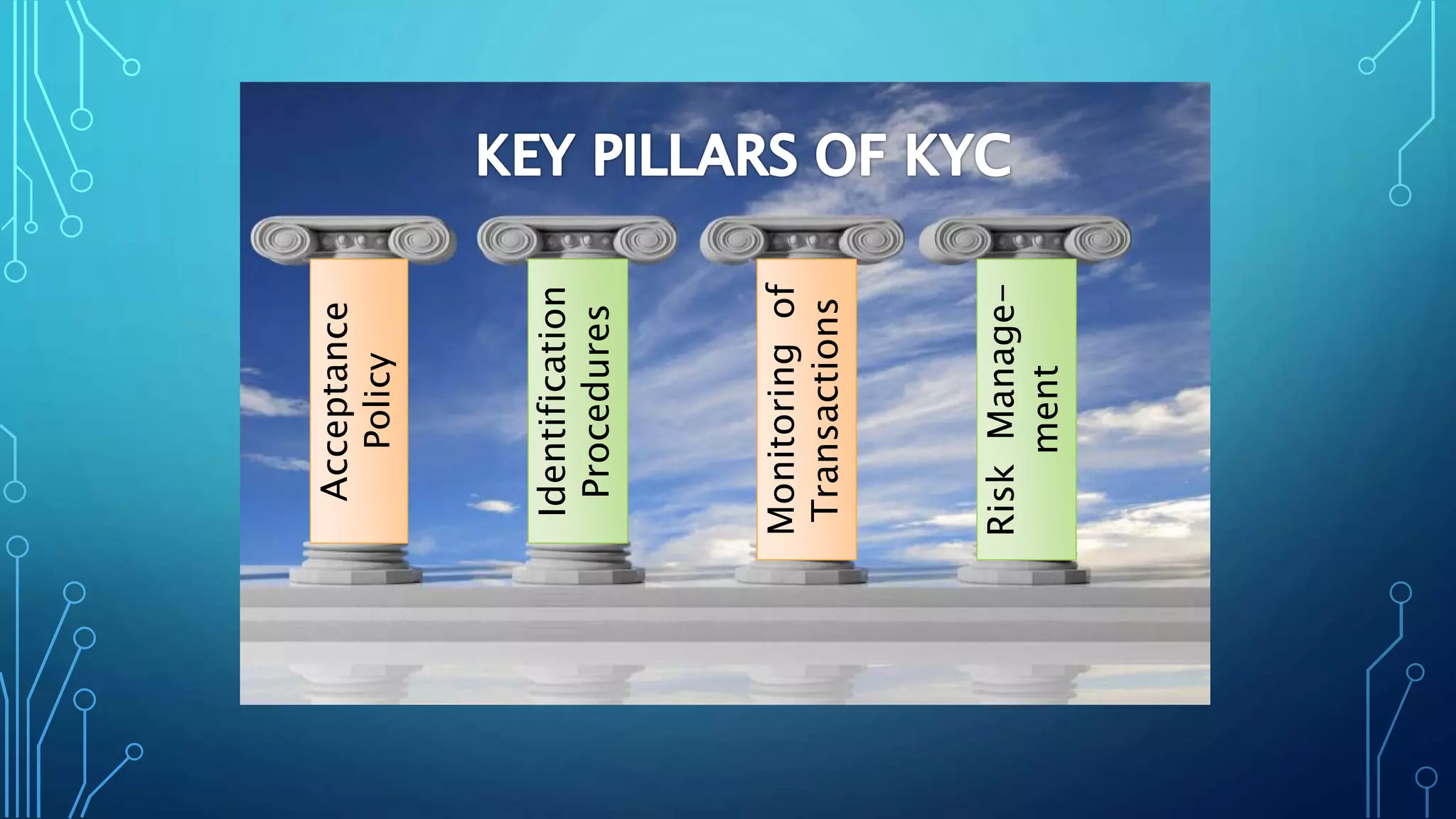

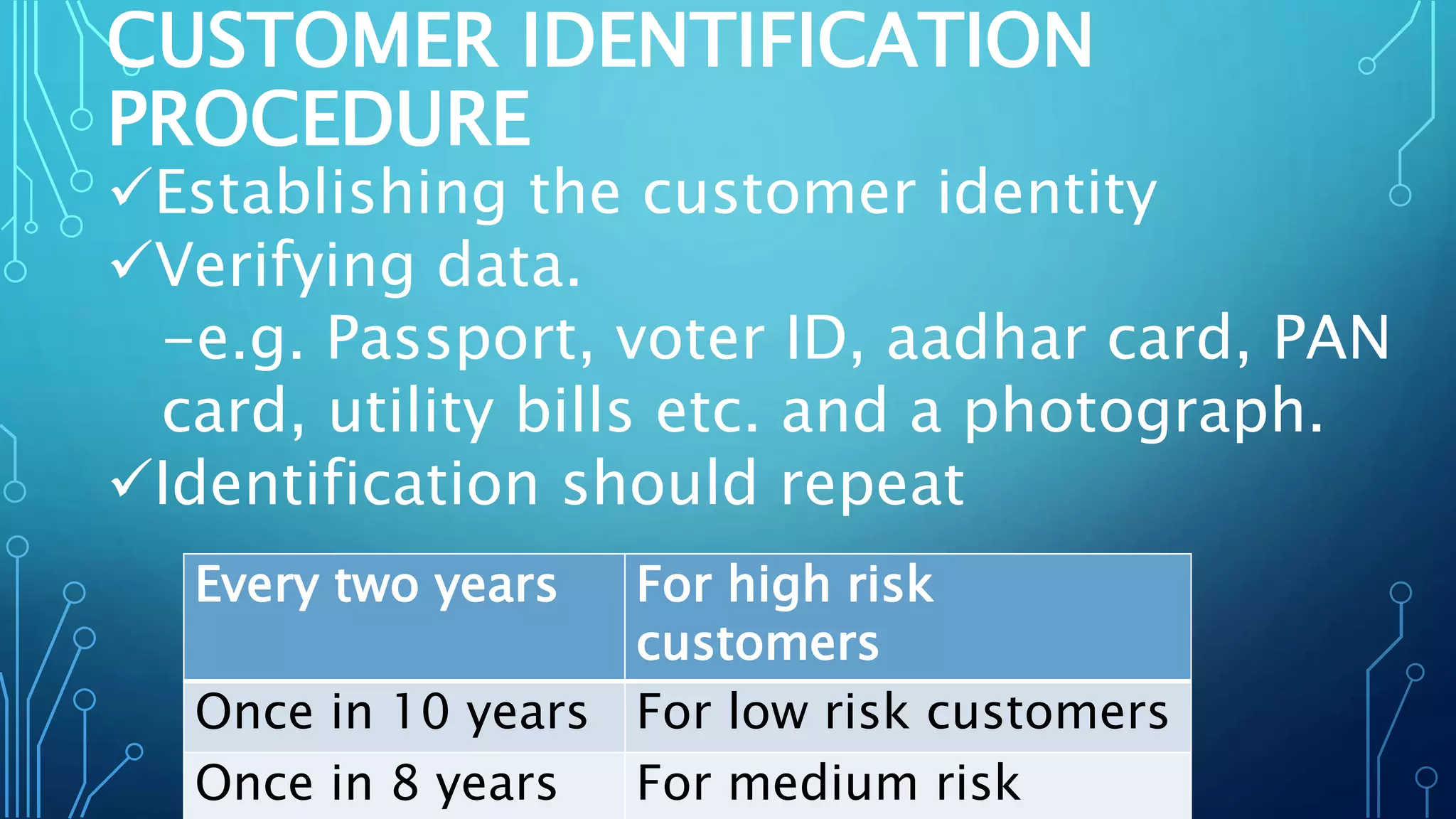

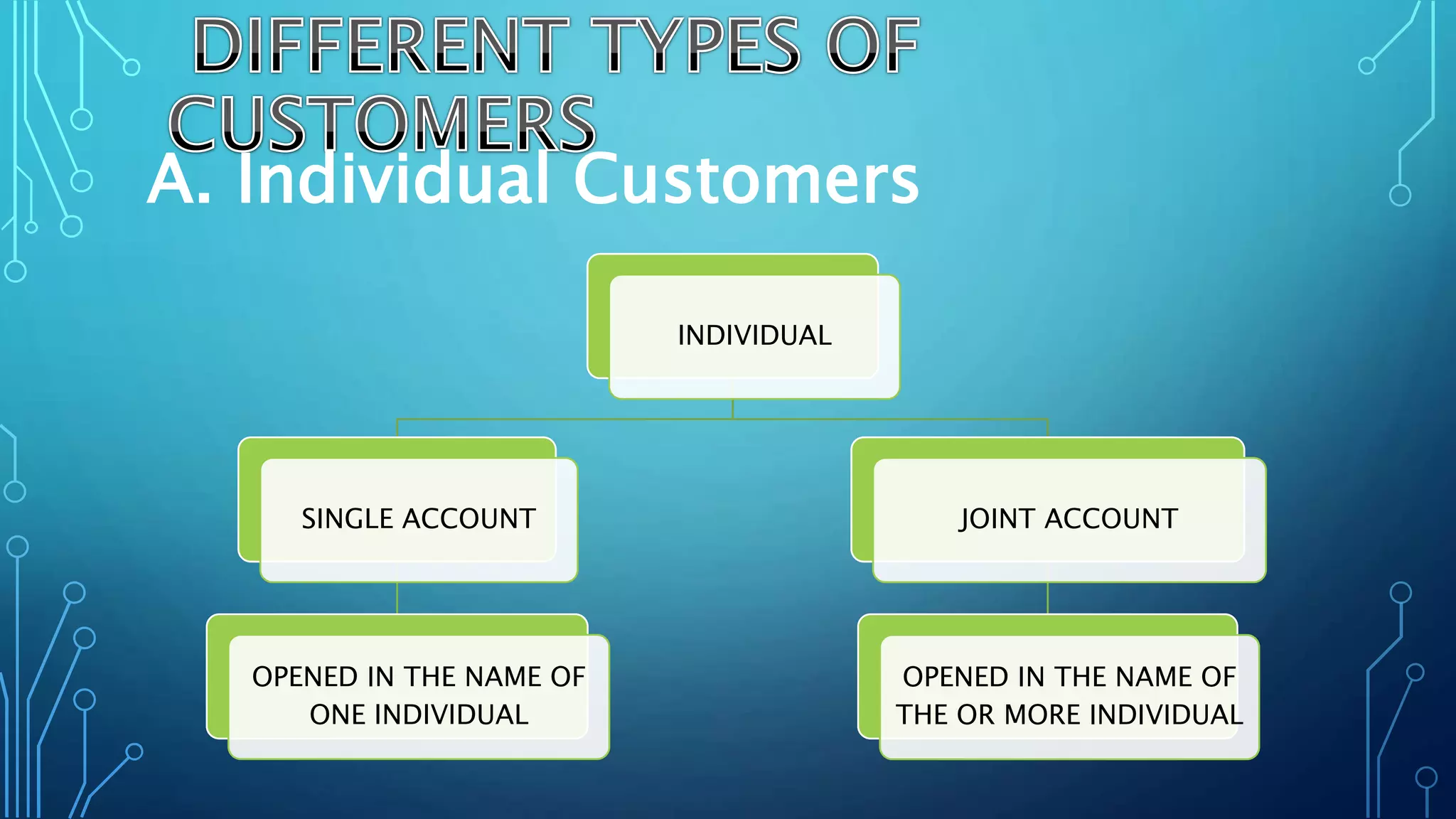

This document discusses types of bank customers and Know Your Customer (KYC) procedures. It defines a bank customer as someone who has an account with a bank branch. Anyone can open an account by providing valid KYC documents like photo ID and address proof. Banks must follow KYC policies regarding customer acceptance, identification, transaction monitoring, and risk management. The document also outlines different types of individual customers like single or joint accounts, and non-individual customers like HUFs, companies, trusts and societies.