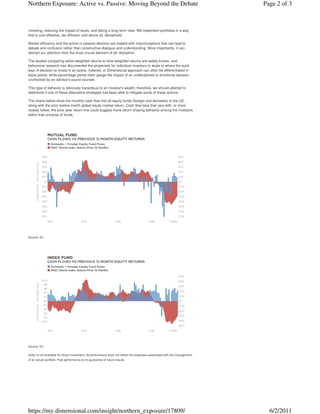

The document discusses the active vs. passive investing debate, emphasizing that the focus should be on providing sound, disciplined advice to clients rather than getting bogged down in technical discussions about market efficiency. It highlights the dangers of speculation and the importance of diversification and controlling transactional costs. Additionally, the document points out that well-informed advisors can help clients remain disciplined through market fluctuations, ultimately benefitting their investment experience.