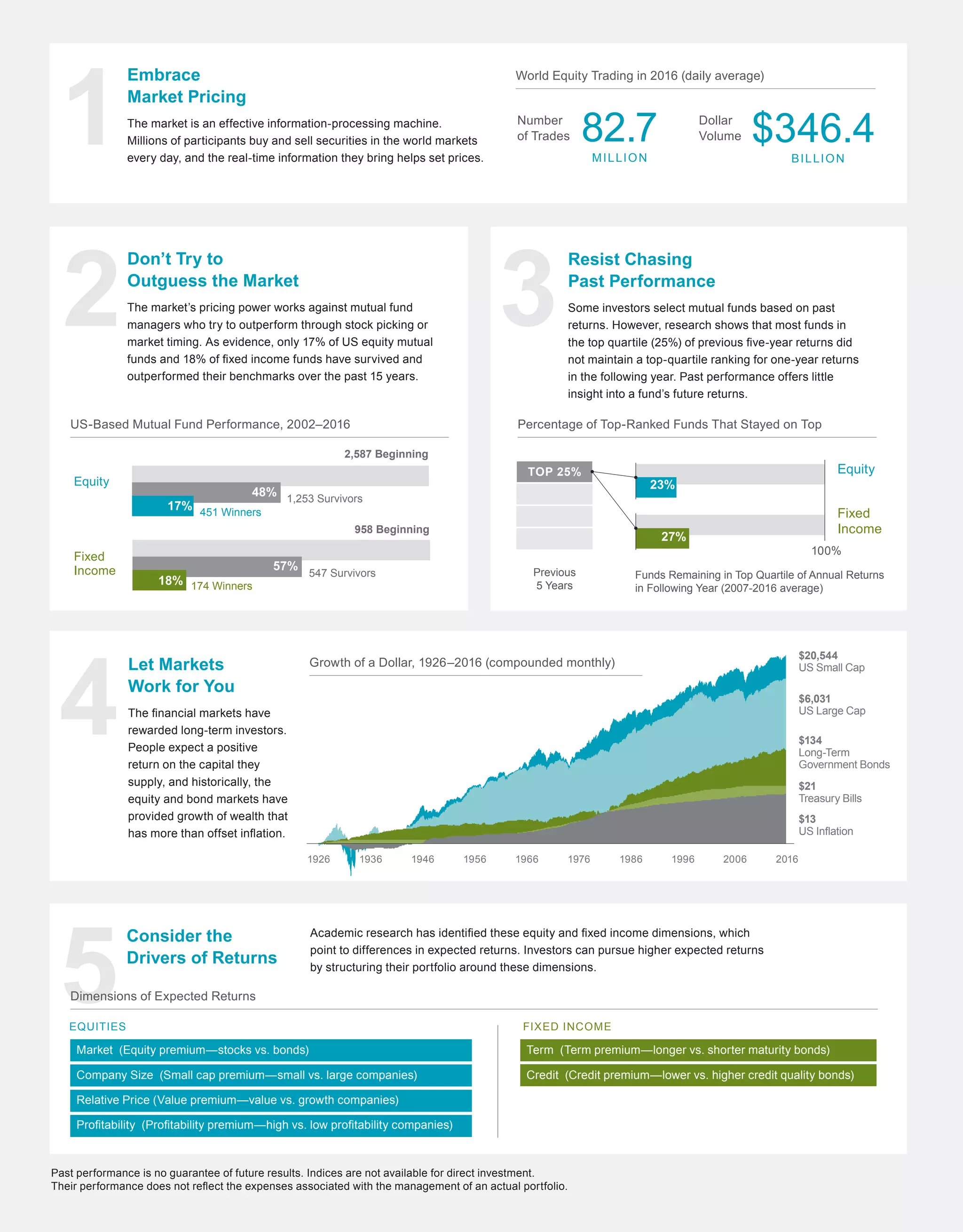

The document provides disclosures and sources for several exhibits. Exhibit 1 discloses trading data sources for world equity trading volumes. Exhibit 2 describes the mutual fund sample and methodology used to determine "winner" funds that outperformed benchmarks. Exhibit 3 explains how the analysis was conducted to determine the percentage of top-ranked funds that maintained their ranking in subsequent years. The source for Exhibits 2 and 3 is also provided.