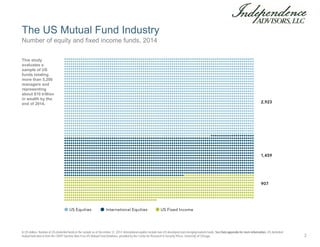

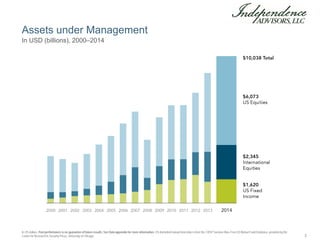

The US mutual fund report analyzed over 5,200 funds representing $10 trillion in assets. It found that:

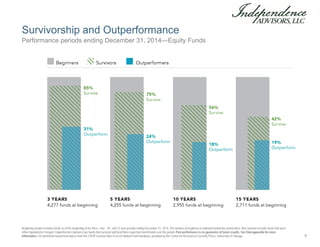

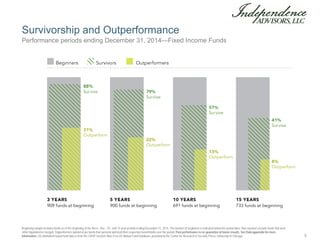

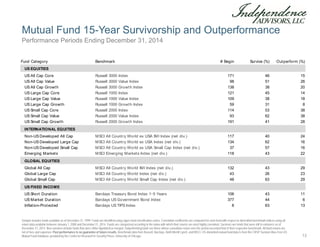

- Most funds underperformed their benchmarks over periods of 3-15 years. Survivorship rates declined over longer periods, while outperformance rates were generally below 25%.

- Funds with strong recent performance often regressed to the mean in subsequent periods, showing past success did not predict future success.

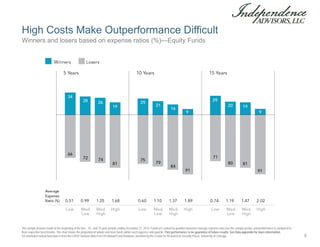

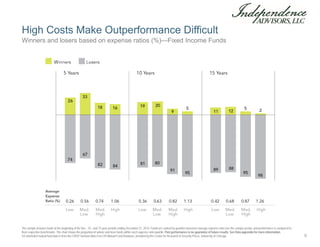

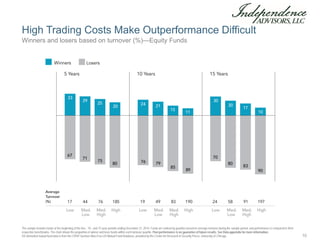

- High-cost and high-turnover funds tended to underperform more, suggesting expenses and trading hurt performance.

So while market efficiency makes outperformance difficult, investors should consider factors like costs, strategy, and objectives rather than just focusing on past returns.