also summarized.

Ml ilipp+stock market_popularretirementchoice2

Avoiding stock market risk and funding a tax free retirement income with select indexed cash value life insurance policies

Strenghs and weaknesses of CAC 40 materiality assessments

The document discusses materiality assessments conducted by CAC 40 companies. It finds that while transparency around materiality assessments has increased, with most companies publishing materiality matrices, many assessments still lack strategic perspective, representativeness of stakeholders consulted, and follow up. It recommends that companies take a more robust analytical approach to link material issues to risks, opportunities and performance, and engage a wider range of internal and external stakeholders. A strategic, long-term approach integrating materiality more fully into reporting and management would help companies better address sustainability challenges.

Funding Options for SaaS Compaines

This document discusses funding options for growing SaaS companies. It provides an overview of BJ Lackland and his experience financing early stage tech companies. It then summarizes Lighter Capital's financing model of revenue-based financing, which provides capital to companies in exchange for a percentage of monthly revenue over time. The presentation outlines various funding paths like venture capital, debt, and blended models. It compares features of different funding sources and provides tips for selecting a funding path and preparing for funding.

More Related Content

What's hot

Parametric perspectives-winter-2010 (1)

Parametric provides strategies for exploiting increased market volatility, including rebalancing portfolios and using options strategies. Rebalancing reduces concentration risks and volatility over time by selling assets that have increased in value and buying those that have decreased, capturing returns from volatility. Options strategies can also provide downside protection for portfolios while retaining upside potential. Parametric implemented an options overlay for a client in 2008 that protected against a 5-20% market decline while retaining upside to 30%, balancing protection and participation in gains.

Pursuing_a_Better_Investment_Experience_Slides

This document provides guidance on pursuing a better investment experience. It recommends embracing market pricing, not trying to outguess the market, resisting chasing past performance, letting markets work for you long-term, considering drivers of returns like company size and profitability, practicing smart diversification globally, avoiding market timing, managing emotions, focusing on long-term advice over entertainment, and controlling what you can like having a tailored plan.

Getting Through a Volatile Market

This presentation shows steps one can take today to get through today\'s volatile market and put oneself in the best possible position going forward

Stock Market And The Economy

The document discusses the stock market boom of the late 1990s and its impact on the US economy. It finds that the stock market boom between 1995 and 2000 added significantly to economic growth during that period, with estimates that GDP growth was 1.5% higher each year due to the wealth effects of rising stock prices. However, it also led to issues like a lower personal saving rate, a higher trade deficit, and made the economy more vulnerable when the bubble burst in 2001-2002. The document concludes that without the stock boom, the 1990s expansion would not have looked as strong and the 2001 recession may not have occurred.

Putnam Absolute Return Funds

This document provides an overview and summary of Putnam Absolute Return Funds. It discusses how increased stock market volatility and low bond yields argue for alternative investment strategies. The Putnam Absolute Return Funds aim to generate positive returns regardless of market conditions with less volatility than traditional markets. Each fund seeks a different return target above inflation over a 3-year period using flexible portfolio management across global fixed income, stocks, and alternative assets.

Pursuing a Better Investment Experience

This document provides guidance on pursuing a better investment experience. It recommends embracing market pricing, not trying to outguess the market, resisting chasing past performance, letting markets work for you long-term, considering drivers of returns like value and profitability, practicing smart diversification globally, avoiding market timing, managing emotions, ignoring entertainment over advice, and focusing on controllable factors like a personalized financial plan.

Dfa basic slides 2013

The document discusses three dimensions of expected stock returns:

1) Company size - Small company stocks tend to have higher expected returns than large company stocks over time.

2) Company price - Lower-priced "value" stocks tend to have higher expected returns than higher-priced "growth" stocks over time.

3) Equity market - Stocks tend to have higher expected returns than fixed income investments like bonds over time.

Market indices

An index is constructed to measure movements in financial markets like stocks and bonds. The SENSEX is India's oldest stock market index, first compiled in 1986 based on 30 large, established companies. It uses a free-float methodology, where the index level reflects the free-float market value of component stocks relative to a base period. Stocks are selected based on criteria like market capitalization, liquidity, and representation of key industries.

Dfa all slides 2013

The document discusses diversification across different asset classes and geographic regions. It presents 5 model portfolios with varying allocations to US and international stocks and bonds. The most diversified portfolio (Portfolio 5) allocates 30% to international stocks, 7.5% to several US stock size and style factors, and 40% to bonds. Tables show the annual returns and volatility of returns for each model portfolio from 1998-2012. The most diversified portfolio had the highest annualized return of 7.02% and second highest standard deviation of returns of 13.68%.

Factors That Influence Stock Price

Understand what and how impacts the market and influences the stock price of several companies. To know more or invest in stocks visit: www.karvyonline.com or call us on 18004198283.

How to Build an Investment Portfolio

This document provides guidance on building an effective investment portfolio through diversification and managing risk. It recommends creating an asset allocation policy based on your risk tolerance that diversifies across asset classes like stocks and bonds. Specific funds should then be selected within each asset class and regularly monitored to ensure the portfolio still matches your goals and risk profile as markets change over time. The focus should be on long-term growth while minimizing downside risk through this diversified, balanced approach.

Putnam Absolute Return Funds Q&A Q2 2013

- Global bond markets were disrupted in the quarter as bond yields rose sharply due to expectations that the Federal Reserve would scale back its bond-buying program sooner than anticipated.

- Within fixed income, mortgage prepayment strategies detracted from performance but rebounded later in the quarter, while term-structure positioning and commercial mortgage-backed securities contributed to results.

- In stocks, selection strategies and some currency positions in non-directional strategies hurt returns in the 500 and 700 funds.

The Science of Investing

Swindells Financial Planning presents "The Science of Investing", demonstrating athe structured, disciplined and evidence based investment philosophy

L Pch6

The document discusses different methods for calculating rates of return on investments. It provides details on simple rates of return, adjusted rates of return, and holding period returns. Historical data on rates of return for various asset classes like stocks, bonds, and bills from 1926-1999 is presented, showing average annual returns and standard deviations. The risk-return relationship and concept of risk premiums are also covered.

Permal TAF sales piece 0510 (2016_01_25 03_57_23 UTC)

This document discusses the Legg Mason Permal Tactical Allocation Fund, a fund-of-funds that invests across global markets and asset classes. It has four dimensions of flexibility: geography, asset class, investment vehicles, and asset allocation. This allows it to adjust its allocation across equities, fixed income, alternatives and cash as market conditions change. Recently it has shifted more to stocks and alternatives from bonds. The fund aims to generate equity-like returns with lower volatility by diversifying across multiple asset classes. It is managed by Permal, a global pioneer in multi-manager funds with over 35 years of experience.

Ntu 2010 Presentation (Tnfm)

This document discusses three investors who achieved billion-dollar fortunes through successful investing strategies:

- Warren Buffett achieved annual returns of 28% by investing in "great businesses with wide moats" and holding them for the long term.

- George Soros made $1.8 billion in 1992 by shorting the British pound and investing in German marks, epitomizing a willingness to take huge risks.

- John Paulson made $20 billion for his firm during the financial crisis by correctly betting against the US housing market and financial stocks.

Market Volitility

This document provides an overview and analysis of the economic situation and stock market in 2008 during the financial crisis. It discusses the major events that occurred, including bank failures and government interventions. It also looks at where the economy and markets currently stand, and offers recommendations to long-term investors to remain invested and not overreact to short-term volatility.

Randomness of returns_historical_asset_class_ranking_2014 skittles

The Need for Diversification (“Skittles Chart”) Asset Class Index Performance

The “Skittles Chart” is a great way to show investors the randomness of investment returns from one year to the next, reinforcing the potential benefits of Asset Class Investing as an alternative to active management.

Stock market and the economy ppt slides

The document discusses the relationship between the stock market and economic activity. It begins by introducing the topic and explaining how firms raise funds through debt and equity financing. It then defines what a stock market is, how stocks are traded, and how stock prices are determined by supply and demand. Several factors that can influence stock prices are explained, including economic conditions, firm-specific factors, and market factors. The relationship between the stock market and broader economy is explored, specifically how changes in the stock market can impact aggregate demand and economic growth through wealth and investment effects, and how economic conditions can in turn impact stock prices and investor sentiment. The role of the Federal Reserve in responding to stock market fluctuations is also summarized.

Ml ilipp+stock market_popularretirementchoice2

Avoiding stock market risk and funding a tax free retirement income with select indexed cash value life insurance policies

What's hot (20)

Permal TAF sales piece 0510 (2016_01_25 03_57_23 UTC)

Permal TAF sales piece 0510 (2016_01_25 03_57_23 UTC)

Randomness of returns_historical_asset_class_ranking_2014 skittles

Randomness of returns_historical_asset_class_ranking_2014 skittles

Viewers also liked

Strenghs and weaknesses of CAC 40 materiality assessments

The document discusses materiality assessments conducted by CAC 40 companies. It finds that while transparency around materiality assessments has increased, with most companies publishing materiality matrices, many assessments still lack strategic perspective, representativeness of stakeholders consulted, and follow up. It recommends that companies take a more robust analytical approach to link material issues to risks, opportunities and performance, and engage a wider range of internal and external stakeholders. A strategic, long-term approach integrating materiality more fully into reporting and management would help companies better address sustainability challenges.

Funding Options for SaaS Compaines

This document discusses funding options for growing SaaS companies. It provides an overview of BJ Lackland and his experience financing early stage tech companies. It then summarizes Lighter Capital's financing model of revenue-based financing, which provides capital to companies in exchange for a percentage of monthly revenue over time. The presentation outlines various funding paths like venture capital, debt, and blended models. It compares features of different funding sources and provides tips for selecting a funding path and preparing for funding.

Pulse of the OIC Islamic Capital Markets report

The document summarizes the current state of Islamic capital markets within Organization of Islamic Cooperation (OIC) member countries. It finds that while the markets have grown significantly in recent years, they remain fragmented and inefficient compared to global markets. The largest Islamic capital markets are in Malaysia and Saudi Arabia. Equity markets in Indonesia and Dhaka Stock Exchange have grown the most recently. Sukuk issuance has slowed due to transparency issues but demand remains high. Most Islamic funds are small, under $50 million, indicating opportunities for growth. Overall, Islamic capital markets have potential but face challenges in becoming more coordinated and developed.

THE ARROGANCE OF ENGLISH LANGUAGE

English rules

- Finance

- Science and technology

- Universities

- Advertising

- Computing

- Publishing industry

- Entertainment

- International organisations

- International transportation

- Interpreting and translation

P Pt Invest France [Compatibility Mode]![P Pt Invest France [Compatibility Mode]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![P Pt Invest France [Compatibility Mode]](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

France is an attractive location for foreign investment for several reasons:

1. It has a highly skilled workforce, particularly in research and development.

2. It has well-developed infrastructure and is centrally located within Europe, providing access to the large European market.

3. Several industries such as aerospace, automotive, and agriculture are growing and have seen foreign companies establish production facilities in France.

National Stock Exchange and Nasdaq 100

The document provides information about the S&P CNX Nifty and NASDAQ-100 stock indices.

The S&P CNX Nifty tracks the performance of the 50 largest Indian companies listed on the National Stock Exchange of India based on market capitalization. It covers 23 sectors of the Indian economy. The NASDAQ-100 tracks the performance of 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization. Both indices have eligibility criteria for initial and continued inclusion and use formulae to calculate index values based on the market values and weights of constituent securities.

Raja hardik nribm 3

This document provides a summary of the French financial system and corporate social responsibility practices in France. It was presented by four students and covers several topics: the structure of the French financial system including regulatory institutions, banking and non-banking institutions, the mutual fund and insurance industries, and supervising institutions. It also discusses corporate social responsibility initiatives in France and provides case studies of CSR practices at several French companies. Finally, it examines business opportunities and trade relations between India and France.

The value of getting CEO succession right

Strategy&’s 15th annual study of CEOs, Governance, and Success highlights the value lost by poor CEO succession planning and what companies can gain by better planning.

EY French Venture Capital Barometer - Annual results 2015

The EY French Venture Capital Barometer identifies financing operations in equity of companies in their creation phase or during their first years after creation, from 1st of January to 31st of December 2015, published before the 14th of January 2016.

Business valuation fundamentals & the maximization of entity value

In the complex world of business valuation, understanding the valuations process can be of key importance to receiving the highest and best value for your company.

Through a basic understanding of the principles of business valuation (both public and private, closely held) one can learn to navigate the process that touches everything from transactions to taxation.

Characteristics of fortune 500 companies

The document summarizes characteristics of companies on the Fortune 500 list. It discusses 12 key characteristics including having a clear vision, treating employees well through empowerment and training, focusing on performance and profitability, prioritizing customer service and quality, effective communication, strong ethics, acceptance of change and innovation. The top industries represented are petroleum and retail. The US, Japan and China have the most companies, though the number from some countries like South Korea is decreasing.

Ten reasons to study French

File provided by AATF at https://frenchadvocacy.wikispaces.com/ for use by French teachers for advocacy. Uploaded here to allow for embedding on my school wiki.

Karachi Stock Exchange (KSE)

The document provides information about the Karachi Stock Exchange (KSE) in Pakistan. It discusses that KSE is the largest stock exchange in Pakistan, established in 1949. It facilitates capital formation and provides a liquid marketplace for investors. KSE has over 500 listed companies and introduced electronic trading systems like KATS. It remains committed to upgrading technology and assessing customer needs. The document outlines the history, vision, mission, products, sectors, indexes and regulations of the KSE.

presentation on sharekhan ltd.

The document discusses equity trading in India and the future of online trading and demat accounts. It provides an overview of Sharekhan Ltd, a stock brokerage firm that offers online trading and depository services. The document analyzes Sharekhan's products, services, competitors and discusses factors like increasing online trading that positively impact the company's future growth prospects. Customer surveys found that awareness of equity trading is high but people prefer less risky investments. The document recommends that Sharekhan expand its branch network and reduce account opening times to better serve more customers.

10 underperforming French companies that could be targeted by activists funds

A research note reviewing shareholder activism in France and presenting ten french companies that could be target of activist hedge funds.

OTCQX: The Clear Advantage -- Research Study

OTC Markets Group commissioned strategic advisory firm Oxford Metrica to conduct an independent study examining the impact of trading on OTCQX, the top U.S. over-the-counter (“OTC”) market, in terms of share liquidity, bid-ask spreads, broker-dealer coverage, and investor perception.

The study evaluated all securities that traded on OTCQX for at least three months during the three years prior to October 31, 2015, a total of 397 primary securities with $1 trillion in combined market capitalization. Liquidity was analyzed for the six months prior to joining OTCQX compared with the subsequent six months.

nifty and sensex movement

The document discusses the NIFTY and SENSEX stock market indices of India. It provides details on:

1) How the SENSEX and NIFTY indices are calculated based on the free-floating market capitalization of their constituent stocks. The SENSEX includes 30 stocks and uses 1978-79 as the base year, while NIFTY includes 50 stocks and uses 1995 as the base year.

2) The major companies that make up the SENSEX (e.g. Reliance, TCS, HDFC Bank) and NIFTY (same top companies).

3) A brief history of the National Stock Exchange and the objectives and products it offers.

Building the Billion Dollar SaaS Unicorn: CEO Guide

In a Venture Capital world that is obsessed with growth, recurring revenue and software as a service, after you validate that you have a solution that people are willing to pay for, there is an entire new world ahead of you in scaling that venture. For many, this involves an entirely new language and set of metrics to manage the business. For the startup that wants to make the leap to scale up and fast growth this should serve as a starting point for key insights and metrics for that journey.

Human Capital Management Why And How

The document discusses the benefits of strategic human capital management including increasing revenue, improving customer satisfaction, improving quality, increasing productivity, reducing costs and cycle times, and increasing market capitalization. It provides studies and research that show correlations between talent management practices and these benefits. It also discusses processes that organizations can use to drive performance, appraise talent, manage learning and succession, and ensure they have the right people with the right skills deployed.

Viewers also liked (19)

Strenghs and weaknesses of CAC 40 materiality assessments

Strenghs and weaknesses of CAC 40 materiality assessments

EY French Venture Capital Barometer - Annual results 2015

EY French Venture Capital Barometer - Annual results 2015

Business valuation fundamentals & the maximization of entity value

Business valuation fundamentals & the maximization of entity value

10 underperforming French companies that could be targeted by activists funds

10 underperforming French companies that could be targeted by activists funds

Building the Billion Dollar SaaS Unicorn: CEO Guide

Building the Billion Dollar SaaS Unicorn: CEO Guide

Similar to Size and value effects for stocks thru 2009

Design, build, protect with Capital Associates

This document discusses Loring Ward's approach to financial planning and investment management. It outlines their three-step process of designing a tailored plan to meet clients' goals, building portfolios using academic research, and protecting plans by providing guidance. It promotes diversifying globally and incorporating small and value stocks. Charts show long-term stock market growth and benefits of rebalancing. The goal is helping clients achieve financial security and stay on track to reach their "someday."

Design build-protect-clients

Loring Ward is an investment advisor registered with the SEC. The strategies discussed may not achieve their objectives and involve risks, including loss of principal. Securities are offered through Loring Ward Securities.

New perspectives on asset class investing

This document discusses various investment strategies including active and passive investing. It notes that most active managers underperform their benchmarks over time. It also discusses the benefits of asset class investing over index investing, including lower costs, improved tax efficiency, increased diversification, better risk exposure, and potentially better long-term performance. Charts show that a diversified portfolio following an asset class approach outperformed the S&P 500 since 2000 and was less volatile, and held up better in the face of withdrawals.

DHGWA Brochure 2015 Portrait

Wealth advisors LLC pursues a better investment experience for its clients by embracing principles of prudent diversification and avoiding behaviors that often undermine returns, such as market timing, chasing past performance, and overreacting to short-term market movements. The firm recommends low-cost, globally diversified portfolios and advises clients to focus on what they can control - their investment plan, taxes, and expenses - rather than trying to outguess unpredictable markets. By following these disciplined strategies, the firm aims to help clients achieve superior long-term returns.

Rethink The Way You Invest

This document discusses pursuing a better investment experience by embracing principles such as embracing market pricing, not trying to outguess the market, resisting chasing past performance, letting markets work for investors, considering drivers of returns, practicing smart diversification, avoiding market timing, managing emotions, not confusing entertainment with advice, and focusing on what can be controlled. The key ideas are that following basic principles of prudent investing over long periods can help investors achieve better results than trying to beat the market through tactics like stock picking, market timing, or chasing past performance.

Portfolio perspectives-greatest lesson-part2-0813

Active managers have generally not outperformed the market in either bull or bear markets. During the 2008 financial crisis, actively managed funds underperformed the S&P 500 index by an average of 1.67% on average. Studies from 2008-2012 also found that the majority of active managers failed to outperform their benchmarks across various market categories. While markets have historically delivered positive returns, it is typically a small group of top-performing stocks that drive those returns, making it difficult for managers to consistently pick winners. Diversification can help reduce risk and volatility compared to investing only in stocks, as seen during the 1973-1976 and 2007-2011 periods where a diversified portfolio lost less than a pure stock portfolio.

Why To Diversify

The document provides a 10-year snapshot of annual total returns for various asset classes from 2006 to 2015. It shows that diversification across asset classes can help manage volatility in changing markets, as the best and worst performing asset classes varied significantly from year to year. Past performance is not a guarantee of future results, and diversification does not ensure profits or prevent losses.

Pursuing a Better Investment Experience Brochure Branded

The Bridgeway Group is a financial services firm with offices in Pasadena and Covina, California. It offers securities and advisory services through Commonwealth Financial Network. The document includes various exhibits with disclosures related to mutual fund performance, dimensions of expected returns, benefits of diversification, and avoiding reactions to short-term market movements. It emphasizes focusing on factors within an investor's control and maintaining a long-term perspective.

RWC Investment Introduction Presentation

The investment philosophy focuses on efficient market investing through portfolio design and implementation that targets dimensions of higher expected returns like value, size, and profitability. It believes prices reflect all available information and aims to add value not by forecasting but by pursuing risk premia in a low-cost, diversified portfolio. Traditional active management often relies on forecasting and generates higher costs without consistent outperformance, while index funds provide little flexibility.

Actions You Can Take After Great Recession

This document provides lessons learned from the Great Recession and actions investors can take. It recommends diversifying investments across different asset classes, rebalancing portfolios as needed, using dollar cost averaging to invest consistently, and avoiding emotional reactions to market volatility. Developing a long-term financial plan that considers goals, risk tolerance and taxes can help investors feel more confident during periods of market turmoil. The key is maintaining a disciplined, balanced approach rather than trying to time the market.

Actions You Can Take After Great Recession

This document provides lessons learned from the Great Recession and actions investors can take. It recommends diversifying investments across different asset classes, rebalancing portfolios as needed, using dollar cost averaging to invest consistently, and avoiding emotional reactions to market volatility. Developing a long-term financial plan that considers goals, risk tolerance and taxes can help investors feel more confident during periods of market turmoil. The key is disciplined investing with a strategy, rather than trying to time the market based on emotions.

Stop Wasting Your Money & Start Having a Better Investment Experience

This document provides a summary of strategies for pursuing a better investment experience. It recommends embracing market pricing, not trying to outguess the market by stock picking, resisting chasing past performance, letting markets work for long-term investors, considering dimensions of expected returns like value and size, practicing smart diversification globally, avoiding market timing, managing emotions during market cycles, looking beyond headlines, and focusing on what can be controlled like working with a financial advisor.

2009 Pulse Of The Market

The document provides an overview of market volatility and downturns. It discusses how declines are normal aspects of the market cycle and outlines historical data on the average length and frequency of different types of declines. It also notes that expansions have typically lasted longer than recessions throughout history.

A Better Investment Experience

The document provides disclosures and sources for several exhibits. Exhibit 1 discloses trading data sources for world equity trading volumes. Exhibit 2 describes the mutual fund sample and methodology used to determine "winner" funds that outperformed benchmarks. Exhibit 3 explains how the analysis was conducted to determine the percentage of top-ranked funds that maintained their ranking in subsequent years. The source for Exhibits 2 and 3 is also provided.

2017 Pursuing a Better Investment Experience

1. The document discusses key principles for improving the odds of investment success, including embracing market pricing, not trying to outguess the market through timing, and resisting chasing past performance.

2. It notes that most mutual funds do not maintain top performance over time and that past returns are not predictive of future returns. Investors are advised to consider the drivers of returns like market risk premia.

3. The principles also emphasize smart diversification across market segments, avoiding reactive investing to headlines, and focusing on controlling what you can, like expenses and discipline, rather than market movements.

Pulse Of The Market

The document provides an overview and analysis of financial markets in 2009. It discusses the economic turmoil affecting markets, outlines different types of market declines, and analyzes stock and bond returns over time. The document emphasizes maintaining realistic expectations, the benefits of long-term investing, and risks of trying to time the market.

Seminar Presentation Actions You Can Take In A Volatile Market

Market got you down? Can\'t make sense of what to do? Here\'s a practical guide to investing in a challenging market

Asset Allocation And Your Portfolio

1) Asset allocation involves dividing investments among different asset classes like stocks, bonds, and cash equivalents to gain exposure to rotating market leaders and help reduce volatility.

2) Maintaining a balanced mix of assets tailored to an individual's goals, time horizon, and risk tolerance can potentially increase returns compared to holding single assets.

3) Asset allocation strategies need periodic rebalancing to maintain the intended risk level as market conditions and individual circumstances change over time.

Why Global Diversification Matters By Anthony Davidow Ap.docx

Why Global Diversification Matters

By Anthony Davidow

April 02, 2018

Over the past few years, some investors have begun to question the merits of global asset

allocation. They wonder whether the risks abroad justify investing money outside the United

States—and whether there truly are diversification benefits to doing so. Some have even

challenged Modern Portfolio Theory itself, which emphasizes the long-term benefits of a

diversified portfolio.

In some ways it’s natural. It’s an unpredictable world, and investors worry about market

volatility both at home and abroad. Everything from political questions in the wake of the U.K.’s

“Brexit” vote in the summer of 2016 to the recent U.S. elections to anticipation of the Federal

Reserve raising rates have indeed contributed to market swings.

Moreover, in investing—as in sports and other areas of life—people often exhibit familiarity bias

(“home-country bias” in this case). We’re inclined to believe in and root for the things that we

know best. While this may be human nature, home-country bias limits an investor’s universe of

available opportunities. Worse, it may not be prudent given the nature of today’s global markets:

According to MSCI data, roughly half of all global companies are based outside the United

States, which corresponds to global gross domestic product (GDP) ratios.

Do you really want to limit your investment opportunities by half? How can you overcome

home-country bias?

As the saying goes…

Times like these show why the adage “don’t put all your eggs in one basket” is so vital for

investors. An investment sector that performs well one month or year might be a poor performer

the next. For example, as the chart below shows, emerging market stocks were the worst

performer in 2008—only to rebound back to the top in 2009 and also 2017. More recently,

international developed stocks were among the top performers in 2017, after placing near the

bottom in 2016.

Over the long run, there’s no discernible pattern to the rotation among the top performers, so it

doesn’t make much sense to concentrate all your investments in a particular region or asset class.

A globally diversified portfolio—one that puts its eggs in many baskets, so to speak—tends to be

better positioned to weather large year-over-year market gyrations and provide a more stable set

of returns over time.

How key asset classes compare to a diversified portfolio

Source: Morningstar Direct and the Schwab Center for Financial Research. Data is from January 1, 2008, to December 31, 2017. Asset class

performance represented by annual total returns for the following indexes: S&P 500® Index (U.S. Lg Cap), Russell 2000® Index (U.S. Sm Cap),

MSCI EAFE® net of taxes (Int’l Dev), MSCI Emerging Markets IndexSM (EM), S&P United States REIT Index and S&P Global Ex-U.S. REIT

Index (REITs), S&P GSCI® (Commodities), Bloomberg Barclays U.S. Treasury Inflation-Protection Securities (TIPS) Index, Bloo.

Market Volatility - Fight or Flight

The document discusses market volatility and strategies for dealing with it. It defines volatility, looks at historical volatility levels, and discusses how volatility affects investors. It then outlines the wealth management group's strategies, which include repositioning portfolios to focus on quality income assets, employing strategies to dampen volatility, and ensuring portfolios align with clients' goals and risk tolerance.

Similar to Size and value effects for stocks thru 2009 (20)

Pursuing a Better Investment Experience Brochure Branded

Pursuing a Better Investment Experience Brochure Branded

Stop Wasting Your Money & Start Having a Better Investment Experience

Stop Wasting Your Money & Start Having a Better Investment Experience

Seminar Presentation Actions You Can Take In A Volatile Market

Seminar Presentation Actions You Can Take In A Volatile Market

Why Global Diversification Matters By Anthony Davidow Ap.docx

Why Global Diversification Matters By Anthony Davidow Ap.docx

More from Weydert Wealth Management

Dfa and the error term 12-2001

This document discusses the concept of error terms in investment returns and strategies. It makes three key points:

1) Even portfolios with identical exposures to risk factors like market, size, and value will experience random variation in returns over time due to residual error from differences in underlying security holdings. This error averages to zero over the long run.

2) Tax-managed investment strategies will differ in returns from benchmarks, but offer higher after-tax returns justifying the tracking error. Maximum annual deviations were 2.3% overperformance and 1.3% underperformance.

3) The Fama-French multifactor model helps investors manage systematic risk factors rather than focus on arbitrary benchmarks or short-term noise in

Fama french 5 factor working paper 11-2013

The document summarizes a five-factor asset pricing model that augments the Fama-French three-factor model by adding profitability and investment factors.

The five-factor model is tested using portfolios sorted on size, book-to-market equity ratio, profitability, and investment to produce spreads in average returns. The results show patterns in average returns related to size, value, profitability, and investment that the five-factor model seeks to capture. Specifically, small stocks and stocks with high book-to-market ratios, profitability, or low investment tend to have higher average returns. However, the model has difficulties explaining the low returns of some small, low-profitability stocks that invest heavily.

Factor investing, andrew ang 12-17-2013

The document summarizes factor investing using Norway's sovereign wealth fund as a case study. It finds that 99% of the variation in the fund's returns can be explained by its strategic asset allocation decisions between equities and bonds. This supports the finding that the most important investment decision is the top-down choice of asset allocation. The document also defines factors as classes of securities that have higher long-term returns than the broad market, such as value stocks, momentum stocks, illiquid securities, risky bonds, and options strategies. Adopting a factor investing approach allows investors to access these premiums in a cost-effective manner.

Semmelweis reflex 12 5-2013

We are all prone to cognitive biases that make it easy to fool ourselves, even more so than others. Confirmation bias and motivated reasoning cause us to only see evidence that supports our existing beliefs and interpretations. The bias blind spot further prevents us from recognizing our own cognitive biases. While the scientific method aims to reduce bias through rigorous testing of hypotheses, even scientists fall prey to these biases and often fail to replicate their own seminal studies. Overcoming cognitive biases requires acknowledging their existence and establishing processes like "adversarial collaboration" that encourage challenging existing ideas without fear of reprisal.

Mutual fund landscape 10-22-2013

1) The mutual fund landscape comprises thousands of funds competing to identify mispriced securities, making it difficult for most funds to consistently outperform their benchmarks over time.

2) Few funds survive for long periods, with about half of equity funds disappearing within 10 years, largely due to poor performance. Similarly, only about one in six funds delivers benchmark-beating returns over 10 years.

3) Past outperformance is not predictive of future success, as most "winning" funds fail to continue outperforming in subsequent periods. High costs also predict future underperformance, with funds in the lowest cost quartiles more likely to outperform over 5 and 10 year periods.

Multifactor investing dfa 7-2006

The three-factor model developed by Fama and French provides a framework for investment strategies that identifies sources of risk that compensate investors. It explains stock returns better than the single-factor CAPM model by including factors for firm size and book-to-market ratio in addition to market beta. While book-to-market ratio may not seem to directly describe risk, it serves as a proxy for a company's financial distress - high book-to-market stocks tend to be more risky with higher expected returns. The three-factor model allows advisors to construct portfolios targeting different risk exposures from size and value factors to outperform the market over the long run.

Dfa matrix book us_2013 - copy

This document provides historical return data for various investment indexes from 1926 to 2012. It discusses Dimensional Fund Advisors' evolution in response to advances in financial research. Key points include:

- Dimensional structures portfolios around dimensions of expected returns identified by research, such as market, size, value, and profitability factors.

- Recent research identified profitability as a new dimension with high profitability firms having higher average returns.

- Dimensional incorporates new research findings by evolving existing strategies and developing new ones.

- Dimensional's approach focuses on expected returns rather than attempting to time markets or capture short-term anomalies.

- Historical return data is provided for indexes spanning US and international equities

Dfa institutional review 2007q4

Dimensional investors are able to capture the value premium where others fail through an integrated investment process. Their process begins with clear investment principles of efficient markets and targeting dimensions of expected return like value and size. They design strategies for continuous exposure to these premium-generating factors. Their portfolio engineering, management, and trading are dynamically integrated to minimize costs from factors like momentum and provide liquidity. This allows Dimensional to reliably deliver excess returns to investors from targeting premiums.

Qir 2013q2 us

This research paper discusses enhancing value investment strategies by incorporating expected profitability.

For small cap value strategies, the paper proposes excluding stocks in each country with the lowest direct profitability, with the percentage excluded depending on the stock's price-to-book ratio.

For large cap value strategies, the paper suggests selecting stocks based on both low price-to-book ratios and high direct profitability. It also proposes overweighting stocks that have higher profitability, lower market capitalization, and lower relative price.

The goal is to structure portfolios to better capture the dimensions of expected returns related to company size, relative price, and expected profitability, while maintaining appropriate diversification and managing costs.

Part-Time CFO Presentation

This document describes the services of a part-time CFO service for small businesses. They help business owners understand their financial metrics through analysis of profitability, cash flow, ratios, and forecasting. They analyze key metrics, identify trends, and grade performance in areas like capital structure and profitability. They also help solve strategic problems by determining how to reach goals through actions like increasing prices or reducing expenses. The service aims to provide actionable financial insights and advice to small businesses without needing a full-time CFO.

10 tools of the trade insert (advisor present) 6 9-11

Examples of the kinds of reports a fee-only wealth manager runs to render professional advice.

4 active vs passive advisor insert funds flows dfa (advisor present) p. 1-3, ...

4 active vs passive advisor insert funds flows dfa (advisor present) p. 1-3, ...Weydert Wealth Management

This excellent article contains three key graphics illustrating how average investors flow into and out of investments at the wrong times and contrasts this with the average DFA investor who remains much more consistent and disciplined.Dfa us matrix book 2011

This document provides a summary of Dimensional Fund Advisors' 30 year history from 1981 to 2010. It discusses how Dimensional was founded on empirical financial research and introduced novel investment strategies like microcap investing. Over the decades, Dimensional expanded its offerings globally while maintaining its focus on translating academic theories into practical investment solutions. Key events include expanding client base, growing assets under management, moving headquarters, and continuing to work closely with leading financial academics.

More from Weydert Wealth Management (15)

10 tools of the trade insert (advisor present) 6 9-11

10 tools of the trade insert (advisor present) 6 9-11

4 active vs passive advisor insert funds flows dfa (advisor present) p. 1-3, ...

4 active vs passive advisor insert funds flows dfa (advisor present) p. 1-3, ...

Recently uploaded

Independent Study - College of Wooster Research (2023-2024)

"Does Foreign Direct Investment Negatively Affect Preservation of Culture in the Global South? Case Studies in Thailand and Cambodia."

Do elements of globalization, such as Foreign Direct Investment (FDI), negatively affect the ability of countries in the Global South to preserve their culture? This research aims to answer this question by employing a cross-sectional comparative case study analysis utilizing methods of difference. Thailand and Cambodia are compared as they are in the same region and have a similar culture. The metric of difference between Thailand and Cambodia is their ability to preserve their culture. This ability is operationalized by their respective attitudes towards FDI; Thailand imposes stringent regulations and limitations on FDI while Cambodia does not hesitate to accept most FDI and imposes fewer limitations. The evidence from this study suggests that FDI from globally influential countries with high gross domestic products (GDPs) (e.g. China, U.S.) challenges the ability of countries with lower GDPs (e.g. Cambodia) to protect their culture. Furthermore, the ability, or lack thereof, of the receiving countries to protect their culture is amplified by the existence and implementation of restrictive FDI policies imposed by their governments.

My study abroad in Bali, Indonesia, inspired this research topic as I noticed how globalization is changing the culture of its people. I learned their language and way of life which helped me understand the beauty and importance of cultural preservation. I believe we could all benefit from learning new perspectives as they could help us ideate solutions to contemporary issues and empathize with others.

一比一原版(UCSB毕业证)圣芭芭拉分校毕业证如何办理

UCSB毕业证文凭证书【微信95270640】办理圣芭芭拉分校毕业证成绩单(Q微信95270640)毕业证学历认证OFFER专卖国外文凭学历学位证书办理澳洲文凭|澳洲毕业证,澳洲学历认证,澳洲成绩单 澳洲offer,教育部学历认证及使馆认证永久可查 ,国外毕业证|国外学历认证,国外学历文凭证书 UCSB毕业证,UCSB毕业证,UCSB毕业证,UCSB毕业证,UCSB毕业证,UCSB毕业证,UCSB毕业证,专业为留学生办理毕业证、成绩单、使馆留学回国人员证明、教育部学历学位认证、录取通知书、Offer、

【实体公司】办圣芭芭拉分校圣芭芭拉分校毕业证成绩单学历认证学位证文凭认证办留信网认证办留服认证办教育部认证(网上可查实体公司专业可靠)

— — — 留学归国服务中心 — — -

【主营项目】

一.圣芭芭拉分校毕业证成绩单使馆认证教育部认证成绩单等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

国外毕业证学位证成绩单办理流程:

1客户提供圣芭芭拉分校圣芭芭拉分校毕业证成绩单办理信息:姓名生日专业学位毕业时间等(如信息不确定可以咨询顾问:我们有专业老师帮你查询);

2开始安排制作毕业证成绩单电子图;

3毕业证成绩单电子版做好以后发送给您确认;

4毕业证成绩单电子版您确认信息无误之后安排制作成品;

5成品做好拍照或者视频给您确认;

6快递给客户(国内顺丰国外DHLUPS等快读邮寄)。

专业服务请勿犹豫联系我!本公司是留学创业和海归创业者们的桥梁。一次办理终生受用一步到位高效服务。详情请在线咨询办理,欢迎有诚意办理的客户咨询!洽谈。

招聘代理:本公司诚聘英国加拿大澳洲新西兰美国法国德国新加坡各地代理人员如果你有业余时间有兴趣就请联系我们咨询顾问:+微信:95270640田里逡巡一番抱起一只硕大的西瓜用石刀劈开抑或用拳头砸开每人抱起一大块就啃啃得满嘴满脸猴屁股般的红艳大家一个劲地指着对方吃吃地笑瓜裂得古怪奇形怪状却丝毫不影响瓜味甜丝丝的满嘴生津遍地都是瓜横七竖八的活像掷满了一地的大石块摘走二三只爷爷是断然发现不了的即便发现爷爷也不恼反而教山娃辨认孰熟孰嫩孰甜孰淡名义上是护瓜往往在瓜棚里坐上一刻饱吃一顿后山娃就领着阿黑漫山遍野地跑阿黑是一条黑色的大猎狗挺机灵的是山室

Tdasx: Unveiling the Trillion-Dollar Potential of Bitcoin DeFi

Tdasx: Unveiling the Trillion-Dollar Potential of Bitcoin DeFi

Solution Manual For Financial Accounting, 8th Canadian Edition 2024, by Libby...

Solution Manual For Financial Accounting, 8th Canadian Edition 2024, by Libby, Hodge, Verified Chapters 1 - 13, Complete Newest Version Solution Manual For Financial Accounting, 8th Canadian Edition by Libby, Hodge, Verified Chapters 1 - 13, Complete Newest Version Solution Manual For Financial Accounting 8th Canadian Edition Pdf Chapters Download Stuvia Solution Manual For Financial Accounting 8th Canadian Edition Ebook Download Stuvia Solution Manual For Financial Accounting 8th Canadian Edition Pdf Solution Manual For Financial Accounting 8th Canadian Edition Pdf Download Stuvia Financial Accounting 8th Canadian Edition Pdf Chapters Download Stuvia Financial Accounting 8th Canadian Edition Ebook Download Stuvia Financial Accounting 8th Canadian Edition Pdf Financial Accounting 8th Canadian Edition Pdf Download Stuvia

^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Duba...![^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Duba...](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Duba...](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Whatsapp (+971581248768) Buy Abortion Pills In Dubai/ Qatar/Kuwait/Doha/Abu Dhabi/Alain/RAK City/Satwa/Al Ain/Abortion Pills For Sale In Qatar, Doha. Abu az Zuluf. Abu Thaylah. Ad Dawhah al Jadidah. Al Arish, Al Bida ash Sharqiyah, Al Ghanim, Al Ghuwariyah, Qatari, Abu Dhabi, Dubai.. WHATSAPP +971)581248768 Abortion Pills / Cytotec Tablets Available in Dubai, Sharjah, Abudhabi, Ajman, Alain, Fujeira, Ras Al Khaima, Umm Al Quwain., UAE, buy cytotec in Dubai– Where I can buy abortion pills in Dubai,+971582071918where I can buy abortion pills in Abudhabi +971)581248768 , where I can buy abortion pills in Sharjah,+97158207191 8where I can buy abortion pills in Ajman, +971)581248768 where I can buy abortion pills in Umm al Quwain +971)581248768 , where I can buy abortion pills in Fujairah +971)581248768 , where I can buy abortion pills in Ras al Khaimah +971)581248768 , where I can buy abortion pills in Alain+971)581248768 , where I can buy abortion pills in UAE +971)581248768 we are providing cytotec 200mg abortion pill in dubai, uae.Medication abortion offers an alternative to Surgical Abortion for women in the early weeks of pregnancy. Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Dubai Abu Dhabi Sharjah Deira Ajman Fujairah Ras Al Khaimah%^^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Dubai Abu Dhabi Sharjah Deira Ajman Fujairah Ras Al Khaimah%^^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Dubai Abu Dhabi Sharjah Deira Ajman Fujairah Ras Al Khaimah%^^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Dubai Abu Dhabi Sharjah Deira Ajman Fujairah Ras Al Khaimah%^^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Dubai Abu Dhabi Sharjah Deira Ajman Fujairah Ras Al Khaimah%^^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Dubai Abu Dhabi Sharjah Deira Ajman Fujairah Ras Al Khaimah%^^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Dubai Abu Dhabi Sharjah Deira Ajman Fujairah Ras Al Khaimah%^^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Dubai Abu Dhabi Sharjah Deira Ajman Fujairah Ras Al Khaimah%^^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Dubai Abu Dhabi Sharjah Deira Ajman Fujairah Ras Al Khaimah%^^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Dubai Abu Dhabi Sharjah Deira Ajman Fujairah Ras Al Khaimah%^^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Dubai Abu Dhabi Sharjah Deira Ajman Fujairah Ras Al Khaimah%^^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Dubai Abu Dhabi Sharjah Deira Ajman Fujairah Ras Al Khaimah%^^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Dubai Abu Dhabi Sharjah Deira Ajman Fujairah Ras Al Khaimah%^^%$Zone1:+971)581248768’][* Legit & Safe #Abortion #Pills #For #Sale In #Dubai Abu Dhabi Sharjah Deira Ajman

快速办理(SMU毕业证书)南卫理公会大学毕业证毕业完成信一模一样

学校原件一模一样【微信:741003700 】《(SMU毕业证书)南卫理公会大学毕业证》【微信:741003700 】学位证,留信认证(真实可查,永久存档)原件一模一样纸张工艺/offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原。

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

【主营项目】

一.毕业证【q微741003700】成绩单、使馆认证、教育部认证、雅思托福成绩单、学生卡等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

如果您处于以下几种情况:

◇在校期间,因各种原因未能顺利毕业……拿不到官方毕业证【q/微741003700】

◇面对父母的压力,希望尽快拿到;

◇不清楚认证流程以及材料该如何准备;

◇回国时间很长,忘记办理;

◇回国马上就要找工作,办给用人单位看;

◇企事业单位必须要求办理的

◇需要报考公务员、购买免税车、落转户口

◇申请留学生创业基金

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

快速制作美国迈阿密大学牛津分校毕业证文凭证书英文原版一模一样

原版一模一样【微信:741003700 】【美国迈阿密大学牛津分校毕业证文凭证书】【微信:741003700 】学位证,留信认证(真实可查,永久存档)offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原海外各大学 Bachelor Diploma degree, Master Degree Diploma

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

一比一原版美国新罕布什尔大学(unh)毕业证学历认证真实可查

永久可查学历认证【微信:A575476】【美国新罕布什尔大学(unh)毕业证成绩单Offer】【微信:A575476】(留信学历认证永久存档查询)采用学校原版纸张、特殊工艺完全按照原版一比一制作(包括:隐形水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠,文字图案浮雕,激光镭射,紫外荧光,温感,复印防伪)行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备,十五年致力于帮助留学生解决难题,业务范围有加拿大、英国、澳洲、韩国、美国、新加坡,新西兰等学历材料,包您满意。

【业务选择办理准则】

一、工作未确定,回国需先给父母、亲戚朋友看下文凭的情况,办理一份就读学校的毕业证【微信:A575476】文凭即可

二、回国进私企、外企、自己做生意的情况,这些单位是不查询毕业证真伪的,而且国内没有渠道去查询国外文凭的真假,也不需要提供真实教育部认证。鉴于此,办理一份毕业证【微信:A575476】即可

三、进国企,银行,事业单位,考公务员等等,这些单位是必需要提供真实教育部认证的,办理教育部认证所需资料众多且烦琐,所有材料您都必须提供原件,我们凭借丰富的经验,快捷的绿色通道帮您快速整合材料,让您少走弯路。

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

→ 【关于价格问题(保证一手价格)

我们所定的价格是非常合理的,而且我们现在做得单子大多数都是代理和回头客户介绍的所以一般现在有新的单子 我给客户的都是第一手的代理价格,因为我想坦诚对待大家 不想跟大家在价格方面浪费时间

对于老客户或者被老客户介绍过来的朋友,我们都会适当给一些优惠。

选择实体注册公司办理,更放心,更安全!我们的承诺:可来公司面谈,可签订合同,会陪同客户一起到教育部认证窗口递交认证材料,客户在教育部官方认证查询网站查询到认证通过结果后付款,不成功不收费!

一比一原版(IC毕业证)帝国理工大学毕业证如何办理

IC毕业证文凭证书【微信95270640】一比一伪造帝国理工大学文凭@假冒IC毕业证成绩单+Q微信95270640办理IC学位证书@仿造IC毕业文凭证书@购买帝国理工大学毕业证成绩单IC真实使馆认证/真实留信认证回国人员证明

如果您是以下情况,我们都能竭诚为您解决实际问题:【公司采用定金+余款的付款流程,以最大化保障您的利益,让您放心无忧】

1、在校期间,因各种原因未能顺利毕业,拿不到官方毕业证+微信95270640

2、面对父母的压力,希望尽快拿到帝国理工大学帝国理工大学毕业证学历书;

3、不清楚流程以及材料该如何准备帝国理工大学帝国理工大学毕业证学历书;

4、回国时间很长,忘记办理;

5、回国马上就要找工作,办给用人单位看;

6、企事业单位必须要求办理的;

面向美国乔治城大学毕业留学生提供以下服务:

【★帝国理工大学帝国理工大学毕业证学历书毕业证、成绩单等全套材料,从防伪到印刷,从水印到钢印烫金,与学校100%相同】

【★真实使馆认证(留学人员回国证明),使馆存档可通过大使馆查询确认】

【★真实教育部认证,教育部存档,教育部留服网站可查】

【★真实留信认证,留信网入库存档,可查帝国理工大学帝国理工大学毕业证学历书】

我们从事工作十余年的有着丰富经验的业务顾问,熟悉海外各国大学的学制及教育体系,并且以挂科生解决毕业材料不全问题为基础,为客户量身定制1对1方案,未能毕业的回国留学生成功搭建回国顺利发展所需的桥梁。我们一直努力以高品质的教育为起点,以诚信、专业、高效、创新作为一切的行动宗旨,始终把“诚信为主、质量为本、客户第一”作为我们全部工作的出发点和归宿点。同时为海内外留学生提供大学毕业证购买、补办成绩单及各类分数修改等服务;归国认证方面,提供《留信网入库》申请、《国外学历学位认证》申请以及真实学籍办理等服务,帮助众多莘莘学子实现了一个又一个梦想。

专业服务,请勿犹豫联系我

如果您真实毕业回国,对于学历认证无从下手,请联系我,我们免费帮您递交

诚招代理:本公司诚聘当地代理人员,如果你有业余时间,或者你有同学朋友需要,有兴趣就请联系我

你赢我赢,共创双赢

你做代理,可以帮助帝国理工大学同学朋友

你做代理,可以拯救帝国理工大学失足青年

你做代理,可以挽救帝国理工大学一个个人才

你做代理,你将是别人人生帝国理工大学的转折点

你做代理,可以改变自己,改变他人,给他人和自己一个机会美景更增添一份性感夹杂着一份纯洁的妖娆毫无违和感实在给人带来一份悠然幸福的心情如果说现在的审美已经断然拒绝了无声的话那么在树林间飞掠而过的小鸟叽叽咋咋的叫声是否就是这最后的点睛之笔悠然走在林间的小路上宁静与清香一丝丝的盛夏气息吸入身体昔日生活里的繁忙与焦躁早已淡然无存心中满是悠然清淡的芳菲身体不由的轻松脚步也感到无比的轻快走出这盘栾交错的小道眼前是连绵不绝的山峦浩荡天地间大自然毫无吝啬的展现它的达

Earn a passive income with prosocial investing

Invest in prosocial funds that earn you an income while improving the world

1:1制作加拿大麦吉尔大学毕业证硕士学历证书原版一模一样

原版一模一样【微信:741003700 】【加拿大麦吉尔大学毕业证硕士学历证书】【微信:741003700 】学位证,留信认证(真实可查,永久存档)offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原海外各大学 Bachelor Diploma degree, Master Degree Diploma

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

在线办理(GU毕业证书)美国贡萨加大学毕业证学历证书一模一样

学校原件一模一样【微信:741003700 】《(GU毕业证书)美国贡萨加大学毕业证学历证书》【微信:741003700 】学位证,留信认证(真实可查,永久存档)原件一模一样纸张工艺/offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原。

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

【主营项目】

一.毕业证【q微741003700】成绩单、使馆认证、教育部认证、雅思托福成绩单、学生卡等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

如果您处于以下几种情况:

◇在校期间,因各种原因未能顺利毕业……拿不到官方毕业证【q/微741003700】

◇面对父母的压力,希望尽快拿到;

◇不清楚认证流程以及材料该如何准备;

◇回国时间很长,忘记办理;

◇回国马上就要找工作,办给用人单位看;

◇企事业单位必须要求办理的

◇需要报考公务员、购买免税车、落转户口

◇申请留学生创业基金

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

falcon-invoice-discounting-a-premier-investment-platform-for-superior-returns...

falcon-invoice-discounting-a-premier-investment-platform-for-superior-returns...Falcon Invoice Discounting

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.falcon-invoice-discounting-a-strategic-approach-to-optimize-investments