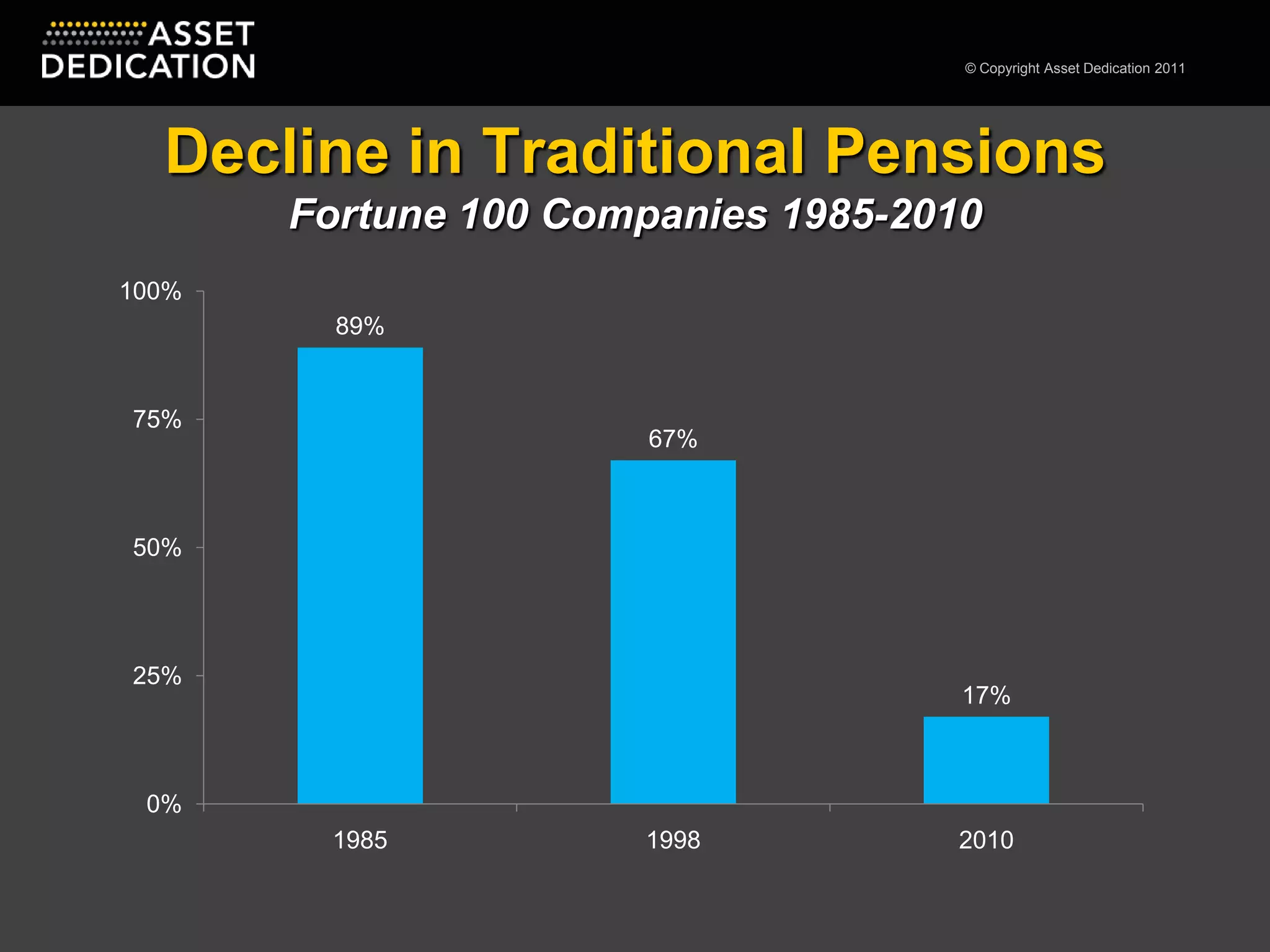

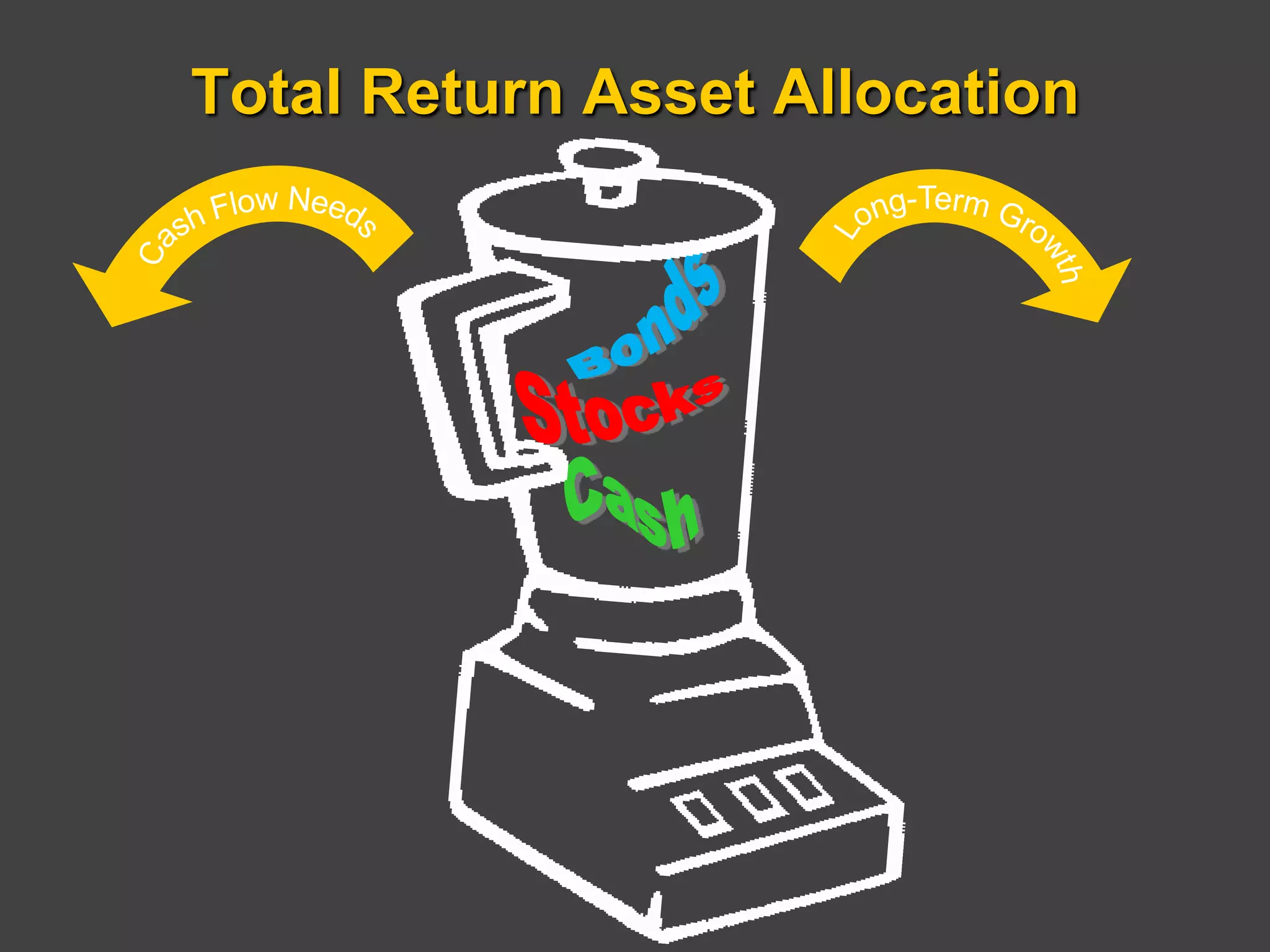

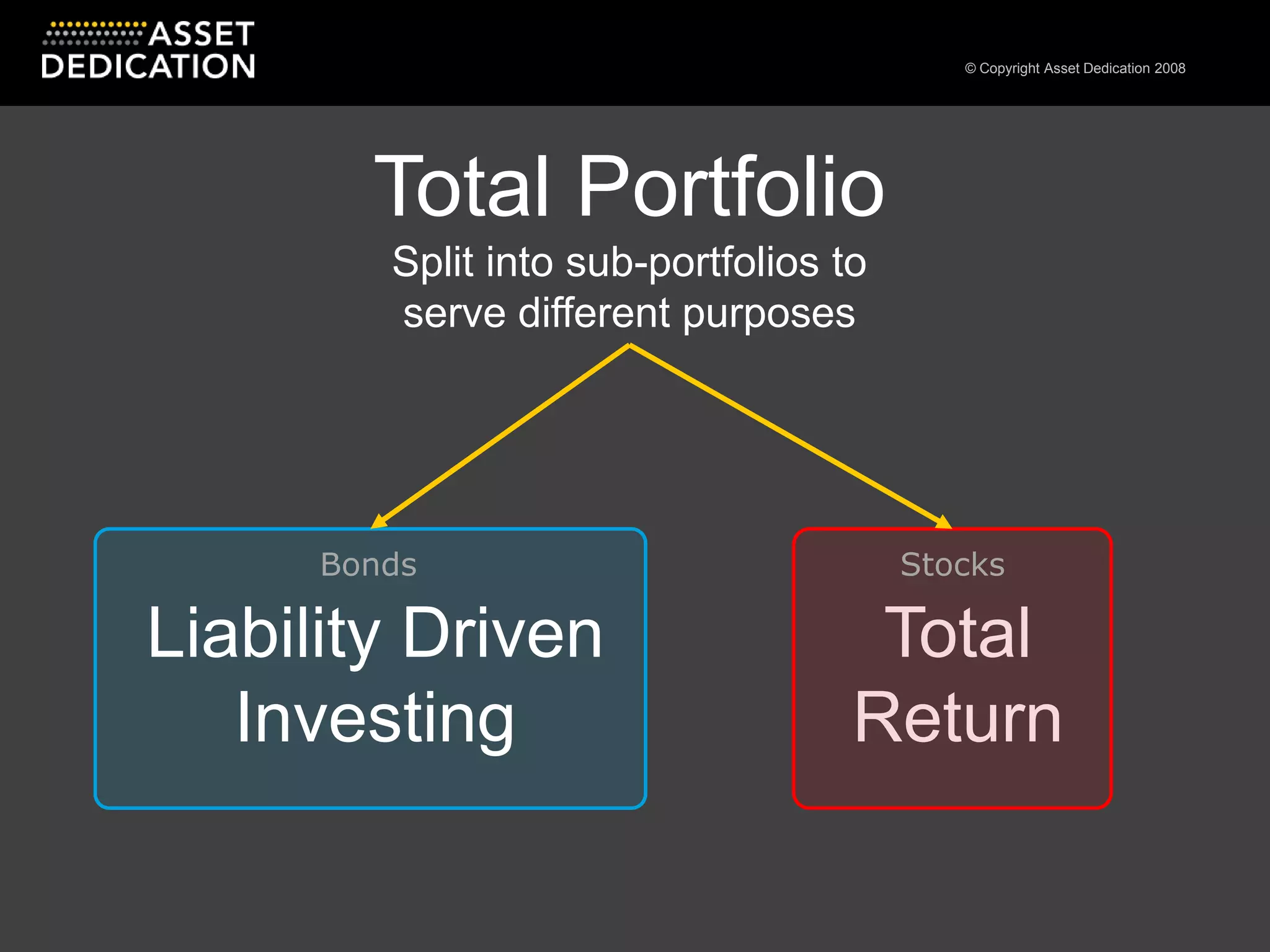

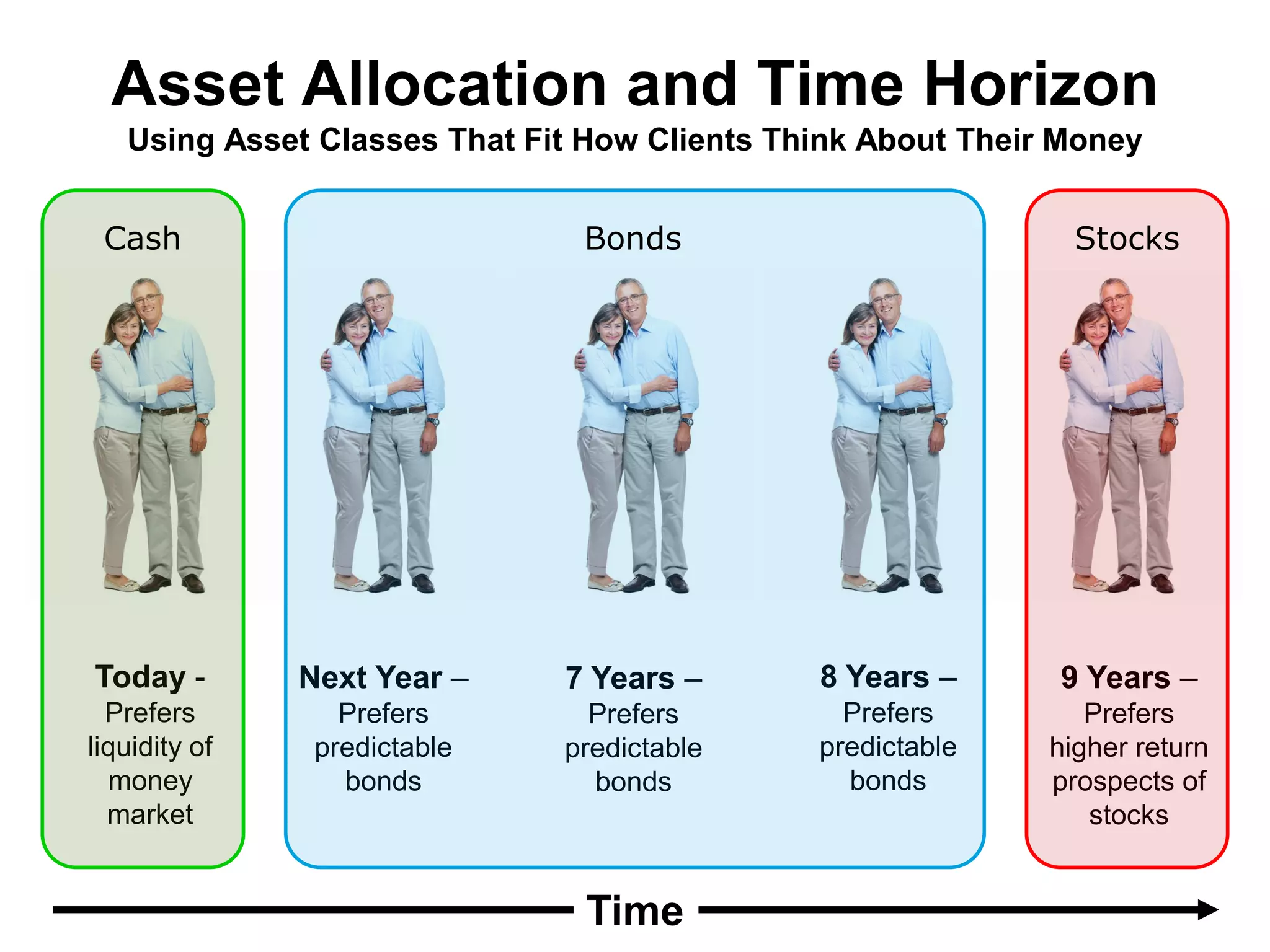

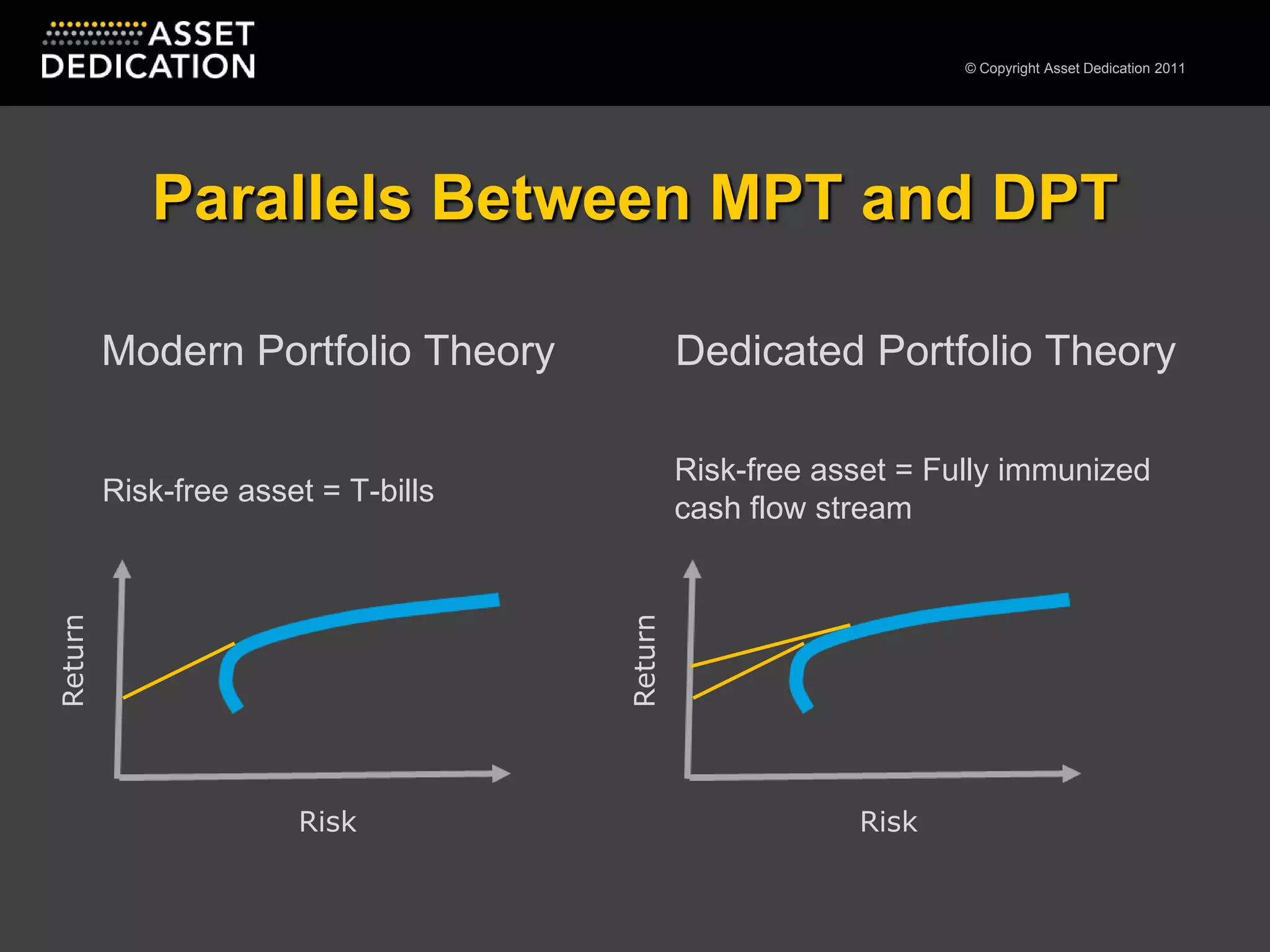

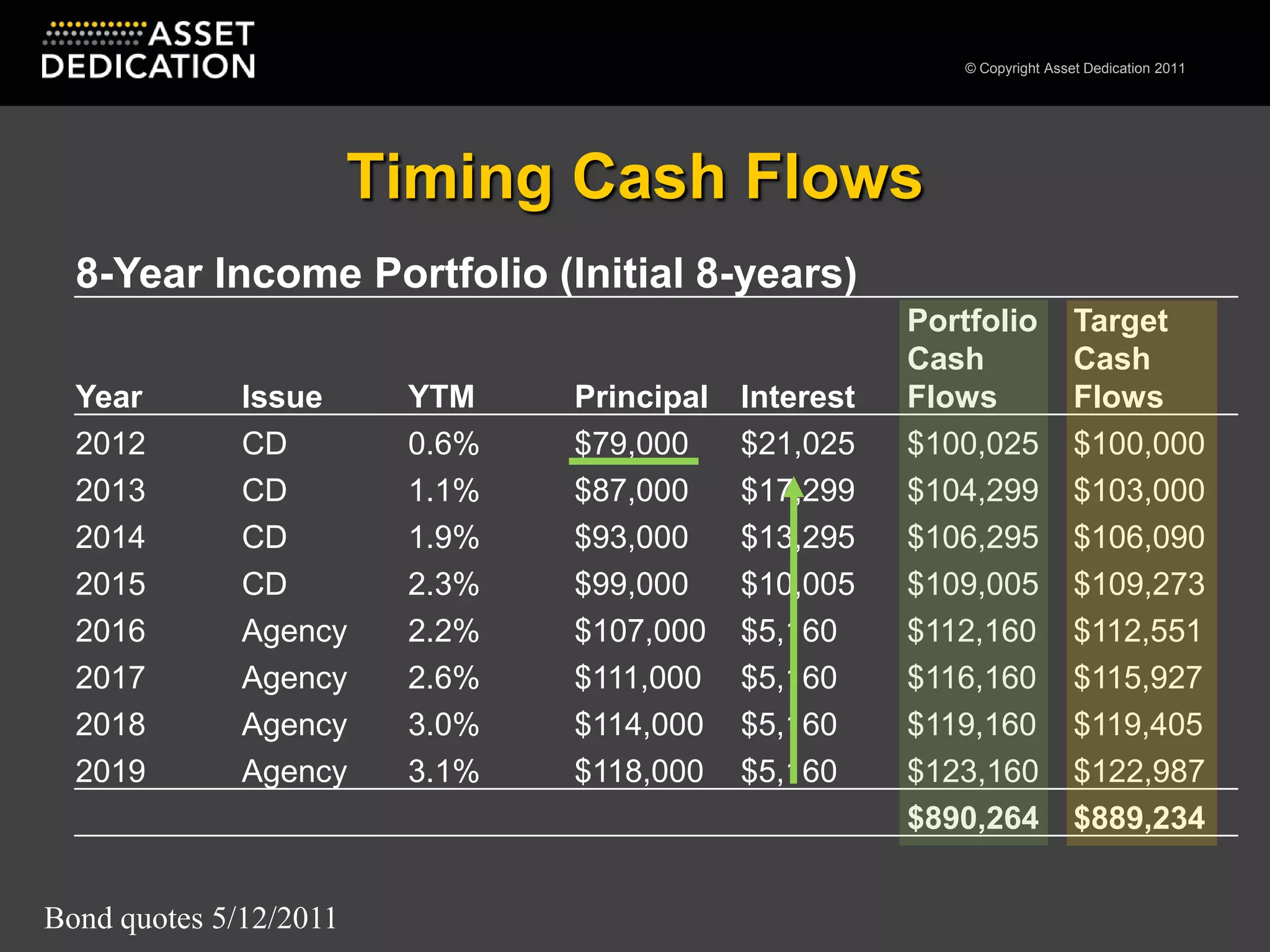

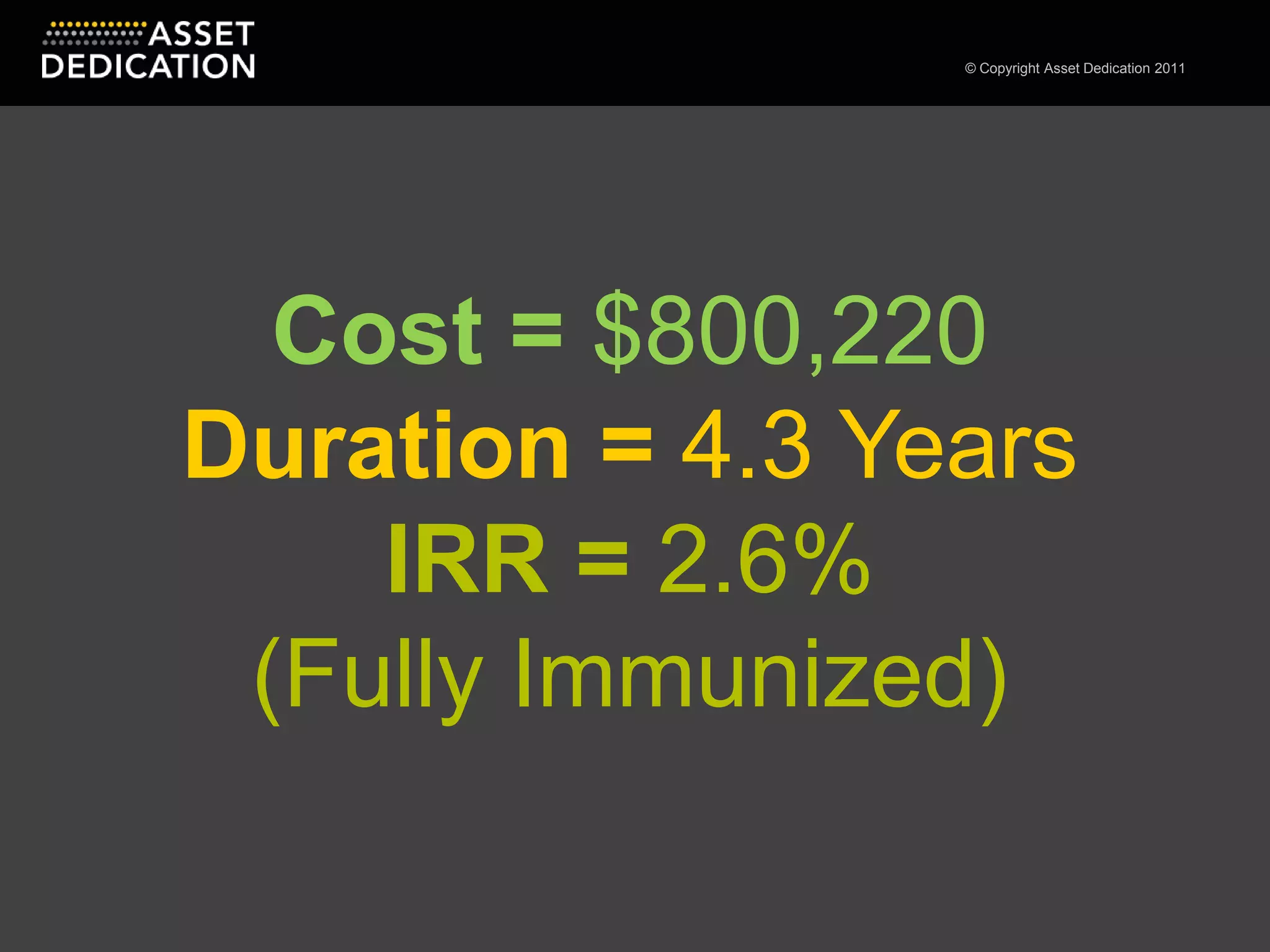

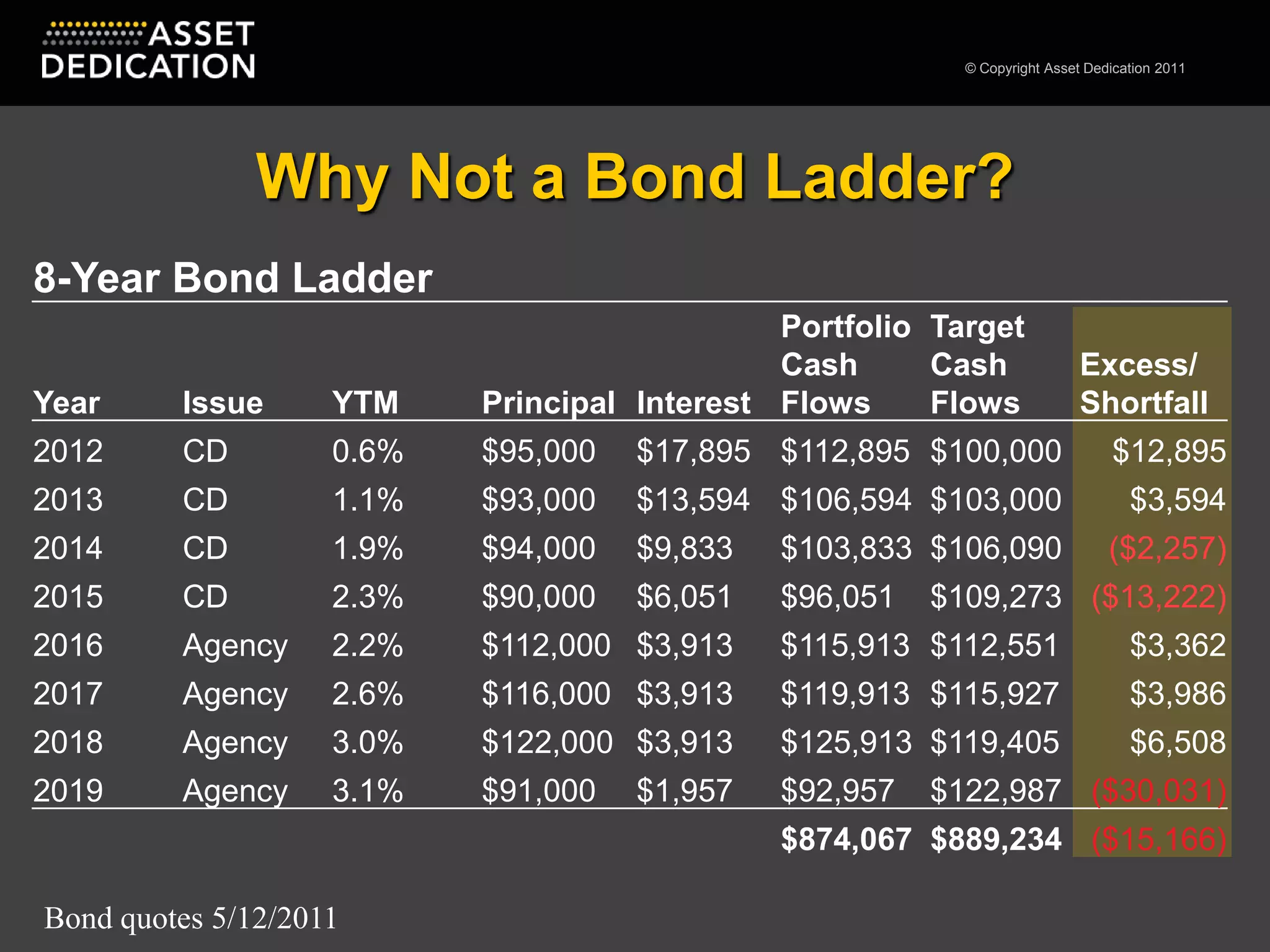

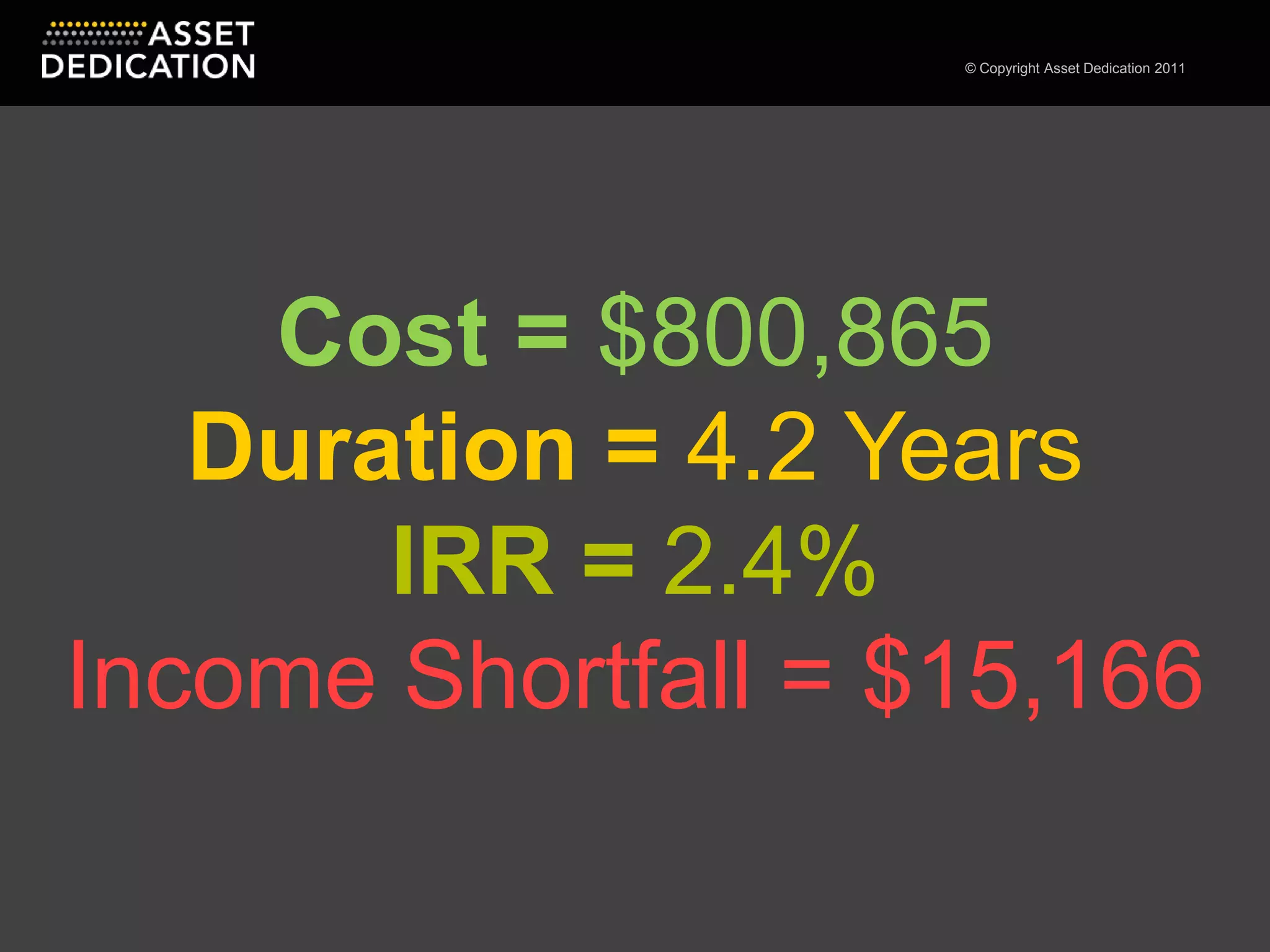

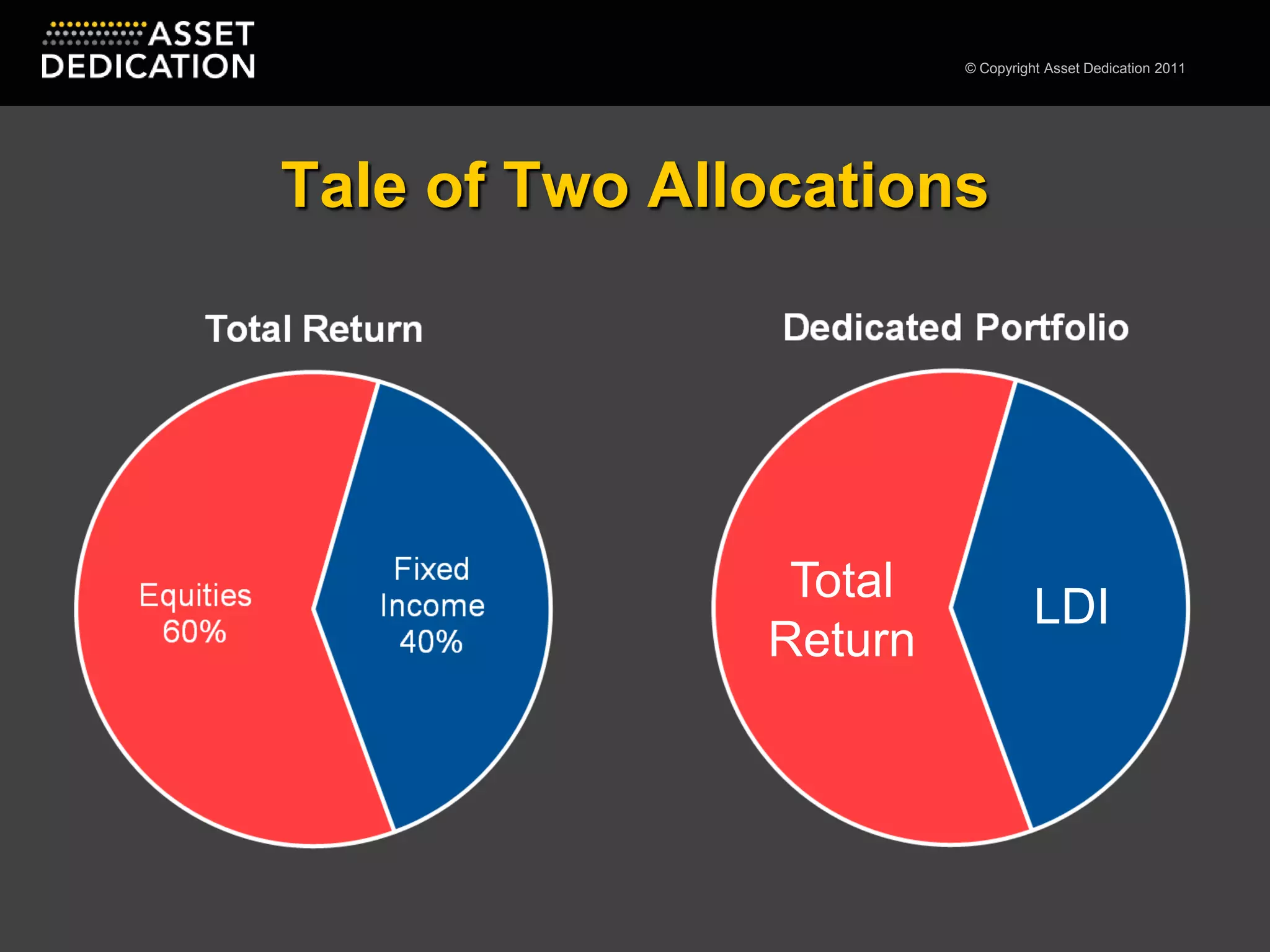

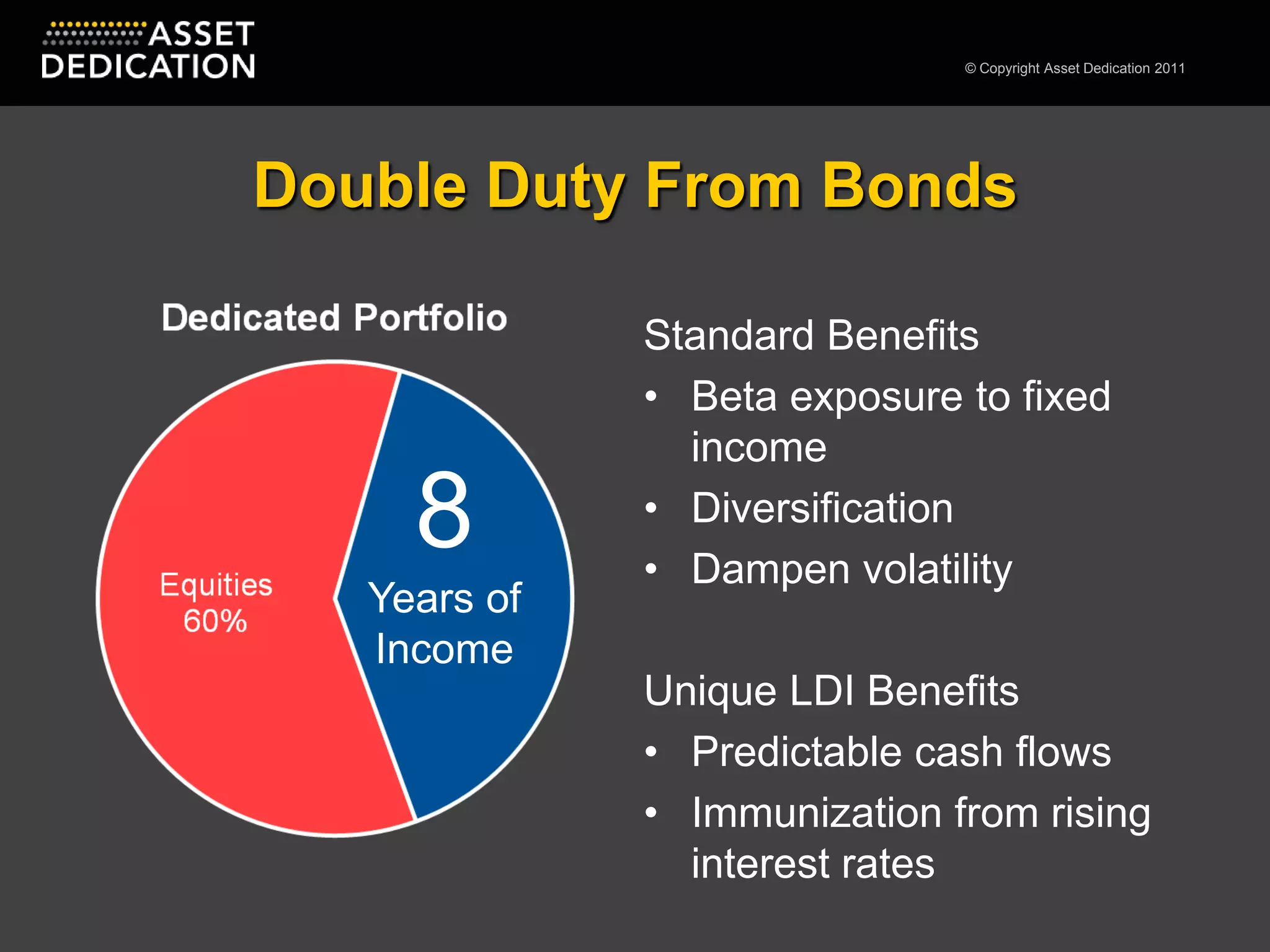

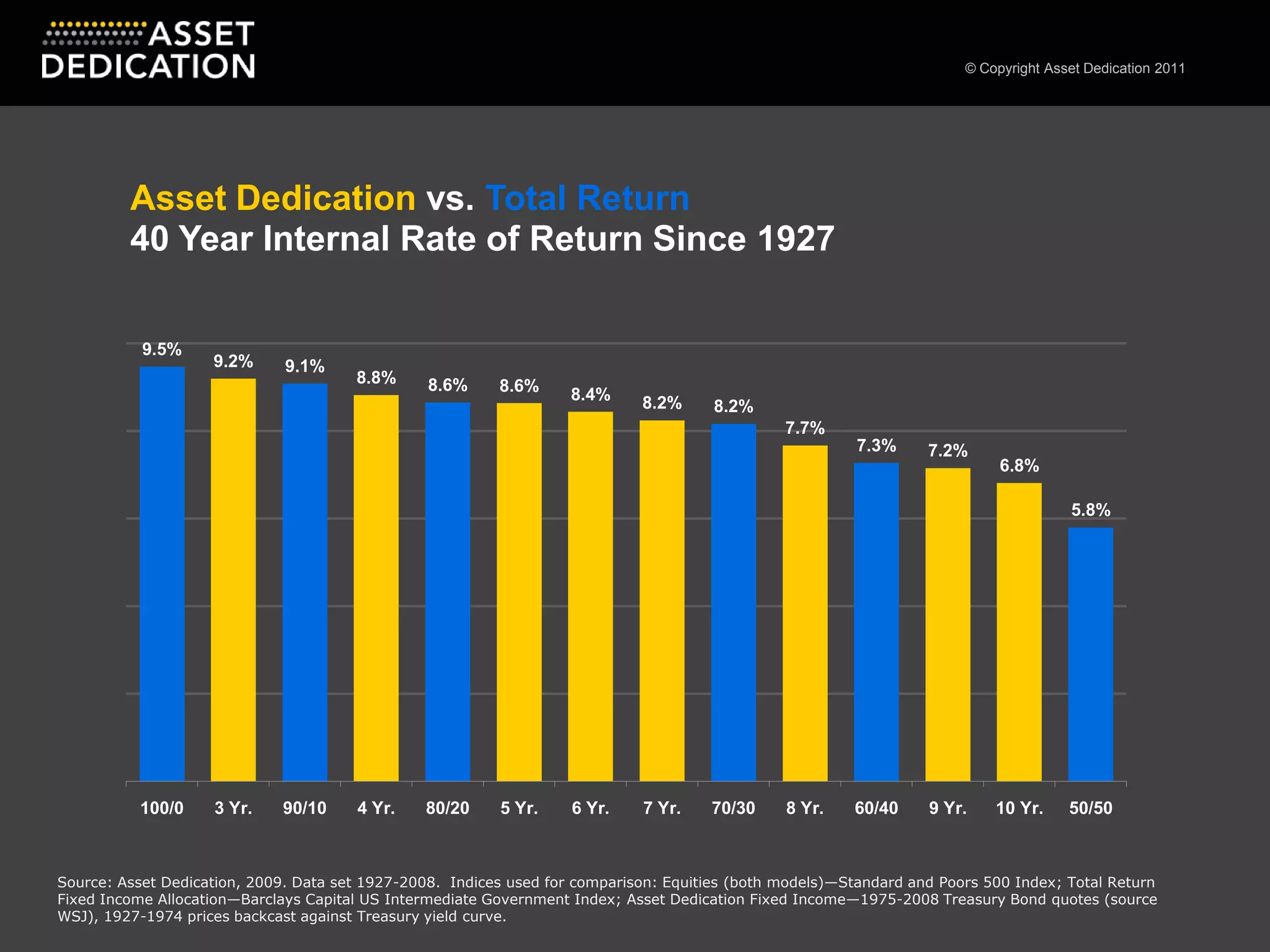

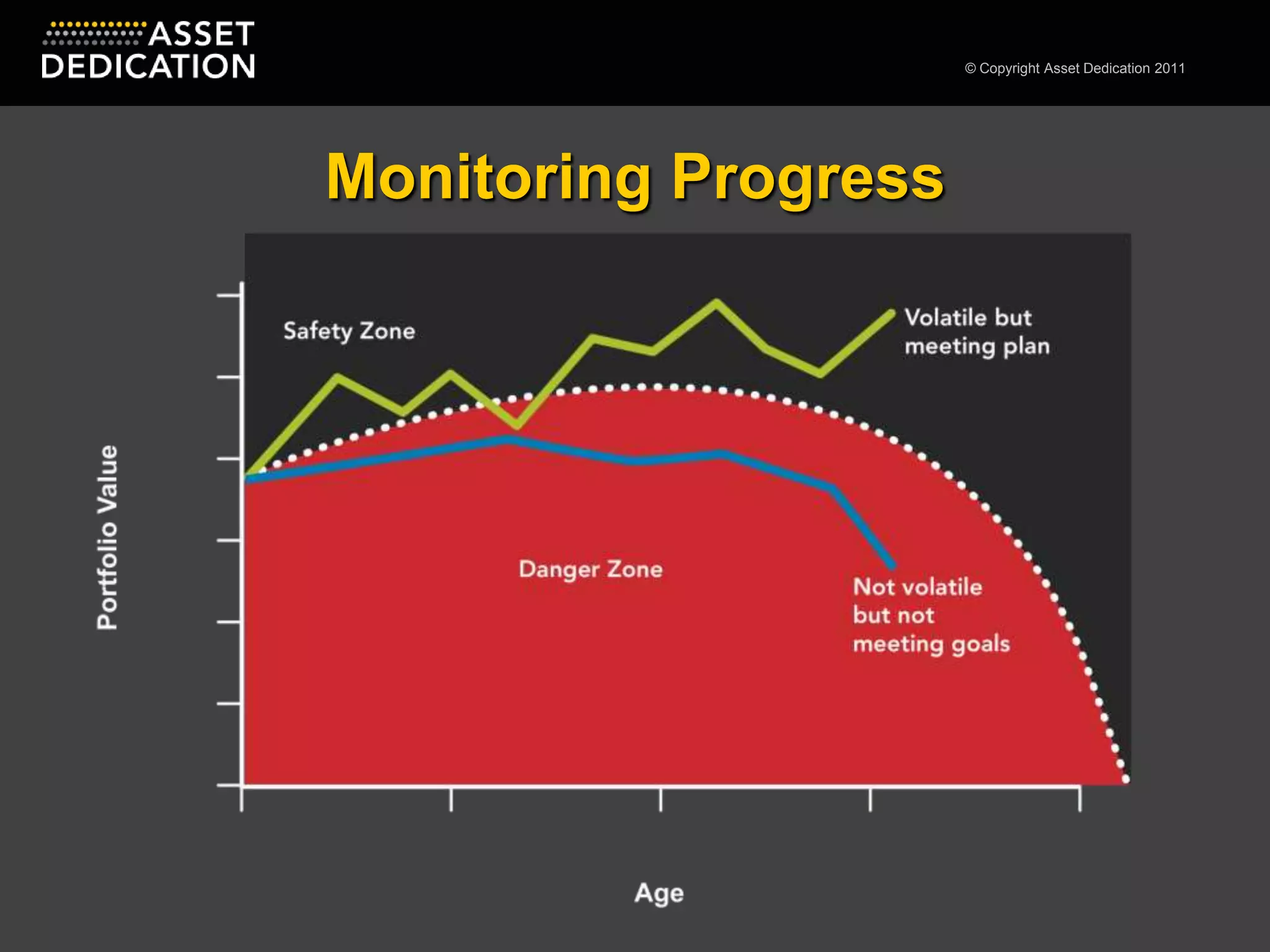

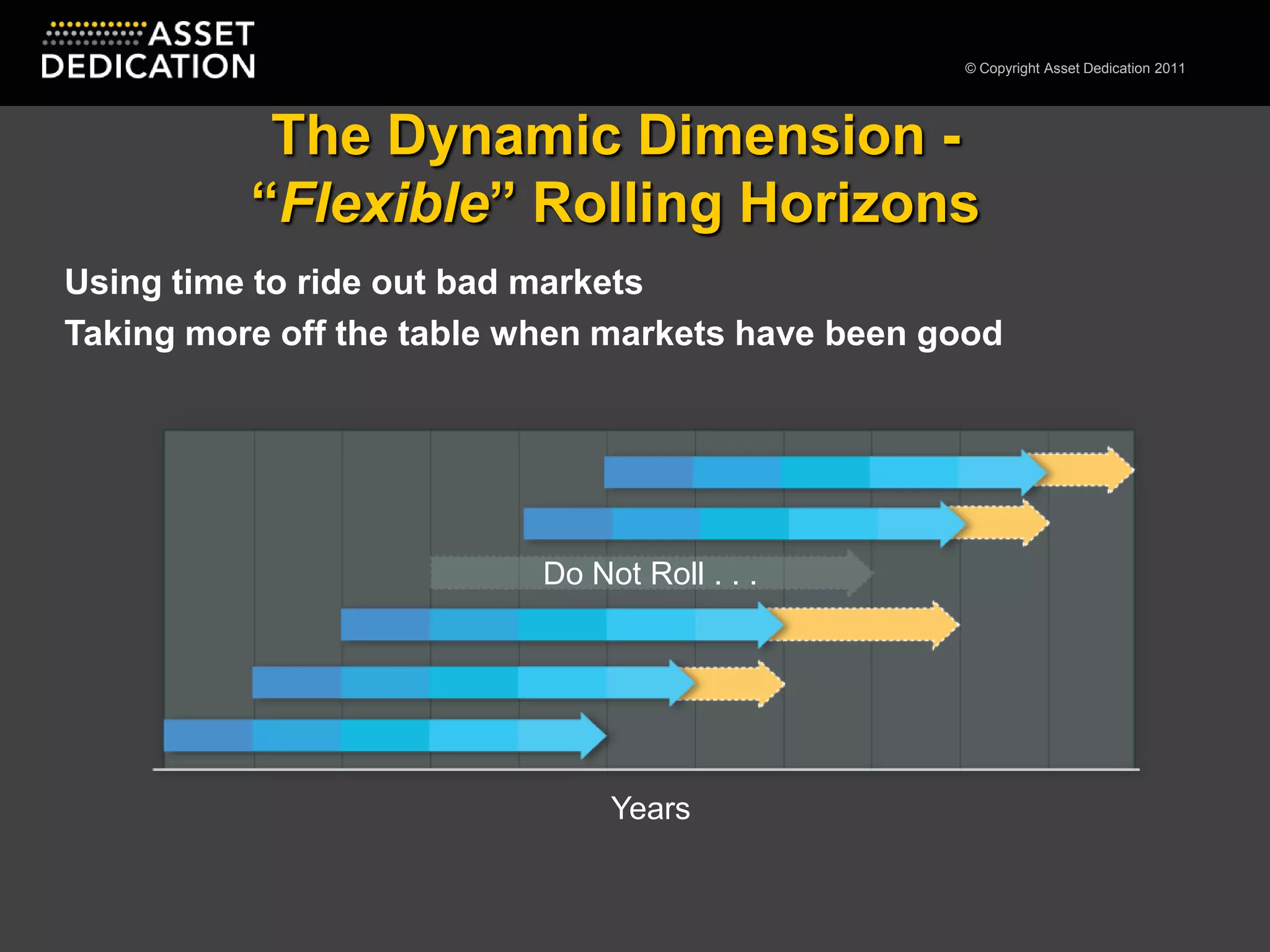

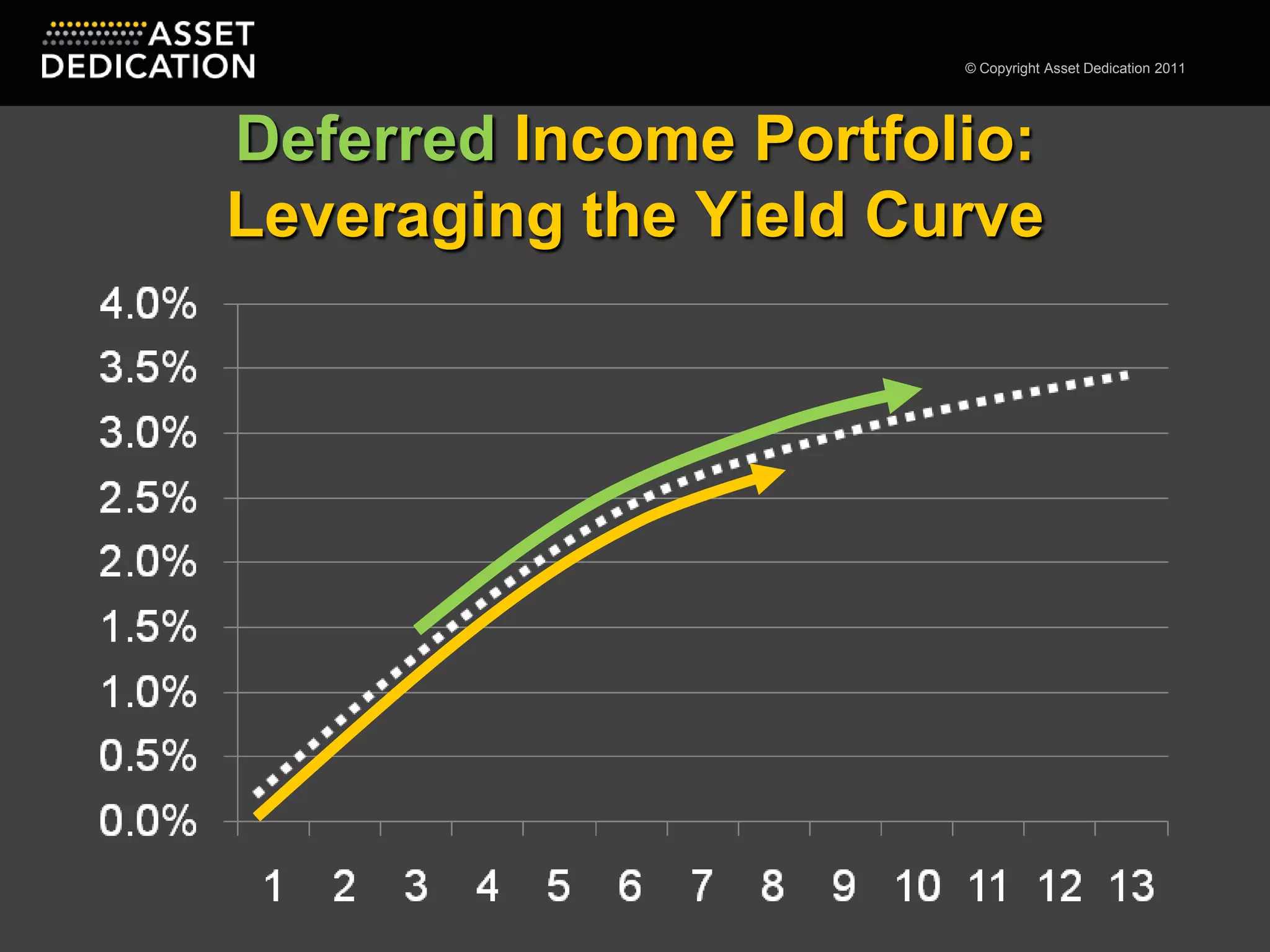

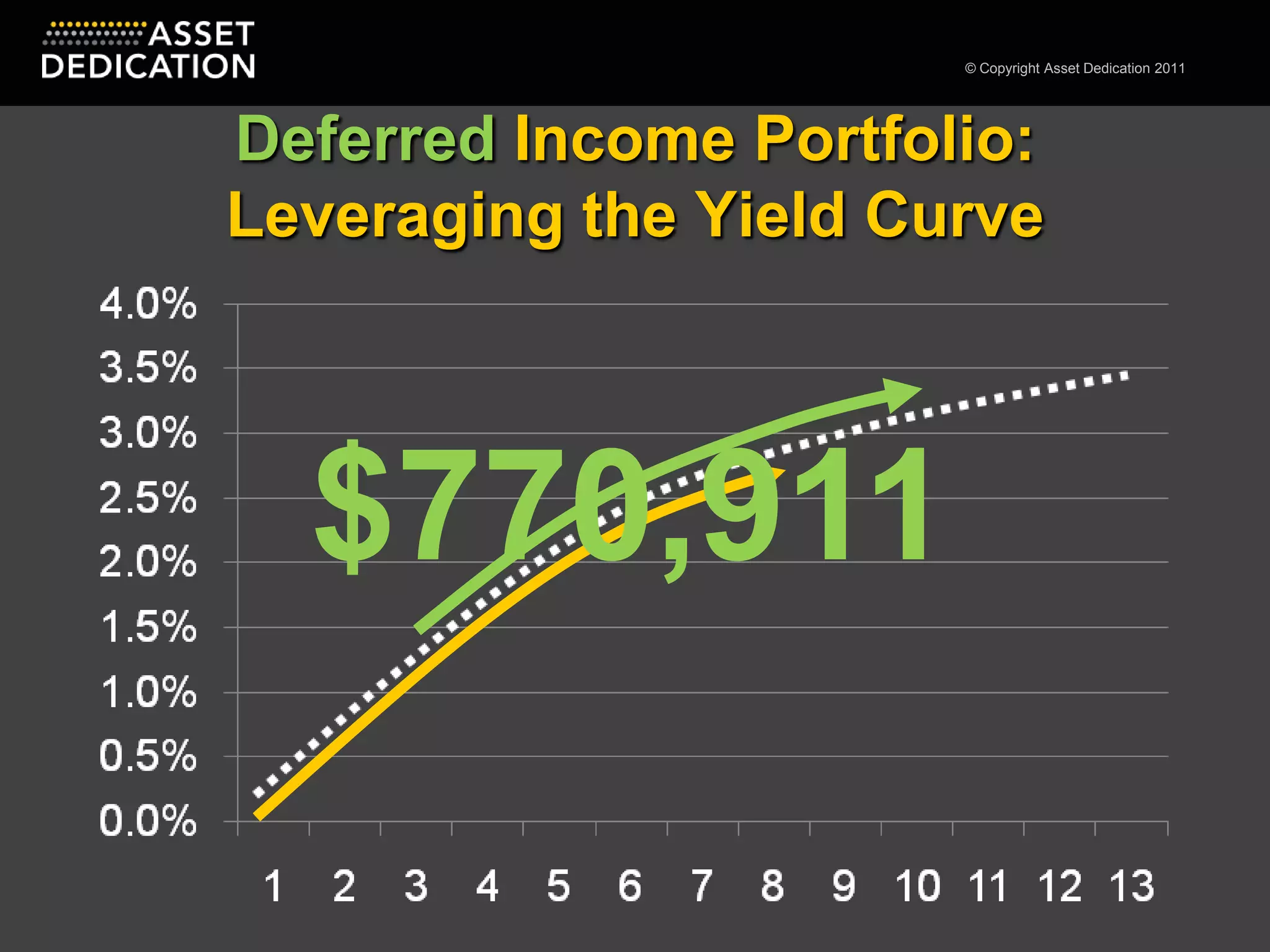

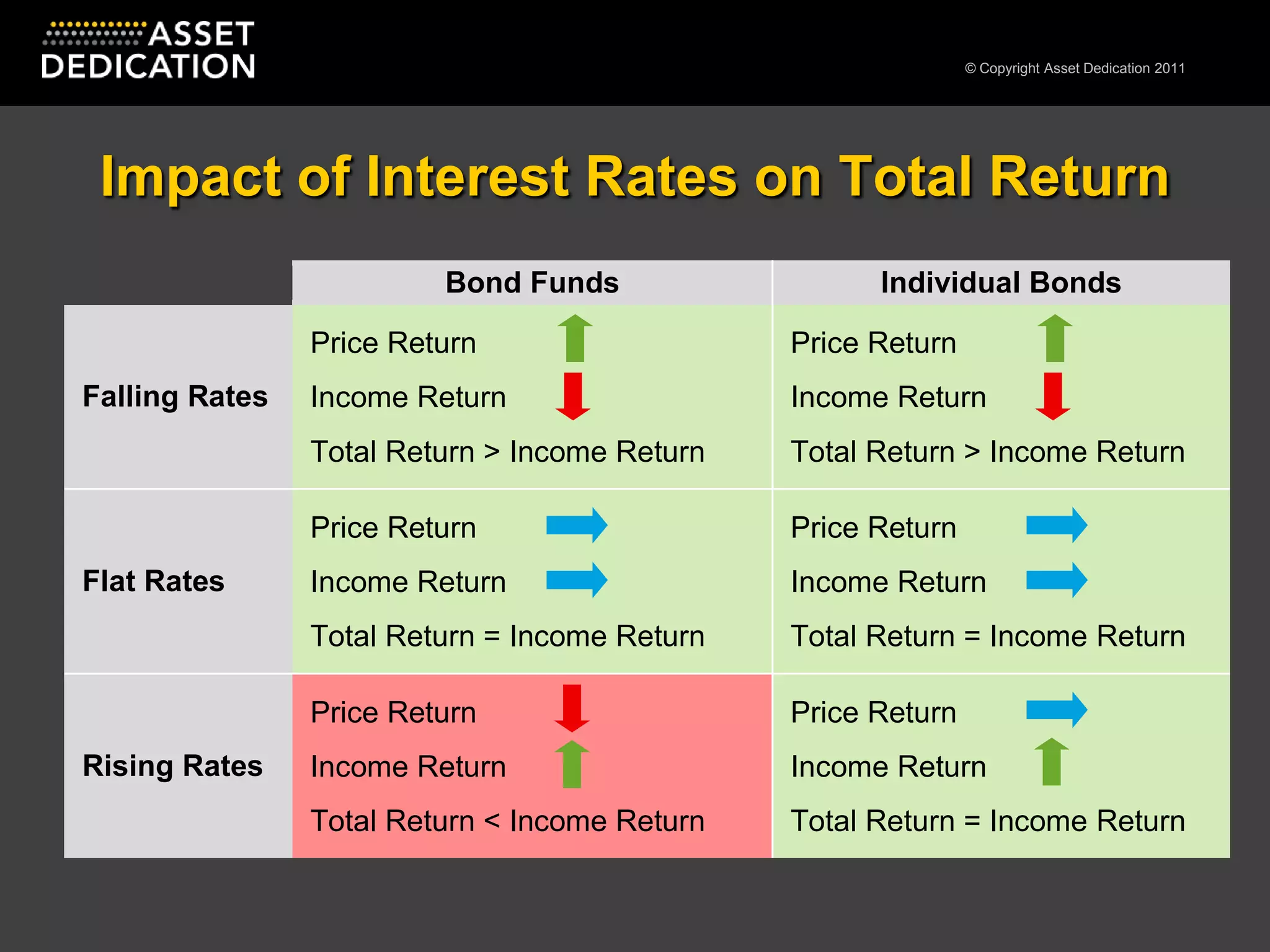

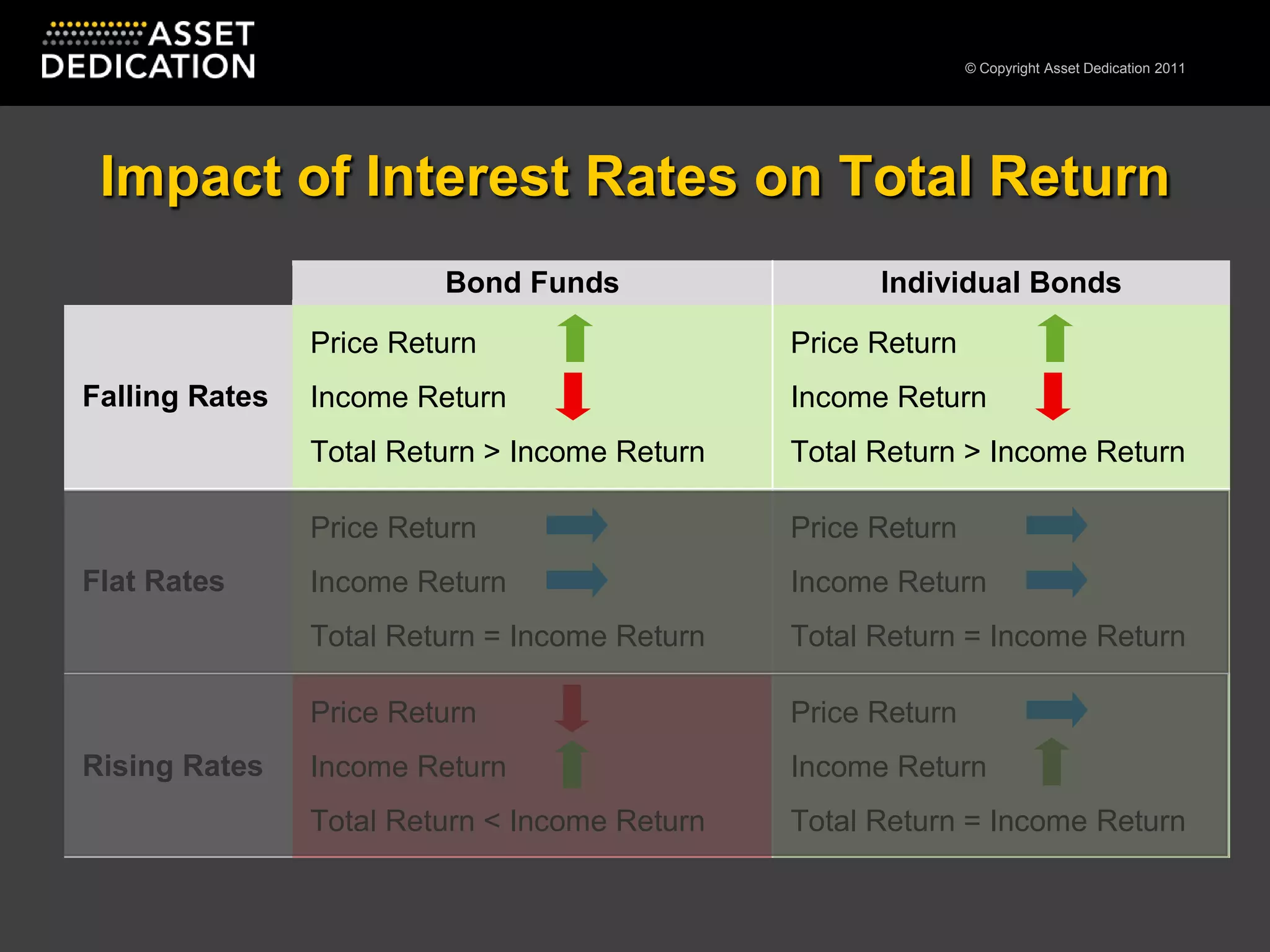

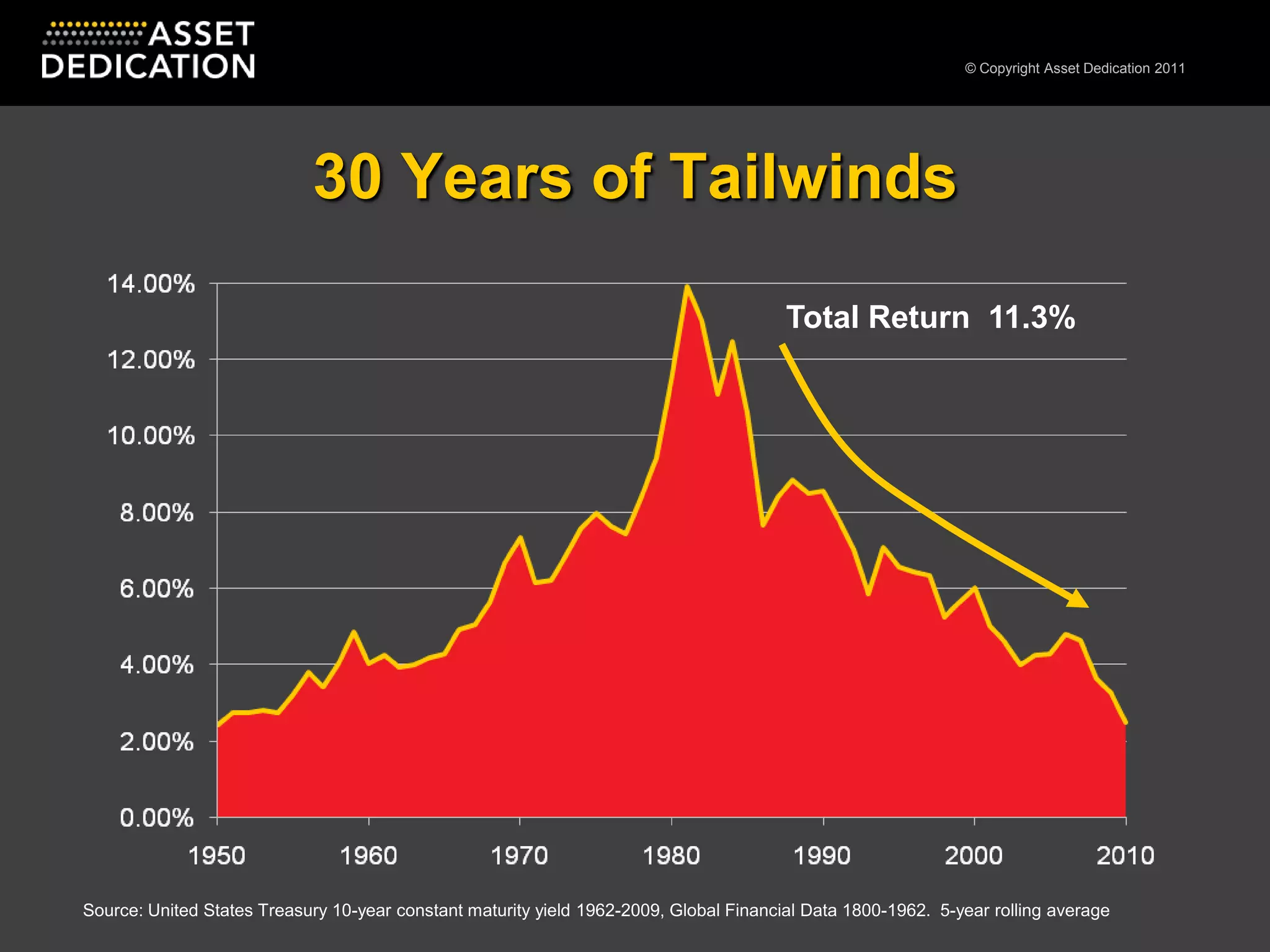

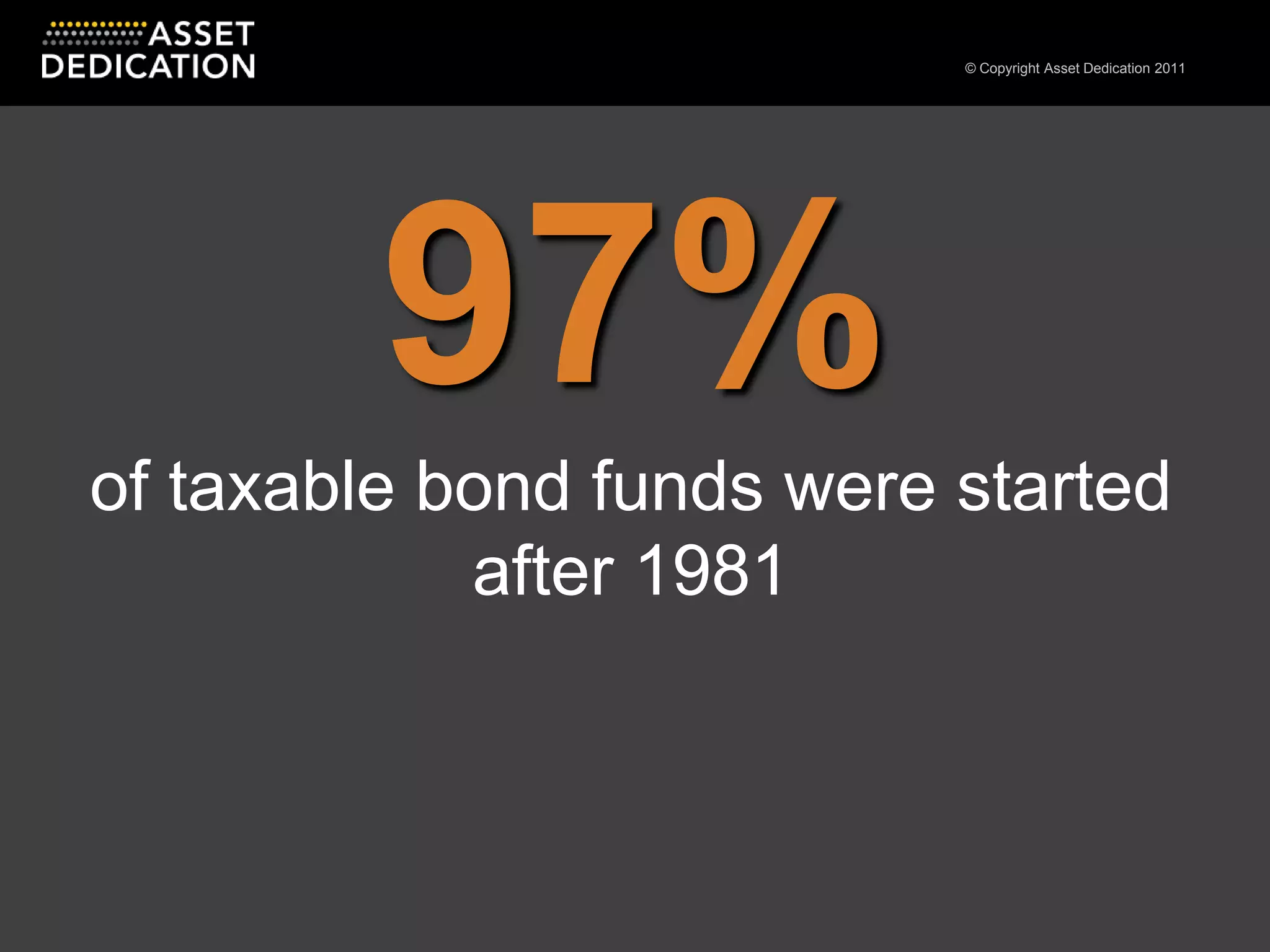

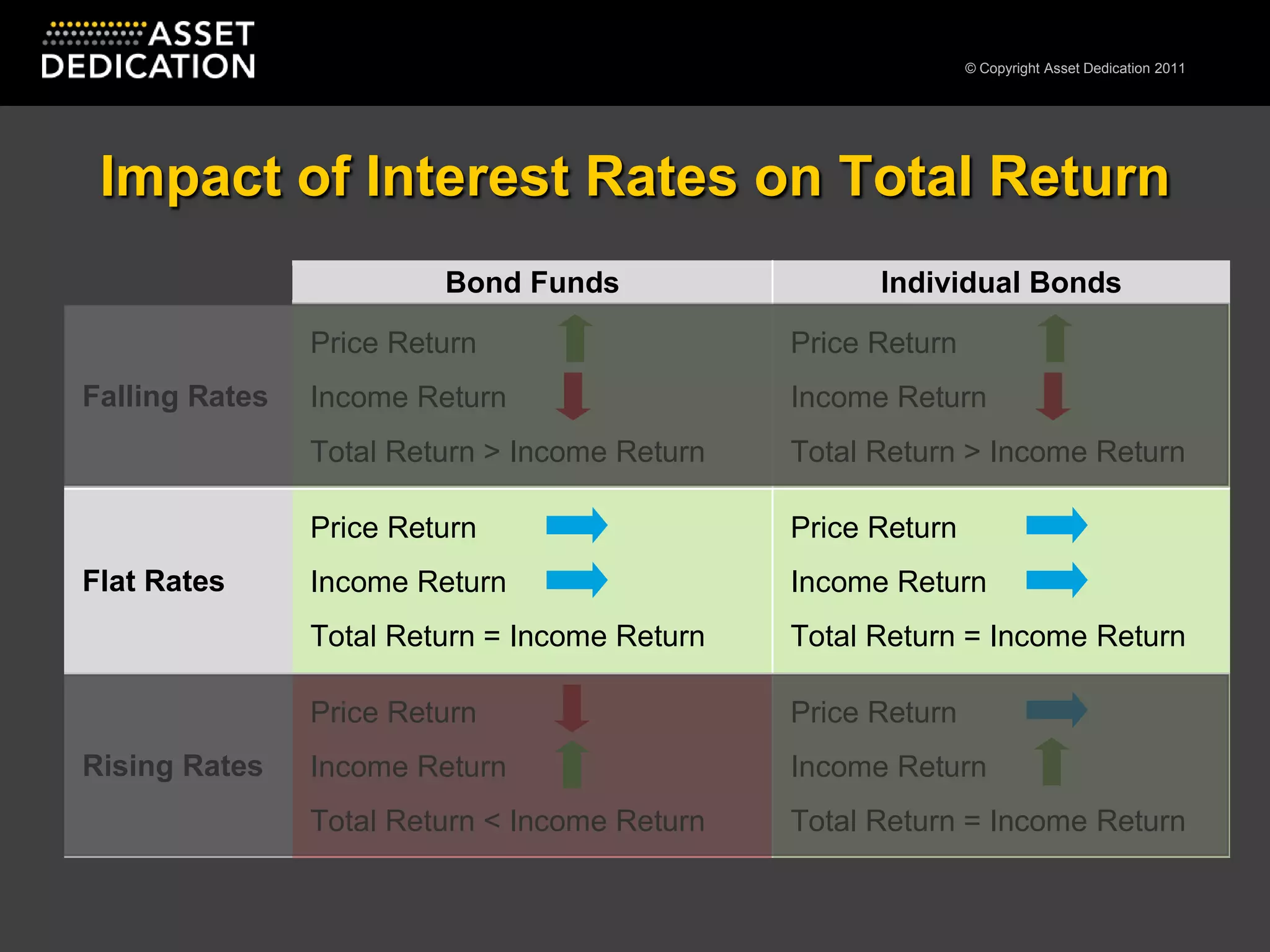

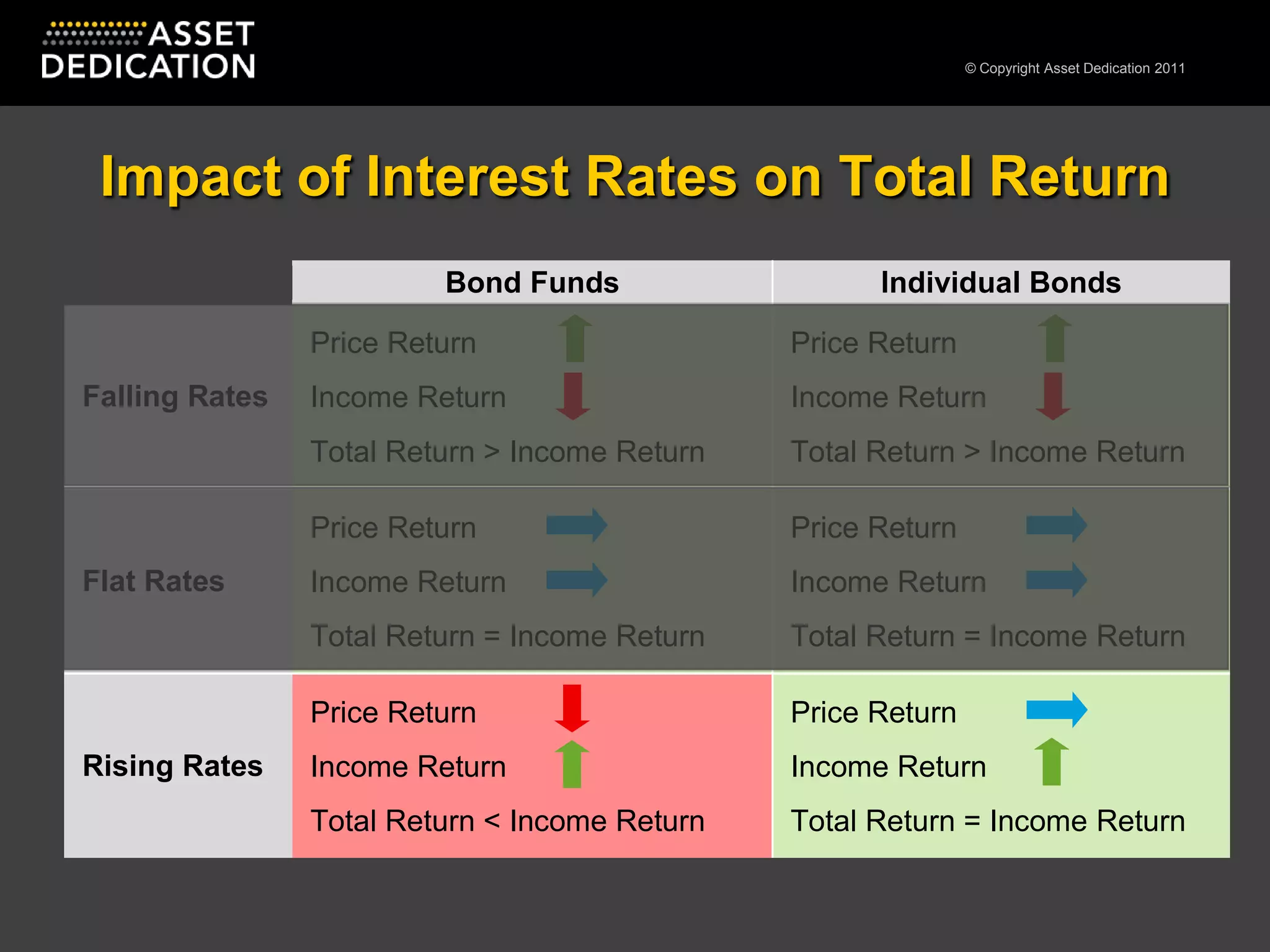

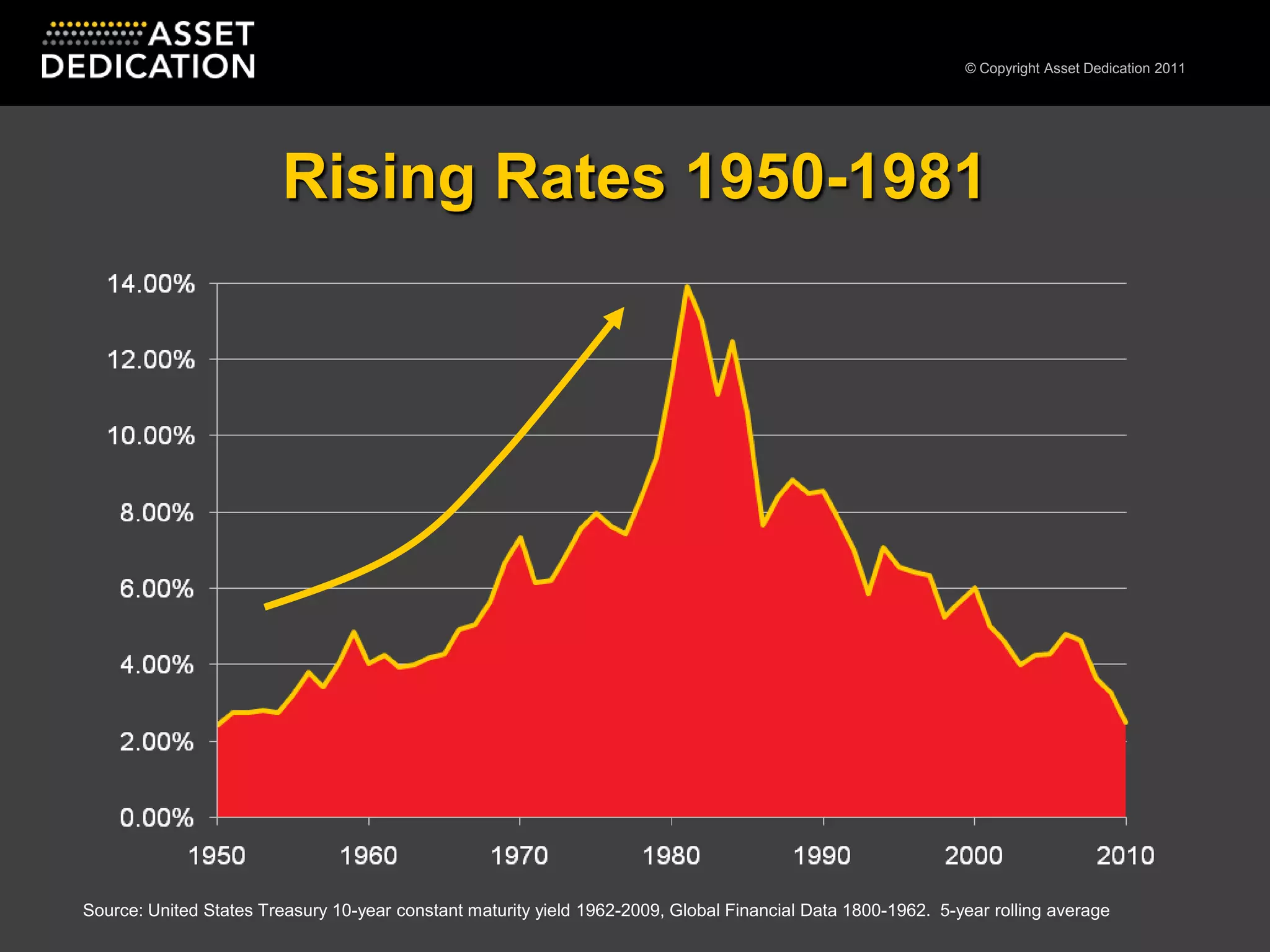

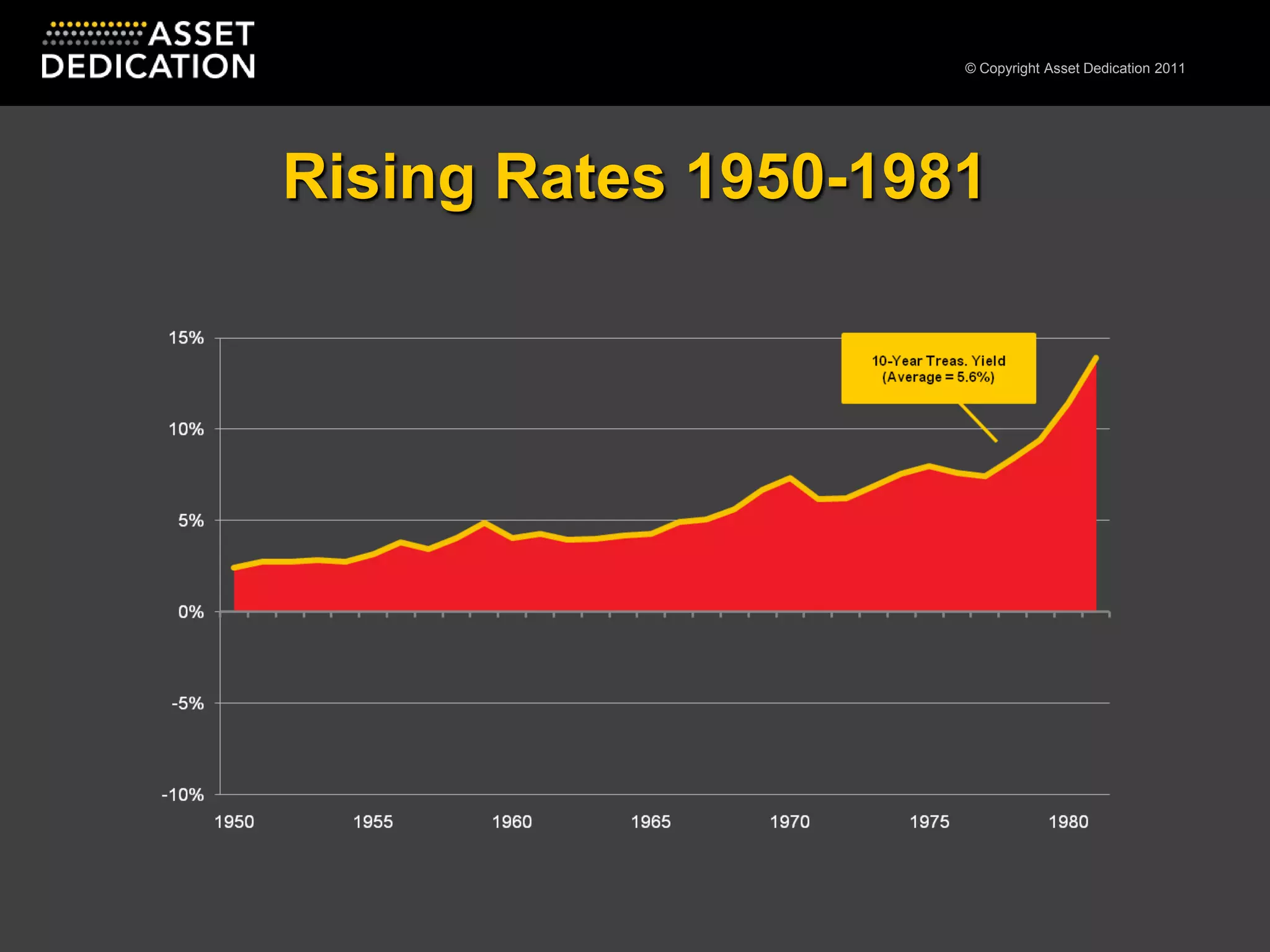

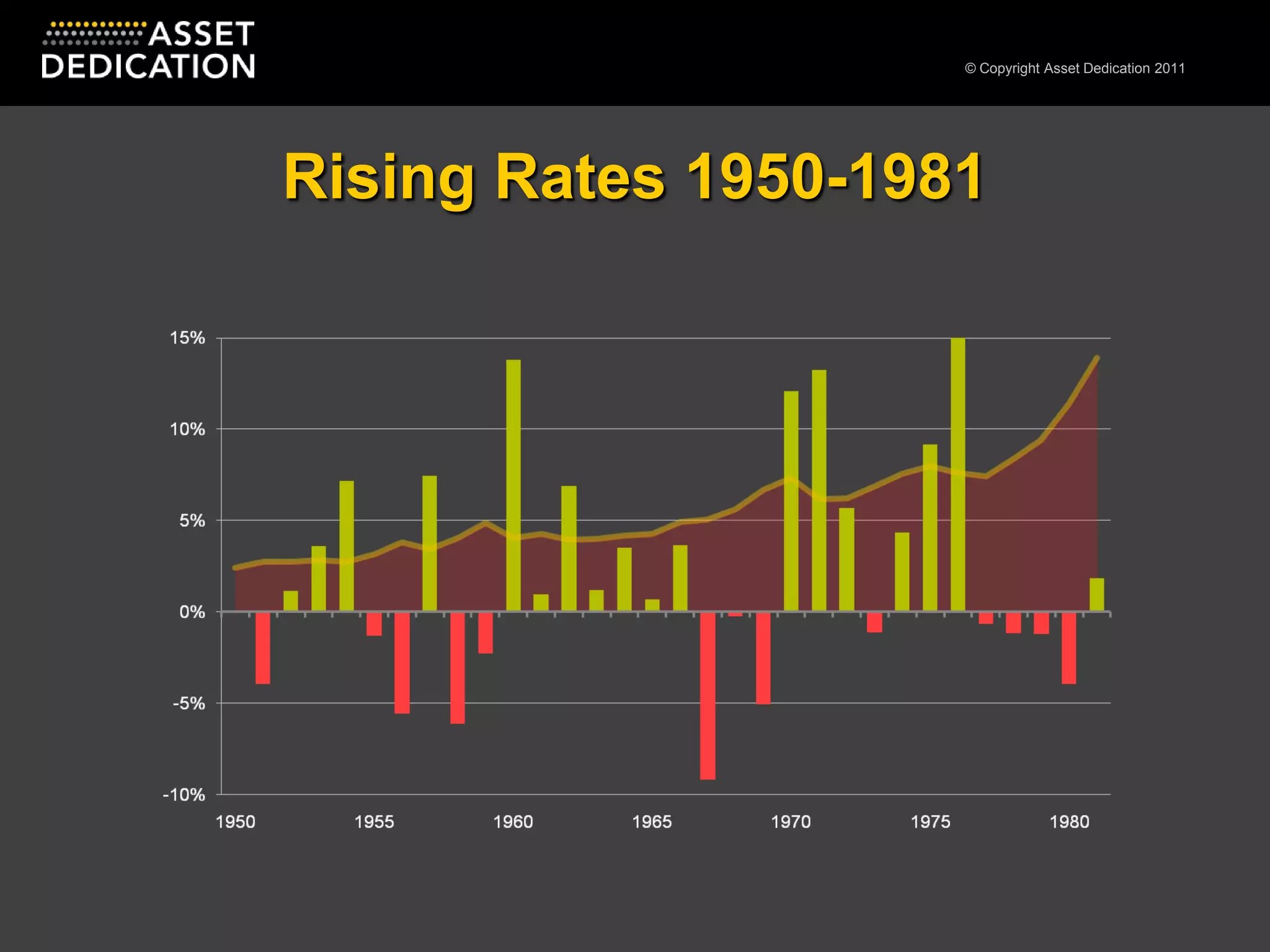

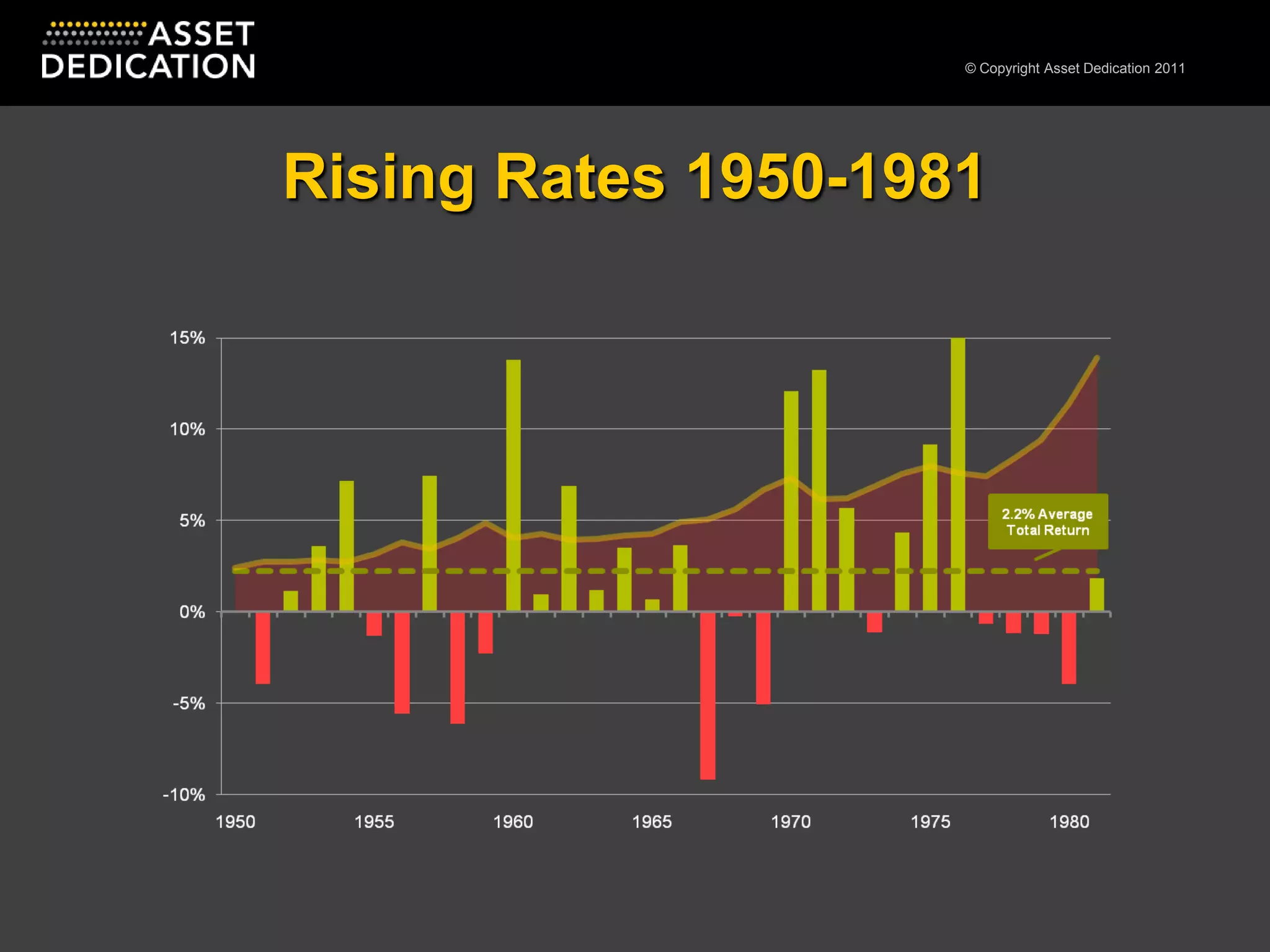

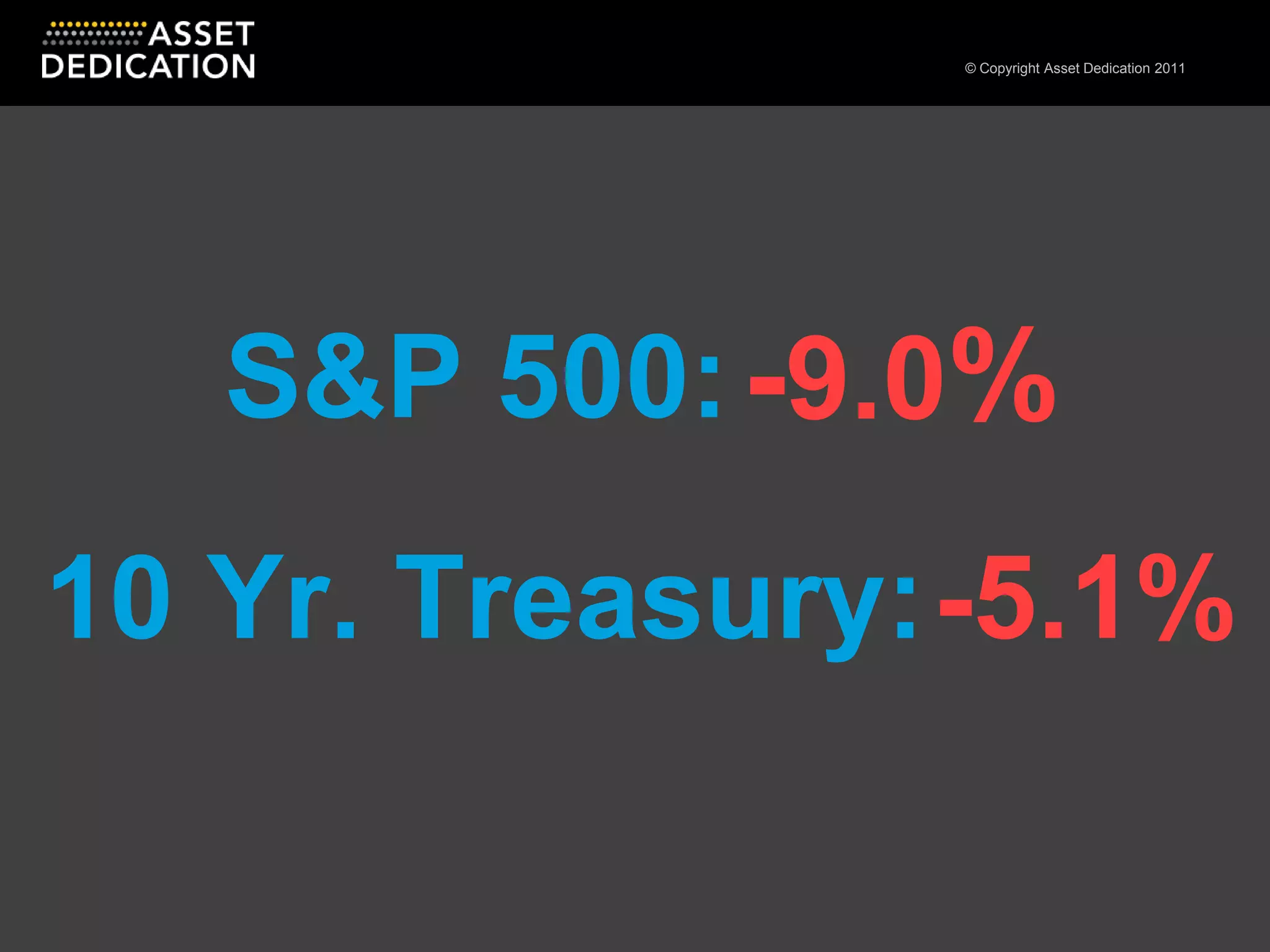

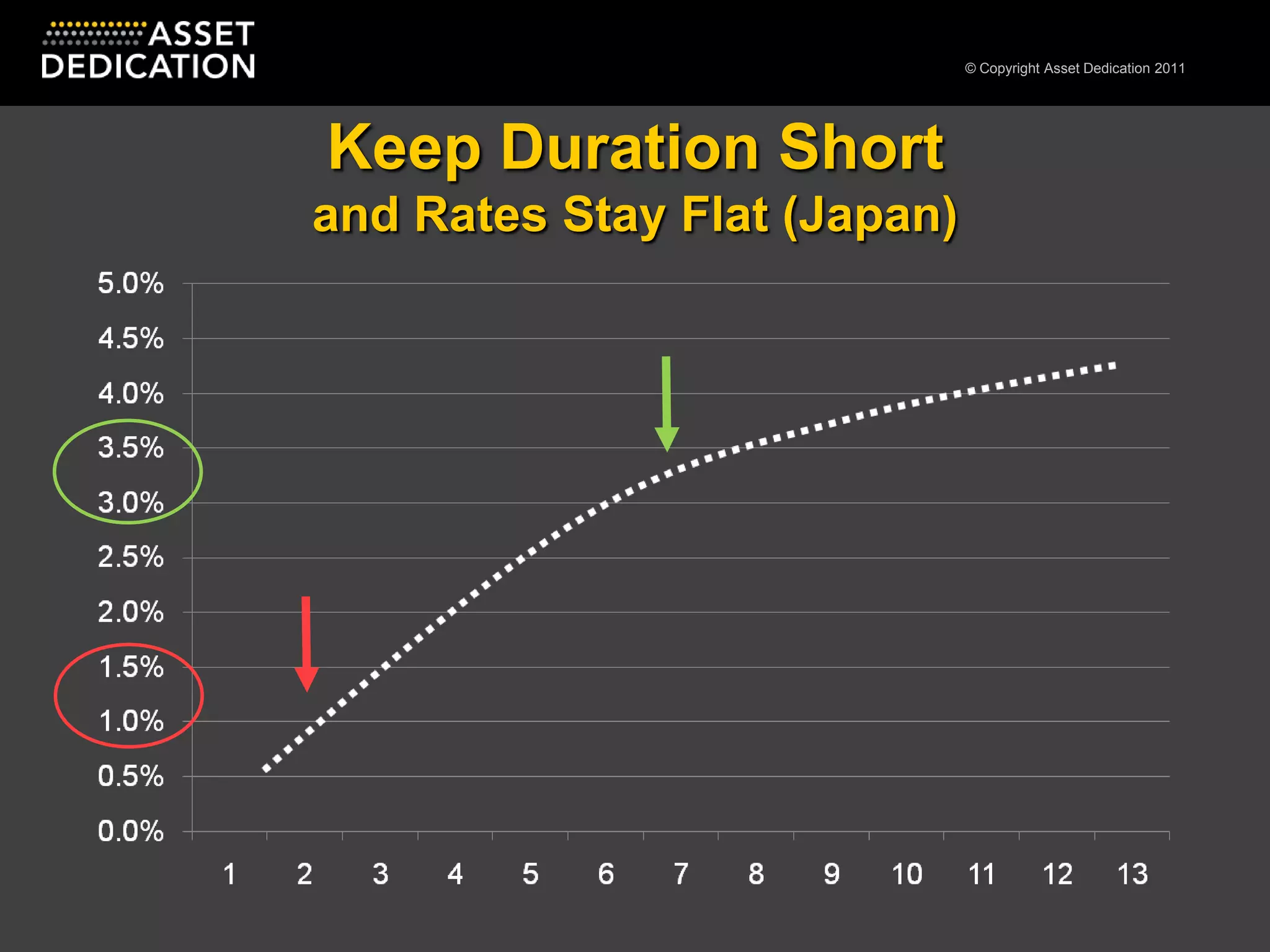

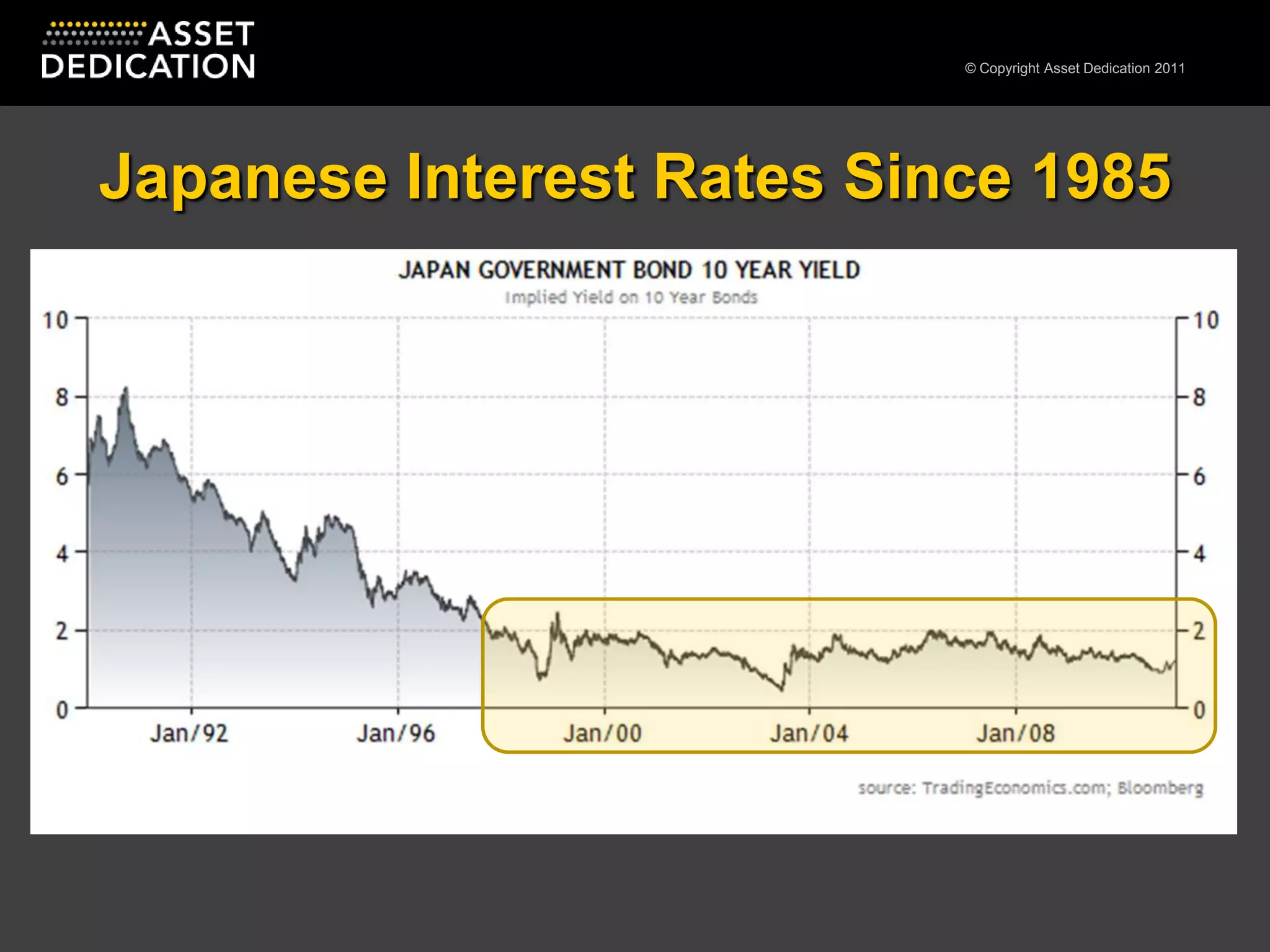

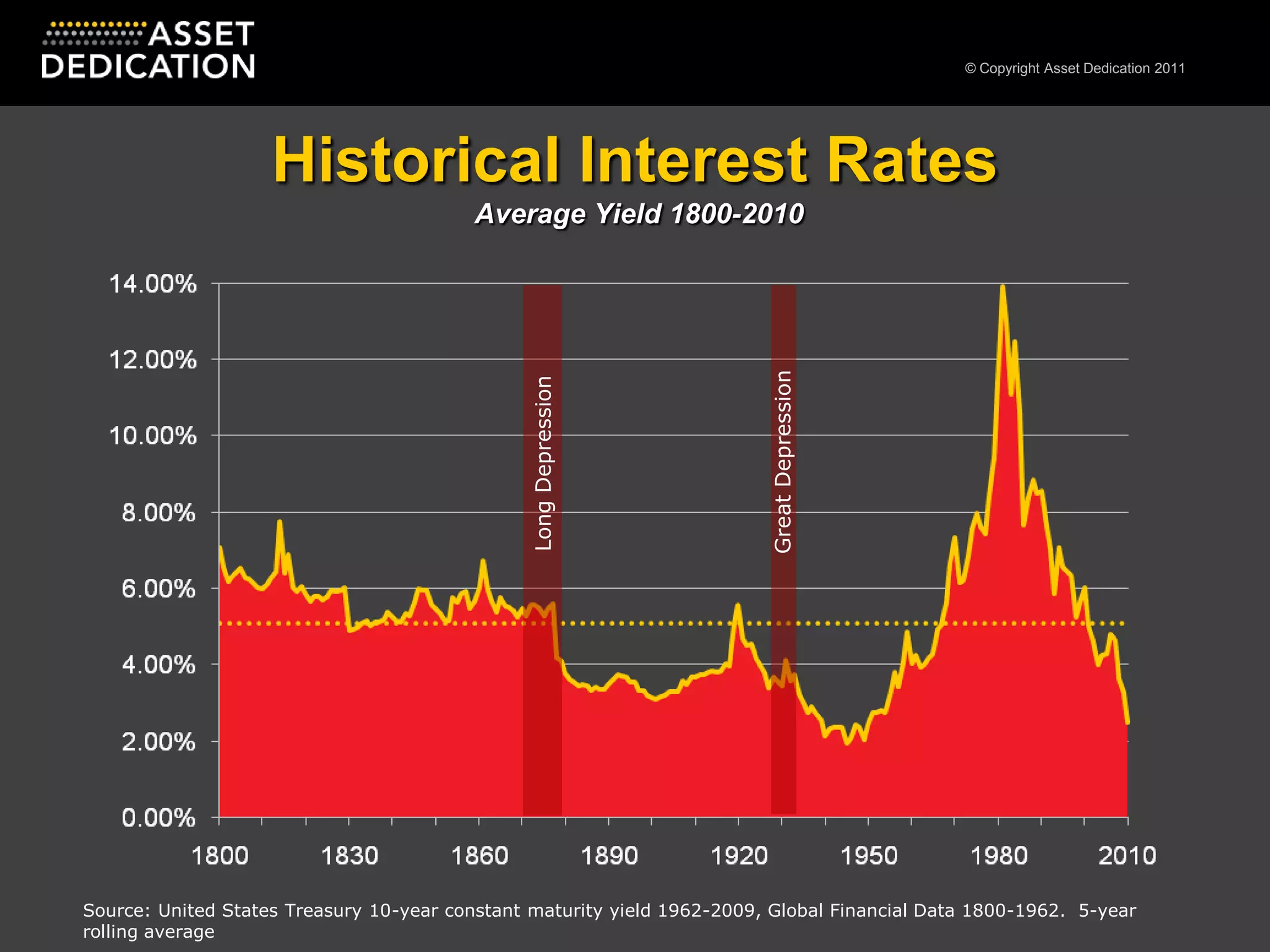

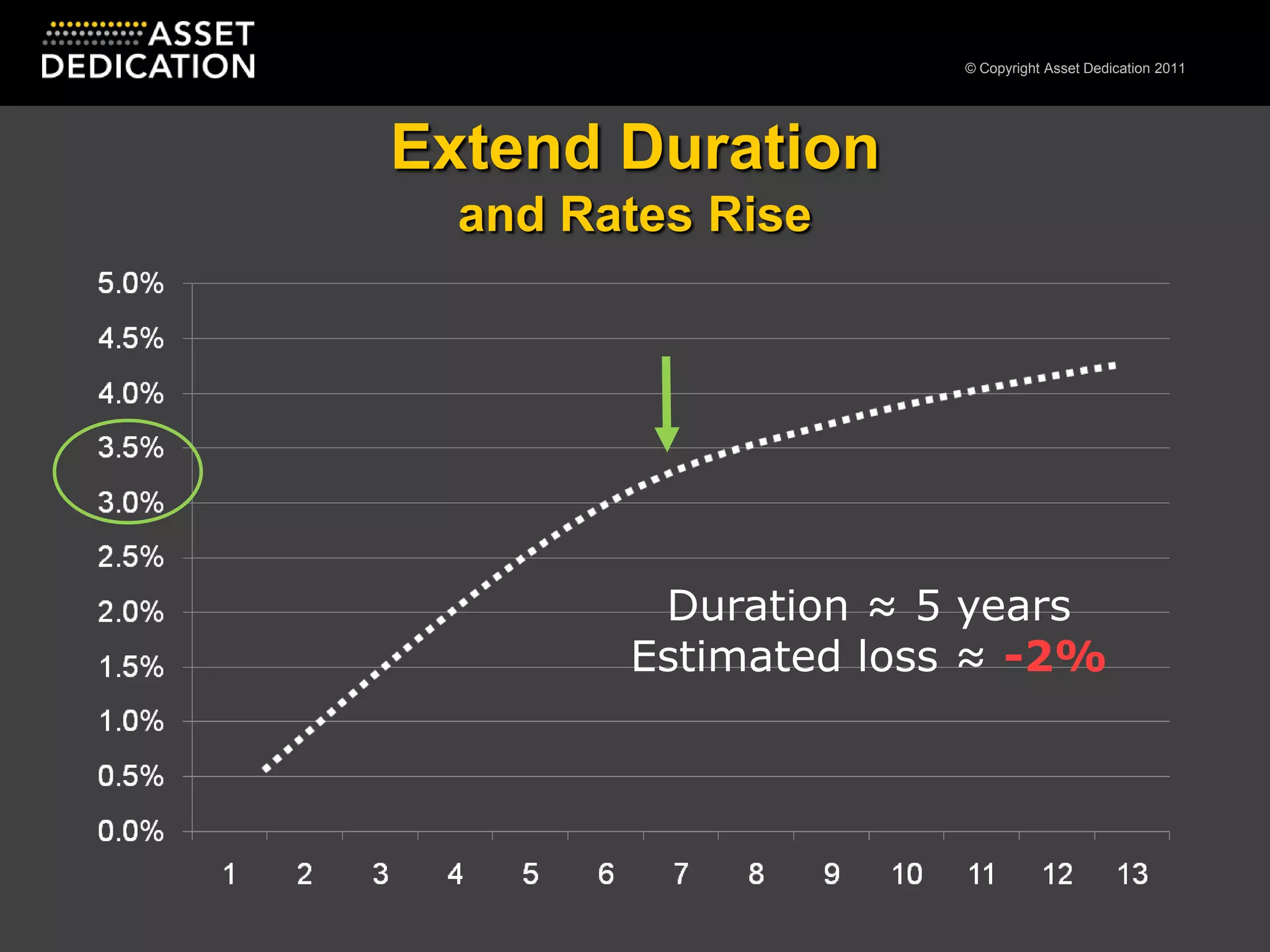

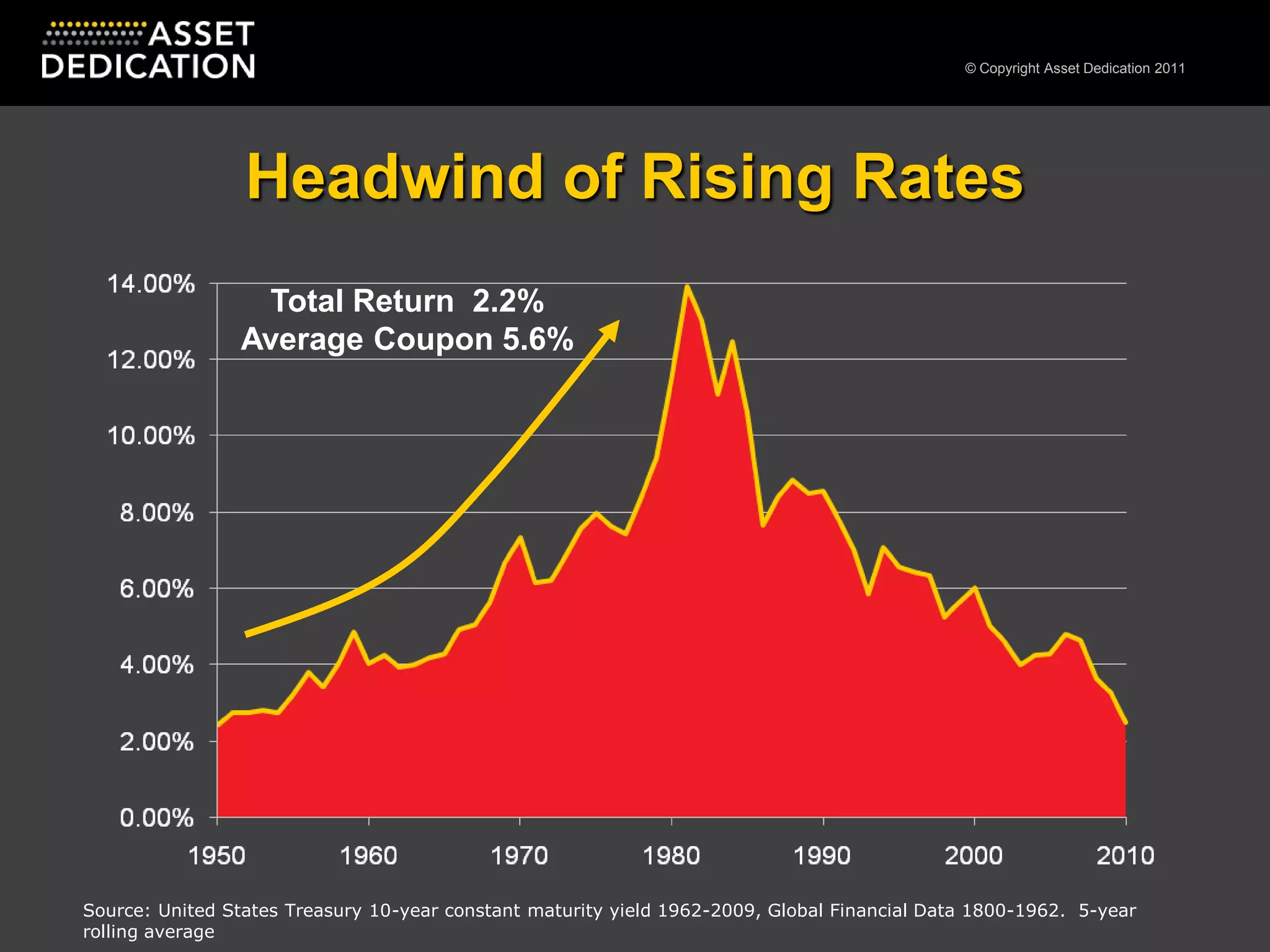

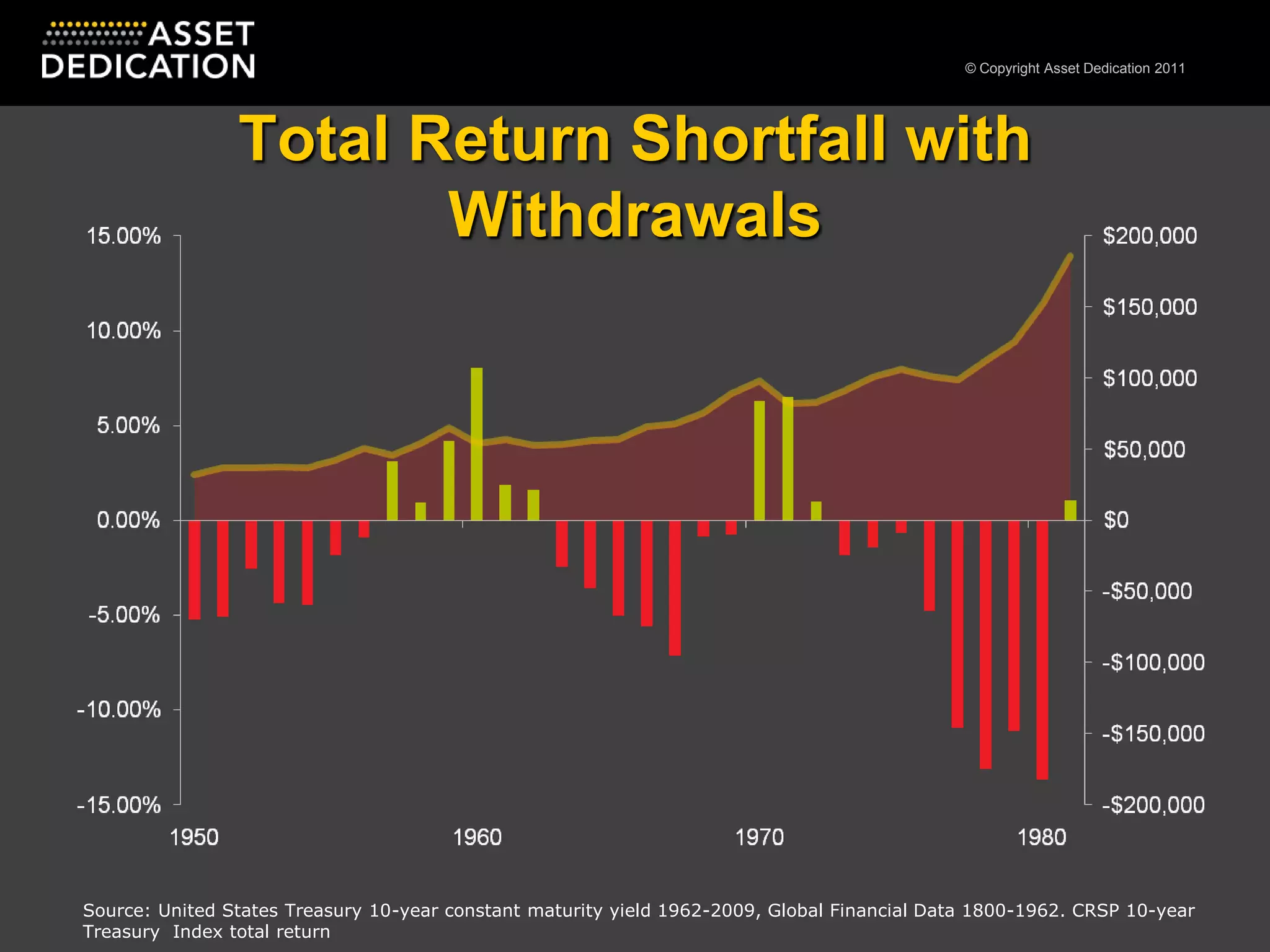

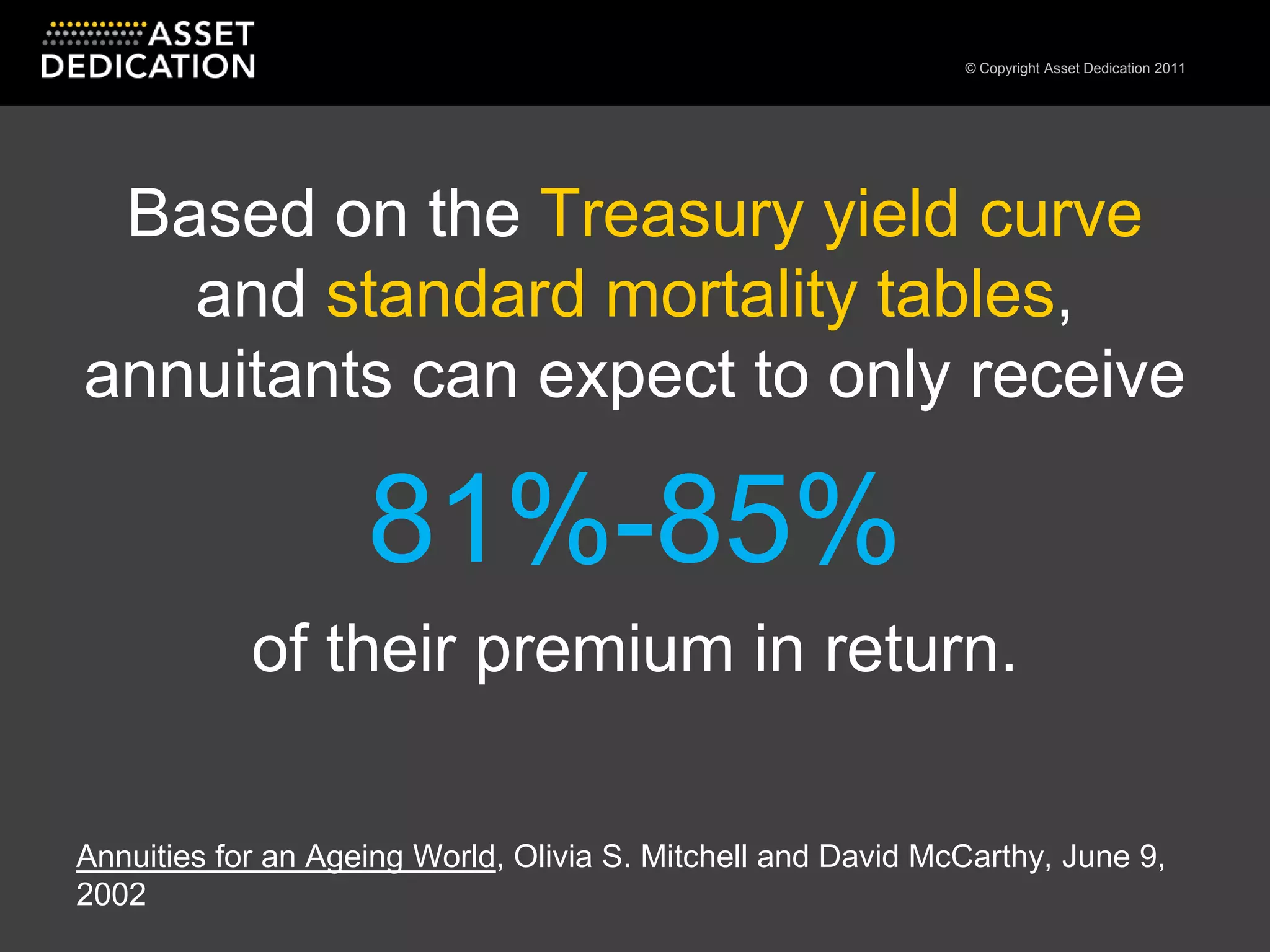

This document presents an alternative investment strategy called income matching using individual bonds. It describes how this strategy can provide predictable income streams through building portfolios of individual bonds that match a client's future cash flow needs. This strategy aims to immunize clients against interest rate risk by constructing bond portfolios with specific durations tailored to the timing of a client's expected expenses. It argues that individual bonds are better suited than bond funds or annuities for delivering reliable income due to risks such as fluctuating dividends, counterparty risk, and losses during periods of rising interest rates.