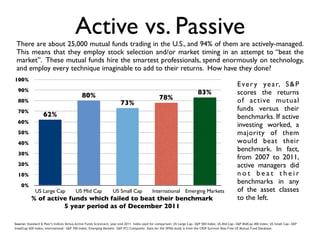

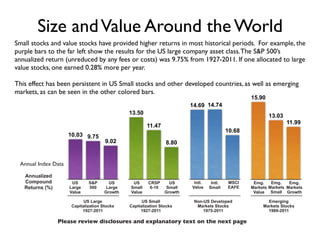

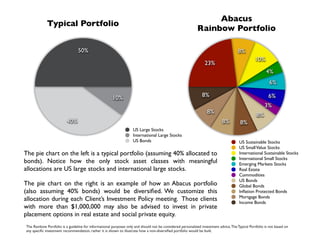

The document discusses strategies for creating an investment portfolio based on Nobel Prize-winning academic research. It recommends structuring portfolios to take advantage of factors like company size, relative price, and profitability that have been shown to increase returns. Specifically, it suggests investing more in small and value stocks, as both have higher returns than large or growth stocks over the long run. The document also provides examples of model portfolios that diversify across global stock and bond index funds targeting these factors.