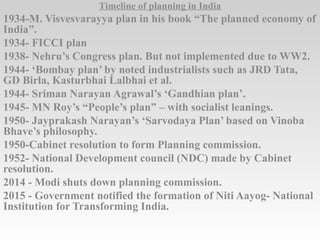

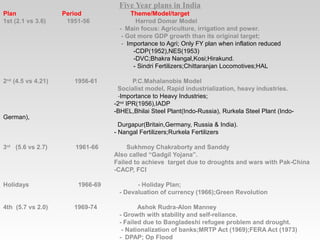

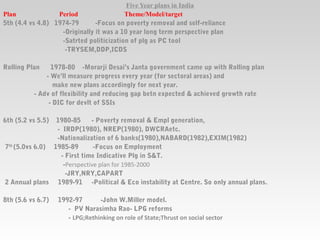

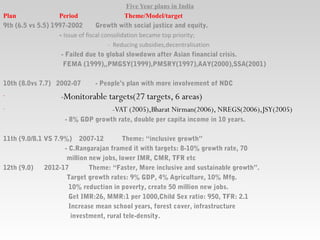

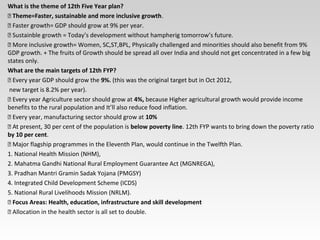

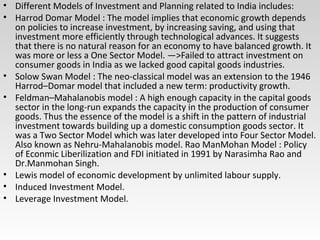

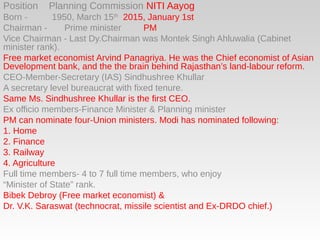

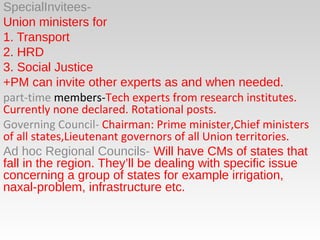

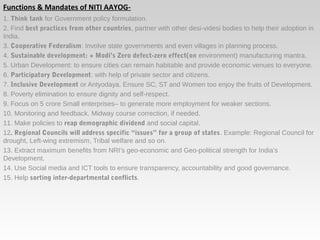

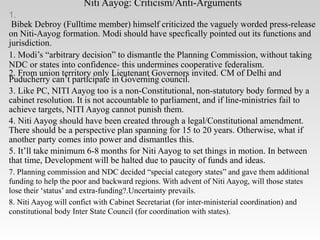

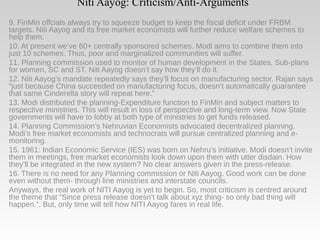

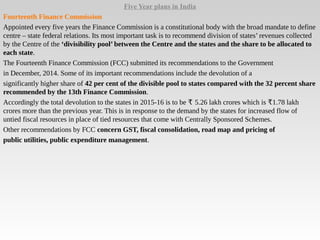

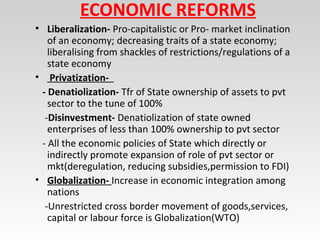

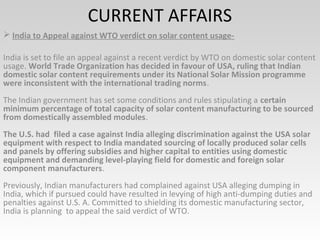

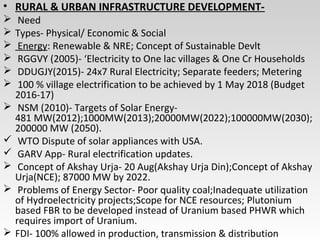

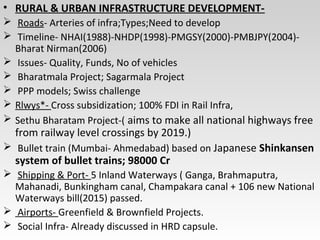

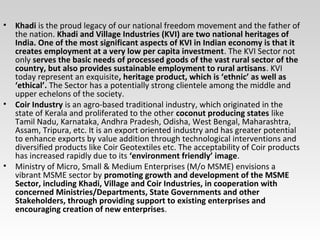

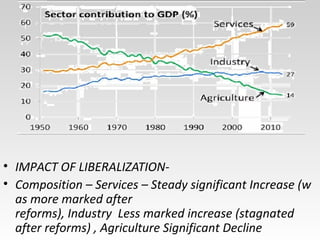

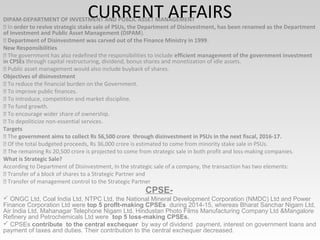

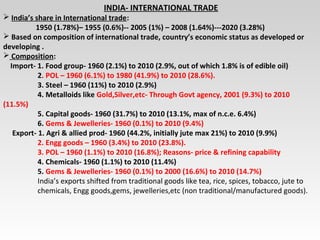

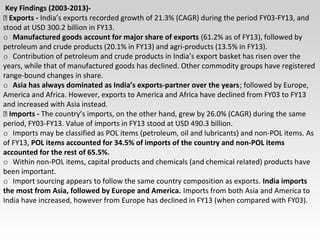

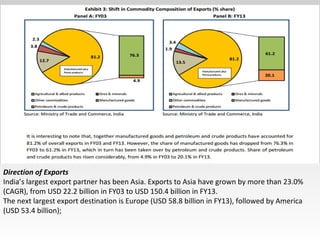

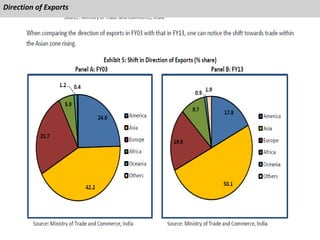

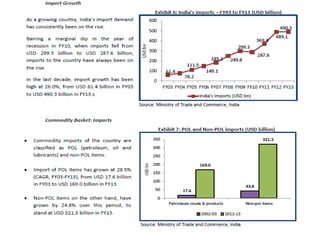

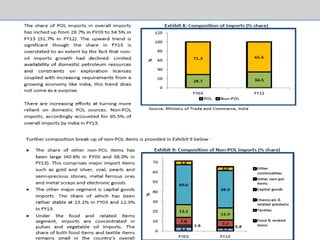

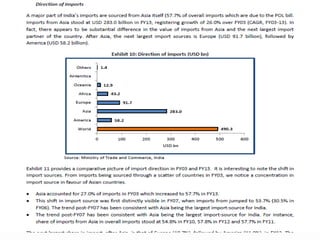

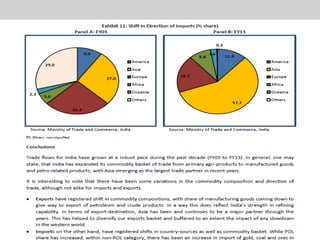

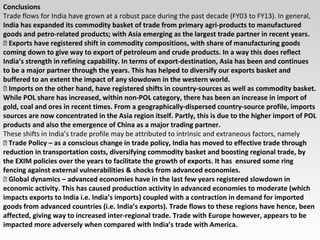

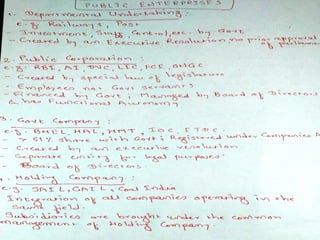

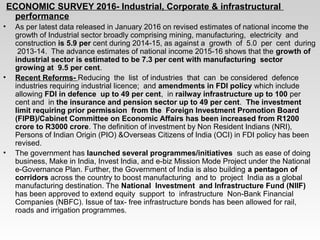

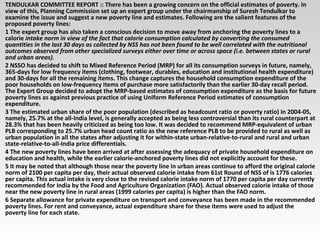

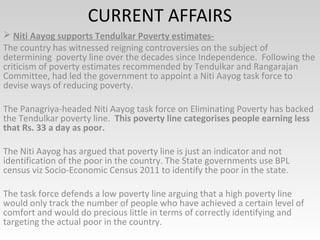

The document provides a comprehensive overview of India's planning history, covering various Five-Year Plans from 1951 to 2017 and their respective targets and economic models. It details the transition from the Planning Commission to the NITI Aayog, highlighting its roles, functions, criticisms, and key recommendations from the Fourteenth Finance Commission regarding fiscal federalism. Additionally, it discusses economic reforms initiated in India, emphasizing the shifts towards liberalization, privatization, and globalization.