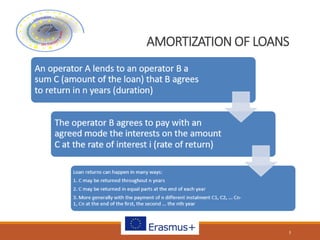

This document discusses different types of loans and mortgages from the perspective of customers and banks. It defines loans and differentiates between secured and unsecured loans. It explains how interest rates affect monthly payments and payoff periods. It discusses reasons why companies may need loans and describes the amortization of loans. It also outlines the process of opening bank credit, factors that influence credit approval, and types of credit commitments banks provide including guarantees. The document further explains mortgage contracts, different types of leasing agreements including operating and financial leases, and real estate lease-back arrangements.