The document discusses several key issues in evaluating active manager skill:

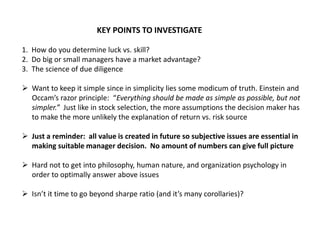

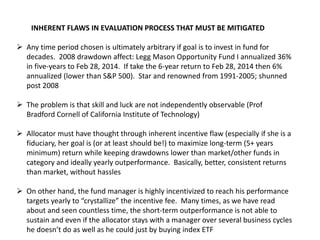

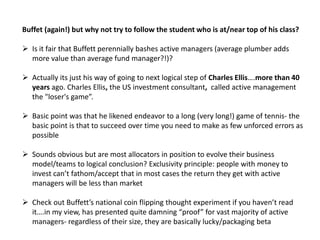

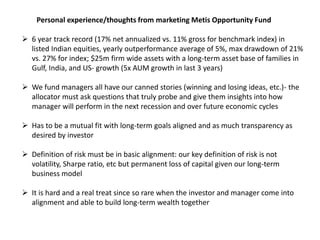

1) It is difficult to determine what is due to luck versus skill when evaluating manager performance.

2) Both large and small managers may have advantages, and simple metrics like Sharpe ratio are insufficient.

3) Manager evaluations should consider future performance over long time horizons, as well as inherent incentive structures, rather than just short-term past returns. Aligning investor and manager goals and definitions of risk is important for successful long-term partnerships.